87: Buy to let outlook for London and England - will prices keep rising?

10-10-2006

PropertyInvesting.net Team

Traditional UK Buy-to-Let investment remains propular - the vast majority of investors purchase second hand property - flats, houses and terraces in citties, towns and suburbs, along with holiday lets. Finance is becoming more readily available and restrictions if anything are being loosened for investors, particularly those with large portfolios.

Gearing 13% money down

We understand Northern Rock allow you to put a 13% deposit down on a buy-to-let in the

The City High Fliers - what will they do with their bonuses?

Now, if you were a city high flier who was earning say £200,000 gross with a bonus of net £110,000 that was due to arrive in January 2007, what would you do with this cash pile? Would you buy stocks and shares with zero leverage and risk profile, or use the 13% money down mortgage offer, leverage up with relatively a low risk

First Time Investor pitfalls to watch out for

For the first time buy-to-let investor, that is keen to start off on the right foot, a few tips and pitfalls. Most property investors have made their money from purchase of second hand properties few specialize in off-plan purchases (only 2% of total buy to let purchases). Off-plan is best in a rapidly rising house price market for new-build property, in developing areas. When an area is mature, because fees have to be paid, it far more difficult to make money quickly, unless you have an inside line of the very best deals e.g. buy in a consortium of investors who leverage to achieve a good price from the developer. Being a first time investor operating in isolation, you will not have access to these deals unless you sign up to companies such as InsideTrack. These companies provide some training course but initial subscription to these clubs can cost upwards of £5,000 so if you only purchase one property, you may not get your money back in the form of a return.

If you purchase you first property, you have to make sure it is for a very good price if you target some 10% below true market price in a popular area then your risks reduce dramatically. If the property can be easily upgraded at minimal cost to add a further say 10% to its value, then your risks will reduce even further. So if you put down a 15% deposit on a £100,000 property that is actually worth £110,000 then spend say £2000 on painting and upgrade which boosts its value to £120,000, then you will have put in £17,000 and have net equity of £18,000 on paper, already over 100% return on your investment. These types of numbers can be developed into personal targets that you wish to stretch yourself to achieve.

Make sure that tenant demand in the area is good, and the market for re-sales is okay. If the property is within 5 minutes walk of a train station, tram, tube and preferably on a major bus route, this will help. If its a rural property, being close to a major road and motorway will help, but not too close for road noise to be an issue. The best locations are close to busy thoroughfares, shops, amenities and supermarkets, but in very quiet side streets. Victorian properties are generally more popular for resale than newer post war properties. Edwardian and Georgian properties are often even more popular particularly if they have some architectural merit or are in a conservation area. Another key criteria to consider is is the area positively changing for example, is there a major regeneration programme, new road or rail links, new offices and jobs, more wealth entering the area. All these aspects will help reduce your risk.

Well give an example Shoreditch just east of the City of London has some 2 bedroom ex-council flats for sale at £180,000. You spot one undervalued at £174,000 then offer £168,000 for a quick sale this is agreed with 15% deposit. You spend £2000 and decorate it yourself and install a new low priced kitchen. Your work has transformed he place you have it revalued for £185,000. You then release the spare equity in the form of a further advance of £14,000 after costs. You then use this to purchase a studio flat in a cheaper area for £95,000.

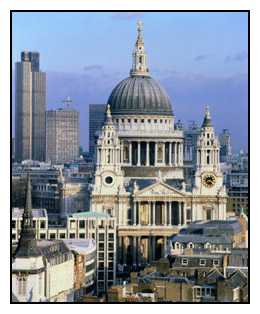

Now the City of London has a huge number of jobs. The Docklands has a huge and expanding number of jobs. Access to the West End is good and the jobs here are booming. Meanwhile,  the next 10 years. 60,000 Eastern European workers have arrived in the city in the last 2 years. The bank/services sector seems to be doing well and local wage earnings are rising at 3.5%+ per annum (more of the city bonuses are added). Because traffic is getting worse, more and more city slicker will require crash pads. Wealthy individuals will want pied-a-terre. The are 100,000 students in 10 colleges within a radius if 3 miles only a Ό of them live in student halls. The council estate is coming up, and is surrounded by many new builds costing £350,000 plus. You think to yourself is this a high risk investment? Can you see tenant demand being satisfactory? You say to yourself if this does not work, what will? You decide to buy your first investment property.

the next 10 years. 60,000 Eastern European workers have arrived in the city in the last 2 years. The bank/services sector seems to be doing well and local wage earnings are rising at 3.5%+ per annum (more of the city bonuses are added). Because traffic is getting worse, more and more city slicker will require crash pads. Wealthy individuals will want pied-a-terre. The are 100,000 students in 10 colleges within a radius if 3 miles only a Ό of them live in student halls. The council estate is coming up, and is surrounded by many new builds costing £350,000 plus. You think to yourself is this a high risk investment? Can you see tenant demand being satisfactory? You say to yourself if this does not work, what will? You decide to buy your first investment property.

Can house prices rise by 30% in the UK 5 years?

Interesting article which tends to go against conventional thinking. PropertyInvesting.net believe it is possible for prices to rise another 30% in five years if:

- Inflation stays at or below 2.5% (oil prices below $75/bbl)

- Interest rates stay below 5.25%

- GDP Growth is maintained at around 2 to 3% per annum

- Unemployment does not rise significantly

The reason why this further rise is possible is because there are approximately 180,000 too few homes being built in the