690: Property Investors Update - Printed Fiat Currency, The Economy, Oil and Property Prices

02-25-2021

PropertyInvesting.net team

Property Investors Update - Printed Fiat Currency, The Economy, Oil and Property Prices

Time for a Recession: It had been 12 years since the last major recession and the world and the UK was certainly due one on average they turn up around once in 8 years. It was a good long run. But COVID-19 kicked the western world into a massive recession more accurately described as a Depression.

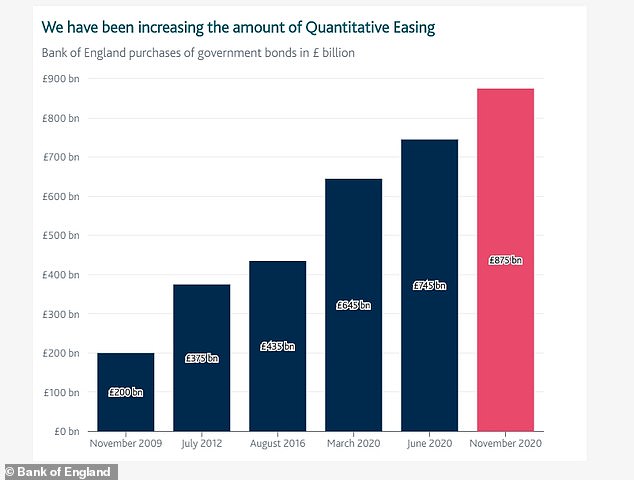

Currency Printing: In the last 50 years what we can count on in a recessionary deflationary period is that central banks will in a concerted way print their respective currencies sometimes called quantitative easing. They print the currency out of thin air electronically by expanding the balance sheets and buying bad debts from banks. They will drop interest rates print the currency and hope the whole thing inflations again towards the 2-3% annual inflationary target.

Financiers Addicted to Fiat Currency: The banks are like drug addicts they need larger and larger fixes of the fiat currency to stay alive. Ultimately every currency that is fiat whilst inflationary pressures stay under control as the onslaught of fiat printed currencies flooding markets takes effect.

Debt Time Bomb: As you can see from the above charts - there has been a gigantic electronic fiat currency printing incursion - and these dollars, Sterling (and Euro) will start swilling around the world and cause havoc - creating inflation and currency debasement - whilst propping up the over indebted economies. One day, the whole financial system - and these fiat currencies - will implode. Gold and silver prices will skyrocket. Oil prices will skyrocket. But for now, it seems that the global central bankers have almost negotiated through the COBVD-19 crisis and are looking for a more stable few year. But it only takes one trigger event - or "Black Swan" event to tip these fragile indebted economies into a negative tails-spin. And the UK is more vulnerable than most because our debt is now round 100% of GDP - into danger levels especially for an economy that imports more than it exports.

Blowing Up Into A Bubble: What is predictable is what is and what will happen as these dollars, Euros and Pounds start flooding the global financial system.

1) Oil prices rise sharply this commodity is considered a hedge ag ainst inflation since it is a real asset and energy unit

ainst inflation since it is a real asset and energy unit

2) Gold and silver prices normally rise sharply this happened in 2020 but could continue through 2021 onwards

3) Cryptocurrency prices rise sharply another hedge against inflation

Eventually all prices of goods and services start rising sharply sometimes in fairly uncontrolled and unpredictable manners. What we see then and this is particularly relevant for property investors is that:

Building material costs rise

Labour-wages rise

Construction bid competition weakens

Land and house building costs go up

Property prices rise sharply

The big re-set crash happened March 2020 in the UK and the recovery has been very weak since. But be careful because the flood of low cost printed currency is about to hit the UK as Lockdown ends we expect the economy to start picking up sharply April 2021 onwards. By the end of 2021 the UK economy will be booming off the back of:

A very successful vaccination programme

Low inflation rates and currency printing

More jobs being created

Brexit uncertainties residing

Opening of international business and travel

International business expanding as investors get used to UK post Brexit

Overall Immunity: Consider this as of end Feb, about 25% of people have been vaccinated and 20% of people have already had exposure to the virus with or without symptoms - since March 2020. So about 55% of people will have a large degree of protection from getting seriously ill with the virus which means the transmission rates would statistically normally have to drop dramatically. By May 2021 we should see infection rates so low that people start forgetting about the virus then the boom on hospitality will commence hotels, travel, tourism, meals out.

Roaring 20s: People will draw comparisons to the Roaring 20 the period 1920 to 1929 when there was a huge global boom in Europe and USA off the back of the end of the Spanish flu period 1918-1920. What happened then is likely to repeat itself this century its uncanny:

People start partying

Cafes, restaurants, theatres, nightclubs will be busy by end 2021

Tourism will boom starting May 2021

People will start gravitating towards the cities again not so much for offices-work, but for the social side of things and the amenities and attractions.

For property investors who are canny and would like view this as an opportunity rather than a threat, now would be the ideal time to make low-ball offers on:

City hotels in distress

Nightclubs and bars in distress

Flats without a garden or outdoors space in prime city centre locations for instance in London Kensington, Chelsea, Islington, Marylebone, Bayswater, Little Venice, Fulham.

Oil Prices: Oil prices are following the money as they always do. There is normally a very strong correlation been the extent of currency printing and commodity prices like oil. So although the demand for oil is still weak as the economies start to recover from the COVID-19 depression, oil prices have risen from about $20/bbl April 2020 to $67/bbl end Feb 2021. Thats a staggering tripling of price s during a recession. The only way to explain this is that all that zero-cost currency is flowing into oil despite climate change concerns and the so called energy transition. The smart money is probably on oil prices rising higher towards $80/bbl as long as OPEC keeps its supply agreements intact and constraints in place and central banks continue to be loose, free and print their low value fiat currencies. Its worth pointing out that OPEC is a legal cartel Oil Ministers from all around the world meet regularly to constrain production and pretty much set oil prices. If a private investor or individual did this they would go straight to jail for anti-competitive colluding practices! If OPEC did not exist, oil prices would probably be languishing around $20-$30/bbl now.

s during a recession. The only way to explain this is that all that zero-cost currency is flowing into oil despite climate change concerns and the so called energy transition. The smart money is probably on oil prices rising higher towards $80/bbl as long as OPEC keeps its supply agreements intact and constraints in place and central banks continue to be loose, free and print their low value fiat currencies. Its worth pointing out that OPEC is a legal cartel Oil Ministers from all around the world meet regularly to constrain production and pretty much set oil prices. If a private investor or individual did this they would go straight to jail for anti-competitive colluding practices! If OPEC did not exist, oil prices would probably be languishing around $20-$30/bbl now.

Who Wins? The affect that high oil prices have is for the oil exporting nations to do far better because their balance sheets improve whilst the developed nations that have high oil import costs and high oil intensity suffer in the medium to long term. Initially as oil prices collapse, the  opposite happens of course. The countries most positively effected by the rising oil prices are: Norway, Canada, Saudi Arabia, Russia, Qatar, Kuwait, UAE, Oman, Iran, Iraq, Brunei, Nigeria, Gabon, Ghana, Algeria, Libya

opposite happens of course. The countries most positively effected by the rising oil prices are: Norway, Canada, Saudi Arabia, Russia, Qatar, Kuwait, UAE, Oman, Iran, Iraq, Brunei, Nigeria, Gabon, Ghana, Algeria, Libya

Countries most negatively impacted with low GDP per oil barrel imported and huge relative oil import bills are: Greece, Italy, Spain, France, Holland, Germany, India, South Africa.

The UK still produces about 50% of its oil needs so is less impacted than most western developed nations. The USA is a net oil-products exporter just, so its slightly positive having higher oil prices, but not by much.

Property Market Outlook: Finally looking at the property market in the last few weeks and projections the big positive news has been the very likely Stamp Duty holiday extension from 31 March 2021 for a further 3 months possibly more. There is even talk about abolishing stamp duty to invigorate the housing market and all the business that surround it but that is probably unlikely simply because the amount of tax revenue would drop in the short term and the government needs the money. A think tank believes though that abolishing stamp duty could actually lead to higher government revenues from other sources such as employment, VAT and capital gains tax, inheritance tax as this would boost house prices, market activity, employment and self employed or employed tax revenues. Hence any dip in prices because of the stamp duty holiday ending has probably slipped from April 2021 to July 2021. However, we expect the economy to be roaring ahead so much by July 2021 that there may not be any noticeable negative impact of property prices.

amount of tax revenue would drop in the short term and the government needs the money. A think tank believes though that abolishing stamp duty could actually lead to higher government revenues from other sources such as employment, VAT and capital gains tax, inheritance tax as this would boost house prices, market activity, employment and self employed or employed tax revenues. Hence any dip in prices because of the stamp duty holiday ending has probably slipped from April 2021 to July 2021. However, we expect the economy to be roaring ahead so much by July 2021 that there may not be any noticeable negative impact of property prices.

Tory Election: Its also worth considering that there will be an election in 2Ύ years or earlier. So the last think the Tory government want or need is house prices collapsing or dropping sharply. They will pick up Labour votes if the economy is growing at a fair clip, employment is improving and house prices are rising particularly in battlegrounds like northern England and the Midlands. London is less important since the bulk of SE England is Tory whilst Labour hold most of the London seats and this is unlikely to change due to the demographics and population mix. But be on the look out believe it or not for a sn ap election sometime July-Oct 2021 in the summer off the back of:

ap election sometime July-Oct 2021 in the summer off the back of:

Successful Brexit (or claims of one!)

Successful vaccination programme

Higher property prices

Improving employment and economic trends

Weak Labour opposition performance Kier Starmer honeymoon period ending

Just dont be surprized to see Dominic Cummings surface again with Boris Johnson to mastermind a successful stap election so the Tories can bag another two extra years in power to drive their policies through.

Asset Prices to Rise: So moving forwards we see in general asset prices rising sharply after the massive dip in early 2020 as the economies around the world recover from COVD-19. So property prices might be rather unstable for a while but we are now thinking there is not likely to be a collapse anymore because of the huge quantities of printed currency flooding markets, a Tory government and other stimulants such as tax breaks and ultra-low interest rates.

We hope you have found this Newsletter insightful. If you have any queries, please contact us on