641: Political divisiveness and trends in young people's views

06-01-2019

PropertyInvesting.net team

Political Extremes: Europe and America have definitely lurched to the extremes in politics in the last five years – some example are:

• Donald Trump getting into power – far right

• Austrian far right government

• Italy far-right and populist socialist left governments

• UK Brexit referendum – rise of UKIP/Brexit Party

Socio-Liberal Elite Went Wrong: Years of socio-liberal rule by elite – often non democratically elected European bureaucrats leading to slow growth, massive printing of currency, increase government debts, bloated public sectors and mis-spending of large projects coupled with concerns on immigration within Europe and USA have probably lead to this outcomes so far. Its all very concerning – the direction of politics and it seems extremes are far more prominent now and have started to become normalised – a classic example is Donald Trump’s tweets that only four years ago would have seemed totally unacceptable for anyone in public office to be making – but he seems to be able to say exactly what is going through his head with impunity.

US Foreign Policy: With regard to the US foreign policy – when Trump got into power there seemed to be a brief period when he seems to be attacking Saudi Arabia and leaving Iran alone. Enter John Bolton and Mike Pompeo – the far-right protagonists – they seemed to have pointed Trump very much in the direct of:

• Siding with Saudi Arabia (broadly the Sunni Arab community) – despite their human rights record and war in Yemen – it has to be mentioned that the USA of course supplies huge amounts of military hardware to the Saudi’s

• Siding against Iran (broadly the Shiite community, non Arab) – isolating Iran. Trump blames Obama for a soft nuclear deal that emboldened Iran – the US administration thinks they then used the economic benefits to ferment terrorism and proxy wars against Saudi Arabia and other Sunni countries.

There certainly seems to be a correlation between the striking of the deal then Iran meddling in the region with military ventures – and it seems Saudi, Pompeo and Bolton in particularly – along with Israel have persuaded Trump to take a hard line approach to Iran. This is important for property investors to understand because this overall policy is likely to lead to:

• More Middle East insecurity – particularly in the short-medium term

• Sanctions against Iran will lead to higher oil prices and higher inflation – that is likely then to feed through to higher general inflation, higher borrowing costs and depressed property prices in nations that import large amounts of oil.

Hawk: Lets make one think crystal clear – Bolton is an ultra-hawk – and he does not shirk away from conflict. He seems to have the ear of the President – who can decide military action without recourse. Pompeo is slightly more moderate but not by much. The three will bully their way around the Middle east – the upside is everyone is scared of them and they keep in their respective boxes. The downside is some country – likely Iran – feels bold enough to antagonise the US so much or openly start a conflict – that the US steps in – then the proverbial s*** will hit the fan. We have the extremes of Iran vs Saudi-US alliance.

Saudi – Iran: As a general rule – we have the Saudi/UAE/Kuwait block (Sunni-Arab) versus the Iran block (Shiite). Its worth pointing out that Iraq is Arab and Shiite run now -so they are able to talk and do deals with Iran – the Iranian influence in Iraq is something the Saudis don’t like. Of course Syria is still run by a Shiite government as well – its all very complicated. But the bottom line is – there is no love lost between Saudi and Iran – the two super regional powers. Saudi is an autocratic family run Kingdom run by Sunni Arab elite. Iran claims to be a democracy (republics) of Persian Shiite – that dislike Kingdoms – during a revolution they overthrow the old Persian Kingdom in 1982 - they think Kingdoms are corrupt and imperialist. You could not have thought of two country bordering each other that have so fundamentally different values and ideals. This in large part goes to the route of the dis-trust and regional jealousy that rages onwards as they fight back-door proxy wars against each other – e.g. Yemen and to a lesser extent Syria. Saudi feels threatened by Iran. Rocket attacks take place from Yemen into Saudi fairly regularly. Iran feels threatened by Saudi – and the USA and Israel – they look to be in cahoots. USA has racketed up its threats to Iran i n the last 6 months. They don’t want them to become a nuclear power – this would set off a regional nuclear power race. The US believe that if Iran got a nuclear capability it would start threatening Israel. It could all kick-off rapidly and spectacularly at any time. If it does, the oil prices would skyrocket and the global economy will take a dip as we get another nasty bout of inflation.

n the last 6 months. They don’t want them to become a nuclear power – this would set off a regional nuclear power race. The US believe that if Iran got a nuclear capability it would start threatening Israel. It could all kick-off rapidly and spectacularly at any time. If it does, the oil prices would skyrocket and the global economy will take a dip as we get another nasty bout of inflation.

Oil Revenues: Iran was exporting around 1.8 million bbls of oil a day until recently – most observers think its does to around 0.6 million bbls/day now – and the US aim to drive this as close to zero as possible. This will put a huge strain in the Iranian economy – even more than at this time - and hyper-inflation is the likely outcome for Tehran as they resort to printing currency to pay their debts and public sector wages. Iran in the next 6-18 months will get increasingly desperate – and will either come to the negotiating table with the USA – or start a war. The status quo seems unlikely. It will become very unstable.

North Korea: is another potential flash-point – disturbingly Trump seems to be showing Jim-Un a lot of respect considering he’s developing nuclear weapons, sets off ballistic intercontinental missiles and kills thousands including members of his own family. North Korea, South Korea, Japan and China are all potential problem areas when one considered the erratic and far-right US foreign policy. Add to that the Putin factor – namely their meddling in Venezuela, Syria, Ukraine and other areas – plus their on-off support for Iran – and it really starts to look like a rather unstable world – and one where a mistake – a rocket fired – could easily escalate into open conflict between various countries.

and China are all potential problem areas when one considered the erratic and far-right US foreign policy. Add to that the Putin factor – namely their meddling in Venezuela, Syria, Ukraine and other areas – plus their on-off support for Iran – and it really starts to look like a rather unstable world – and one where a mistake – a rocket fired – could easily escalate into open conflict between various countries.

Young People in the Property Market – Trends: We are going to switch tact a bit now to discuss the difference in the western world between the young and the old – and how people change over time – because property investors need to understand this – their market – whether they be young or old.

The younger people tend to:

• Be far more “green”, environmentally conscious, have a strong social values, more likely to vote green, Labour or Liberal

• More likely to be vegetarian or vegan

• Less likely to smoke tobacco

• Have high student debts

• Less likely to want to drive a large gas guzzling car

• Prefer to travel extensively by airplane

• Monitor their CO2 emissions-footprint and talk about the environment

• Highly educated

• Live in rented accommodation

• Use Facebook, Instagram, Snapchat, Twitter etc – develop their public profile

• Open minded to immigration and diversity – striving for equality

The younger people tend to:

• Be far more conservative, less environmentally conscious, less strong social values, more likely to vote Tory, UKIP or Brexit party

• More likely to be meat eating – not a vegetarian

• More likely to smoke tobacco

• Have now student debt

• Likely to want to drive a large gas guzzling car

• Happy to travel within UK or abroad for holidays – by plane or car

• Don’t monitor their CO2 emissions-footprint and or talk about the environment

• Less well educated than the youngsters (only 5% of over 55’s went to University)

• Own their own homes

• Only use Facebook for family photos – don’t use Instagram, Snapchat, Twitter etc – tend to want to stay private

For property investors looking to rent to younger people – the following trends could help you maximise your yields, avoid voids and help you increase your rents slightly – whilst keeping your tenants happy and providing a super service:

• The market for room rentals for single individuals – particularly in densely populated cities with high housing costs like London is increasing. These are normally HMOs – or say 4-6 single people living in the same overall household – be it a flat, maisonette or house.

• You people want clean rooms, small to large double rooms – with a small double bed but for a single individual only (they may have the occasional overnight guest)

• Bedsits – that’s homes with small stoves and kitchen sinks – are going out of fashion – instead the younger people would prefer to share a well equipment clean kitchen with other (nice) tenants

• Instead of a bedsit – younger people if they do want a kitchenette – would prefer a properly sized studio flat or 1 bedroomed flat if they can afford it

• Tenants don’t want to be sharing their homes with unemployed people – or people that smoke weed, take drugs or drink heavily – they want to share with like minded employed people that are quiet, polite and well educated

• Young tenants might have a good job – but prefer to spend disposable income on travelling and other lifestyle choices like eating out, buying expensive food. Many have “given in” with regards to trying to save up to buy a property – particularly in the light of average £50,000 student debts for the 55% of youngsters that go to University/College

• Most youngster will look to hook up with a partner (or get married) – therefore have two incomes before ever considering saving for a deposit and buying a flat. Because they might not know who this is – they are less motivated to immediately save – and more motivated to find a super partner that they can then look to move in with in the future

Market: So one of the best letting markets to be in is higher quality rooms for professional sharers – small HMOs – of between 3 and 6 rooms per property – in the more prosperous areas of higher growth and population-business expansion like London, Bristol, Southampton, Reading, Oxford and Cambridge.

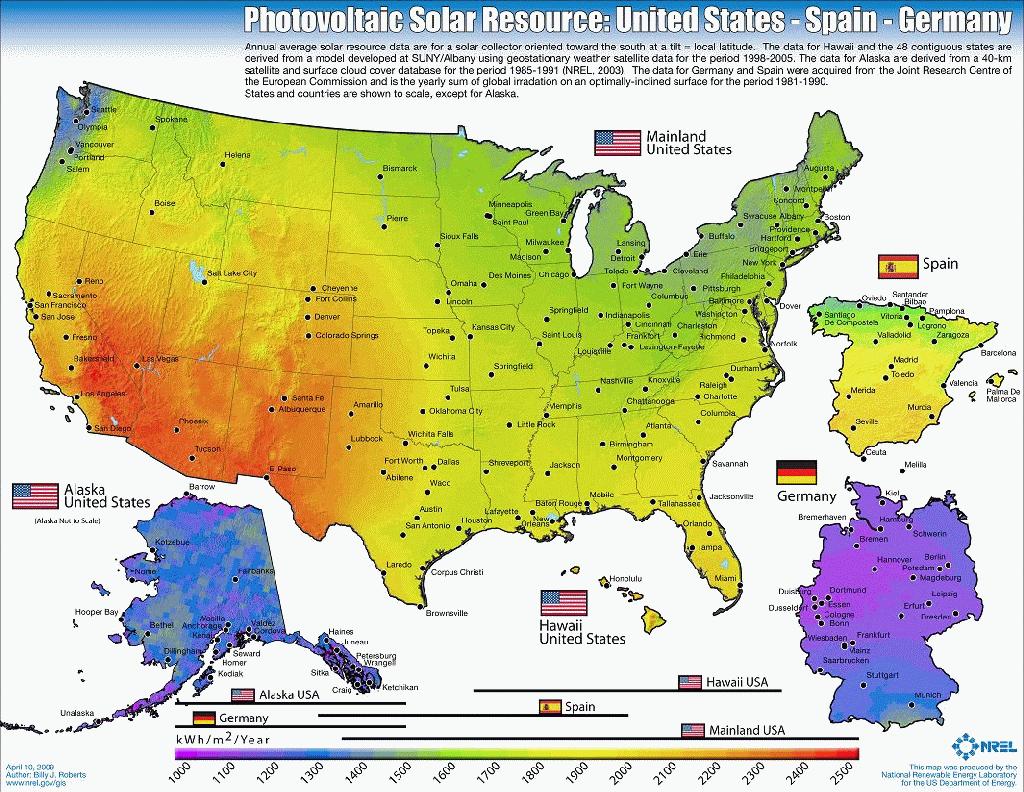

Energy Transition – How Quickly: The so called energy transition – which young people are so enthusiastic about – will start to gain momentum partly because these young people w ill get older, holding more senior positions and will genuinely want to do something about “climate change”. But its worth pointing out that the oldest companies in the world are oil companies, 10 years ago the world was producing 90 million bbls/day, today its 100 million bbls/day and by 2030 it will be 110 million bbls/day – that a pretty sizable growth rate. Gas consumption is skyrocketing around the world. As is electricity consumption. Yes, renewables will become more important as solar and wind power prices drop rapidly – but oil is required for airline fuel, plastics, to manufacture electric cars, mining lithium – there is no economic replacement for strong and light plastics for cars/trucks/trains etc. The question is – when will this gigantic oil supply start to plateau off – is it 2025 or 2030. For it to decline, we’d all have to stop flying, start cycling and become conservations – and there is not much evidence of this happening. Just look at the size and power of vehicles in 2019 compare with in the 1970s – double the size and double triple the power. Its also worth pointing out that western government make huge tax revenues by taxing petrol and diesel. 90% of the cost of car fuel is tax – that 80% on petrol/diesel and the government tax half of the oil revenues from the North Sea – through tax and royalty payments on oil companies). So if we switch to electric cars – the government will have a giant £50 billion annual hole in the finances – enough to bankrupt them – so if electric cars take off, they will then need to start taxing the electricity-charge to make up for the shortfall.

ill get older, holding more senior positions and will genuinely want to do something about “climate change”. But its worth pointing out that the oldest companies in the world are oil companies, 10 years ago the world was producing 90 million bbls/day, today its 100 million bbls/day and by 2030 it will be 110 million bbls/day – that a pretty sizable growth rate. Gas consumption is skyrocketing around the world. As is electricity consumption. Yes, renewables will become more important as solar and wind power prices drop rapidly – but oil is required for airline fuel, plastics, to manufacture electric cars, mining lithium – there is no economic replacement for strong and light plastics for cars/trucks/trains etc. The question is – when will this gigantic oil supply start to plateau off – is it 2025 or 2030. For it to decline, we’d all have to stop flying, start cycling and become conservations – and there is not much evidence of this happening. Just look at the size and power of vehicles in 2019 compare with in the 1970s – double the size and double triple the power. Its also worth pointing out that western government make huge tax revenues by taxing petrol and diesel. 90% of the cost of car fuel is tax – that 80% on petrol/diesel and the government tax half of the oil revenues from the North Sea – through tax and royalty payments on oil companies). So if we switch to electric cars – the government will have a giant £50 billion annual hole in the finances – enough to bankrupt them – so if electric cars take off, they will then need to start taxing the electricity-charge to make up for the shortfall.

Gas Consumption Skyrocketing: It’s also worth pointing out that in percentage terms, gas has been gaining market share over oil and cola for many years now – because it is cheaper and cleaner – very little particulate pollution (clean skies) and around 50% (to oil) and 25% (to coal) CO2 emissions. This transition has been going on for decades. The first LNG (liquid petroleum gas) plants were built in the 1970s (Brunei) – still going strong – and LNG-gas will continue to rapidly expand as the global population skyrockets and more “middle class” people want heating/cooling, drive cars and live in larger homes - for example 1.5 billion people in India and 1.2 billion people in China. The UK is only 60 million people – that only 0.8% of the world’s population. It’s the combined USA, Europe, China, India and the entire fast developing world that will shape things in the future – the UK is pretty close to irrelevant when you look at the numbers and our global influence has been on the wane for years – recently accelerating from Brexit and our own internal divisions. We’ll expand on this in a future Newsletter.

We hope you have found this Newsletter helpful in shaping your investment strategies – if you have any queries, please contact us on

enquiries@propertyinvesting.net