640: Property investors update

05-10-2019

PropertyInvesting.net team

This Newsletter aims to discuss trends that will affect property investment in the next five years that all property investors need to be aware of to protect their investment from the onslaught of regulations.

1 Draconian Tax, Regulations, Legal Culture of Blaming Landlords: Landlords will increasingly be blamed by all political parties particularly Labour for the housing crisis. Following on from the draconian tax increases of the last few years (tax on losses after mortgage interest payments made) further fiscal tightening is likely:

- More taxes

- More regulations

- More punitive fines for those infringing the regulations

- More legal actions by councils and tenants against landlords for minor infringements

- Likely end to Section 21 powers with landlords needing to find legal fault with tenants before they can be evicted with all the stress, hassle, cost, time and angst that this will cause

- Empowering of tenants with new rights aiming their poor behaviour against Landlords

The sum total of all the above is that Landlords will be drive from the market both large and small it will be increasingly difficult to make a profit and hence the housing crisis will worsen considerably as the market tightens with lack of investment and new rental supply.Landlords will be far more picky about which tenants they allow into their properties and hence the outcome is likely to be more homelessness the unintended but frankly predictable consequence of too onerous and draconian regulations, legal and fiscal frameworks.

2 Environmental: Young people are increasingly concerned about climate change and tend to blame the older generation for the systematic problems. Politicians and councils are increasingly picking up on this and driving through environmental taxes and regulations that are punitive towards Landlords this started with Energy Performance Certificates, requirements to improve insulation and heating efficiency. Again, the onus will increasingly be put on landlords to improve their properties assuming that there are making a profit when most are making a loss and this will also eat into profits and have the requirement to drive rents to higher levels or get out of the market. The bottom line is politicians have realise that its a vote winner particularly Labour they want to capture the younger voters and this will add cost to Landlords in years to come. They might also be blamed for climate change in due course.

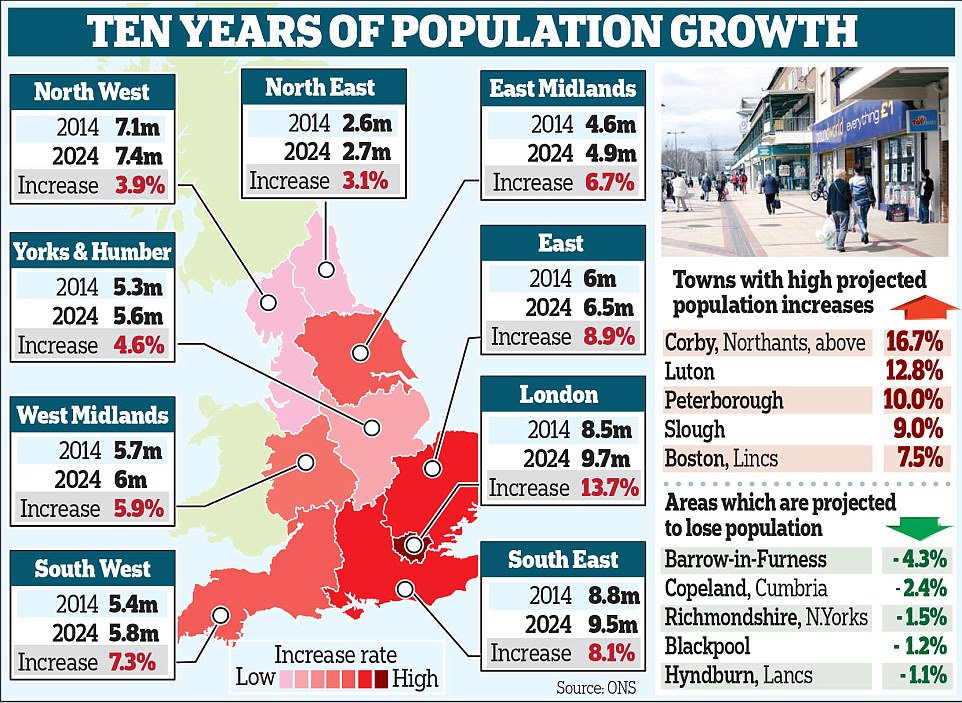

3 Population: As the population of southern England explodes upwards as more jobs in the lighter higher tech industries are created, then housing will become in even shorter supply. The will also be a net migration from rural areas to city areas and from north and Scotland to south. The only caveat is that some rural areas in south-west England and southern coastal areas will see their populations increase dramatically as rich people retire from north-Midlands and London and migrate to the southern coastal area where it is warmer and sunnier (than the north). The nimbies throughout Britain will try and put a stop to all building and building land will be in short supply hence in southern England the housing crisis will be most acute and house prices will continue to rise. The below summary says it all - its worth studying.

In Scotland the population will be stagnant only marginally growing so the housing crisis will be far less acute and the socialist policies of the SNP government have and will le ad to a lower GDP and jobs growth outlook. Hence Scottish house prices are likely to rise at around half the rate in the long term as those in southern England. This is also true of most of northern England albeit Manchester probably has the brightest economic future out of the northern cities, being Englands second city (at least commercially). For property investors, any southern property in a large town or city that can be bought fairly cheaply and has many rental units say six could still be lucrative, but the high costs of property purchase and conversion costs means most investors will struggle to make a good return moving forwards and rents will have to rise to reflect the shortage of supply. For anyone wandering where the population increase is coming from its multi-facetted:

ad to a lower GDP and jobs growth outlook. Hence Scottish house prices are likely to rise at around half the rate in the long term as those in southern England. This is also true of most of northern England albeit Manchester probably has the brightest economic future out of the northern cities, being Englands second city (at least commercially). For property investors, any southern property in a large town or city that can be bought fairly cheaply and has many rental units say six could still be lucrative, but the high costs of property purchase and conversion costs means most investors will struggle to make a good return moving forwards and rents will have to rise to reflect the shortage of supply. For anyone wandering where the population increase is coming from its multi-facetted:

- 40% from net migration into the UK around half of this from non EU countries (many commonwealth people) and half from mainland European countries

- 40% caused by the higher fertility rates of immigrants that have arrive to the UK in the last 20 years

- 20% from an increase in the fertility rate of indigenous UK people whose parents-grandparents were born in the UK its now trendier to have kids than 25 years ago

The scene is set for a big population increase Brexit will have not meaningful im pact on the population increase its almost set in stone this trend. We have to remember the UK is one of the richest countries in the world 65 million people live here and 7 billion people live on earth. We ate only 1% of the worlds population so when the developing countries rich people decide to re-locate West London because of its excellent schools and universities and language and open culture one can start to understand why inward migration will continue at high levels regardless of Brexit or what the politician say. Its worth also considering India a big friend of the UK and their are 1.5 billion Indian many want to live in the UK. This will not change over the next 50 years. The UK will increasingly become a multi-cultural society.

pact on the population increase its almost set in stone this trend. We have to remember the UK is one of the richest countries in the world 65 million people live here and 7 billion people live on earth. We ate only 1% of the worlds population so when the developing countries rich people decide to re-locate West London because of its excellent schools and universities and language and open culture one can start to understand why inward migration will continue at high levels regardless of Brexit or what the politician say. Its worth also considering India a big friend of the UK and their are 1.5 billion Indian many want to live in the UK. This will not change over the next 50 years. The UK will increasingly become a multi-cultural society.

Property Trends

- There will be more loft conversions are people chose to stay in their house and increase the size this is more economical than moving and paying stamp duty

- People will be even less often because of escalating house prices, high fees, and ver

y high stamp duty as more properties are snared in the tax duty higher tax brackets you may be interested to know that in the 1960s people moved on average every 6.5 years, in the 1980s every 18 years and by 2015 every 30 years a staggering increase in the time spent in each house driven by escalating stamp duty-moving costs and house prices.

y high stamp duty as more properties are snared in the tax duty higher tax brackets you may be interested to know that in the 1960s people moved on average every 6.5 years, in the 1980s every 18 years and by 2015 every 30 years a staggering increase in the time spent in each house driven by escalating stamp duty-moving costs and house prices. - There will be more basement conversions particularly in the more expensive southern cities and London these become economic when house prices for a terrace rise to about £450,000.

- There will be more rear extensions to houses

- More people will build summer houses (10m2 size) to store the stuff in

- Parking will become increasingly difficult parking space prices and garages prices in cities will shoot up more people will pave over their front gardens for 2-3 parking spaces

- The size of properties is likely to stay small and get even smaller whilst the relative cost of cars will drop so people will buy increasingly large vans and cars to store their stuff in and in part compensate for their small homes

- As more car become electrified over the next 20 years rather than car sizes dropping any plentiful renewable energy is likely to be use in more ferociously in large fast and powerful electric cars and vans that can also haul stuff around that does not fit in the home

- Parking spaces and garages will in time need to be re-sized to cater f

or the taller, wider and longer cars, trucks, SUVs and vans property investors should be careful buying garages that are very small because they could become close to useless except for storage in the next 20 years (e.g. if you park a car, you need to be able to open the door to get out!).

or the taller, wider and longer cars, trucks, SUVs and vans property investors should be careful buying garages that are very small because they could become close to useless except for storage in the next 20 years (e.g. if you park a car, you need to be able to open the door to get out!). - As more solar and wind power is available in the next 20 years then electric prices might drop compared to gas prices and make electric heating more economical than at present. This could lead to small efficient electric heating systems become the norm that are more reliable than gas-boilers this could be good news for Landlords (albeit at present, gas is around half the cost and hence most tenants are looking for gas central heating and water heating). Its worth pointing out gas prices are likely to sty the same or increase whilst solar power and wind power prices are dropping annually as their manufacturing processes and scales improve.

High Effort Henceforth: For the property investor the days of low effort and high returns are well and truly over. We have to be very efficient and effective at managing tenants, protecting ourselves legally and catering for the onslaught of draconian fiscal, legal and environmental legislations-regulation from councils, government and law courts. Its not an attractive business to get into for the new investor any more. For the more establish investors if you still love it continue for as long as possible, but many will be starting to sell their portfolio and the lack of new rental properties is likely to start biting even harder very shortly.

Best Areas: The best areas to invest in our opinion in a 25 year time frame a re:

re:

- Anywhere close to a new Crossrail station

- In the Reading-Maidenhead-Slough-Ealing-Acton jobs growth corridor (that also maps onto Crossrail) where many new jobs will be created and the population will boom

- Higher end HMO properties close to city centres in southern English cities like Oxford, Cambridge, Bristol, Bath, Southampton, Brighton, St Albans

- Holiday lets in coastal areas in southern England (preferably with sea views) particularly Cornwall, south Devon, Dorset and possibly Sussex.

In summary aim for the areas with highest population increase and highest growth in higher earning jobs and for holiday lets - where wealthy people from all over the UK will migrate to retire or go on holidays.

Prime Real Estate: For people looking for prime real estate then the safest bet most be in a quiet street close to the new Bond Street Crossrail station that will become a new hub with superb communications in all directions in Mayfair and close to Oxford Street. The centre of the world for international jet setters! If you can research the areas further north and east you might come across some properties that are significantly cheaper in prices than Mayfair of course with higher yields if you rent these out.

Why Property Has Been Attractive: And just to balance things a bit wed like to remind you why property as an investment class is normally very good compared to other asset classes:

- Strong-robust legal title

- Can leverage banks money to buy-invest creating higher returns if prices rise

- Bricks and mortar and land dont disappear like paper investments like stocks and shares

- You control your investment rather than having a fund manager or CEO taking their cut or destroying value for you

- Governments create inflation to inflate away their debts this leads to escalating house prices over the long term (and increasing rents) the real value of the debt decreases over time even if you dont pay it down -only pay interest on the debt

- You can add value to your investment with upgrades, conversions, expansions, changes in use

- As nimbies and environmentalists stop building supply will stay low whilst the population expansion will see demand increase so rental demand should stay robust and house prices longer term particularly if Labour do not get into power should continue to increase

We hope this Newsletter has been helpful in shaping your property investment decisions. If you have any queries, please contact us on enquries@propertyinvesting,net