526: UK May Election - Impact on Property Prices for Investors

01-04-2015

PropertyInvesting.net team

UK Election

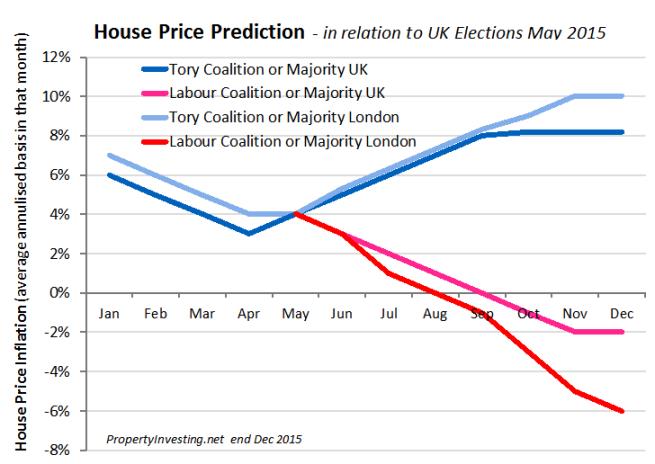

Because the election outcome is so uncertain and also so important for the forecast of the economy and hence house prices, we have modelled the two potential outcomes which will occur, either 1) Tory Coalition or Majority; or 2) Labour Coalition or Majority.

Labour: If Labour win power, our view is that the economy will tank because international financial institutions, wealthy individuals and businesses will shun the UK and invest in other countries instead - "in the global market place" since Labour will undoubtedly:

-

increase taxation

-

increase regulation

-

increase deficits, public sector spending and government size

-

implement anti-business policies.

Unemployment will then rise, GDP growth will decline and house prices will drop sharply along with this. If Labour form a Coalition with the Liberal-Democrats or SNP, the outcome will be the same since all three parties have left wing policies.

Tory: The converse will be true if the Tories win an outright majority or form a Coalition with U KIP, the Liberal Democrats again and/or the SNP. Namely:

KIP, the Liberal Democrats again and/or the SNP. Namely:

-

lowering taxation

-

reducing regulation

-

decreasing deficits and public sector spending with smaller government

-

continued implementation of pro-business policies.

Unemployment will drop further, GDP growth increase and house prices will increase sharply along with this. The economy will boom >3% GDP growth helped by lower oil prices.

Its really that simple. But the outcome of the Election is impossible to predict. Its just too uncertain. Enclose a chart describing the two scenarios, we hope this helps. The bottom line is - by end 2015 property prices will be all about who won the election.

Regardless of what a normal UK citizen thinks, because financial markets and large investors have so little confidence in Labour's ability to properly manage the economy - if Labour win power there would be following ramifications for all business investors and private citizens:

-

Sterling would decline sharply against the Dollar and Euro

-

Inflation would therefore rise since exports become more expensive (e.g. consumer goods, oil, gas, coal. food, service etc)

-

Interest rates would need to rise to control inflation and try and support Sterling currency

-

Mortgage rates would rise

-

Property prices would drop

-

Buy to let profitability would drop

-

Home building would dry up

-

Housing shortages of rental property would increase

-

Rents would rise

Tipping Point: This chain of events is fairly predictable in an economy which is out of favour with international financial markets and investors. We have to remember the UK is an island, not part of the Euro, has very liquid markets and hence a run on Sterling would be an outcome of a Labour victory as the Treasury finances deteriorated and putting up taxes had the consequence of destroying businesses and eventually reducing overall tax take.

Risks: This is the key risk for property investors in the next year or so - a Labour victory. It is about 50/50 that Ed Miliband will be the next prime minister in our view simple because there are so many people that seem to like his populist anti-business rhetoric. Despite Ed Miliband being completely out of touch with his mainstream Labour voters being a London based career politician (who's never had a non political job) from a posh Oxbridge background and having socialist policies far to the left of New Labour - we still think there are enough supporters in urban areas to elect him as prime minster. UKIP have divided the centre-right vote and could let Labour in through the back door.