524: 2015 Predictions (and 2014 look-back)

12-31-2014

PropertyInvesting.net team

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gains, for the thousands of daily visitors to the website and the thousands of people signed up to your Newsletter. This Special Report describes our 2015 Predictions and takes a Look-back Review of our 2014 Predictions for good order.

We start with our view on 2015 property prices in the UK followed by economic criteria. Weve been performing this analysis for the last nine years now. All our previous predictions can be reviewed on the website in our Special Reports section, so you can judge for yourself how accurate we have  been.

been.

496: 2014 Prediction (and 2013 look-back)

456: 2013 Prediction (and 2012 look-back)

409: 2012 Prediction (and 2011 look-back)

356: 2011 Prediction (and 2010 look-back)

301 2010 Prediction (and 2009 look-back)

245 2009 Prediction (and 2008 look-back)

179 2008 House Price Predictions Global

102 Property Price and Economic Predictions for 2007

For 2015, there will be a number of criteria that will pull property prices one way or the other, which we outline below:

Positive Criteria for Property Prices in 2015

· More competitive and abundant mortgages may become available albeit its possible interest rates may rise through to May 2015 then

· Lower oil prices stimulate the economy and financial markets

· Lack of house building

· Strong rental market

· London likely to continue to boom with expanding population and inward migration

· Increasing UK population

· Pent up demand from years of low market activity 2008-2012 people needing to move

· Further flood of wealthy Europeans escaping economic problems e.g. Russia, Ukraine and heading for central London

· Crossrail building in London

Negative Criteria for Property Prices in 2015

· Global economic slowdown in China and oil exporting nations

· High levels of debt spending in western countries

· Possible interest rates rising

· Punitive stamp duty on >£900,000 property effects London mid-high end market

· Currency fluctuations affect London property market

· Public sector jobs losses continuing through 2013 albeit wages continue to rise faster than private sector wages

· High levels of deposits required even with help to buy measures

· Difficulty getting mortgage for average person even with help to buy measures

· Low lending to salary multiples offered

· Low oil prices effect Aberdeen and SE Scotland property market

Overall, we believe the positive factor more or less cancel out the negative factors and prices will remain fairly subdued and fluctuating around current levels through 2015 on an overall UK national level. However, we predict like in 2014 property prices in the more wealthy southern areas close to London, property prices will be stronger than in northern areas that are more exposed to public sector and manufacturing sector jobs losses and spending cuts.

2015 Predictions

Property Price Predictions

1. London +2% (West London +1%)

2. SE England +7%

3. East Anglia +4%

4. Scotland +1%

5. SW England +3%

6. NW England +3%

7. Midlands +3%

8. Wales +3%

9. North England +3%

10. Northern Ireland +1%

11. Yorkshire +3%

Note: Published inflation will be ~1% (though real inflation will be more like 2.5%), hence real terms property prices will still decline in some rural like Northern Ireland and Scotland.

Other criteria

-

US Dollar to the UK $1.56 / £1 Dollar-Sterling track each other

-

UK £ to the Euro £1 / 0.78 Euro Euro-Sterling-Dollar track fairly closely

-

Oil price starts year at $55-60/bbl, rising to $80/bbl by end 2015

-

UK Gas price 52p/therm

-

UK Interest Rates staying at 0.5% throughout year

-

FTSE100 index range 6600-6800

-

UK Inflation CPI starting at 1% rising, dropping to 0.7% by Feb then rising to 1.8% by end 215

-

UK GDP staying around 2.2% (slowing down end 2015)

-

Security situation stays grave in NE Iraq and eastern Syria with ISIS affiliated units making advances in North Africa. Russia continues to create security tensions in SE Ukraine and considers advance in eastern Estonia.

-

Euro interest rates staying at record lows throughout 2015 (deflation threat, leading to more bond purchases)

-

US Interest rates staying at or close to 0.5% through 2014

-

UK unemployment stays around 6% until August then starts to rise to 6.5% by end 2015

-

Wage inflation stays low at ~1.5% throughout 2015 in both private and public sectors

-

GDP growth London 4.5%, North 1.5%, Midland 2.1%, Scotland 0.5%. Wales 1.5% (overall 2.2% for 2015)

-

GDP China 5%, GDP India 6%, GDP Africa 2%, Global GDP 2.6%, UK 2.2%, USA 2.8%, Euroland 1.2% - as a whole over 2015

-

Gold rising from $1190/ounce to $1300/ounce with silver rising from $16 to $18/ounce by end 2015

USA debt situation - lower oil prices and higher GDP growth improve US finances over 2015 even though debt levels remain very high. Dollar value remains well supported by higher growth and newly found shale-oil that is economic at prices above $60/bbl.

Inflation very subdued because of crash in oil prices in the UK this will mean interest rates do not need to rise as soon as they would otherwise.

Greece, Portugal, Ireland, Spain and Italy finances continue to improve getting a boost from low oil prices and reduced oil import costs. German economy is hit by lower trade with Russia, though lower oil prices feeding through to lower inflation leads to financial services performing better than expected.

Russia: Real threat that the sanctions, low oil prices and financial stresses possibly lead to a default of Rosneft, and President Putin expanding military going to war to boost or maintain popularity at home. Eastern Estonia could be the next target for subversive or outright territorial invasion.

BRIC: Brazil economy suffers from high debt at Petrobras (possible Petrobras default) 2% GDP growth only. Indian economy booms off the back of lower oil prices and global trade with western nations 8% GDP growth.

European and Japanese Wows: Japan continues to print money like there is no tomorrow. These countries have succeeded in kicking the can down the road and its likely to continue for 2015 at least. Possible Japanese financial crisis and Yen crash off the back of poor financial management by Japanese government.

Large bankruptcy: Petrobras and Rosneft go bankrupt suffering from ~$60/bbl oil prices and massive debts. Both respective government are unable to bail them out.

Note: Just like last years prediction, sometime in the next 6 months to 5 years we expect a real economic-financial crisis in western developed nations caused by the US bond market meltdown. At this time, gold and silver prices will go ballistic (silver from $20/oz to $400/oz and gold from $1200/oz to about $6400/oz. The Dow Jones may rise, but inflation adjusted real terms will decline still in an overall cyclical bear market.

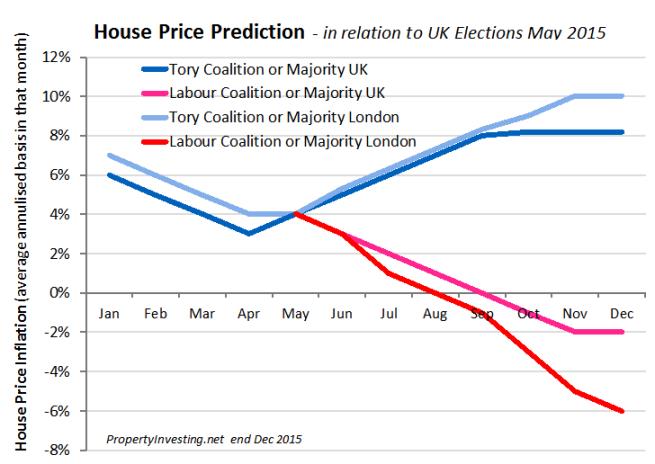

UK Election

Because the election outcome is so uncertain and also so important for the forecast of the economy and hence house prices, we have modelled the two potential outcomes which will occur, either 1) Tory Coalition or Majority; or 2) Labour Coalition or Majority.

Labour: If Labour win power, our view is that the economy will tank because international financial institutions, wealthy individuals and businesses will shun the UK and invest in other countries instead - "in the global market place" since Labour will undoubtedly: 1) increase taxation; 2) increase regulation; 3) increase deficits, public sector spending and government size; 4) implement anti-business policies. Unemployment will then rise, GDP growth will decline and house prices will drop sharply along with this. If Labour form a Coalition with the Liberal-Democrats or SNP, the outcome will be the same since all three parties have left wing policies.

Tory: The converse will be true if the Tories win an outright majority or form a Coalition with UKIP, the Liberal Democrats again and/or the SNP. Namely: 1) lowering taxation; 2) less regulation; 3) smaller deficits and public sector spending and smaller government; 4) continued implementation of pro-business policies. Unemployment will drop further, GDP growth increase and house prices will increase sharply along with this. The economy will boom >3% GDP growth helped by lower oil prices.

Its really that simple. But the outcome of the Election is impossible to predict. Its just too uncertain. Enclose a chart describing the two scenarios, we hope this helps. The bottom line is - by end 2015 property prices will be all about who won the election.

Look-Back on 2014 Predictions

Property Price Predictions

1. London +8% (West London +7%) Actual +11.1%

2. SE England +5% Actual +9.5%

3. East Anglia +3.5% Actual +3.8%

4. Scotland +1.5% Actual +2.5%

5. SW England +2.5% Actual +6.0%

6. NW England +2.0% Actual +3.0%

7. Midlands +3% Actual +1.0%

8. Wales +1.5% Actual +2.6%

9. North England +0% Actual +1.4%

10. Northern Ireland -2% Actual +1%

11. Yorkshire +2% Actual +3%

Note: Because published inflation will be ~2% (though real inflation will be more like 4%), real terms property prices will still decline in some rural like Northern Ireland and NE England. Actual reported inflation dropped to 1%, though real inflation is probably ~2.5%.

Other criteria

§ US Dollar to the UK $1.52 / £1 Dollar-Sterling track each other close, ended year at $1.56 / £1

§ UK £ to the Euro £1 / 0.8 Euro Euro-Sterling-Dollar track fairly closely very close, ended year at 0.78

§ Oil price $100/bbl (range $88 to $105/bbl) wrong, oil price dropped to $60/bbl by year end (through fluctuated from $88-$105 up until early Oct

§ UK Gas price 55p/therm - yes, very close, gas price ended year at 52p/therm

§ UK Interest Rates staying at 0.5% until May 2014 increasing to 1% by end 2014 interest rates stayed at 0.5%

§ FT dropping dropping from 6600 to 6250 by end 2014 wrong, ended at 6700

§ UK Inflation CPI staying close to 2.4% through 2014 wrong, dropped to 1%

§ UK GDP staying around 2.3% - correct, GDP grew by 2.3% in 2014

§ Security outlook improving (except Iraq and Lebanon/Syria) correct, Iraq and Syria went pear shaped with ISIS expansion starting July 2014, other areas fairly peaceful

§ Euro interest rate staying at 1% through 2014 yes, stayed at record low throughout 2014

§ US Interest rates staying at or close to 0.5% through 2014 correct, no change

§ UK unemployment reducing from 7.2% end 2013 to 6.7% end 2014 actually dropped far faster than expected to 6% by year end

§ Wage inflation ~3.3% through 2014 in public sector and 3% in private sector wages only grew by 1.3%, less than expected

§ GDP growth London 4.5%, North 1%, Midland 1.5%, Scotland 1%. Wales 1% - accurate and trend good, Midlands did better than expect at ~1.9%

§ GDP China 6%, GDP India 6%, GDP Africa 2.5%, Global GDP 2.5%, UK 2.3%, USA 2.3%, Euroland 1.5% - as a whole over 2014 All indicators very close

§ Gold staying around $1200/ounce with silver rising from $20 to $22/ounce - correct, gold ended year at $1190/ounce though silver stayed low at $16/ounce

Syria-Lebanon problems continue after these tw o countries. Security situation in Egypt improves. Yemen and Iran stay the same no overall crisis. Close the Syria and Iraq situations indeed deteriorated significantly. Situation in Eqypt did improve.

o countries. Security situation in Egypt improves. Yemen and Iran stay the same no overall crisis. Close the Syria and Iraq situations indeed deteriorated significantly. Situation in Eqypt did improve.

USA debt situation deteriorates further through some degree of tapering of QE is possible from $75 billion / month to $45 billion / month. Interest rates remain at or close to 0.5%. Bond market look unstable but do not yet collapse. Correct - QE was tapered to nothing by end 2014

Inflation situation improves through to May 2014 then worsens somewhat later in the year as general inflation is affected by the housing boom. Oil prices stay range bound between $85/bbl and $110/bbl. They did stay range bound until Oct 2014 when they crashed to $60/bbl

Greece, Portugal, Ireland, Spain and Italy austerity measures continue to improve the finances of these countries and these slowly start to grow once more as the main Euro crisis affects die away. Correct broadly improvement in all these countries.

South China Sea: The new security hotspot will be the South China Sea tensions with Japan and USA in relation to territorial claims. This escalation in tensions happened albeit situation improved by Aug 2014

BRIC: Brazil and India continue to boom with GDP increasing 5% and 6% respectively. Correct although they did not perform quite as well as expected.

Euro, UK, Japan and US Wows: These countries have succeeded in kicking the can down the road for another year or so. The debt mountain increases and the bond bubble increase along with the housing bubble. It looks more likely the bust will be in 2015 2014 could be more stable than 2013 but beneath the faηade lie deep seated cracks that will likely appear later in 2015. Correct, the bust deferred at least a year.

Note: Just like last years prediction, sometime in the next 6 months to 5 years we expect a real economic-financial crisis in western developed nations caused by the US bond market meltdown. At this time, gold and silver prices will go ballistic (silver from $20/oz to $400/oz and gold from $1200/oz to about $6400/oz. The Dow Jones may rise, but inflation adjusted real terms will decline still in an overall cyclical bear market. Prediction is maintained.