522: Global Migration, Population Growth, Inflation and Property Prices

12-05-2014

PropertyInvesting.net team

The global population explosion is having a profound impact on the economies of western developed nations and this also impacts property prices. Let’s explain.

Migration: So called “Globalization” – the freer trade of goods and services around the world – has kept a lid on prices of manufactured goods and services for the last 1½ decades. But it’s the free movement of people resources that is arguably having a bigger impact moving forwards.

Lid on Inflation: Migration of people from poorer developing countries to the more wealthy developed countries is keeping a lid on wage inflation, providing low priced labour for manual  jobs and supplementing high end technical jobs with some very well-educated entrants to the labour market. The migrants tend to be higher motivated individuals and families that want a better life and work hard. The countries that have allow large scale immigration like the UK and USA have generally grown at a far faster pace since the 2008 crash than countries that have keep immigration levels down like Italy and Greece.

jobs and supplementing high end technical jobs with some very well-educated entrants to the labour market. The migrants tend to be higher motivated individuals and families that want a better life and work hard. The countries that have allow large scale immigration like the UK and USA have generally grown at a far faster pace since the 2008 crash than countries that have keep immigration levels down like Italy and Greece.

Lower Interest Rates: In addition, this wage inflation has capped general inflation levels and therefore allowed lower interest rates, more affordable borrowing, and encouraged a higher level of borrowing on properties because of the low repayment rates.

Higher Property Demand: Furthermore, large influxes of migrants to major cities has created higher demand for both purchased and rented properties and helped drive prices up as well - because of property shortages and insufficient supply, particularly in areas of the UK with strong business growth like London and Manchester.

GDP Growth: The migrant workers also create demand of their own for public and private sector  goods and services – and hence have a marked positive impact on overall GDP levels. As the population expands, so does the GDP. As migrant families tend to have larger families with more kids, this also stimulates growth and GDP. This is particularly important in countries with an aging “babyboomer” population – which characterised the UK back in in 1995. This problem will start to go away if the population continues to grow strongly with many young people being added – supporting the elderly population.

goods and services – and hence have a marked positive impact on overall GDP levels. As the population expands, so does the GDP. As migrant families tend to have larger families with more kids, this also stimulates growth and GDP. This is particularly important in countries with an aging “babyboomer” population – which characterised the UK back in in 1995. This problem will start to go away if the population continues to grow strongly with many young people being added – supporting the elderly population.

Aging Babyboomers: Conversely, if we look at Greece with a very low fertility rate, declining population, low retirement age, low immigration levels and an aging babyboomer population – you will see a country destined for many decades of economic decline as GDP growth is simply not able to rise sharply because so many elderly people are reducing their expenditures and not creating any products and services. Demand for property will be weak – particularly in rural inland areas with low levels of tourism, away from the main jobs centres.

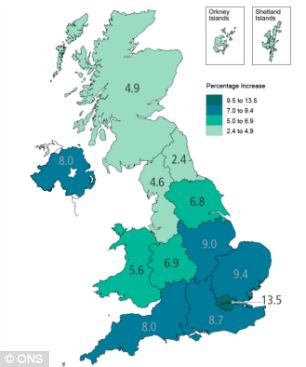

Migrants Go To Cities: In this environment where migrants generally gravitate to the cities and larger towns to look for work, and be with their fellow nationals, you can see how property prices in London, Manchester and Leeds would rise sharply, whilst the areas like rural Wales and Cumbria – where indigenous English populations are aging and declining will see property price rising at different lower trend level.

London Boom: Despite all talk of a property bubble in London – for the long term – with 1,000,000 additional people expected in the next 10 years, it’s hard to see property prices declining because demand is just so strong – particularly for middle level properties. Not enough low priced flats and homes are being built. Building rates would need to triple to make a big difference, The only building seems to be high rise flat with prices >£800,000.

Clustering: Another interesting angle is that migrants tend to like living in cities – partly  because they can find clusters of their own nationals in communities that make them feel more “at home”. It can be because of churches, grocery stores, clothes shops, cafes, schools, restaurants, cinemas, nightclubs – for example, the French like South Kensington, the Japanese Ealing, the Americans Little Venice, the Lebanese Edgeware Road, the Australian Earls Court, the Nigerian’s New Cross and Peckham, the Chinese Soho. That said, major cities tend to be very cosmopolitan places and people from all backgrounds mix and feel at home in London – this creates a magnet for people from all over the world that come to work in London. This keeps a lid on wages, keeps a lid on inflation and keeps a lid on borrowing costs whilst driving up property prices.

because they can find clusters of their own nationals in communities that make them feel more “at home”. It can be because of churches, grocery stores, clothes shops, cafes, schools, restaurants, cinemas, nightclubs – for example, the French like South Kensington, the Japanese Ealing, the Americans Little Venice, the Lebanese Edgeware Road, the Australian Earls Court, the Nigerian’s New Cross and Peckham, the Chinese Soho. That said, major cities tend to be very cosmopolitan places and people from all backgrounds mix and feel at home in London – this creates a magnet for people from all over the world that come to work in London. This keeps a lid on wages, keeps a lid on inflation and keeps a lid on borrowing costs whilst driving up property prices.

North Growths At Half Pace of South: We expect more of the same in the coming years – as the economic growth in southern England motors onwards at approximately double the rate compared to northern England. All the talk of a “Northern Powerhouse” is posturing – yes, there will always be successful industry in the north as well, but far more investment, population growth, int ellectual property and high-tech business will grow in the area within 50 miles of London compared to further north.

ellectual property and high-tech business will grow in the area within 50 miles of London compared to further north.

High Growth Cities: Longer term, for property investors, we maintain that investment in cities like London, Bristol, Cambridge, Oxford and Reading will see a better return than mid Wales, Cumbria and Newcastle for instance. These areas in southern England have the highest population growth, highest property demand, low property supply and highest employment growth with a smaller aging population compared to in the far north, west and Scotland.

Principles: If you use these principles to guide your property investments – it will lower you exposure-risk, and likely lead to higher returns in the long run.

Public Sector Cuts: It’s also worth pointing out that if the Tories get into power in May 2015 – they will drive through swinging public sector-services cuts – they need to cut £65 billion off the annual budget by 2020 to balance the budget as they have promised. These cuts would definitely effect the north and west more than SE England because there is a far higher proportion of public sector jobs in these northern regions – and the reliance on the public sector economy and services for aging populations is far higher.

North vs South Public Sector: The area least likely to be affected is London because it has such a small – approx 19% (compared to 48% in Newcastle) part of its economy reliant on th e public sector. Even if Labour get into power, frankly they also will not have any money to invest in a big public sector expansion in the north – if they tried – they would create a collapse in the value of Sterling, high general inflation rates and this would cause a depression.

e public sector. Even if Labour get into power, frankly they also will not have any money to invest in a big public sector expansion in the north – if they tried – they would create a collapse in the value of Sterling, high general inflation rates and this would cause a depression.

UK Growth Through Inward Migration: It is our view that the key reason why the UK is now able to grow at a far higher rate of GDP growth compared to Germany and Switzerland for example at present is because of its massive inward migration of workers. Take this away and by now, Sterling might have declined sharply and inflation would be far higher.

Escaping Bankruptcy: It is definitely the case that without the Tories at the helm – trying to reign in public sector expenditure and therefore supporting a higher value Sterling and lower inflation, the UK would be bankrupt by now. They managed to save the country from humiliation in 2010 – when the markets turned in UK’s favour just in time in April 2010 after hearing Osborne’s first budget. It was a close call. But headwinds remain strong and if Labour win a majority, which is still quite likely – then we predict a slow steady decline initially then a general depression as inflation rises, property prices drop and unemployment and taxation increase for everyone but the lowest paid workers and unemployed – the UK will go the same way as France and worse, since our manufacturing and businesses are less able to cope with high public sector spending and rising tax burdens

We hope this Newsletter has helped give some insights as you develop your property investment strategies. If you have any queries, please contact us on enquiries@propertyinvesting.net

Population increase mid-2011 to mid-2012 - showing highest increase in London and SE England (London's percentage increase is about five times that of NE England).

Now for some light relief. We shot these photos at an open air concert in summer 2013 at the Emirates Stadium - home to Arsenal Football Club. We thought the people putting the signs up were playing games!

Arse Exit

Fly Emirates Hell