519: Oil Price Dropping - Stock Market Crash Warning - Start Of Recession

10-12-2014

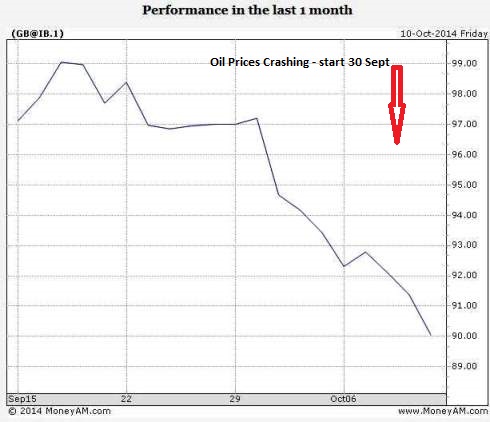

Oil Price Decline Equals Recession: You might have noticed the oil price declining recently which is normally good news for developed and developing economies. However, all is not well in the financial world.

Oil Price Decline Equals Recession: You might have noticed the oil price declining recently which is normally good news for developed and developing economies. However, all is not well in the financial world.

Propped Up With Printed Currency: Ever since the financial crash of 2008 in part triggered by oil prices spiking to $147/bbl and oil shortages, the only tactic central banks have had to prevent a deeper crisis has been to print currency and prop the whole lot up. This  gave an illusion of real growth. The CPI and RPI inflation number communicated by government are totally unrealistic as to what the real inflation is. In the last 6 years, wages have been growing at about 1.5% to 2% - but real inflation has been running at 5-8% when you consider rents, house prices, taxes, education, transport and energy/fuel for almost everyone. Our real disposable incomes have dropped and the only reason there has not been a crisis is because interest rates stay at abnormally low levels whilst employment of low end jobs has risen. Bankers have used the no cost printed currency to leverage up again seeking high returns. Debt has increased further. The Chancellor will have to borrow 6% more this year than last just to keep standing still. The lack of manufacturing, and creation of real value in the economy from goods and services is a real concern. When you add the private and public sector debts including those of the UK banking system plus liabilities, the UK debt is approaching range 800%-1000% of GDP. The public sector debt itself is claimed to be only 130% of GDP. Despite all this, Sterling had a really good run up in value as the Tories started sorted out the mess that labour left them with by implementing some austerity measured, but the actual savings have only been half of what was hoped for.

gave an illusion of real growth. The CPI and RPI inflation number communicated by government are totally unrealistic as to what the real inflation is. In the last 6 years, wages have been growing at about 1.5% to 2% - but real inflation has been running at 5-8% when you consider rents, house prices, taxes, education, transport and energy/fuel for almost everyone. Our real disposable incomes have dropped and the only reason there has not been a crisis is because interest rates stay at abnormally low levels whilst employment of low end jobs has risen. Bankers have used the no cost printed currency to leverage up again seeking high returns. Debt has increased further. The Chancellor will have to borrow 6% more this year than last just to keep standing still. The lack of manufacturing, and creation of real value in the economy from goods and services is a real concern. When you add the private and public sector debts including those of the UK banking system plus liabilities, the UK debt is approaching range 800%-1000% of GDP. The public sector debt itself is claimed to be only 130% of GDP. Despite all this, Sterling had a really good run up in value as the Tories started sorted out the mess that labour left them with by implementing some austerity measured, but the actual savings have only been half of what was hoped for.

Dynamics of Oil: The drop in the oil prices is probably broadly neutral for the UK since the country imports 550,000 bbls/day but produces 600,000 bbls/day. However, the drop in oil prices is probably indicating a few things that property investors should be very wary of:

-

The US oil shale production is ramping up and has started to flood the market

-

Saud Arabia has so far not cut back production possibly wanting to either:

-

maintain market share;

-

drive the price lower to reduce oil-shale production in the US;

-

create a buffer in case ISIS starts to disrupt oil production in southern Iraq; and/or

-

working with the US to drive prices down to put pressure on the Russian economy. It could be any one or more of these reasons its difficult to say.

-

both prefer the price drop to $80/bbl to help combat threats to their own interests. Since Saudi has only miniscule debts of 2.5% of GDP, it can certainly afford a protracted period of low oil prices to gain market share.

both prefer the price drop to $80/bbl to help combat threats to their own interests. Since Saudi has only miniscule debts of 2.5% of GDP, it can certainly afford a protracted period of low oil prices to gain market share. Recession: However, if we take away the conspiracy theories, and this is equally possible what we are seeing is overall demand reduction as supply stays steady and this points to a global recession as manufactures and customers need less oil and energy. If this is indeed the case, we believe the financial markets are probably in denial. They may believe the lower oil prices will help boost or stimulate economic growth. The argument is a valid one. But we rather think on balance the drop in oil prices is pointing to a major global economic slowdown and if this manifests itself financial turmoil could be just around the corner.

Bad News: Before a recession begins, most people stay in denial for a while. Objectively one only needs to look around at what is happening to assess all is not well - when everyone gets downbeat then a recession starts as people start cancelling orders - some trigger starts the panic. Lets just go through a few potential triggers that are currently out there in play:

-

Russia-Ukraine

-

Syria-Iraq-ISIS

-

Ebola

-

German manufacturing slowdown - sliding into recession

-

French-Italian recession

-

Bubble popping in stock market

-

Chinese slowdown and real estate and general 15 year bubble popping

-

Hong Kong disorder

We think the summation of all of these is certainly enough to trigger another recession in the UK and possible the US.

Bubble: The trillions of dollars and pounds combined with record low interest rates has created bubbles in the stock markets and other assets all around the world. Once everyone realises a global recession is starting there will be a stock market crash in most countries as smart investors pull their risk money off the table. Just like they did in 2008. They may park this in high end property and/or gold/silver for a while as they strive to protect their wealth.

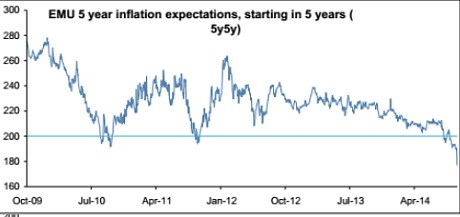

Chart shows European inflation expectations - pointing to deflation - a rapid decline

Physical Gold Rising: Our feeling is now is the time to act to get your money ou t of the US and UK stock markets - into cash for a while. If you see gold prices rising, thats a pretty good place to park wealth if panic sets in also - gold prices rose 5% over the last week to 10 October.

t of the US and UK stock markets - into cash for a while. If you see gold prices rising, thats a pretty good place to park wealth if panic sets in also - gold prices rose 5% over the last week to 10 October.

Oil Prices Could Crash for a While: Oil prices could nosedive below $70/bbl and gas prices drop more than 40% to 35p/therm in the UK or $2.80/mmbtu in the USA as a recession starts and unemployment rises. We just cannot see stock prices moving any higher - they are in bubble territory through the massive printing of fiat currency - and we think there will be a big slide from Monday 12 October onwards. Mining shares could be hammered as well as oil/gas company shares.

More Currency Printing: If and when this happens, and the floor is reached after a crash, Central Banks will again do the only thing they know to do and that is keep interest rates at record lows levels and print more fiat currency to try and prop the whole lot up then the next QE cycle will start and stock prices would rebound.

Get Out Now: What we are saying is the up cycle is at a top after years of currency printing and the financial markets are likely to shift into turmoil later in October as the world wakes up to the next recession which is of course well overdue since the last one was 2008. This is all part of a super cycle stock market bear trend as we described a few years ago that should end in 2018 we a due a big down leg now. Inflation adjusted stock prices are well below levels of 14 years ago in early 2000.

The Baltic Dry Index is heading down - starting to point to a recession (historically a good predictive indicator of a recession) .

Another Black Monday? If we go back in history to 1987 - on 19 October 1987 there was Black Monday when stock markets crashed 20% in a day. Shortly before this there was the famous London-SE England  hurricane that destroyed many forests in Kent. We are expecting similar stormy conditions in London on 13 October just like 26 years ago and we would not be at all surprized if the summation of all the bad news over the last few months precipitated itself as a panic stock market crash. It's just got that feeling about it. 5 years of currency printing propping things up and the easing back of this printing will in our view lead to the stock market bubble finally popping! It could start tomorrow 13 October.

hurricane that destroyed many forests in Kent. We are expecting similar stormy conditions in London on 13 October just like 26 years ago and we would not be at all surprized if the summation of all the bad news over the last few months precipitated itself as a panic stock market crash. It's just got that feeling about it. 5 years of currency printing propping things up and the easing back of this printing will in our view lead to the stock market bubble finally popping! It could start tomorrow 13 October.

Good luck out there!