490: Energy prices and property investment

10-26-2013

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gain, for our five thousand website visitors a day and the thousands of people signed up to your Newsletter. This Newsletter cover one key topic:

1: Energy prices and property investment

Oil and Gas Prices: For ten years now we have been writing reports about energy prices and the impact these have on property investing. As oil and energy prices have risen throughout the world in the last 13  years, countries with high oil and gas import costs have struggled economically whilst countries with huge oil and gas exports have generally boomed. This has been even more accentuated if/when the energy exporting nation has:

years, countries with high oil and gas import costs have struggled economically whilst countries with huge oil and gas exports have generally boomed. This has been even more accentuated if/when the energy exporting nation has:

* A small population

* Other mining and natural resources (forestry, water, hydro, nuclear)

* A strong manufacturing sector

* A strong financial services sector

* Good governance – high levels of transparency

* Women strongly contributing to the overall work force

* Positive demographics – moderately expanding though small population

* A large land mass with plentiful land

* A well educated workforce - with innovative work practices and businesses

Best Countries: Some countries such as Norway, Canada and Australia stand-out as shining examples of countries that generally rank highly in all the above, as well as having oil and gas exports to help their booming economies. Energy exports help pay for public sector and social spending and a high overall standard of living. These countries all have high participation levels of women in employment and management-government, both in private and public sectors. They have high levels of transparency, law, human rights and justice. Whether one goes before the other is debatable. The investment climate is stable and low risk partly because draconian new laws or policies that penalise businesses are rare.

Lower Production Per Head of Population: Some countries have high actual oil exports – although they suffer from large populations and weak industrial sectors with low levels of transparency - examples include Nigeria and Venezuela - these countries have struggled economically in the last ten years despite high oil prices.

Trends Important: For global property investors, the strategy to consider should be to look at the trends in oil and gas production, consumption and energy price levels along with the other socio-economic aspects outlined above - then predict how things will either improve or deteriorate over time. If the country is on an improving trend, then property prices should rise. If countries are on a trend where oil and gas imports are rising with underlying weak demographics, manufacturing and financial service, then property prices will stay depressed or drop sharply. Rents will also stay low – and recessions will become the order of the day.

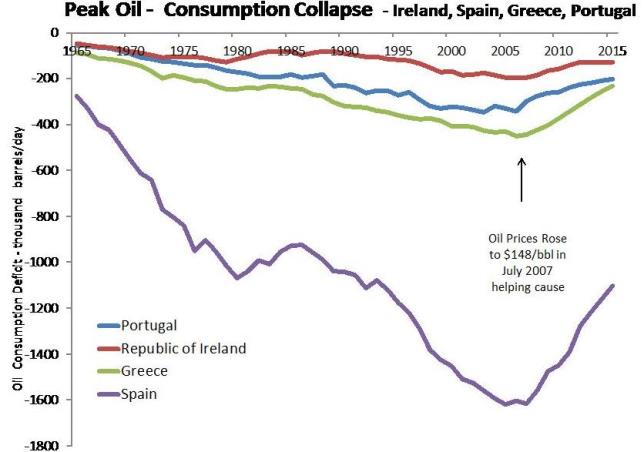

High Oil Prices Kills Some Economies: Every time the oil price rises above $100/bbl, some countries will automatically suffer hugely because of their bloated levels of oil and gas imports, poor demographic trends with weak manufacturing and financial services – in order of the worst first:

* Greece

* Portugal

* Spain

* Italy

* Ireland

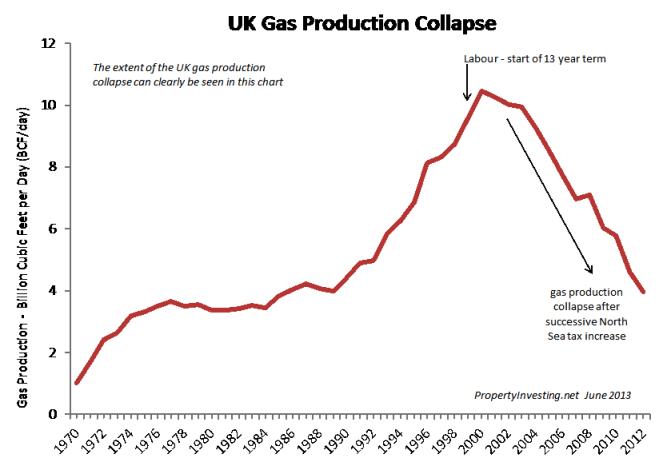

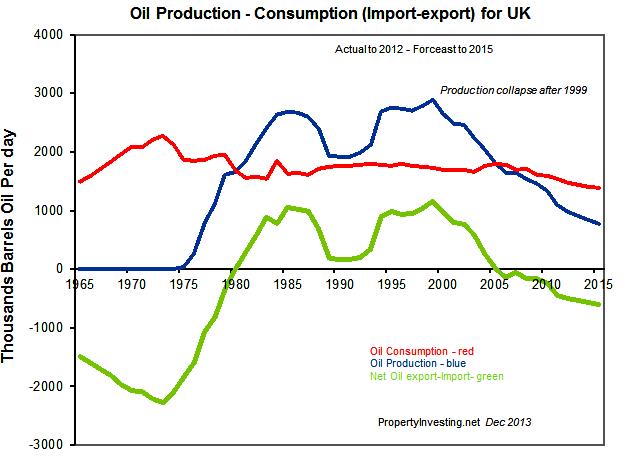

UK Worsening Trend: Some of you will be wandering about the UK. Well, it’s looking pretty bleak because the UK’s oil production has crashed from 2.8 mill bbls/day in 1999 to 0.7 mln bbl/day in 2013 – and each year it is declining over 15% - it crashed 23% in the 12 months after March 2011 after the government raised North Sea taxes. Despite $110/bbl oil prices, drilling activity has crashed 35% in the last year. Gas production has shown a very similar trend. Hence the key thing for property investors is a worsening trend with rising oil and gas imports. It doesn’t take a rocket scientist to infer that the UK economy will be depressed because of rising deficits from oil and gas imports when it can least afford them.

On a more positive note, the demographic trends are looking up – mainly due to inward migration and immigrants having larger families than the indigenous population. This is preventing an aging population dominating the UK economy - particularly in London and SE England. But the trends are rather spotty and the main population boom is in London. Hence its little surprise with so little home building and this booming population is leading to property prices rising sharply along with rents.

But the property investor needs to be acutely aware that in other parts of the UK, things are very much different. If you go the remote parts of Scotland and Wales, you will find declining or stagnant populations, aging people, young people having moved to the cities and higher costs because energy prices are rising – both oil/petrol and gas. Hence property rentals and property prices will remain depressed - driven by high energy prices, poor communications and lack of industry.

Northern Areas: Some of the Northern and Midlands cities can still see property prices rising as some areas of manufacturing are doing reasonably well – particularly the car manufacturing business. The UK now manufactures more cars than it did back in 1972. But overall, areas far from booming London will see depressed economies from high oil and gas prices and suffer from high oil intensity per unit or per  capita GDP created. These areas are also most exposed to public sector jobs cuts and the giant high street retail decline. They are also exposed to manufacturing that relies on low energy costs – which have risen sharply in the last 8 years. As less tax revenues are pulled in and oil and gas revenues dry up – the public sector will need to be cut back more significantly. There really has not been a significant austerity drive yet – certainly in real pound terms – since public sector spending continues to rise with inflation despite all the talk of austerity. Yes, you might have seen front line services reduced and seen some publicised pay freezes, but the public sector administrators seem to be keeping their jobs and bonuses and wage rises through promotions. The public sector wage growth has been double that of the private sector for the last four years. For property investors, one needs to consider the scenario – a very real one – that another deep recession hits in the next year or so – then more severe public sector cuts need to be enacted. What we are saying is, its really not going to get any better than this with oil and gas production crashing so dramatically.

capita GDP created. These areas are also most exposed to public sector jobs cuts and the giant high street retail decline. They are also exposed to manufacturing that relies on low energy costs – which have risen sharply in the last 8 years. As less tax revenues are pulled in and oil and gas revenues dry up – the public sector will need to be cut back more significantly. There really has not been a significant austerity drive yet – certainly in real pound terms – since public sector spending continues to rise with inflation despite all the talk of austerity. Yes, you might have seen front line services reduced and seen some publicised pay freezes, but the public sector administrators seem to be keeping their jobs and bonuses and wage rises through promotions. The public sector wage growth has been double that of the private sector for the last four years. For property investors, one needs to consider the scenario – a very real one – that another deep recession hits in the next year or so – then more severe public sector cuts need to be enacted. What we are saying is, its really not going to get any better than this with oil and gas production crashing so dramatically.

London and Aberdeen Safest In Energy Crisis: For property investors, the only cities that are protected from the massive oil and gas imports are Aberdeen and London. Aberdeen has in the last 15 years become a global centre for oil and gas services and engineering – so it works on global projects. As the North Sea declines, the skilled workforce starts working on global projects, and hence it will continue to boom despite the UK North Sea’s oil and gas production and activity decline. It’s the oil and gas intellectual property and skills in the city that has the value – property prices should continue to climb.

London is a huge global oil, gas and mining investment centre with many energy companies headquarters in or around the city. Middle Eastern, Russian, European and African oil wealth all find a home in London – if anything this has been accelerating in the last five years as London’s security and tax haven status for rich foreigners has come to the fore. This is not likely to change in years to come – as global super-cities develop further and attract the super-rich elite – namely:

* London

* Singapore

* New York

* Shanghai

* Tokyo

(other arguably second tier cities are Los Angeles, Kuala Lumpur, Sydney, Geneva, Paris, Rome, Berlin etc)

London Prime: As they say in the property business “location, location, location”. This means the prices of land and property within the central most select-prime few square miles goes up exponentially. As cities expand and populations increase, these central locations command an even higher premium because the rich and super-rich all want a central “pad” or house there - close to the high class amenities. In London, the epi-centre of the prime area is probably near Hyde Park Corner. The closer you can get to this location with low cost the better – areas radiating out like Mayfair, Knightsbridge, Holland Park, South Kensington and Green Park-Westminster all have huge property prices some four times higher than areas only a few miles further out. Almost every global city has a similar market.

Bubble or Start of UK Recovery? Many people talk of a property bubble in London. However, every property recovery in the last 50 years has started in West London and spread out – the so called “ripple effect”. This ripple effect has now passed through Fulham-Hammersmith, is heading through Southwark, Highbury and Limehouse and Clapham. Eventually – may be after another few years - this ripple will get to the lowest priced areas like Southall, Dagenham, Sidcup, Ilford, Woolwich and Slough. But for now – the prices in these low priced areas has hardly moved in the last two years.

London Market Dynamics: The Help to Buy scheme that was accelerated into existence in September allows people to borrow a deposit at a very low cost for London property valued at up to £600,000 with only a 5% cash deposit. Clearly this will encourage younger first time buyers to apply for borrowing of up to £570,000 – many using money given by "mummy and daddy" or inheritance wealth. This should help drive flat prices in the £300,000 range rapidly higher in areas like Clapham, Battersea, Hammersmith and Highbury for instance.

Unintended Consequences: The expectation of house price rises has risen to 97% for people in London  (24 October survey), many sellers will be holding back from putting properties on the market in the hope prices will rise further. Asking prices are rising sharply. However, because mortgage valuation professionals will be reluctant to lend the full amount because no “comparables” or benchmarks exist, its likely some of the purchase transactions - those needing a mortgage - will collapse – or at least the purchaser will need to raise further cash to buy the property. An unintended consequence could actually be a slowing of the market sales volume – many properties could be caught in this trap – whilst other people are disparately trying to locate a property of any sort in the desirable central London locations. This could temporarily drive prices even high. Meanwhile very few new developments have started – we are sceptical whether large new home supplies will come to market because of a slow and complex planning process, taxes applied by councils and lack of good returns on new building project – too many firms were burnt in 2008 and their balance sheets are still weak. Overall, the market has been distorted and it’s likely London prices will move sharply higher in the next six months at least. In northern areas, the effects of the Help to Buy scheme will be far more subdued – enough to prevent house price declines, and in major cities, enough to get property prices moving in line with general inflation at around 3-4% per annum only. In remote areas, prices are still likely to decline further in real terms – may be increasing by 0-1% per annum only (declining against the real inflation rate of say 5% by 4% per annum therefore in real terms).

(24 October survey), many sellers will be holding back from putting properties on the market in the hope prices will rise further. Asking prices are rising sharply. However, because mortgage valuation professionals will be reluctant to lend the full amount because no “comparables” or benchmarks exist, its likely some of the purchase transactions - those needing a mortgage - will collapse – or at least the purchaser will need to raise further cash to buy the property. An unintended consequence could actually be a slowing of the market sales volume – many properties could be caught in this trap – whilst other people are disparately trying to locate a property of any sort in the desirable central London locations. This could temporarily drive prices even high. Meanwhile very few new developments have started – we are sceptical whether large new home supplies will come to market because of a slow and complex planning process, taxes applied by councils and lack of good returns on new building project – too many firms were burnt in 2008 and their balance sheets are still weak. Overall, the market has been distorted and it’s likely London prices will move sharply higher in the next six months at least. In northern areas, the effects of the Help to Buy scheme will be far more subdued – enough to prevent house price declines, and in major cities, enough to get property prices moving in line with general inflation at around 3-4% per annum only. In remote areas, prices are still likely to decline further in real terms – may be increasing by 0-1% per annum only (declining against the real inflation rate of say 5% by 4% per annum therefore in real terms).

Cash Buyers Rush In and Compete: Because the Help to Buy scheme has created an expectation of rising prices, cash buyers or investors – both national and international – have come to the fore and are snapping up 33% of UK properties now, more in London. This means many people on the Help to Buy scheme are struggling to enter the market because mortgage valuers are reluctant to raise their value – they got bitten before in 2007 and don’t want to repeat this six years later – they have their jobs and reputation to think after all. This is therefore creating a further distortion – the Help to Buy scheme is bring out more cash buyers. Of course these buyers would then hope eventually to sell to the Help to Buy purchasers when the prices have risen up sharply. Of course, some of this could be described as speculative bubble behaviour – albeit so far it’s probably not too pronounced. Though it could get more extreme moving into 2014.

Intervention and Control: Talk of the Bank of England stepping in to slow the market is way overdone. Fi rstly, if they cool the market they will likely create a crash in northern England. Remember only 15% of homes are above their pre-crash 2007 levels in nominal terms six years on – this miserable in real terms. Any so called bubble is only restricted to the higher priced and more desirable properties in London – focussed around Central-West London. If the bank of England did something to calm the market, they might very well trigger un-intended consequences to the rest of the UK market and it would be further interference into a normal market. Let’s face it, every recovery in the last 60 years has started in London so its nothing new. It seems government, regulators and public love to interfere and control markets – this is common practice in socialist countries or ultra-right wing countries with dictators.

rstly, if they cool the market they will likely create a crash in northern England. Remember only 15% of homes are above their pre-crash 2007 levels in nominal terms six years on – this miserable in real terms. Any so called bubble is only restricted to the higher priced and more desirable properties in London – focussed around Central-West London. If the bank of England did something to calm the market, they might very well trigger un-intended consequences to the rest of the UK market and it would be further interference into a normal market. Let’s face it, every recovery in the last 60 years has started in London so its nothing new. It seems government, regulators and public love to interfere and control markets – this is common practice in socialist countries or ultra-right wing countries with dictators.

Ripple Effect: For the canny London property investor – who wants to take advantage of this ripple effect, of course you would need to purchase properties in front of the wave, see it go through then go to the next part of the wave – as prices ripple out. For instance, as prices rise in Chelsea, they fan out to Kennington first, then Stockwell and Camberwell, then Streatham and south. The last place in the London area will be Tilbury and Dagenham – the most deprived towns.

Commuting Ripple: Of course commuter towns away from London are seeing an impact – for instance Winchester, Woking, St Albans, Kingston and Tonbridge Wells will see prices rising first since these are some of the most desirable towns. Then peripheral towns like Leatherhead, Dunstable, Gravesend and Rochester will see prices rising later. If the property boom comes to an end, these outlying areas might not see any significant increase. As we say, it starts in West London and spreads out. The last place the prices will rise are places like St Davids in SW Wales, Saltburn near Durham and Barrow-in-Furness in Cumbria or the Western Isles of Scotland – this could be 5 years away. Because most of the press are in London, the focus of property news is London house prices – but most of the rest of the UK see prices in the doldrums. Despite real inflation levels of about 5% and wage growth of 2%, property prices have been stagnant or declining for the last five years – so real terms property prices are down about 35-40% from their peaks. It’s about time property prices started edging up with broad inflation – starting to track general inflation.

US Oil shale Boom and Property: For those global property investors that are looking to take advantage of the current boom in shale oil and shale gas production in the USA, there are some excellent investment opportunities for both asset price rises and rental price rises in cities like:

to take advantage of the current boom in shale oil and shale gas production in the USA, there are some excellent investment opportunities for both asset price rises and rental price rises in cities like:

* Midland – Texas*

* San Antonio – Texas

* Austin - Texas

* Dallas-Fort Worth - Texas

* Houston - Texas

* Williston– North Dakota*

* Bismark – North Dakota

* Operational town-city – excellent rental demand for high paid rig crews and oil service workers, requiring good quality accommodation for rotational working.

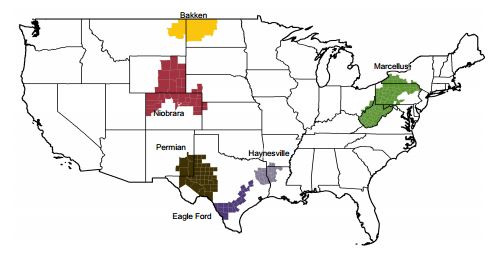

Property Investors Oil Shale Boom - can use this map to determine the areas where property prices will boom as the shale-oil and shale-gas revolution continues. West Virginia has the whole state underlain by the Marcellus Shale - we prediction property prices to rise robustly in West Virginia in the next few years. It's really simple to predict property prices rising with this geological map....follow the horizontal shale fraccing boom is our steer

Booming US Oil Provinces: As the US economy struggles to stay out of recession, these areas are set to boom as high oil prices and the huge levels of drilling and oil services related activities drive these economies. Texas has not seen such a boom since the mid-1980s – it’s taken 30 years and the good times are finally back. It’s been even longer for North Dakota. This desperately remote state had the lowest property prices of any state back in 2003 – ten years later the NW part of the state is booming – all rooms sold out – there just in not enough accommodation for all the rig crews operating in the area. Of course there has been a building boom trying to cater for the influx of workers – drilling horizontal fracced shale oil wells. Take a look at the oil production profiles.

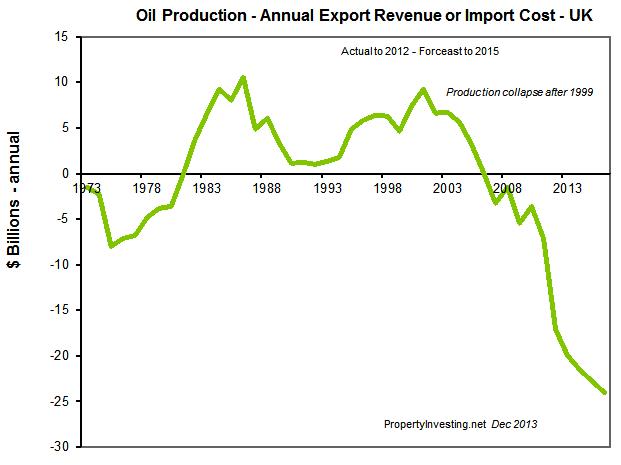

UK Peak Oil: Coming back to the UK, if you are sceptical about the presence of global “Peak Oil” – its undeniable the fact that the UK is suffering from the effects of Peak Oil – yes, its own indigenous oil and gas supplies have been crashing for years. It’s little wonder UK energy prices are skyrocketing since so much gas for power generation and heating is now imported at high cost from places like Russia and Norway. Wellhead gas prices in 2002 were about 15p/therm, spot prices are now about 55p/them – over three times higher in ten years. Then we need to look at the previous Energy Minister Ed Milliband who instigated a raft of policies to boost expensive renewable projects like inefficient and ugly wind farms in an effort to appease the global warming lobbyists at the time – we are now seeing the costs of these policies feeding through into skyrocketing energy prices. This was further pressed forwards by the Tory-Lib Dem Coalition that has tried to tax coal and gas to make it so expensive the costs are similar to renewables. Meanwhile there is no proven link between CO2 levels and the warming of the climate or climate change broadly. Hence it’s probably rather disingenuous Mr Milliband to point the finger at the Tories since it was he that put the policy in place when he was Energy Minister, something that seems to be lost in the press. They have both had their part. Anyway, both Labour and Tory parties have increased North Sea taxes three times in the last 12 years that have led to the production crashes and lack of investment we see today.

Production Collapse: It’s also worth noting that in the period 3 October 2008 to 11 May 2010 that Ed Milliband was Energy Minister, gas production dropped from 7.1 BCF/day to 5.5 BCF/day (a massive 25% decline 18 months) and oil production dropped from 1.5 mln bbls/day to 1.3 mln bbl/day (a massive 13% decline in 17 months). This caused a significant increase in the UK balance of payments deficit and help create increased wholesale energy prices and gas imports. Gas imports rose during Mr Milliband’s 18 month tenure from 2.5 BCF/day to 4.0 BCF/day – a not insignificant 65% increase. One could argue the Rt Hon Ed Milliband has probably done more than practically anyone else in the UK to shift energy prices higher - the outcome of these policies and the ensuing increasing energy imports from a declining North Sea oil and gas production rates.

Property and UK Peak Oil: Shifting to the effect on property – areas most affected by UK Peak Oil are:

* rural areas far distant from London and Aberdeen

* regions in the north and west exposed to public sector jobs cuts

* regions in the north and west that are reliant on energy intensive manufacturing

* regions in the north and west that are exposed to bus (or rail) services being cancelled – hence shifting the burden to more energy intensive car usage

* regions in the north and west with aging and poor populations, where young people have fled to cities to look for work

* areas not popular with wealthy London, Midlands and northern city professional people looking for second homes

UK Oil Deficit: The UK oil trade deficit in US dollar terms has skyrocketed - as oil production peaked in 1999 oil prices were at an all time inflation adjusted low of $10/bbl. Now 13 years later, oil production rates have collapses and imports are increasing - whilst the oil prices have skyrocketed to $95/bbl (Dubai, which this chart is based on - oil prices going back to 1973 for this insightful calculation)

Depressed Backwaters: Some examples of declining areas are: Barrow-on-Furness, Bury, Barmouth, St Davids, Stranraer and Holyhead. Counter to these depressed backwaters, some towns that will benefit from rich Londoners retiring will be: Salcombe, Sandbanks, Dartmouth, Exeter, St Ives, Ludlow, Goudhurst, Whitstable, Brighton.

Oil Towns: The areas that have exactly the opposite trends to the depressed backwaters are West London and Aberdeen – both oil cities with large private sectors, less energy intensive industries, small public sectors, expanding populations, super-rich inward migration and low levels of house building that can never keep up with demand.

London Efficiency: The UK has reached Peak Oil and perversely we believe the two oil cities Aberdeen and London will actually be the beneficiaries – simply because these skills workers will be re-deployed globally. London’s excellent public transport system means less energy is expended per unit of GDP compared with anywhere else in the UK – this great city is truly efficient.

We hope you have found this Special Report insightful and helpful to mould your property investment strategies. If you have any questions or queries please contact us on enquiries@propertyinvesting.net