484: Peak Oil Collapse In Some Countries - Effects of High Oil Prices

08-22-2013

PropertyInvesting.net team

Peak Oil is referred to as the maximum level of oil production – notionally of the world – that is expected (or passed). There has been much talk of Peak Oil over the years – however, the world seems able to produce ever increasing quantities of liquid oil as new technology and method develop to extract oil – for the time being at least.

Peak Oil is referred to as the maximum level of oil production – notionally of the world – that is expected (or passed). There has been much talk of Peak Oil over the years – however, the world seems able to produce ever increasing quantities of liquid oil as new technology and method develop to extract oil – for the time being at least.

Decline: When you look at each country individually though, many countries have passed Peak Oil and are on a permanent declining oil production like Norway, Denmark and the UK. For these countries, the chance of each nation surpassing their previous peak is probably less than 5% - it’s almost certain they are passed their peak.

Peak Cheap Oil: The important point to make is that despite oil prices rising tenfold from 1999 ($10/bbl) to 2013 ($100/bbl) oil production has only risen 20%. This also means that there has been a peak of cheap oil or “Peak Cheap Oil”. If you take out the new oil production that costs >$65/bbl to produce, it’s likely there would not have been any rise in oil production over 1999 levels. We seem to be on an undulating though slightly increasing plateau as new expensive oil is able to keep up with the growth in demand from developing nations, the increasing global population whilst demand from developed nations continues to decline.

When you look at the make-up of the oil production, it has radically changed in 13 years. It’s gone from almost exclusively conventional oil to a mix of:

-

Convention oil (light and heavy oil)

-

Deepwater oil

-

Oil sands

-

Natural Gas Liquids

-

Ethanol from sugar cane and corn

-

Shale Oil and natural gas liquids bi-product from Shale Gas

It’s the combination of new technologies and production techniques such as deep long multiple fracced horizontal wells and highly energy intensive oil sands production that has helped the world keep away from overall global Peak Oil. If you cut the prices of oil to $30/bbl, we would definitely be in production decline and have suffered the “Peak Oil” event.

But the more important point for individual countries are whether they have respectively reached Peak Oil for that nation or not. Because having oil production and oil exports gives a big economic boost, though when this is taken away, the countries that was used to cheap oil all of a sudden has to import oil - they suffer from a “Peak Oil shock” or crisis. In a way this is quite predictable. The balance of payments deficit increases, import costs sky-rocket, fuel subsidies need to be stopped, inflation rises, food prices rise, currency values decline and the economy suffers contraction and stress. Then the population gets stressed, often angry and sometimes then get violent and/or demonstrate – especially if food and fuel prices rocket higher. These are all the effects of Peak Oil on a country.

Let’s look at some examples – of which there are many.

-

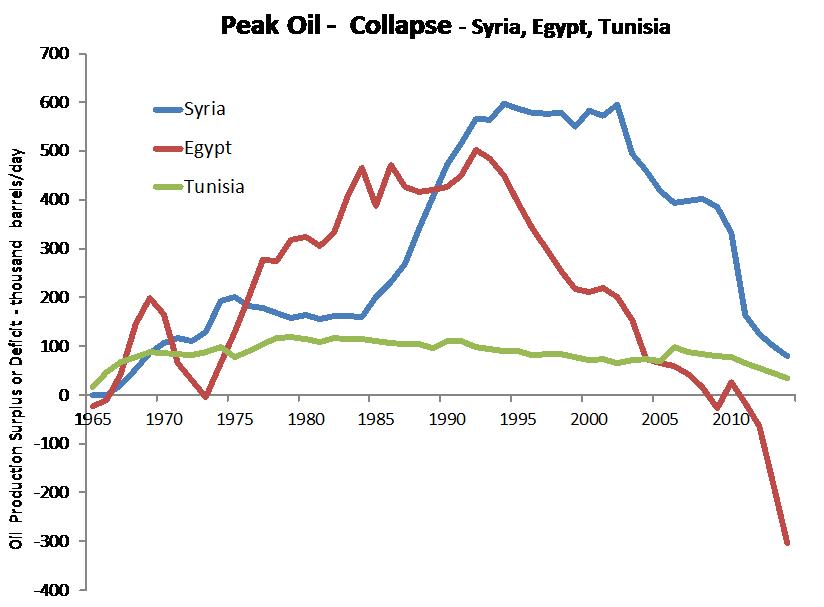

Yemen – oil production started a steep decline in 2006 and the country has suffered severe economic and security problems ever since

-

Syria - oil production started a steep decline in 2006 and the country has suffered severe economic and security problems since 2011, a truly dreadful degrading situation

-

Tunisia - rather low oil production dwindled to almost nothing by 2006 then oil prices rocketed higher – culmination in severe economic and security problems since 2010

-

Egypt - oil production started a steep decline in 2009 and the country has suffered severe economic and security problems since 2011 which have worsened as oil and gas production has been effected – a vicious circle of decline

-

Venezuela – since the socialists gained power in 1999 oil production has halved – and with it economic hardship and decline that seems inevitably to worsen by the year

-

Libya – just before Col. Gaddafi was deposed, the country was producing 1.6 million bbls/day at a steady rate – Libya now produces 0.25 million bbl/day after oil port strikes, security problems and insurgents shutting pipeline demanding payments etc. The economy has spiralled into miserable a depression as oil revenues have dried up.

Peak Oil Production -" after the peak" correlates with socio-economic-security collapse

A key theme is that all these countries have been reliance on cheap oil and oil exports to help their struggling economies – the government and populations probably got used to their own cheap oil – then it started to run out and their economies were not robust enough to cope. Particularly as these countries are hot, have water crises and much of their food needs importing. Getting fat on cheap oil then having this taken away has been a disaster – probably worse than having it in the first place. One reason why we say this is that countries like Jordan have no oil or gas, but have remained remarkably stable during this same period.

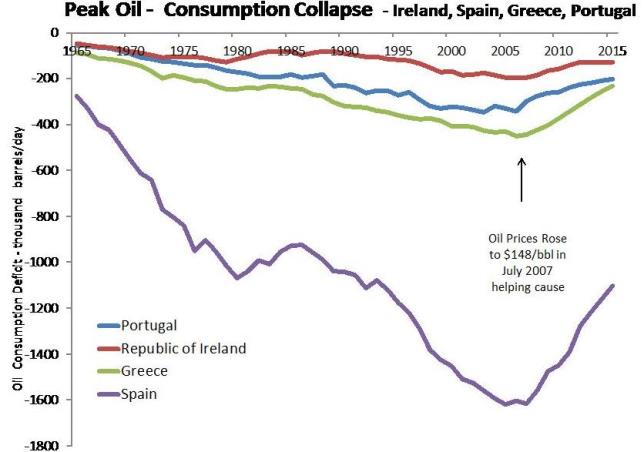

Examples of countries that have suffered severe economic crises because of the rise in oil price from $10/bbl in 1999 to $100/bbl in 2013 – that do not produce any significant oil or gas are:

-

Ireland

-

Spain

-

Greece

-

Portugal

Peak Cheap Oil - sent oil prices rising from $9/bbl in 1999 to $148/bbl in July 2007 - causing oil shock and economic decline in PIGS countries - with ensuing collapse in oil consumption as depression set in.

These countries all joined the Euro and got an easy ride from the strong Euro with low interest rates from 1999 through to 2007 – but when oil prices skyrocketed to $148/bbl in 2007 – it tipped these countries over the edge in part because their manufacturing and financial services industries were so weak or small. Their economies could not cope. At $100/bbl Greece’s finances are unsustainable – Ireland is recovering and once their new gas production comes on stream late 2013from Corib this should help boost their small economy. Spain is still struggling – with oil at $100/bbl and gas import prices linked to the oil price, this will act as a significant drag on their economy.

For the property investor, it’s very important to consider the broader socio-economic environment before allocating your capital. All countries are being affected by “Peak Cheap Oil” and as oil prices remain high, the big oil exporters with small populations will be the most prosperous. Countries like:

Norway

Qatar

UAE

Kuwait

Canada

The countries with large populations, weak manufacturing, strongly declining oil production – with increasing oil imports, weak financial services sectors, weak agriculture, water shortages and increasing food prices will be the countries that go into terminal decline. Such countries are:

Syria

Egypt

Yemen

Tunisia

Greece

Spain

What have these countries all got in common? They had wealth through either oil or cheap Euro financing-loans, and then this was taken away – leading to a downward spiral. They also suffer from aging populations and an unsustainable or non-existent welfare state.

London Boom: The richest most mobile people in these countries will take their  money out of the country and move to places like London – this causes further economic misery and depression. This is one reason why West London property prices have risen sharply. As countries have struggled – the super-rich have bailed out – and put their money into London property which is widely considered as a safe haven. London property has excellent legal rights, reasonable taxes and is an open market for overseas cash buyers. Other places to benefit are Monaco, Luxemburg, Switzerland and Malta – all tax and safe havens.

money out of the country and move to places like London – this causes further economic misery and depression. This is one reason why West London property prices have risen sharply. As countries have struggled – the super-rich have bailed out – and put their money into London property which is widely considered as a safe haven. London property has excellent legal rights, reasonable taxes and is an open market for overseas cash buyers. Other places to benefit are Monaco, Luxemburg, Switzerland and Malta – all tax and safe havens.

North Sea Decline: The UK’s oil and gas production has crashed since 1999 – both Labour and the Tory Coalition have put up North Sea taxes three times precipitating a collapse of production and exploration drilling. In the 12 months from the last rise in March 2011, production of both oil and gas collapsed 23% and has not recovered – it’s still declining at a rate of 15% a year. So the UK is another country that used to be flush with oil revenues that will struggle in future years – because it built a public sector based on these oil revenues and it now cannot afford these services. As long as London can maintain its global city status, it stands a chance of attracting foreign investment that can boost property prices, but don’t be surprized if UK Sterling bond rates rise sharply as the deficit remains under severe pressure and government borrowing stays very high – some $120 Billion a year predicted form 2013. This will lead to further Sterling decline and higher inflation.

For the areas far from London, either recession or outright depression will continue as an aging population, low fertility rates and younger wealth people either returning in the south or moving to London for work will all work against the local economies.

Manufacturing: in the UK was destroyed years ago and shows no sign of gaining significant ground – there is not enough investment, innovation or engineering prowess to compete with the Germans and other emerging manufacturing centres like China. Manufacturing now only accounts of 11% of the UK economy – a shadow of its former self. So areas in the north and Midlands will feel the pressure as factories continue to close and the bloated public sector is cut-back with the UK running deficits of 8% - unsustainable levels – particularly as oil revenues decline.

Property Invest ors: What property investors can expect is the continued decline in the value of Sterling and increasing pressures on inflation. The two tier economy will continue as the rich get richer and the poor get poorer through inflation. Two extremes will be:

ors: What property investors can expect is the continued decline in the value of Sterling and increasing pressures on inflation. The two tier economy will continue as the rich get richer and the poor get poorer through inflation. Two extremes will be:

Central London – huge inward investment, new business growth, large private sector, small public sector, young population, dynamic economy, rising house prices, rising rents, rising costs, booming population, housing crisis, growing manufacturing, large vibrant services sector, safe haven, tax haven

Teeside – declining inward investment, no new business growth, small private sector, large but declining public sector, aging population, stagnant economy, stagnant or declining house prices, low rents, low costs, declining or stagnant population, housing crisis through dereliction, declining manufacturing, small services sector, risky area, non non-tax haven.

Middle East Movers: One trend seems clear – the old Middle Eastern family run autocracies are one by one toppling – and being replaced by largely unstable government with greater insurgency and security instability. As richest elite and immediate middle class supporter who ran these countries flee – many of them move to London to make a new life. Some might have already bought homes – as a hedge – years ago – and other might be buying more homes for them and their extended families. London is still considered one of the safest cities in the world – no wonder these people flock to London to walk freely in the parks and shop without worry.

Central London Premium: Another consideration is that as global inflation creates more super-rich people because asset prices rise, and create more poor because food, rental and fuel prices rise higher than wages, the difference in price between the cheaper property (cheaper areas) and expensive property (expensive areas) will increase. This is obvious when you look at property prices in Kensington for instance that have ben rising about 8% a year since 2009, whilst prices in far off places like Bexley in SE London have risen only about 2% a year. But we expect this trend to continue for the following reasons:

-

Inflation will be created to keep an impression or illusion of growth – by continued low interest rates and money printing

-

Large suburban homes far from the city centre are rather an “English preserve” – most foreigners like to live close to the city centre (shops, theatre, restaurants, their respective communities, action).

-

he indigenous English are having smaller families – and often move out of London altogether – selling up their suburban family home

-

The incoming wealthy foreigners are driving the property market – and these people want to live in West-Central London (not far SE London for example).

-

Wealthy foreigners would far rather live in a nice flat in a nice central area than a house with garden in a far flung suburb

-

As the London population continues to skew towards foreigner incumbents – central London property premiums should rise

Ripple Effect: So for the property investor, the trick is to find the areas as close as possible to places like Chelsea, Mayfair, Notting Hill, Kensington, Bayswater and Bloomsbury. A ripple effect is fanning out from these prime areas – to places like Fulham-Hammersmith, Belsize Park, Primrose Hill, northern Southwark, Wandsworth-Putney-Barnes, Shoreditch-Hoxton, Kennington. It seems an obvious trend that more and more wealthy foreigners will be buying properties in these area as Kensington and other prime areas become unaffordable.

Gentrification: Which are will be the next Hoxton or Shoreditch though? The ripple of gentrification will fan out eventually to places like Clapton, Stoke Newington, Peckham-New Cross, West Greenwich and Elephant & Castle.

Farringdon: If you want to be right in the middle of the action though, look no further than Farrington station – which has to be a super place to invest in property. The reason is – it will become the east-west and north-south crossing point of Crossrail and the Thameslink upgrade. For the business professional or rich resident who wants to get everywhere fast, and be handy for the West End – on the fringe – then this is the place to be!

Broader View: For the UK based property investor, regrettably it looks like chaos in the Middle East driving up oil prices, that will then feed through rapidly to general inflation. If Mark Carney keeps interest rates low – and Sterling continues to decline – with the help-to-buy scheme being expanding, it’s likely London property prices will continue their relentless rise. But be careful because any wider war in the Middle East – that drives oil prices up to $150/bbl would probably lead to another recession. It’s been 5 years since the last crash and in a way – in this inflationary world – we are due for another big dip. So we are need to be on our guard for higher oil prices triggering the economy dipping because into recession – possibly with a crash.