483: Will House Prices Increase?

08-10-2013

PropertyInvesting.net team

This special report gives insights into property prices in the next few years based on current trends. Firstly we analyse the current socio-economic trends and indicators, then use this to predict what will happen in property prices in the UK.

General Election: Firstly, a General Election is likely around May 2015 - that's only 20 months away. The Tory party will do all it can to create a mini-boom before the election. Realistically it's the only way they stand a chance of being re-elected with a majority. They will struggle to even get enough votes for another Coalition, and there is a chance the Liberal Democrats will desert them and go with Labour. We believe this will be a central driver to house prices.

BoE: Mark Carney will be working in concert with the current government that appointed him to work up an economic recovery and small housing boom, to create a feel good factor prior to the elections. This will be achieved through:

-

stable and low interest rates

-

help to buy scheme - delivering 15% deposits (first time buyers only needing a 5% deposit) - on used property from Jan 2013 (already exists for new property)

-

this will stimulate building, renovation, upgrades and general economic activity in housing and services sectors

-

property prices will rise

-

home owners will start to use their properties as ATM machines again

-

consumer spending will rise

-

indebtedness will rise further

Not Prudent: All these policies are not exactly prudent. They will have the effect of driving up property prices. But although people will call it a boom, in fact it will just be a fairly healthy recovery from previous very depressed levels. Let’s remember inflation has been running at 3% a year for the last five years, so property prices in real terms have been in decline in all areas apart from London. They are still dropping in Newcastle for instance.

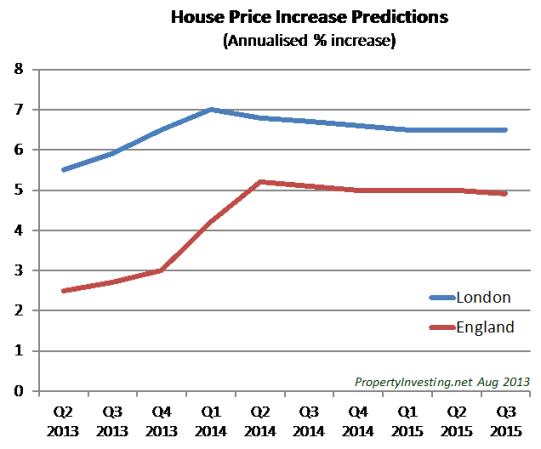

It's likely inflation will rise to over 3% per annum, whilst house price inflation will rise to 5-7% prior to the election. London will continue to see the highest price rises, but the rest of England will start to catch up a little towards the election as the ripple effect spreads through England as it always does after a London lead property price recovery (e.g. 1975, 1985, 1993, 2003, 2012). In real terms, property prices will only be rising 2-3% a year, but this would hugely help indebted property investors and owners because the value of the debt would (or will) be eroded.

For those not convinced property prices will rise, take a look at the facts below on London demographics:

London and the Demographics

-

London’s population increase by 104,000 extra residents in 2012

-

The capital’s population stood at 8,308,000 mid 2012

-

That is 104,000 more people living in London compared to a year ago — equivalent to half the current population of Islington or Richmond, a 1.27% increase.

-

London's population is 13.5% more than in 2001

-

There were 134,000 births in London in the year up to mid-2012 - 30,000 up compared to 2002

-

Deaths were only 47,570

-

The difference between births and deaths was 86,000

-

Net migration was 69,000 in 2012 (176,000 arrivals from overseas, 107,000 departures)

-

There was a net exodus of 51,000 of mostly older residents

-

Boroughs with the largest increase include Tower Hamlets, Hillingdon and Barnet, which all gained more than 6,000 extra people during the year.

-

Hammersmith and Fulham and Kensington and Chelsea saw their populations fall, mainly because of more people migrating overseas than arriving.

-

The UK population has grown by more than 420,000 to 63.7 million (the biggest growth of any country in Europe)

-

Only 25,000 properties were built in London in 2012 (whilst the population increased 104,000)

England and the Planning System

-

Only 10% of England is developed (including all commercial, residential, and industrial land)- most of the development – over 50% - is gardens and parks.

-

Scotland is almost half the landmass of the UK – hence the UK only is only developed ~5% of its land

-

Only 6.8% of England is urban (the majority is gardens, parks, allotments etc)

-

Only 2.3% of England is actually concreted over or covered with homes, roads, offices or car parks.

-

Agricultural land is cheap – priced at about £20,000 a hectare.

-

Industrial land with planning permission – is priced at about £1m a hectare

-

Residential land with planning permission – is priced at about £4m a hectare

-

Land scarcity is entirely man-made – relating to planning and environmental constraints imposed.

-

Satellite data shows the built up area of London grew by 1.5% a year in the 1990s as people crammed more people into the same space.

-

The UK’s [population is increasing at double the rate of France, but the level of home building is about 107,000 properties a year versus 350,000 in France.

-

Property building reached a 100 year low in 2009 at 80,000 despite record population growth

-

Most properties built in the UK are flats, although most people want houses

-

Despite property prices rising three fold in SE England since 1992, the building pf properties has declined

So why is there so little new properties being built?

-

The planning process is long, drawn out, expensive and very risky

-

Anyone that wants to build a property normally becomes a hated person – their reputation can be damaged through bad press, nimbyism and legal challenges

-

Residential land prices are extremely high adding to development risk

-

Building materials and labour costs have skyrocketed – denting profits

-

Banks are reluctant to lend to builders or private individuals looking to build properties because they think another property crash could occur

-

Councils give tax penalties against building – demanding money for affordable homes and/or infra-structure

-

Most available land is Brownfield, normally difficult to build on, requiring expensive clean-up or remediation – or in awkward small spaces adding to logistics and civil engineering costs

Will This Change?

Of course you can form your own view on this, but we believe the answer is no – because of nimbyism and the slow public sector planning process. It is so engrained in the British society and psych that it won’t change as the population ages and becomes more environmentally conscious and sensitive. It also doesn’t seem to win votes building houses. Supporting house prices probably wins votes – at least not allowing them to crash – but a mass building campaign acro ss the country probably wins no votes. Therefore don’t expect any big change.

ss the country probably wins no votes. Therefore don’t expect any big change.

To their credit, the government is trying to stimulate the property market with their help to buy schemes in part:

-

To prevent a house prices crash or prolonged debt stagnation (deflation)

-

Simulate building – to provide employment for construction and services

-

By stimulating building, adding to supply and helping the housing crisis.

Demand Increase, Supply Constrained: But we all know – in our heart of hearts – that because of nimbyism and the incredibly slow planning process along with reluctant banks and builders not wanting to take too much risk, plus councils imposing heavy taxes on building – the “Help to Buy” scheme will not help build many more properties – it could help build a few more expensive flats in London – but we think it’s impact on the supply side will be minimal. Hence the demand side will see a big increase, as younger people holding back for the last five years jump into the property market assisted by the government, but the supply side will stay severely constrained. This adds up to property price increases as long as interest rates don’t rise sharply.

Bond Markets Key: The key think to watch out for though is the bond prices – is they rise sharply and then interest rates follow in a credit squeeze, then property prices could drop suddenly and sharply. However, the Bank of England will do everything in its powers to prevent this from happening – and very well might succeed. It’s likely they would start money printing again to buy their own bonds and try and drive down bond rates and increase bond prices – therefore suppressing interest rates. For property investors, its absolutely key to keep in eye on bond prices – click this link to check them out – as you can see, in the last week, they have risen sharply in the UK – not a good sign. Hopefully then will drop back – but this could be the start of the UK bond market bubble going pop – something we have been warning about for a few years now.