455: Over The Cliff Into Recession - Bond Bubble To Pop

12-28-2012

PropertyInvesting.net team

As 2012 draws to a close, it’s good to look back on the year and look forward to what 2013 holds for investors.

Stumbling Along – How Much Longer? The western world continues to stumble along carrying a huge hang-over from the high private sector debt growth period up to end 2007, and the set-back of the financial crash of 2008. Almost five year on, real growth has not returned. Instead, we have stagflation. Money printing eased the pain of the banks and private sector. The public sector took on more debt to bail out failed banks. It spent money in the hope of g etting the economies going. Firstly, interest rates we jacked down to close to zero percent, but this did not achieve growth. So governments started printing money. This cheap "money" was given to banks to help bolster their balance sheets, but it has been used to speculate on commodities and equities which has caused base prices to rise and equities to hold-up. This has created a feeling of stability – but it’s not real. It’s purely a function of the money printing. Real inflation rates in the US and UK have risen to about 5%, whilst government claim inflation is running at 2.5%. This means that instead of growth of 1% in many countries, real true inflation adjusted growth is more like -2% - yes, a recession of -2% per annum. We are serious when we say most areas of the western world have been in recession for most of the last five years. It’s really been a depression eased short term by money printing. The only real winners have been the people that can take the ultra-cheap money and speculate and achieve high returns on things like commodities with this money. The middle class currency savers have been destroyed achieving negative savings rates of around 3% per annum (3% lower than real inflation). People owning large debts have benefited from the low interest rates. Money printing has debased currencies.

etting the economies going. Firstly, interest rates we jacked down to close to zero percent, but this did not achieve growth. So governments started printing money. This cheap "money" was given to banks to help bolster their balance sheets, but it has been used to speculate on commodities and equities which has caused base prices to rise and equities to hold-up. This has created a feeling of stability – but it’s not real. It’s purely a function of the money printing. Real inflation rates in the US and UK have risen to about 5%, whilst government claim inflation is running at 2.5%. This means that instead of growth of 1% in many countries, real true inflation adjusted growth is more like -2% - yes, a recession of -2% per annum. We are serious when we say most areas of the western world have been in recession for most of the last five years. It’s really been a depression eased short term by money printing. The only real winners have been the people that can take the ultra-cheap money and speculate and achieve high returns on things like commodities with this money. The middle class currency savers have been destroyed achieving negative savings rates of around 3% per annum (3% lower than real inflation). People owning large debts have benefited from the low interest rates. Money printing has debased currencies.

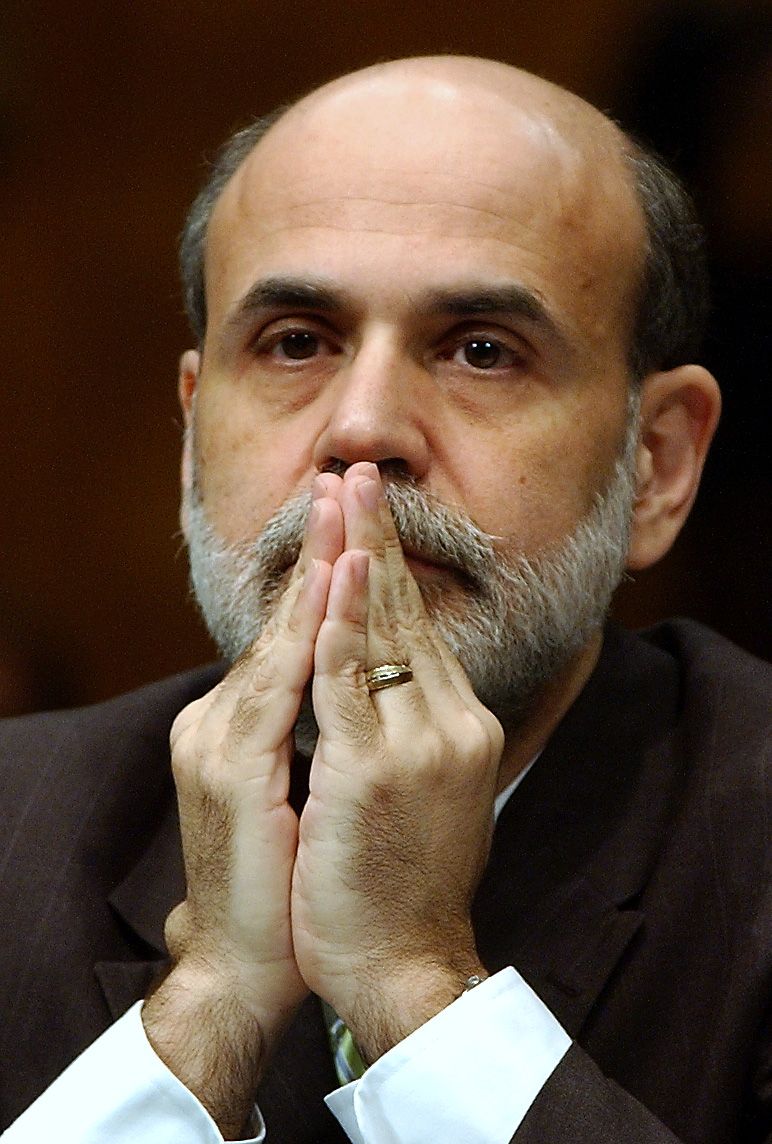

Forward Outcome: So the question is – what will happen moving forwards. We think regrettably more of the same. The money printing will if anything accelerate. Central Banks will be desperate to prevent deflation like what occurred in Japan in the period 1990 to 2005. It's rather easy for banks to prevent deflation these days, they just need to add numbers into a computer. The currency i s not real. It’s a number on a screen – it’s not even printed anymore. It’s not worth the paper its not printed on. It's not money. It's currency.

s not real. It’s a number on a screen – it’s not even printed anymore. It’s not worth the paper its not printed on. It's not money. It's currency.

European Austerity Starting To Work: Europe has at least tried to address its deficits with austerity measures to reduce public sector spending and public sector employment, to try and boost the private sector – remember some well qualified public sector workers can add huge value to the private sector, but too often, the public sector salaries and conditions have been so high and attractive that they have enticed top quality people into the “spending” side of the economy rather than the “value creating” side of the economy. If deficits rise, taxes need to rise to pay for public sector workers and services – and thence the private sector is squeezed out of the economy. If and when this happens, less taxes are collected and the economy starts going pear-shaped – as it did when the Soviet Union collapsed with the weight of a huge public sector centrally planned economy. One has to be reminded that all public sector spending is paid for by taxes on the private sector. Without the private sector there cannot be a public sector. The austerity measures are starting to work in Greece and Spain - in that their projected deficits out to 2015 have dramatically dropped. If they can hang in their and stimulate the private sector and keep within the Euro it could work in their benefit in a few years time.

Social Spending Unsustainable: As socialist government have got into power, taxes have increased on the wealth that eventually stifles the economy. But there is often a boom  before this as big public sector expansion, employment and spending using debt boosts the economy. The country then runs out of money and there is a crash. This familiar pattern can been seen in the UK for decades going back to the 1950s. Every time Labour get in, big spending, high taxes, high debt, high growth then the money runs out. Like it did in 2008. The we have to have severe austerity to get the books back into shape and try and reduce the tax burden before the private sector can grow again. The Tory Coalition has tried to cut spending, but its probably not been fast enough. There has been a re-balancing from public to private sector slowly, but not fast enough to create vigorous growth. Taxes have not really dropped. Deficits still remain stubbornly high. The UK economic picture looks rather bleak. One of the underlying problems is that manufacturing is now only about 15% of the GDP – and remains weak. Exports remain weak. The economy is so reliant on London banking that significant downside risks exist moving into 2013. If there was a run on Sterling, inflation could rise sharply and force interest rates up. This is a real threat for 2013. If the Bank of England starts to have failed bond auctions – and this drives bond rates up – this could be another negative trigger for the UK.

before this as big public sector expansion, employment and spending using debt boosts the economy. The country then runs out of money and there is a crash. This familiar pattern can been seen in the UK for decades going back to the 1950s. Every time Labour get in, big spending, high taxes, high debt, high growth then the money runs out. Like it did in 2008. The we have to have severe austerity to get the books back into shape and try and reduce the tax burden before the private sector can grow again. The Tory Coalition has tried to cut spending, but its probably not been fast enough. There has been a re-balancing from public to private sector slowly, but not fast enough to create vigorous growth. Taxes have not really dropped. Deficits still remain stubbornly high. The UK economic picture looks rather bleak. One of the underlying problems is that manufacturing is now only about 15% of the GDP – and remains weak. Exports remain weak. The economy is so reliant on London banking that significant downside risks exist moving into 2013. If there was a run on Sterling, inflation could rise sharply and force interest rates up. This is a real threat for 2013. If the Bank of England starts to have failed bond auctions – and this drives bond rates up – this could be another negative trigger for the UK.

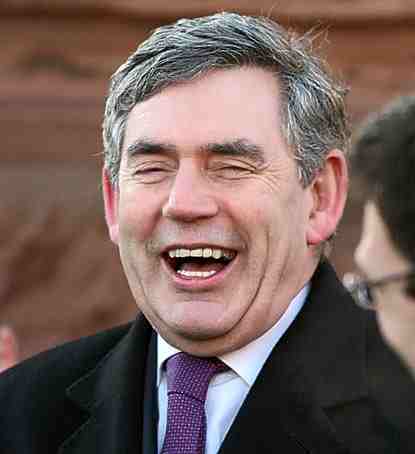

UK Gold Or Lack Of It: Furthermore then UK only holds about 400 Tons of gold, against Germany’s 3800 Tons. Gordon Brown sold off 60% of the UK gold at record low prices – known as “Brown’s Bottom”  because he flooded the gold market for years at ~$300/ounce in 2002 (gold now trades at $1650/ounce). He lost the UK taxpayer £60 Billion with his foolish fire sales at a time of record surpluses – selling the family silver at exactly the wrong time. He should be ashamed of this. So the outcome is that the UK has very little gold to back-up its currency or economy. Back in 1999, Gordon Brown inherited record oil and gas production in the UK, but just when this started to go into decline, he jacked up North Sea taxes twice in six years which helped precipitate a collapse in the oil production from 1.8 million bbls/day in 1999 to 0.8 million bbls/day when he left office in 2009. Gas production also halved in this time as he jacked up gas taxes as well. These means the UK has far less oil and gas reserves to back-up Sterling. The banking sector was crippled in 2008 and the Labour left the economy in a right old mess with deficits running at 10% by 2009. It will be a long and slow recovery, but you can see that without the oil/gas, gold and manufacturing, the UK stands a zero chance of getting back to where it was before in 1999.

because he flooded the gold market for years at ~$300/ounce in 2002 (gold now trades at $1650/ounce). He lost the UK taxpayer £60 Billion with his foolish fire sales at a time of record surpluses – selling the family silver at exactly the wrong time. He should be ashamed of this. So the outcome is that the UK has very little gold to back-up its currency or economy. Back in 1999, Gordon Brown inherited record oil and gas production in the UK, but just when this started to go into decline, he jacked up North Sea taxes twice in six years which helped precipitate a collapse in the oil production from 1.8 million bbls/day in 1999 to 0.8 million bbls/day when he left office in 2009. Gas production also halved in this time as he jacked up gas taxes as well. These means the UK has far less oil and gas reserves to back-up Sterling. The banking sector was crippled in 2008 and the Labour left the economy in a right old mess with deficits running at 10% by 2009. It will be a long and slow recovery, but you can see that without the oil/gas, gold and manufacturing, the UK stands a zero chance of getting back to where it was before in 1999.

Mega-Rich Safe Haven: One might wonder how the UK survives – a lot of the wealth is imported by mega-rich families and investors in London. These billionaires create huge trickle down and spend millions each year servicing their lifestyles. The waves of immigrants help to service these mega-rich and capital inflows into London remain strong. If you took this away and weakened banks further, the UK would be in serious trouble. This is one reason why the UK property market manages to hold up and interest rates can stay lower than they would normally.

Which Will Crash First: In 2013 the key question will be whether Japan, USA, UK or Eu rope bond markets crash – or all at the same time. The bond market prices have been rising since 1980 – 33 years. This was after they dropped for 40 years. Interest rates are at all-time lows and printing or money at all-time highs. It’s clearly a gigantic bubble. You can call it a debt bubble or a bond bubble – it’s really the same thing. Anyone that tries to rationalise that this as “not a bubble” is probably being foolish in our view. This bubble will go pop. It’s just a question of timing. You need to position for this bubble going pop. That means being in gold and silver and out of government bonds. It’s no different this time. It’s not a new world, new paradigm or a new economy – just like people said in 1999 before the Tech Bubble went pop, or late 2006 just before the US Real Estate bubble went pop.

rope bond markets crash – or all at the same time. The bond market prices have been rising since 1980 – 33 years. This was after they dropped for 40 years. Interest rates are at all-time lows and printing or money at all-time highs. It’s clearly a gigantic bubble. You can call it a debt bubble or a bond bubble – it’s really the same thing. Anyone that tries to rationalise that this as “not a bubble” is probably being foolish in our view. This bubble will go pop. It’s just a question of timing. You need to position for this bubble going pop. That means being in gold and silver and out of government bonds. It’s no different this time. It’s not a new world, new paradigm or a new economy – just like people said in 1999 before the Tech Bubble went pop, or late 2006 just before the US Real Estate bubble went pop.

Winning Gold Owners: The real winners will be the people holding safe physical gold. It’s worth reviewing some of the numbers because it has an important impact on how well the countries will fare during the ensuing turbulence and bond market crash.

· Firstly there have been 171,000 metric tons of gold mined in gold up to 2011. That equivalent to 2/3rds of a cubic tennis court. Not much considering how big the planet is.

· 100,000 Tons of gold are privately held globally. Only 30,000 Tons are in bank reserves – these including significant amounts at the European Central Bank, International Monetary Fund a nd Bank of International Settlements. This is the summation of all global central banks.

nd Bank of International Settlements. This is the summation of all global central banks.

· A gigantic 25,000 Tons is privately by Indian citizens in India – this jewelry and gold in temples.

· Only 8,139 Tons is held by the US Fed (or central bank) though some people think this could be far less since they have not audited their gold since 1956.

· Germany has a healthy 3800 Tons of gold reserves at its central bank, but 65% of this is house in Paris, London and New York and is not properly accounted for – it may have been leased out, sold or be non-existent, no-one really knows for sure.

· The UK has a miserable 300 Tons of gold reserves in London at its Bank of England (central bank) after Gordon Brown foolishly sold 65% of the UK’s gold at record low prices of $280/ounce around (gold now trades at $1700/ounce) – loosing £60 billion in value for the UK tax payer in the process. This is commonly known as “Brown’s Bottom” after he drive the price down after swamping the gold market for 1-2 years.

· Out of all gold, 50% is held in jewelry, 40% is investment gold (private and central banks), and 10% held in industry.

· There are 29167 Troy ounces in 1 Ton of gold. If we take the total 171,000 Tons of gold and divide this by the total amount of dollar fiat currency in the world in all countries – that’s all derivatives and debt – estimates at approx $75 Trillion, then gold should be priced at $15,000 ounce (current price $1700/ounce). Using this calculation, one can see that the value of the dollar is far too high compared to the value of gold today.

· Even assuming the official US government dollar debt of $16.3 Trillion, gold should be valued at $3268/ounce.

India Well Placed: In the event of an all-out global currency crash and hyper-inflationary period, India could do very well because it has so much gold privately held per GDP. The UK is ve ry exposed to fiat printed currency and has little gold to fall back on. It does store a lot of foreigners gold, but it cannot just steal this gold – that’s not an option and would lead to at least a trade war if not all out war.

ry exposed to fiat printed currency and has little gold to fall back on. It does store a lot of foreigners gold, but it cannot just steal this gold – that’s not an option and would lead to at least a trade war if not all out war.

China Gold: China is rapidly expanding its gold reserves – it must have noticed how little gold it had compared to GDP which is rapidly growing. Its also encouraging its citizens to buy as much gold as possible. The Chinese are not stupid – they can see the writing on the wall for currencies like the dollar. Let’s face it, the dollar has lost 97% of it’s value since 1922 when the Fed was created. But the debasement will accelerated as more money is printed and debts get larger.

Sell Induced Fiscal Cliff: It looks increasingly unlikely the so called “fiscal cliff” will be avoided – so the tax increases and spending cuts should kick-in automatically and hence automatically trigger a recession. The taxes will increase inflation, the growth rates will crash, the Fed will undoubtly accelerate its currency printing in response to try and stimulate demand. But supply will drop, demand will drop and recession will be a foregone conclusion by March 2013 – just like we predicted a year ago now.

Trigger For Crash: If this then triggers the bond market bubble to pop, then all hell w ill break loose with higher interest rates, higher inflation, higher unemployment, a further sharp down-leg in property prices and a widespread deep recession in the US that would then start to affect other parts of the world like UK, Europe and Japan.

ill break loose with higher interest rates, higher inflation, higher unemployment, a further sharp down-leg in property prices and a widespread deep recession in the US that would then start to affect other parts of the world like UK, Europe and Japan.

Politician Being Pay But Not Working: It really does look increasingly likely the politicians on their Xmas-New Year holiday – refusing to do any meaningful work on the “fiscal cliff” could be the Black Swan triggers for the next global recession. But just like World War II – everyone could see it coming along but no-one believed it would happen.

Anyway, for 2013, best batten down the hatches and get a ring-side seat for the greatest crash you will ever have seen in the form of the bond market bubble going pop.