444: Directional Trends Leading Into 2013

09-07-2012

Crisis 2013: Things are starting to build-up to a real crisis for year end. Remember Obama took over during a crisis as Bush ducked out. It looks almost certain Obama will get back in, mainly because Romney is so ineffectual and keeps making errors - and frankly seems only to appeal to such a small audience of business people - after all, the public sector is so big now - he's certainly up against it. The US economy is a mess, unemployment is staying high and gasoline prices are really high but Obama has given enough hand-outs to win votes whilst Romneys message is tax cuts for the rich and cull the public sector not exactly a vote winner. What this means for the investor is the rich will get richer - because of far more uncontrolled money printing, dollar debasement and inflation with a stagnant economy at best but more likely recession.

Five Years Since Last Official Recession: Its been five years since the last official recession in the USA so we are due for another - high oil prices have not gone away and this causes recessions. The US is in long and sl ow decline inflation is under-reported so the actual GDP has been more or less zero for years now. Jobs have moved overseas. Rich people have been exporting wealth to safe havens. Oil import bills have given dollars to OPEC. Cheap imports of stuff from China have exported dollars and bubbles. Debt levels have gone up exponentially. Its a gigantic dollar bubble about to go pop.

ow decline inflation is under-reported so the actual GDP has been more or less zero for years now. Jobs have moved overseas. Rich people have been exporting wealth to safe havens. Oil import bills have given dollars to OPEC. Cheap imports of stuff from China have exported dollars and bubbles. Debt levels have gone up exponentially. Its a gigantic dollar bubble about to go pop.

Gigantic Debt: Because the direct debt is now so gigantic, at $16 Trillion, there is no way the USA can increase interest rates because the government, banks and businesses would all go broke within months if rates shifted from 0.25% to 4.5%. Savers are destroyed. This giant Ponzi scheme that has been building up steam since the US dollar came off the gold standard in 1971 is about to go pop. But instead of being allowed to deflate, the Fed will just keep adding zeros to the available dollars and inflation will rage. After the dot.com bubble went pop, the Fed kept rates far too low, far too long cause a real estate bubble. This then went pop and the Fed started massive money printing. The bond bubble will be the next thing to pop at government level - then we will have a real mess.

Weimer: In Weimer Germany in the thirties, it took just two years for the currency to be destroyed and most of the action was in a six month period. The key point in this journey is when the general public realise they have to offload their currency (dollars in this case) because prices are rising so sharply they buy assets like there is no tomorrow before the value of their dollar currency is destroyed over a short time period. We are fairly close to this situation now may be 6 months to 2 years away. It could happen very quickly we all need to be on guard.

Shock, Deflation, Then High Inflation: When a short deflationary shock occurs, the printing will commence into overdrive - big style - and inflation will then get out of control. Then gold will start to sky-rocket as people loose faith in the dollar and the bond market bubble finally goes pop.

Gold Price: If you took the total dollars in the world and divided it by the total  amount of gold, to achieve a dollar gold standard once more - the real price of gold would be $65,000/ounce. Yes, we are serious it's current price of $1700/ounce is a steal.

amount of gold, to achieve a dollar gold standard once more - the real price of gold would be $65,000/ounce. Yes, we are serious it's current price of $1700/ounce is a steal.

High Oil, High Food Prices: As successive peripheral global economies have imploded after oil and commodities prices sky-rocketed, people flocked to the US dollar as a so called safe haven. But it's frankly very far from a safe haven because the USA is the biggest debtor nation in the world. It directly owes $16 Trillion and with all unfunded liabilities included it's more like $75 Trillion. When you add all dollar derivatives to the number of dollars circulating, some people estimate the amount of dollars to be around $175 Trillion. Its colossal. But all these dollars are currently hidden away a tidal wave of dollars about to be unleashed. Mainly bonds and treasuries that can be sold and bailed out of rapidly if governments and institutions loose confidence in the US Administration.

Dollar Global Reserve Currency Status: Up until now, the US has wanted to flood the world with dollars so everyone uses them as the global reserve currency of the world. This has made imports cheap for the US and raised US living standards about 30% higher than they would be otherwise. Even though the USA imports 8 million bbls of oil a day, it has still managed to keep oil priced in US dollars. These $ 65 to $175 Trillion of dollars are not really back by anything it is a true fiat currency. The illusion of the US dollar as a safe haven and world reserve currency is likely to come to an end shortly only 15 years ago the US economy was 33% of global GDP. It is now 25%. In 10 years it will probably be 15%. It's status as the global economy is diminishing all the time. It's military might is being eroded. It cannot afford all the military ventures and the arms races. Its living off its history and is in decline. When the US economy drops fast into recession it will become very evident to investors that this safe haven reserve currency status has been an illusion almost like a mirage. If and when the dollar declines sharply, all US import costs will go through the roof and inflation will run far higher very rapidly. The only way out will be to print even more money to make the debt payments then the market will finally catch on and run against the dollar. Its an accident waiting to happen. A tipping point is about to be reached.

65 to $175 Trillion of dollars are not really back by anything it is a true fiat currency. The illusion of the US dollar as a safe haven and world reserve currency is likely to come to an end shortly only 15 years ago the US economy was 33% of global GDP. It is now 25%. In 10 years it will probably be 15%. It's status as the global economy is diminishing all the time. It's military might is being eroded. It cannot afford all the military ventures and the arms races. Its living off its history and is in decline. When the US economy drops fast into recession it will become very evident to investors that this safe haven reserve currency status has been an illusion almost like a mirage. If and when the dollar declines sharply, all US import costs will go through the roof and inflation will run far higher very rapidly. The only way out will be to print even more money to make the debt payments then the market will finally catch on and run against the dollar. Its an accident waiting to happen. A tipping point is about to be reached.

Run On Dollar: When the US economy finally clearly falls into recession in 2013 when the spending cuts start, the tax hikes begin and the spending prior to the election stops the country will drop into a recession. New forward projections will show that the US will never be able to pay off its debts. Interest rates will then start to rise as the market take fright then the Fed will be forced to print and buy more of its own debt before it has to buy almost all of it. Like a big money pumping scheme of scam-like proportions.

Crude Oil peaked in 2005 - the only reason we forecast total liquids to rise is because of increases in natural gas liquids, heavy oil, ethanol (offsetting food) - all resource intensive higher cost liquid variants of the "real thing". The above forecast assumes no significant wars affect the Middle East over and above this troubles experienced in June 2012 (any significant war will take 2 to 5 million bbls/day off the market). Notice demand still out-strips supply, meaning oil prices have to rise despite the USA and Europe being in a stagflationary period of more or less zero real growth.

Spike in Gold: Investors will then panic buy oil, food, gold and silver as the last safe haven when it looks like the 30 year bond market bubble has finally popped. Gold prices will go ballistic. Gold will start to account for all the dollars in existence. The gold price should reach the price of the Dow Jones index if the Dow is 12000, then gold should be $12,000/ounce (if the Dow is 6000, gold should be $6000/ounce) at the end of the gold bull run. Real Estate prices will rise because of the wall of dollars but almost everyone will feel worse off because prices rise so sharply.

Shares Bear Market: In this outcome, do not expect stocks and shares (equities) to rise faster than inflation, but they should at least rise and inflate inflation adjusted they will be in a bear market, but at least you will not lose all your money. Its difficult for governments to confiscate private company equity. Big companies survived world wars and crises - so a good steady company like Philip Morris cigarettes - should stay in business and still keep pumping out profits - people aren't going to stop smoking.

Bonds and Treasuries: But if you own government bonds or treasuries expect to lose everything the government will either default, give a gigantic hair-cut or inflate the currency so much the value of the bond is almost worthless. Stay well away from US government bonds. You just cannot trust you will get your money back in inflation adjusted terms as the crisis commences in earnest.

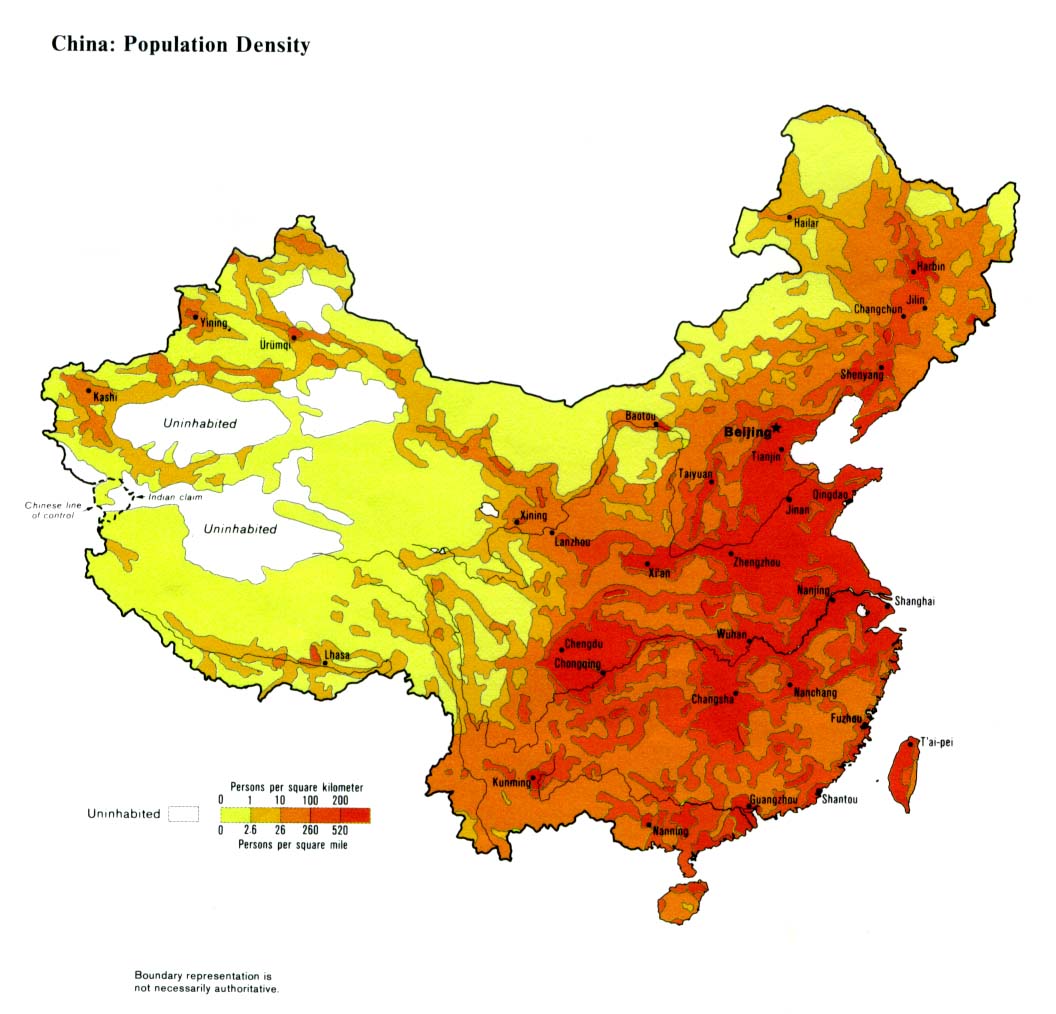

China Has Driven Global GDP: So much of the global GDP growth has been driven by Chinas massive growth spurt in the last 15 years. Its been keeping things going in the west for the last five years fuelled by printed dollars and commodities needs. But this is likely to slow dramatically in the next year as the Chinese Real Estate bubble slowly deflates leading to lower construction and commodities imports.

Chinas massive growth spurt in the last 15 years. Its been keeping things going in the west for the last five years fuelled by printed dollars and commodities needs. But this is likely to slow dramatically in the next year as the Chinese Real Estate bubble slowly deflates leading to lower construction and commodities imports.

Tensions Rise: Global tensions are increasing all the time with major conflicts possible between Israel and Iran in the Middle East and big troubles in Syria. It has echos of the 1970s problems all over again. the Iranian Revolution took place in 1979, Lebanese war around this time. Gold prices roses from $35/ounce in 1978 to $850/ounce in Jan 1980 leading to a global recession and wars. Silver prices rose to $55/ounce. Now 32 years later, silver is $35/ounce (almost half the cost) and gold $850/ounce (only twice the cost) - name anything that has gone down in price since 1980 - most things have risen ten fold. Gold and silver are incredible cheap in our view - and this is no bubble yet - far from it.

Security: 2013 is likely to see wars spread. They normally do when economic recessions start and food prices rise sharply - as governments like to deflect away from in-country economic problems. Dont be surprized to see Israel and Iran involved but also keep in eye on the South China Sea because emotions are running very high over rights to a huge swath of offshore oil acreage with six countries involved. China seems to claim the lot and this dispute wont go away especially as oil prices rise and energy needs become even more important.

Rising Tenions in South China Sea - over resources

London Property Safe Haven For Super Rich: As far as property investors are concerned, if we take all this into perspective, you can see why London property prices continue to rise.

-

UK Sterling continues to decline making London property cheaper for overseas buyers

-

As peripheral countrys economies start to go pear shaped the richest elite s

hift their cash out of these countries and look for a safe home somewhere where better than London?

hift their cash out of these countries and look for a safe home somewhere where better than London? -

They pay cash no debts required and they own land-bricks-mortar a real tangible asset that is an excellent hedge against inflation in a world class location

-

As the central governments print more money, the rich get richer and the poor stay poor the middle class are squeezed and savers are destroyed the best thing to do in this instance is to shift debasing cash into something safe like London property. Then hold tight.

-

Then these same global elite buy physical gold and silver then put it into safe deposit boxes in West London banks handy close to their properties. These overseas investors are from the Middle East, Russia, Africa, southern Europe and recently joined by the French.

They can go down the road and shop, meet their financial advisers in the city, go to a festival or show and live safely away from troubles in a cool climate full of culture, history and heritage in a country that treats people with respect and dignity.

As wars break out and revolutions become more common-place around the world as oil and food prices rise, London will remain a safe haven for the ultra-wealthy. We cannot see this changing any time soon.

Rich Get Richer Regardless: The biggest threat to London property prices is the health of the financial district so a recession will hit the financial services industry badly. But that said, downturns did not seem to affect New York or London in either Sept 2001, after the dot.com bust or in 2008 financial crisis. It seems the bankers always seem to make money regardless of the ups and downs. Their bonuses always seem to rise. As their bonuses rise, the tax on their bonuses rises. Inflation again and more. Just think back to 1980 when a house cost £20,000 and people earnt £4000 a year. Prices have risen ten fold in 32 years even though was say we have been living through low inflationary times. Now we are printing money even faster than ever, in the next 32 years, we would be surprised if prices did not rise another ten fold. So a £200,000 house would cost £2,000,000 yes, we are serious. People earning £40,000 a year will be earning £400,000 a year. But oil prices might be ten times higher in 32 years time. Lets face it, in 1999, oil was $10/bbl and now it is $100/bbl. So dont be surprized in 32 years time if gold is $17,000/ounce instead of todays $1,700/ounce.

The main reason why the rich get richer is they buy real assets that are a hedge against inflation. They borrow money to leverage and invest in physical assets and cash-flowing businesses. Then the value of the debt is destroyed because of inflation. But the equity value of their assets keeps rising as governments print more money.

Middle Classes Destroyed: The average person gets taxed more, prices rise, t heir disposable incomes drop and their savings are destroyed by inflation and low or zero savings rates. The governments lend at zero % to rich people, who then lend it to the middle class at 6% per annum (safe mortgages) and to the poor at 20% per annum (credit cards, sub-prime). After profits are made, the bankers give themselves massive bonuses. When they make a loss, they say they are too big to fail, then the governments step in and bail them out with tax payers money money from the middle classes and savers and poor.

heir disposable incomes drop and their savings are destroyed by inflation and low or zero savings rates. The governments lend at zero % to rich people, who then lend it to the middle class at 6% per annum (safe mortgages) and to the poor at 20% per annum (credit cards, sub-prime). After profits are made, the bankers give themselves massive bonuses. When they make a loss, they say they are too big to fail, then the governments step in and bail them out with tax payers money money from the middle classes and savers and poor.

Savers Destroyed: Savers have negative rates of about -3% - but when you take real inflation into account it's more like -6%. So any cash is eroded rapidly. The only way to survive is to get hold of assets and hope they inflate above real general inflation.

Babyboomer Crisis: One of the most important trends to watch in property investing and overall investing is the demographics of a country. People spend the most money and hence GDP rises the fastest when people are aged 28 to 48 year old - this is when they have families, buy larger houses, spend more money on schooling, transport, holidays and save very little. When they get to 50 years old, they seriously start to cut back spending and start saving for retirement. By age 62, the average person is then drawing down these savings and trying to spend as little as possible. This trend has a huge impact on country's economies. If there are waves of people retiring - as happened in early 1990s in Japan - then the country will slip into recession. This started happening in Greece, has now hit Spain and will soon hit the USA and to a lesser extend the UK. All you have to do is take the peaks in the chart above and add 48 years - then you will get the slowing down of GDP. If we take the mid point at 1949 then add 50 years, that's 1999 - which is when the dot.com bust occurred and the stock market reached an all time high. It has struggled ever since as this conveyor belt of old people have slowed their spending. It will only get worse - culminating in the lowest growth around 2025 - that's 1975 low plus 50 years. Then it may start recovering a little. If this sound bleak, indeed it is, its very bleak indeed. Do not expect any real inflation adjusted growth in the USA henceforth after 2010. That's 50 years after the population growth crash in 1960 you can see int he chart above. It's that simple. Take this very seriously. It is very predictable. The UK's demographics look a little better - less severe decline in population growth after 1957 so its possible the UK may just stagnate. But if one uses this tool only - one would expect a big deceleration in growth in 2010 as spending - which accounts for 70% of US GDP - drops from 1999 onwards - decreasing rapidly through to 2015 then staying low for the next decade.

6%. So any cash is eroded rapidly. The only way to survive is to get hold of assets and hope they inflate above real general inflation.

Smart Investors: The reason why the stock market keeps rising is the smart investors are not stupid more QE or money printing drives the stock prices high along with commodities. This is the only way to survive the inflation. The suckers buy government bonds and treasuries hoping to get their money back one day. Other suckers put money into cash savings. The smart investor buy safe haven real estate, gold, silver, oil and commodities-mining stocks. They avoid retail, tourism and anything exposed to the dollar collapse.

Trust: The question you should ask yourself is do you trust the government with your money do you trust the central bankers and banks? If the answer is no then avoid bonds and treasuries, shift money from cash to physical gold/silver, buy equity in oil stocks, safe haven real estate and expect or position for more wars breaking out around the world and inflation. Also locally, make sure you stock up on food and fuel its handy having an allotment as a hedge against potential supply chain disruptions. In the US, Wall Street and the US Government are more or less the same the Fed is a private bank and the elite move from one to the other (public to private sector and back) and print money, try and keep the show on the road, but meanwhile they are probably buying gold, oil and silver we cannot believe they are buying their own bonds.

believe they are buying their own bonds.

Inflation Taking Off: Dont be surprized in 2013 if you see inflation rise from the government quoted 2% - to more like 10% or more. Food will definitely go up over 10% as will fuel. Its about to get ugly with stagflation. And it will start looking like the last 1970s all over again heading towards a 1980 look-alike period.

Crisis Shortly: This commodities bull run is only half way through and will end with oil rising sharply followed by gold and silver skyrocketing and the dollar crashing. It's getting closer now and the following all coming together is quite disturbing:

· Obama re-election further Fed money printing binge and helicopter Ben staying at the helm

· US tax rises and spending cuts

· Israel-Iran tensions

· Drought in US driving food prices higher

· Syria conflict spreading in Levant

· China economy slowing

· Eurozone debt issues leading to bond buying and money printing explosion

· South China Seas tensions

· Possible oil crisis as supplies are cut not able to meet demand

All these factors coming together end 2013 are bullish for gold and possibly oil and bad news for bonds. Expect a recession and war in 2013 when we look back 2012 will look like a calm period.

We hope this special report has been insightful to help you position your investment portfolio and anticipate trends coming in the next 1-2 years.