423: USA, Europe and the End of Cheap Oil

04-26-2012

PropertyInvesting.net team

2012 is turning out more or less as we imagined. The key elements are:

-

Europe continues to stumble along with efforts to reduce deficits and austerity measures making things politically turbulent as the stagnation sets in with severe recessions in Greece, Spain and other PIIGs countries

-

Obama and Bernanke are working in perfect concert to keep the US show on the road. Every time the stock market looks like it could drop, they say some warm words about more money printing and it props it back up again. The overall strategy is to get this monster economy safel

y landed before the Nov 2012 elections, so Bernanke and his colleagues keep their jobs along with Obama and his Administration.

y landed before the Nov 2012 elections, so Bernanke and his colleagues keep their jobs along with Obama and his Administration. -

The USA will be trying hard to make sure Iran stays out of the limelight until after the US Elections – the Russians have stepped in to help broker a deal it seems.

-

If there is any oil shortage, two things will happen. Firstly the US government will release some of it’s strategic reserves to allow gasoline prices to stay down just before the election.

-

Saudi Arabia has been busy stock-piling oil storage before the summer and they will be able to pull on the 36 million bbls sitting in tanks to help the US out.

-

Behind the scenes, every effort will be made to keep the US economy from showing any big cracks until after the Nov 2012.

Get the drift.

2013 Will Be Bad: Then by early 2013 the bad news will come flooding out. The US debt cannot be re-paid – it’s $15.2 Trillion. Unfunded liabilities are $75 Trillion. The deficit is 10% of GDP. Tax revenues are $1.75 Trillion with government spending $2.75 Trillion per annum. An economy 70% reliant on consumer spending. Record imports. Declining exports. Increasing taxes. Increasing brain drain to other parts of the world. A prolonged property slump. A $350 billion annual oil import bill. The USA really is in severe trouble and inflation will start to increase end 2012 through to 2013, at which time gold and silver prices will sky-rocket as interest rates lag inflation. The whole charade is being kept on the road by the bond market debt bubble - this is about to go "pop" when markets run on the dollar when the next recession starts and money printing accelerates further.

USA Bubbling Along in 2012 Before 2013 Crash: So don’t expect any big crash in the USA in 2012. They will use the European problems to claim their own economy is in good shape in comparison. But meanwhile the store of bad news is being hidden and is building. The USA is so reliant on oil with its gigantic suburban sprawls that in future years, large parts of the country could be in permanent decline as people cannot afford to live on in far flung suburban areas away from city jobs. The American Dream of a large detached four bedroom suburban house 60 miles from the city with an acre yard will come to an end – and these property prices in non oil producing states will slide further down. Suburban repossessions in cheaper far flung urban areas will rise sharply. Energy inefficient poorly built homes will be worst hit. The reliance on gas guzzling SUVs and trucks for commuting vast distances is drawing to a close.

2012. They will use the European problems to claim their own economy is in good shape in comparison. But meanwhile the store of bad news is being hidden and is building. The USA is so reliant on oil with its gigantic suburban sprawls that in future years, large parts of the country could be in permanent decline as people cannot afford to live on in far flung suburban areas away from city jobs. The American Dream of a large detached four bedroom suburban house 60 miles from the city with an acre yard will come to an end – and these property prices in non oil producing states will slide further down. Suburban repossessions in cheaper far flung urban areas will rise sharply. Energy inefficient poorly built homes will be worst hit. The reliance on gas guzzling SUVs and trucks for commuting vast distances is drawing to a close.

Impact of High Oil Prices: Just to highlight how high oil prices impact the economy, we have prepared a table below. It’s a simple model to show how investments and the overall economy in western oil importing nations can be severely impacted. This is not going to end any time soon:

Impact of high and low oil prices on western oil importing economies (USA/Europe)

HIGH OIL PRICES

LOW OIL PRICES

High inflation

Low inflation

High unemployment

Low unemployment

Lower disposable incomes

Higher disposable incomes

Higher food prices

Low food prices

Higher oil, fuel, diesel and gasoline prices

Low oil, fuel, diesel and gasoline prices

Lower dollar value

High dollar value

Lower growth rate or recession

High growth rate (no recession)

Less employment

More employment

Less travel

More travel

Less tourism

More tourism

Less long distance commuting

More long distance commuting

Less driving

More driving

Smaller cars

Larger cars

More efficient cars

Less efficient cars

Lower property prices

Higher property prices

Lower stock markets

Higher stock markets

High gold and silver prices

Low gold and silver prices

High commodities prices

Low commodities prices

Difficult borrowing environment

Easy borrowing environment

Low investment levels

High investment levels

Low construction activity

High construction activity

Physical assets-commodity demand

Currency/bonds/debt demand

PropertyInvesting.net

Bumpy Peak Oil Plateau: As the world is unable to increase its oil production significantly moving forward and the developing economies of China, India, Africa, Middle East and Far East all increase their oil consumption, the global oil supplies will tighten further – and hence oil prices will have to increase to destroy the demand and improve efficiency of oil burning whilst encouraging a switch where possible (e.g. power plants) to natural gas. There is plenty of energy in the world in the form of natural gas, but there is a definite shortage of oil (liquid oil that is easily transportable and can be easily refined). This lack of cheap oil to fuel the global economy will continue to inflict severe economic destruction on all economies. It will particularly impact the economies that use oil inefficiently – more specifically those countries that have the lowest GDP output per barrel imported and consumed – the worst offenders are Greece, Ireland and Portugal – and it’s no coincidence these are the countries with the biggest recessions at the moment. They simply drive too many big cars and produce too much power from oil compared to their GDP output. In Greece’s case, they have almost no industry (or manufacturing) and consume almost as much oil per person as the British.

US Gas Opportunity: The good news for the USA is that their indigenous oil production is now rising – mainly because of the high oil prices have driven large investment in deepwater production and liquids from shale gas. Meanwhile their recession (if you take the true inflation numbers) and high une mployment has led to declining oil consumption. Hence their oil imports have actually dropped – this actually shows the extent of the economic downturn in the USA – people driving less to work and making shorter journeys in slightly smaller cars. The other good news for the USA is the glut of gas – gas prices at $2 mbtu are now 7 times lower than in Japan ($15/btu) and 5 times lower than in the UK ($9/btu) because they have discovered and developed huge new shale gas reserves in the last five years. It’s completely changed the energy scene in the USA but unfortunately they have been very slow to switch cars and lorries to natural gas. If the US could just enhance this gas development and cut their reliance on imported oil, it could dramatically improve their economic prospects. It could also help CO2 emissions by cutting the burnt coal consumption. Regrettable we think this will all come to late to save the US economy from imploding in 2013.

mployment has led to declining oil consumption. Hence their oil imports have actually dropped – this actually shows the extent of the economic downturn in the USA – people driving less to work and making shorter journeys in slightly smaller cars. The other good news for the USA is the glut of gas – gas prices at $2 mbtu are now 7 times lower than in Japan ($15/btu) and 5 times lower than in the UK ($9/btu) because they have discovered and developed huge new shale gas reserves in the last five years. It’s completely changed the energy scene in the USA but unfortunately they have been very slow to switch cars and lorries to natural gas. If the US could just enhance this gas development and cut their reliance on imported oil, it could dramatically improve their economic prospects. It could also help CO2 emissions by cutting the burnt coal consumption. Regrettable we think this will all come to late to save the US economy from imploding in 2013.

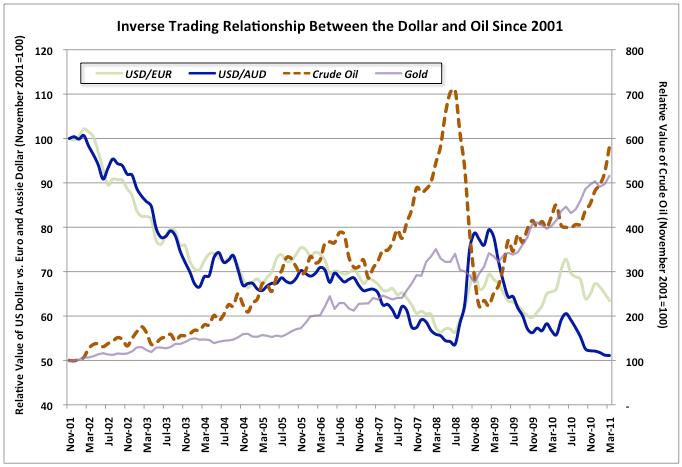

Circulating Money: For those people that blame high oil prices on speculators, one needs to consider the correlation between the number of US dollars in circulation (or in the ether) and the oil price. There is a very strong correlation between the amount of dollars and the oil price. In fact, if you look at the long term oil price to 1969 just before the US came of the gold standard in 1971, you will find that prices have hardly risen as a measure of the dollars decline (devaluation due to money printing).

Inflation: Oil in 1971 was $10/bbl and now it’s $100/bbl. Meanwhile the number of dollars in existence has risen more than ten-fold, and inflation has risen about ten-fold. In 1971, a VW Beetle cost £1000. It would now cost £15,000. In 1971 a house cost £10000, now it cost £150,000. One can see oil has only risen with the amount of currency in circulation – so one needs to look at the Fed for the increase in the oil prices. In fact, it’s remarkable the price has not risen far higher when you consider the tight oil market at this time and concerns over Iran.

· Anyone that things oil price is high needs to consider the following.

· A litre of gasoline will drive a one ton car with six passengers 12 miles – and cost £1.50

· A litre bottle of water costs £1.50 and cannot get anyone anywhere

· A litre cup of Starbucks coffee costs £4 – about three times more than gasoline/petrol

Petrol Is Cheap: Why does petrol cost less than bottled water and a cup of coffee? It’s crazy. That’ s also the UK cost of petrol with 80% tax rate. In the USA, gasoline is ridiculously cheap with tax of 20% - its about 25 cents a cup and you can drive miles on a cup. But a cup of coffee will set you back $1.50 in the USA, five times the price. When you consider the risks, environmental constraints, threat of nationalisation and technology needed to extract oil from 3k depth versus putting some water into a bottle, it just seems absurd that people complain that gasoline prices are high in the USA. They have clearly not considered the wider economies and risks.

Silver: Linked to cheap oil is the price of silver. One ounce of this precious metal costs $30. There is only 1/14 th of an ounce of silver at the earth’s surface per person on the planet. Yes, $30 will  buy you 14 people’s worth of silver. The question is, would be rather drink one Starbucks coffee for $3, or have 1.5 people’s worth of silver. The price of silver is so ridiculously low it defied comprehension. It will go ballistic. Would you rather have 20 bottles of water ($1.50 each) or one ounce of silver – enough for 14 people. Just try and buy as much silver at $30/ounce as you can. You will never see a better investment opportunity in your life. We are busy buying bullion, scrap silver, junk coins and the like at the moment – it really is dead easy. Just cut out the Starbucks and buy silver – otherwise you are a dummy!

buy you 14 people’s worth of silver. The question is, would be rather drink one Starbucks coffee for $3, or have 1.5 people’s worth of silver. The price of silver is so ridiculously low it defied comprehension. It will go ballistic. Would you rather have 20 bottles of water ($1.50 each) or one ounce of silver – enough for 14 people. Just try and buy as much silver at $30/ounce as you can. You will never see a better investment opportunity in your life. We are busy buying bullion, scrap silver, junk coins and the like at the moment – it really is dead easy. Just cut out the Starbucks and buy silver – otherwise you are a dummy!

Peak Oil Not Dead: It’s interesting to see articles declaring Peak Oil is Dead. Sorry to say that Goldman Sachs are right – tightening supply will drive oil prices. Saudi Arabia probably only has 1 million bbls/day spare capacity – they are using this at this moment to fill tanks – because they need this 1 million bbls/day in a few weeks time to burn at power plants for air-conditioning as temperatures soar to 48 deg C. Things are so tight now that Saudi turning their p ower plants up sends the oil prices higher. When they turn the plants back down again in late October, they will be able to export more oil – but until then, things will be tight and they will be drawing down their tanks. But don’t expect to see any numbers on this, because its remarkably opaque – they like to make out they have full control and plenty of extra capacity – but their rig fleet has risen tenfold in ten years and they are drilling like crazy to try and keep up with their own oil demand never mind the exports. Last year, Saudi Arabia used 2.7 million bbl/day – that three times more than the UK – which is the world’s fifth biggest economy. Yes, they use giant quantifies of their own oil very inefficiently and their exports are dropping as a result – see graph below:

ower plants up sends the oil prices higher. When they turn the plants back down again in late October, they will be able to export more oil – but until then, things will be tight and they will be drawing down their tanks. But don’t expect to see any numbers on this, because its remarkably opaque – they like to make out they have full control and plenty of extra capacity – but their rig fleet has risen tenfold in ten years and they are drilling like crazy to try and keep up with their own oil demand never mind the exports. Last year, Saudi Arabia used 2.7 million bbl/day – that three times more than the UK – which is the world’s fifth biggest economy. Yes, they use giant quantifies of their own oil very inefficiently and their exports are dropping as a result – see graph below:

Physical Assets In Super Cycle: Finally, just to remind you of the overall Super Cycles in commodities and stocks. We are now entering the later stages of a gigantic commodities super-cycle which should end around 2016-2018. So investors need to by physical commodities like oil, gas, coal, metals, gold, silver, food, farmland, coal and fertilizer. Investors should avoid retail, consumer, currencies, bonds, government debt, financial "assets". Anyone heavily invested in oil, gold and silver in the next five years will make serious money. Don't get caught out. Governments will default, currencies will be devalued, stocks will decline in inflation adjusted terms and money printing and inflation will accelerate - until the big crash occurs and there is a "reset". Quite possibly the Chinese forcing the return to the gold standard when the USA goes bankrupt. This is the end game scenario which is our base case. Every currency has now turned into a fiat currency - being debased - and its only a question of time before inflation gets out of control and western government have no option but to print their currencies into oblivion. This will be the end of western economic dominance and the beginning of eastern economic dominance some time at the end of this decade.

Peak Oil Google resource