411: US Bond Market Crash - Gold-Silver Skyrocket

01-19-2012

PropertyInvesting.net team

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gains, for the thousands of daily visitors to the website and the thousands of people signed up to your Newsletter.

This Newsletter concerns one key topic:

US Bond Market Crash - Gold-Silver Skyrocket

Years of US money printing is finally catching up. The Fed will print much more in 2012 in the run up to the US elections. Interest rates set by markets will start rising in 2013. Bond markets will collapse as inflation takes off - then gold and silver prices will go ballistic.

Euro Doom Market Psych: It’s become very obvious to us that there will be a profound shift in the market thinking and psych in the next year or so. It involves the Euro, Dollar and Gold. It will lead to tremendous returns to those smart people that understand the fundamentals. And for those that follow the herd, it could destroy your wealth. This Newsletter is for all those independent smart investors that want to stay one step ahead of the pack. And position to make spectacular returns. We don’t thing we will be wrong.

Europeans Attempting To Solve Problems: Firstly on the Euro. Indeed, Western Europe has been stumbling from one debt crisis to another since 2008 and it shows no real signs of ending. There are many  scary stories out there – and indeed, the situation is serious. But at least these individual member nations are trying to tackle their debt issues. They are slowing government spending, reducing public sector employment, slashing projects, freezing wages and re-structuring debts. Some like Greece have got themselves into a real predicament – and might default like Iceland did. Start from a low base again. Others like Portugal and Ireland are in very bad shape – investors might need to take at least a 50% haircut. Italy may be forced to re-structure it's debt or give a hair cut to investors in due course. If oil prices rise sharply, it could even lead to the end of the Euro as we know it. But the message is – behind the scenes – these politicians and bankers seem committed to acting on the problem – they take it seriously. All the meetings create lots of news, drama, riots and noise. Most European countries have deficits of 5-10% of GDP, and this is being bought down by austerity measures to more sustainable levels – with a target of 3%. There has been a continuous re-adjustment since 2008 and it will continue for years henceforth. The problems are not going away, but wholesale crisis may be averted. Bond rates for Italy rose to 7% briefly – some other countries as well – and the concerted efforts have led to these rates dropping. They may rise again, but the message is - something is being done to try and balance the books.

scary stories out there – and indeed, the situation is serious. But at least these individual member nations are trying to tackle their debt issues. They are slowing government spending, reducing public sector employment, slashing projects, freezing wages and re-structuring debts. Some like Greece have got themselves into a real predicament – and might default like Iceland did. Start from a low base again. Others like Portugal and Ireland are in very bad shape – investors might need to take at least a 50% haircut. Italy may be forced to re-structure it's debt or give a hair cut to investors in due course. If oil prices rise sharply, it could even lead to the end of the Euro as we know it. But the message is – behind the scenes – these politicians and bankers seem committed to acting on the problem – they take it seriously. All the meetings create lots of news, drama, riots and noise. Most European countries have deficits of 5-10% of GDP, and this is being bought down by austerity measures to more sustainable levels – with a target of 3%. There has been a continuous re-adjustment since 2008 and it will continue for years henceforth. The problems are not going away, but wholesale crisis may be averted. Bond rates for Italy rose to 7% briefly – some other countries as well – and the concerted efforts have led to these rates dropping. They may rise again, but the message is - something is being done to try and balance the books.

US Dinosaur: But the elephant in the room is the USA. Their bond rates are below 2% - something quite extraordinary in our view. Inflation was recently reported as 2.4% but base rates are 0.5% - negative 2.1%. Real inflation numbers however are more like 9%. The global market focus has been on driving down the European currency – probably shorting and putting pressure on Europe. It’s been in the news, scary stuff. But the USA is in even worse trouble – it’s just not got out yet - let’s explain:

1 The US annual deficit is >10% of GDP

2 The US spends $1 Trillion annually on the military in 140 countries with 700 bases

3 The US has a very low 3.1% savings rate at present

4 43% of US retirees have less than $10k in retirement savings

5 Federal worker wages are far too high – the average including benefits is $130,000 – this is twice the private sector wages which average only $65,000

5 Federal worker wages are far too high – the average including benefits is $130,000 – this is twice the private sector wages which average only $65,000

6 Wage growth in the public sector was 2% in 2010 and was even higher at 3.9% in 2009 – meanwhile private sector wages were stagnant

7 The US debt is $15.2 Trillion and rising at $1.5 Trillion a year despite economic growth – that does not include $6.3 Trillion for Fannie Mae and Freddie Mac liabilities

8 Unfunded liabilities are thought to be in excess of $75 Trillion including Medicare, Medicaid and Social Security - this is 500% of annual GDP

9 The derivatives market is thought to be around $75-100 Trillion

10 The US government has to borrow 40% of every dollar it spends

11 Tax revenues are $1.75 Trillion but government spending is $2.75 Trillion per annum

12 There are too many government jobs being created and not enough private sector jobs – an example is the 1.2 million temporary census workers created to produce a people survey that does not create any value

13 Each US person costs $6500 per annum in Medicare and Medicaid expenditure

14 Each US person costs $1500 per annum in Military expenditure

15 Each US person costs $1500 per annum in Oil Import expenditure

16 The USA has 5% of the world’s population but uses 22% of the world’s energy – importing half of it

17 The Department of Education costs $63 billion per annum – costs have risen 40% since 2002 – college costs have also risen 40% since 2002, more than many country’s GDPs

18 The Department of Energy was created to reduce the US dependence on imported oil – however, –since it was created oil imports have risen from 50% to the current 70% and costs $300 billion per annum

18 The Department of Energy was created to reduce the US dependence on imported oil – however, –since it was created oil imports have risen from 50% to the current 70% and costs $300 billion per annum

19 Europe has problems with Greece which is 3% of Europe’s GDP. This is the same since % as Virginia’s GDP within the USA. Meanwhile California is almost bankrupt and has 13.4% of the US GDP

20 It would take retirement savings of $100,000,000 to earn $50k in retirement income at Wells Fargo bank due to low interest rates

21 Only 1% of USA’s GDP is now agriculture, a very low amount considering the gigantic natural farming resources the country has

22 The USA claims to have 8133 Tons gold reserves – however, no-one has been allowed to audit these reserves and they may not all exist

23 The value of the gold assuming the gold exists in Fort Knox is $0.4 Trillion, but the immediate direct US debt is $15 Trillion, 35 times larger than the value of the gold reserves

24 The US dollar would have to devalue by 80% to cover the annual fiscal deficit in 2011 alone – if it was, inflation would be rampant is import costs skyrocketed

25 The US dollar would have to be devalued 98% to be able to pay off the National Debt (based on the assumption that the US actually holds the 8133 tons of gold reserves)

26 This would imply a gold price of fifty times current levels – or $80,000/ounce – to get the US back to the gold standard

27 It takes years for monetary inflation to translate into price inflation – we will see the results of the monetary inflation playing out in price inflation in the next few years

28 The Government has grown from 5% of the economy in 1915 to 40% of the economy today – but taxes are not enough to pay for this giant government

29 The US’s credit rating of AA is far too generous – some argue it should be close to junk status

30 The aging US baby-boomers will start retiring in the next few years – and with it pensions, health and social spending costs will skyrocket

31 Technological innovation has slowed and productivity improvements are declining

32 The average age of farmers and offshore oil worker is 59 years old – these are key workers to safeguard prosperity – they will be retiring soon

33 The government is polarised – left and right - no agreements can be reached on spending cuts

33 The government is polarised – left and right - no agreements can be reached on spending cuts

34 There is no plans in place or political will to tackle the deficit and massive spending programmes

35 The Fed only knows how to print money – it has no other strategy

36 The US is past the point of no return – either the US will either massively devalue or hyperinflation will hit, or both

Okay, the USA has natural huge resources and the dollar is the reserve currency of the world. But could this change in short order? We think the answer is – yes. As the Fed continues to print the dollar into oblivion – it will no longer be considered the world's reserve currency.

US Economy – The Truth: Firstly – the US economy is only able to plunder along because interest rates are 0.5% and bond rates are ~2%. But what happens if and when the market decides they want 6% instead of 2% in bond auctions. No-one will be able to afford debt payments anymore, rates will have to skyrocket and default would occur. The USA is in a very precarious state. But you just won’t hear about this in the mainstream media. There are too many important vested interest groups wanting to keep the show on the road, avoid panic and keep confidence high – who can blame them with so many dollar investments at stake. It’s only the current dollar strength and low bond rates allowing an almost zero percent interest rate that is saving the USA from a massive financial crisis.

Now here’s what we thing will happen. Firstly:

1. Ben Bernanke will continue to print money like there is no tomorrow – even if this is through the back door – this will accelerate towards the November 2012 US elections

2. President Obama will be narrowly re-elected off the back of an economic mirage of fiat printed money hitting the streets

3. Meanwhile oil prices will rise, food prices will rise and the European debt issues will bubble along all year

4. Then at the very end of 2012 or sometime in 2013 there will be an almighty shift in “negative” sentiment away from the Eurozone and onto the US and the dollar – the dollar will decline sharply

5. Bond markets will take fright – then US interest rates will skyrocket as the true size and extent of the US debt issue is realistically acknowledged by markets

6. Everyone will try and offload their dollars as China turns it's back on the US bond markets – US inflation will increase rapidly as the dollar declines

7. Oil, gold and silver prices will then go ballistic as every man and his dog dumps the dollar and shifts into real hard assets (commodities, physical assets)

8. The US will not be able to raise interest rates since it would bankrupt almost everyone with debt in the US so there will be no other course of action but to print the dollar into oblivion – then start all over again – a default or reverting back to the gold standard.

No Control – All The Authority: No-one is controlling the Fed’s printing. No-one is forcing US austerity measures. No-one is able to stop the debasement of the US dollar. When Ben and Barrack get back into power in November – the train will start to come off the rails as the extent of the issue becomes clear when the markets decide they want 6% instead of 2% for Bonds. Bond auctions will struggle. No takers. Rates will skyrocket.

Federal Reserve: It’s not Federal. It has no Reserves. Remember the Federal Reserve is a private entity that more or less does what it likes – it controls the world economy – their key financial instrument is p roducing dollars from thin air, and writing IOUs to the big banks. They are backed by a secretive bunch of European, Saudi and other private investors – many overseas investors. The Fed works in concert with Wall Street. Wall Street supply politicians. This upper elite promote the dollar while it is debased. The Fed shifts IOUs around, using fractional banking and allows banks to charge 5% over base rates. The Senior Bankers take 40% of company profits as bonuses placed into their bank accounts and the shareholders get 60% - since many are nationalise, the general public gets about half of profits only – elite bankers get the other half, with their shares declining year-on-year with dividends weakening. The tax payer bails the banks out. The Fed Chairman thinks gold is just another asset class. He does not think gold is money. Instead he thinks his printed fiat currency is actually “money” – remarkable. The Fed deliver the rocket fuel – but regrettably the fuel tanks have an almighty leak. It’s just no-one has told anyone. Let’s get real – who thinks the US will ever pay back their $15.2 Trillion debt – or the unfunded liabilities? It’s impossible because the debt is rising at well over 10% a year, the US has $75 Trillion of unfunded liabilities, don’t collect enough taxes and are incapable of reducing spending. We think the markets either know this – but haven’t made their move yet, or are in complete denial like they were about the US Real Estate bubble in 2007. It could be a combination of the two.

roducing dollars from thin air, and writing IOUs to the big banks. They are backed by a secretive bunch of European, Saudi and other private investors – many overseas investors. The Fed works in concert with Wall Street. Wall Street supply politicians. This upper elite promote the dollar while it is debased. The Fed shifts IOUs around, using fractional banking and allows banks to charge 5% over base rates. The Senior Bankers take 40% of company profits as bonuses placed into their bank accounts and the shareholders get 60% - since many are nationalise, the general public gets about half of profits only – elite bankers get the other half, with their shares declining year-on-year with dividends weakening. The tax payer bails the banks out. The Fed Chairman thinks gold is just another asset class. He does not think gold is money. Instead he thinks his printed fiat currency is actually “money” – remarkable. The Fed deliver the rocket fuel – but regrettably the fuel tanks have an almighty leak. It’s just no-one has told anyone. Let’s get real – who thinks the US will ever pay back their $15.2 Trillion debt – or the unfunded liabilities? It’s impossible because the debt is rising at well over 10% a year, the US has $75 Trillion of unfunded liabilities, don’t collect enough taxes and are incapable of reducing spending. We think the markets either know this – but haven’t made their move yet, or are in complete denial like they were about the US Real Estate bubble in 2007. It could be a combination of the two.

Bond Bubble: The US bond market is a bubble about to go pop. When it pops – in the next 1-2 years – gold and silver prices will go ballistic.

Shift Your Portfolio – Don’t Be Too Late: Before the bond bubble pops, you need to make sure you own physical gold and silver. It could even be a good time to start considering buying real estate or at least watching for the bottom – remember rapid inflation destroys debt – and real estate is a physical tangible asset class as well, unlike paper currency. Oil will do very well. As will agriculture and food, industrial and precious metals and commodities in general. Remember, oil prices have risen from $10/bbl in 2000 to $100/bbl in 2012. But if you look at the amount of printed dollars and dollar derivatives created in the world, which have risen about ten-fold in 25 years, oil has only really kept pace with the money printing. It’s hardly surprising oil has gone up in price – and we expect this to continue as there is a very close correlation between the US money printing and the oil price. OPEC and Saudi know this of course - this is why each year they say the "fair price" of oil is 10% higher. They are probably following a chart of printed money they got from the Fed accounts.

Bull Market Blow Off: We are entering the closing 35% of the 17½ year bull market in commodities and closing 35% of the 17½ year bear market in stocks and shares – both started in 2000. By 2018, the world will look very different. There will have been a gigantic gold and silver bull market blow-off and real estate prices will be dead having declined in inflation adjusted terms for many years. Then the next cycle will begin sometime between 2014 and 1019. It’s quite possible at this point - at the height of the  commodities blow-off - the Dow will equal the gold price. Hence if the Dow was 12000, gold would be $12000/ounce. If the Dow was 6000, gold would be $6000/ounce. Silver will likely be about 15th of the price of gold – so if gold was $6000/ounce, silver would be $400/ounce.

commodities blow-off - the Dow will equal the gold price. Hence if the Dow was 12000, gold would be $12000/ounce. If the Dow was 6000, gold would be $6000/ounce. Silver will likely be about 15th of the price of gold – so if gold was $6000/ounce, silver would be $400/ounce.

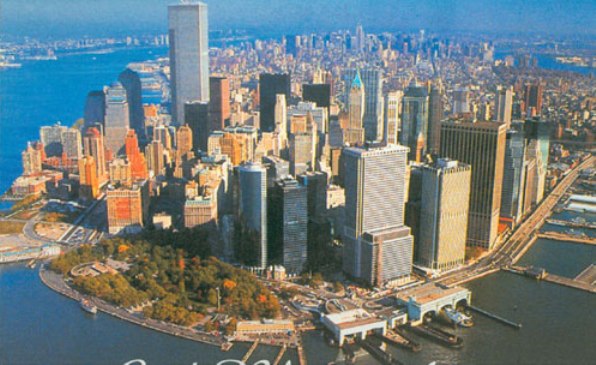

Stocks and Shares: Interestingly, high dividend yielding stocks in quality companies will probably be safer than many investments like bonds because they will continue to pay 5% dividends through this period and will not be confiscated or seized. Good quality oil and mining stocks spring to mind – as the bull market continues its upward momentum – just get out before the commodities bull run ends of course. But stay well away from US governments bonds (treasuries etc) – because they are most likely to turn to nothing – we are serious – US debt default now looks most likely. It’s suicide buying bond with 2% yield on 10 year notes. There’s going to be a massive run on the US bond markets. Then the Chinese will start buying cheap US assets after their currency is allowed to appreciate – using dollars pulled from the bond markets. The Chinese will buy tower blocks in New York, shale gas deposits in the mid-west and railroads and pipelines when the US defaults. As payment for defaulted dollars, they will demand the US hand over its gold. The US did this to the British after WWII – the French did this to the Germans after WWI - this gold will be heading further west over the Pacific.

Prices: According to our analysis:

1 Rather than $1730/ounce, gold prices should currently be at least $6400/ounce based on three separate methods of calculating

2 Based on a historical gold:silver price ratio of 1:15, rather than $33/ounce, silver should be at least $400/ ounce

ounce

3 One ticket to a football match costs £30. That’s the same as a silver coin. That’s ridiculous.

Silver Uses: Did you know that silver is used for solar, all mobile phones, electronics, flat screen TVs, mirrors, high-tech military weapons, light bulbs, anti-odour clothing, water purification, sterilization and so forth. 80% of silver is used in manufacturing processes – it is used up. Silver prices were $50/ounce in 1980, 32 years ago. Dollars circulating are now ten times more, but silver is only $33/ounce. Silver is rarer than gold. In fact, there are 7 billion ounces of gold in stocks but only 0.5 Billion ounces of silver in stocks. Yes, silver is rarer than gold. But silver prices are 50 times cheaper than gold. There are 7 billion people on earth. There is only 0.5 billion ounces of silver stocks. That’s 1/14th of an ounce per person. That means if you buy one silver mint coin for £30, you will have 14 people’s worth of silver. We bought a wet razor at Christmas with a recommended retail price of £38. Yes, that’s one razor with five blades for more than the price of a silver coin. It’s outlandish. Silver is the deal of the century. Our guidance is for everyone to try and buy as much physical silver as possible as soon as possible – that’s certainly what we are doing!

Inflation Lies: Let’s talk about the inflation numbers issued. Don't believe them. The US official inflation 2.4%. But real inflation is about 8-10%. The reason they can keep the official number so low is a combination of the following:

A Hedonic Adjustment: adjusting inflation down by calling technology improvements and efficiencies added value (e.g. power steering in a car, air conditioning)

B Substitution: as an example, if beef prices rise and people substitute beef with cheaper chicken because they can no longer afford beef, the price of meet goes down even though the prices of beef goes up

C Weighting: as an example, if the price of wheat rises, the government can elect to weigh it less than oats which might be dropping in price

D Subtraction: money is pushed into stocks or sent overseas - exported - so it does not hit the inflation numbers - a tactic used particularly by the US government to boost the global economy and hence their exports to these countries

Negative GDP Recession: Of course if the GDP - which is always adjusted for inflation - runs at 2% and inflation is say 2% - this should mean the economy is growing at 4% before inflation and 2% after inflation. But since inflation is more like 9%, then the actual true GDP is 2% minus 9% - a recession  of -7%. Yes, the US has been in a recession for years – it’s just that the government has not told you. This is consistent with the rising unemployment and reducing disposable income as prices rise. This also matches the crash in gasoline consumption to half its previous levels.

of -7%. Yes, the US has been in a recession for years – it’s just that the government has not told you. This is consistent with the rising unemployment and reducing disposable income as prices rise. This also matches the crash in gasoline consumption to half its previous levels.

Silver Price Is A Crazy Low: Let’s now take a look at silver prices. Silver was $50/ounce in 1980. Since then the US government has increased dollar money circulated by well over ten fold. Hence silver would normally be $528/ounce at the end of this bull run. Silver prices are currently $33/ounce. Name one thing that costs less now than it did in 1980 in dollar terms! Gold was $850/ounce in 1980. It should therefore be something like $9220 in view of the increase in dollars - at the end of this bull run. As you can see, this bull run has only just started off – it’s got a long way higher to go yet. It's very early on. It will end with a parabolic blow-off, any time from end 2012 onwards. Then the gold prices should equal the Dow by the time the bull run ends. So if the Dow is 10,000, then gold prices should be $10,000/ounce - rather than its current $1730/ounce. Gold is cheap. Silver is ridiculously cheap - the bargain of the century. And we are serious.

Silver 1980 compared to 2012:

1 In 1980, there was 4 billion ounces of silver in stocks. There are now 0.5 billion ounces.

2 In 1980 the world's population was 3.8 billion people. It is now 7 billion.

3 In 1980 only 15% of the world's population had an opportunity to invest in silver, it is now more like 50%.

4 In 1980 35% of the world's GDP was the USA - the US is now only 23% of global GDP and the Chinese, Indian, Middle Eastern and Russian investors love gold and silver investments

5 In 1980 you had to buy gold and silver at banks - you can now by it over the internet, on e-Bay, via ETFs (not advisable) and through funds – you can buy gold in a desert using satellite broadband internet usage from your home

6 Financial news is far more pervasive now than in 1980 and debt levels are ten times higher

Silver Price Suppression: Silver prices are report to be suppressed by bankers – in part because they work in concert with governments - if silver and gold prices rise, it damages the reputation of paper currencies like the dollar. Hence banks hold massive short positions, likely to try and suppress the price. But we all know that this cannot last forever. One day, someone will want to get delivery of their physical silver – and if it’s when it’s not there or something else happens, silver prices will just take off in short order. It is a very small market – only $30 Billion (compared to gold which more like $6 Trillion).

Silver By-Product: 80% of silver is a mined by-product of copper, lead, zinc, gold and other metals. Only 20% of silver comes directly from silver only mines. Hence if prices rise, it does not mean supply will follow suit quickly, especially if the value compared to the main metal mined is <15% which it is in almost all cases.

Electrical Properties: Silver is the best conductor of electricity – except for gold. It is also the second most malleable metal, is the most reflective metal and has very low corrosion rates. Only gold can match silver for conducting and not corroding. Hence only gold is a replacement for silver in electronics. We are convinced there will be severe silver shortage in years to come and are confident that silver will rise above $100/ounce in 2013 and will rise far further moving forwards.

Silver Coins: Newly minted .999 pure 1 ounce silver coins for $35 each are a screaming bargain buy at the moment. Even if you just buy 10 coins, it will do you very well. Consider this – there are 7 billion people on this planet, but only 0.5 billion ounces of silver available. That means each person has 1/14 of an ounce of silver (7% of one silver coin). If you buy one coin, you will own 14 people’s worth of silver. We would encourage you to own at least a towns worth of silver for yourself. A town of 10,000 people's worth of silver would cost you $25,000. We expect silver prices to rise tenfold in the next few years. Just don’t tell anyone you own it – and store it in a vault or safe deposit box. But don’t fall for any scams. Make sure you buy the right physical metal from a reputable source.

Silver Fundamentals: Also consider that silver prices were $55/ounce in 1980, some 32 years ago. Meanwhile the number of dollars in circulation has risen about 15 fold. But silver prices are only $30/ounce today. Name one physical asset that is lower in price today compared with 1980 – it’s the only one. In 1980 a home cost $75000, it now costs $200,000. A car cost $3000, it now costs $23000. Gasoline was $1/gallon, it’s now $4/gallon. Meanwhile industrial silver consumption is exploding higher with more electronics and solar panels being produced and a doubling of the population in 40 years. Silver mining is severely constrained because it is a by-product of gold, tin, lead and copper. Environmental and government restrictions on mining operations mean supply is not keeping pace with demand and silver stocks are dropping. Silver is extremely difficult to mine. It requires a lot of energy. If prices shot higher, supply would probably hardly shift to match because it is a low priced or low quantity by-product. And unless prices sky-rocket it won’t be worth recycling. Each mobile phone has 50 cents worth of silver in it. Not enough to collect and melt down. Meanwhile stocks of silver are now only 2% of the levels in 1980. Silver is rarer than gold but 50 times cheaper. It’s the most conductive metal on earth – its only replacement for electronics use is gold. If the dollar turns to confetti and people need to trade in gold and silver coins, everyone will need silver because you cannot buy food with a gold coin. But you could buy a week’s worth of food with a silver coin. It’s called the “poor man’s gold”. Let’s face it – there’s going to be plenty of poor people around and currency may be worthless – so everyone will want silver coins if a really big crisis breaks out.

Silver Market: For many years, the big US banks have held massive silver short positions that has held  back the silver price. As these unwind, the market should shift higher. Also consider the global market is extremely small - only $30 Billion - compared to $6 Trillion for gold and $75+ Trillion for dollar derivatives. Hence just imagine if a serious investor got into silver - Warren Buffett could buy the whole global market twice over. It really is a market that could go ballistic at any moment. Almost no Central Banks own silver – but it’s used for essential public services. When shortage crop up, these banks will also want to buy silver. It will always be very volatile. They call it the devils metal because it climbs a wall of worry. It can crash 30% in a day, shake out small players then double in a few months with ease. It's not for the faint hearted. Avoid Silver ETFs - because there are too many stories that this market is not properly backed by the physical metal. It is controlled by the banks. Do you trust these funds? ETFs could quite easily halve while physical silver doubles if investors take flight when silver is not seen properly backing this paper - ETF are run by many of the same bankers that failed in 2008. Is this paper safe and worth something?

back the silver price. As these unwind, the market should shift higher. Also consider the global market is extremely small - only $30 Billion - compared to $6 Trillion for gold and $75+ Trillion for dollar derivatives. Hence just imagine if a serious investor got into silver - Warren Buffett could buy the whole global market twice over. It really is a market that could go ballistic at any moment. Almost no Central Banks own silver – but it’s used for essential public services. When shortage crop up, these banks will also want to buy silver. It will always be very volatile. They call it the devils metal because it climbs a wall of worry. It can crash 30% in a day, shake out small players then double in a few months with ease. It's not for the faint hearted. Avoid Silver ETFs - because there are too many stories that this market is not properly backed by the physical metal. It is controlled by the banks. Do you trust these funds? ETFs could quite easily halve while physical silver doubles if investors take flight when silver is not seen properly backing this paper - ETF are run by many of the same bankers that failed in 2008. Is this paper safe and worth something?

Silver VAT: For UK investors, don’t worry too much about the ridiculous VAT you have to pay on silver coins – at 20% of the original price, if prices rise tenfold, this will only equate to 2% of the final sale price. You’ll make such stellar returns that you will have forgotten about it by then. Bottom line for silver is – if it does not rise to $100/ounce (triple) we would be shocked. And we think it’s more likely to rise to something like $400/ounce at the end of the eventual blow-off bubble in commodities. In the US, quite rightly there is no tax on silver purchases because it is money - so you don't have to worry about this.

We hope the Special Report has given you some interesting insights. Firstly warning about the US bond markets – and then highlighting how this will lead to gold and silver prices exploding. Happy investing.