407: Peak Oil Crisis

12-23-2011

PropertyInvesting.net team

Peak Oil The Underlying Issue: What most people don’t realise is that the economic and social unrest around the world has Peak Oil as the underlying cause. This refers to the point when global oil production peaks, before slipping into decline.

At Peak Oil: As we have stated before for many years now, peak conventional crude oil was mid 2005 – some 6˝ years ago. Since then,unconventional oil production of biofuels and heavy oil sands plus natural gas liquids have all increased, which has produced a sort of undulating plateau of total liquid oil production. We are now at the ov erall peak. It’s just possible the global oil supplies could rise a few million barrels further, but this will not be enough to keep up with demand and hence oil prices will need to rise to destroy demand.

erall peak. It’s just possible the global oil supplies could rise a few million barrels further, but this will not be enough to keep up with demand and hence oil prices will need to rise to destroy demand.

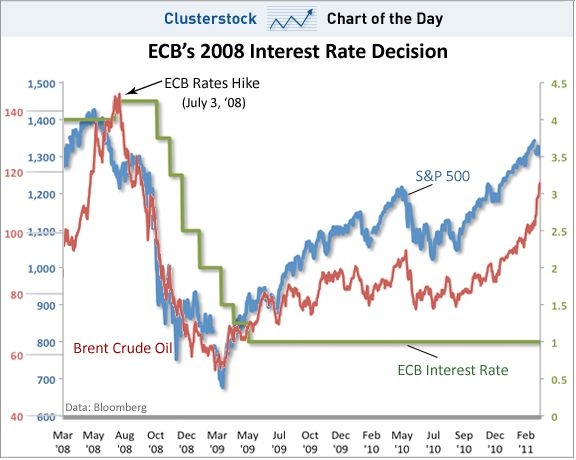

High Oil Price Equals Recession: Calculations suggest that every time oil prices rise to an equivalent of $90/bbl in today’s money terms, a US recession commences. No different this time – the US economy has bearing grown this year after suffering a further shock from high oil prices coinciding with the so called “Arab Spring”.

Oil: Oil powers 75% of global transportation and 33% of overall energy needs. It is used for fertilizer, drugs, chemicals, paints, diesel, shipping, airline and other fuels. The world cannot live without oil. There is no replacement for airline fuels, chemicals and many other of oil's uses.

Tight Oil Market: Despite a massive recession in 2008 and stagflation in western economies, oil prices have rebounded to over $100/bbl – because of rampant oil consumption growth in China, India, the Middle East and developing nations. As the global population rises from 7 billion today to about 9 billion by 2050, oil consumption is forecast to rise from about 89 million bbls/day to 120 bbls/day. But the problem is, the world is not capable of producing much above 90 million bbls/day. There is also a significant chance the global oil production could actually start to decline.

by 2050, oil consumption is forecast to rise from about 89 million bbls/day to 120 bbls/day. But the problem is, the world is not capable of producing much above 90 million bbls/day. There is also a significant chance the global oil production could actually start to decline.

Cheap Oil All Gone: In 1999, oil prices were $9/bbl with production costs of about $4/bbl. Now oil prices are $100/bbl with production costs for new reserves of ~$50/bbl. It is the end of cheap oil. The best light sweet crude has largely been produced, and the world is needing to adjust to different types of oils from biofuels, natural gas liquids and heavy oil sands. As countries struggle to keep production rates up, there will be an overall tightening of the oil market.

Inventories Crash: The worrying statistic that came yesterday from the USA was that inventories dropped by a gigantic 10 million bbls (five times more than expected) to ~250 million bbls – the lowest inventories for almost a decade. This was despite Saudi Arabia producing at maximum rate of 10 million bbls/day last month. As Libya has lost 1.3 mill bbls/day, Syrian 0.3 mill bbls/day, Yemen 0.3 mill bbls/day, Nigeria 0.2 mill bbls/day, Saudi Arabia has not been able to keep pace with the declines. There has been an overall tightening of the oil market that is now starting to drive prices higher again.

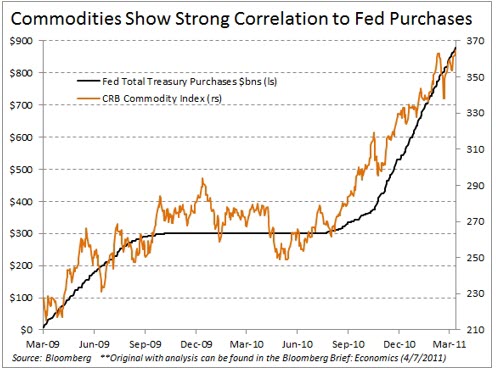

Printing Leads To Inflation: As the Fed continues to print money, much of this new money goes into commodities as a hedge against inflation that this printed money causes. In a way, instead of creating jobs, it destroys jobs by driving oil prices higher. It creates bubbles in the commodities market – in oil, gold, silver and food. This damages the very thing that the Fed is trying not to – they don’t seem to understand this.

Printing Leads To High Oil Prices: The degree of quantitative easing shows an almost perfect correlation with the overall commodities index (above). So you can see that because we all know the Fed will continue to print money, it's almost a certainty that oil prices will rise further – because the printed money causes: 1) cheap money to invest in oil; 2) hedging against inflation; 3) general inflation of oil prices; 4) oil inflation through the decline in the value of the dollar.

Ramp Up In Oil Prices: We think some time in 2012 oil prices will rise to $150/bbl before dropping back again. The reasons are:

· Security threats from Iran and North Korea, along with continued troubles in Yemen and Syria (and possibly Iraq now that the Americans have left)

· Lack of spare capacity in Saudi Arabia

· Decline in oil exports from Iran as sanctions start to bite

· Rampant demand growth in China, India and other developing nations

· Saudi water desalination and power consumption increases due to gigantic population increase in energy intensive desert nation

Oil Import Bill: As oil prices rise, it will put far more pressure on the US and European economies as oil import costs rise substantially. Already the USA spends $300 Billion on oil imports each year, and Europe spends even more than this. These two super economies are heavily reliant on the availability of cheap oil – and it's now come to an end. It's just that the politicians haven’t told anyone yet. They don’t want to scare people. They don’t want to reduce the already shaky confidence levels. They want to try and get people to buy dollars and put money into the markets. But instead, people should be selling dollars and buying gold and oil.

Oil Causing Euro Break-Up: If oil was $5/bbl – the European and US deficits would be  half the amount. And there would not be a credit and debt crisis. It is only because of expensive oil that the debt troubles have been magnified into a crisis. USA and Europe were built on cheap oil. Now it's expensive, the infra-structure, manufacturing and general economies are not geared up for this. The only countries in North Amercia and Europea that prosper during high cost oil price times are Norway, Canada and Russia – all other countries suffer.

half the amount. And there would not be a credit and debt crisis. It is only because of expensive oil that the debt troubles have been magnified into a crisis. USA and Europe were built on cheap oil. Now it's expensive, the infra-structure, manufacturing and general economies are not geared up for this. The only countries in North Amercia and Europea that prosper during high cost oil price times are Norway, Canada and Russia – all other countries suffer.

PIGS and Oil: No surprise that the most exposed countries to the affects of Peak Oil are – Italy, Greece, Spain, Ireland and Portugal. It’s quite simply because they have to import all their gas, oil, coal and metals – and have almost no nuclear or renewable energy production. Their economies have been subsidized by the Euro for the last 20 years and their economies have been built on cheap oil. Now these countries – also with aging populations and some of them with declining populations – reliant on energy intensive tourism – will go into decline. This is no surprise. We have been warning about this for four years now. But rather than the situation getting better, it will get far worse. It’s just the beginning of the decline in living standards in the PIGS and a long term rise in unemployment.

Globalization Declines With Peak Oil: Peak Oil will also start to ha ve an effect on globalisation. Globalisation is the ability to split manufacturing centres from markets across country and regional borders. It is only possible with cheap oil. All transported goods burn oil. If the oil price rises, the cost of transport exceeds the benefit of the reduced labour or environmental cost. Hence cross-border trade drops and growth rates drop as oil prices rise. The positive news is that local manufacturing in western developed nations is actually stimulated as the cost advantage of low cost labour areas such as China and India is destroyed by the high shipping costs. This is not true of global services like IT/finance that are far less energy intensive and do not rely on oil for shipping. So over the next ten years, expect more local manufacturing to take root as oil prices rise further – manufacturing demand will be low and more of the manufacturing will be done locally.

ve an effect on globalisation. Globalisation is the ability to split manufacturing centres from markets across country and regional borders. It is only possible with cheap oil. All transported goods burn oil. If the oil price rises, the cost of transport exceeds the benefit of the reduced labour or environmental cost. Hence cross-border trade drops and growth rates drop as oil prices rise. The positive news is that local manufacturing in western developed nations is actually stimulated as the cost advantage of low cost labour areas such as China and India is destroyed by the high shipping costs. This is not true of global services like IT/finance that are far less energy intensive and do not rely on oil for shipping. So over the next ten years, expect more local manufacturing to take root as oil prices rise further – manufacturing demand will be low and more of the manufacturing will be done locally.

Ridiculous Oil Wastage: As for agriculture, there will be far less banana’s being imported from the other side of the world, and apples from Argentina for example. Local agriculture will be stimulated. Currently every calorie of food takes 7 calories of oil to produce it. And beef takes about 50 calories of oil to produce one calorie of beef – particularly oil intensive (transport, grain, feed, preparation, refrigeration etc). As food becomes more scarce, people in western developed nations will likely eat less meat and more cereal and local vegetables as food prices skyrocket along with inflation. Some people might actually start growing their own food – something that was commonplace in the 1950s, but declines as supermarkets took over the supply chain - governments also wanted more control of the food chain and put in more regulation and planning rules that stifled allotments and small-holding usage. One of the most crazy examples of the wastage of oil was a story that a supermarket in England bought applies from Kent, then flew them to South Africa so they could be hand polished, then they were flown back to England to be sold in the supermarkets. That’s twice around the world on a plane just to be polished because labour costs are cheaper in South Africa. Talk about waste of resources – clearly oil prices have been too cheap too long - for aviation fuel at least.

imported from the other side of the world, and apples from Argentina for example. Local agriculture will be stimulated. Currently every calorie of food takes 7 calories of oil to produce it. And beef takes about 50 calories of oil to produce one calorie of beef – particularly oil intensive (transport, grain, feed, preparation, refrigeration etc). As food becomes more scarce, people in western developed nations will likely eat less meat and more cereal and local vegetables as food prices skyrocket along with inflation. Some people might actually start growing their own food – something that was commonplace in the 1950s, but declines as supermarkets took over the supply chain - governments also wanted more control of the food chain and put in more regulation and planning rules that stifled allotments and small-holding usage. One of the most crazy examples of the wastage of oil was a story that a supermarket in England bought applies from Kent, then flew them to South Africa so they could be hand polished, then they were flown back to England to be sold in the supermarkets. That’s twice around the world on a plane just to be polished because labour costs are cheaper in South Africa. Talk about waste of resources – clearly oil prices have been too cheap too long - for aviation fuel at least.

Turbulence Increases: If you think 2011 was a turbulent year, 2012 is likely to be even more so. As western developed nations struggle with high oil prices, high debts, high inflation and high unemployment, central banks will continue to print money then rampant inflation will kick in by end 2012. This is likely to be fuelled by a further sharp rise in the oil price as crude supplies tighten further.

OPEC Ratchet Up The Oil Price: Don’t expect OPEC to come to the rescue. They have already budgeted in $90/bbl oil prices for their booming populations – and will likely want to see the oil price shifted upwards to something like $120/bbl in 2012. Enough to feed the masses, keep them off the streets – preventing rioting. But just enough to prevent a whole-scale economic global recession or a switch to alternatives.

Bumpy Plateau: The world is bumping along a Peak Oil plateau – where cheap oil production is a thing of the past. America’s answer to the problem seems to be to deflate the dollar and devalue the currency by printing money. But the Middle Eastern powers are far from stupid and build this into their calculations for what they think is a “fair price” for oil. They will keep edging up oil prices, low enough to prevent a global recession and stifle any big switch to alternatives, but high enough to take as much of the returns from oil importing nations like the USA as possible. 30 years ago, the Middle East probably thought that the USA would have made more of a switch away from oil by now - by major efficiency drives - but OPEC are probably laughing all the way to the bank as almost no progress has been made by the USA in weaning itself off oil. In fact, cars are bigger now (in volume terms) than in 1970 when oil prices were $1/bbl. the standard US issue car is a 4x4 6 litre or a pick-up 6 litre. Cars are about twice as powerful today as they were in 1970. Thats absurd for a country that is close to bankrupt - with a $300 Billion annual oil import bill.

Peak Oil Exports: Also consider the likely more important measure that we are past "Peak Oil Exports" - that's the maximum ever oil exported. The reason is that all oil producing nations normally rapidly expand their oil consumption through subsidies, inefficient oil usage and a feeling of individual and industrial rights to using oil since it is produced indigenously. Hence over time, oil exports drop in oil producing countries. This can be seen in this unique calculation we have prepared going back to 1965 - a compilation of 90 countries oil surplus in each year. As you can see, the world reached Peak Oil Exports in 2006. Despite consumption rising 1.5+% per year, exports decline. No wander oil prices are rising. Interesting also to note that oil prices skyrocketed after 2006 when oil exports dropped sharply - from 50/bbl to $147/bbl by mid 2008. Oil prices have remained stubbornly high at ~100/bbl as exports have stay low - at the same level as 1997. More countries fighting for less oil as the global economy struggles to grow and diesel shortage become more common.

Regional Picture - Peak Oil Exports and Imports: The regional analysis below shows that it is the gigantic increase in imports from Asia Pacific (5 billion people buying cars, electrical goods and scooters) that is causing a dramatic increase in demand - and oil imports. Other regions have (and will have to) to decline to feed oil to Asia Pacific to fuel this growth. This is actual to 2011 and forecast to 2015 - one can see the general trend through is a straight line - rapidly increasing imports since 1987 (begining of the end of Chinese communism - evolution to free markets).

Investment In The Peak: This brings us onto investing. In the next few years, as oil prices rise, inflation rises, unemployment rises, debts rise and western living standards decline, there will only be a few investment areas that will do well in western nations. We will list them here:

· Oil exploration and production companies – as oil prices rise well over $110/bbl (possible spiking above $200/bbl for short periods)

· Gold – likely to rise from $1600/ounce to around $6500/ounce in the next 6 months to 6 years

· Silver - likely to rise from $30/ounce to around $400/ounce in the next 6 months to 6 years

· Gold and Silver Mining Companies

· Agriculture – fertilizer, farming, food commodities (sugar is a particular bargain at the moment)

· Real Estate – in secure oil and gas exporting nations – Norway, Canada, Australia (West London is also okay in view of international oil/finance/investing and mining)

· US Real Estate – in North Dakota (and possible Texas)

Avoid: We believe the following stocks and investment are overpriced:

· US Bonds (2% is far too low, investor should be demanding >6%, a massive bubble is about to pop)

· US Real Estate in most states, particularly those energy intensive states without oil production like Arizona, Florida and New Mexico

· Technology stocks

· Banks

· Airlines

· Tourism in western nations

· All real estate that relies on long distance commuting – energy intensive suburbs

Our Portfolio: Hence our portfolio almost exclusively consists of:

· Gold

· Silver

· Oil stocks

· London real estate

That’s it!

Stay Out Of Bonds: If you own any US bonds or Treasuries, sell now  is our guidance. It’s a gigantic bubble about to pop. When it does pop, inflation will go through the roof as people desperately dump the dollar and try and buy as many hard assets at they can with their US dollars. This is the time when physical oil, oil mining, commodities and gold and silver prices will sky-rocket. The markets confidence in the dollar will be destroyed, panic will set in and every man and his dog will dash into oil, gold and silver in the last phase of a final bubble blow-off created by the Fed’s printed fiat money.

is our guidance. It’s a gigantic bubble about to pop. When it does pop, inflation will go through the roof as people desperately dump the dollar and try and buy as many hard assets at they can with their US dollars. This is the time when physical oil, oil mining, commodities and gold and silver prices will sky-rocket. The markets confidence in the dollar will be destroyed, panic will set in and every man and his dog will dash into oil, gold and silver in the last phase of a final bubble blow-off created by the Fed’s printed fiat money.

Stocks Will Not Be Completely Wiped Out: Just remember that bonds and the dollar can turn close to zero as default takes place. Cash can turn to zero if hyper-inflation kicks in or a bank folds. At least stocks will retain some form of value as inflation increases – so you will not be completely wiped out. There has also not been a case of seizing of shares, albeit if the company goes under – then it can be nationalised - like a bank – and you can lose most or all of your investment.

"Global Warming" Billions have been made or spent on research into so called global warming, now called climate change. Most people put this down to CO2 emmissions. We have done a bit of research and below present a firm hypothesis - a rather contrarian view - that the key driver to the presence of global warming is actually - "particulate pollution" or levels of smog/soot mainly caused by dirty coal burning power plants - especially low quality "brown coal". As the earth's atmosphere has cleaned up from the high levels of soot in the USA, Western Europe, Eastern Europe and the old Soviet Union, then the land mass has warmed substantially. Each bout of dirty coal burning power plant closures has helped temperatures rise another notch, likely also assisted by increasing CO2 levels, but the levels of soot being more important. Take a look at our interpretation of events below. Remember, in 1988 the Soviet Union collapsed, then brown coal plants were closed and the whole region lost its smog cover. In Western Europe the discovery of natural gas led to a rapid conversion from dirty sooty town gas (from coal) to clean natural gas combustion. These two led further east to the Siberian permaforst bogs thawing and methane being released as cloud/soot cover lifted - remember methane is ten times more warming than CO2. The methane release helped further increase temperatures. A simple explanation. Hence moving forwards, we need more clean cloud cover over Siberia again. Too much sun is getting through in the wrong places. Don't you think this explanation is compelling?

Forestation: As we've described before, another issue is that forests are being cut down in equatorial regions - forests in such regions cool the plant - through moisture, cloud and precipitation. Then dark conifer forests have been planted in polar areas - these aborb sunlight, warm then environment and lead to ice melting. Remember ice in arctic areas reflects sunlight leading to cooling. So we are burning and cutting forest in equatorial regions whilst planting in polar regions -exactly the opposite to what is required to cool the earth. Its pretty clear man has changed the plants - lets face it - there is only half the rain forest around now compared to 40 years ago and double the population. Man made changes, but our point here is, we should be more understanding as to the affects of the different variables affecting climate change rather than focussing all our efforts and capital expenditure and research on the amount of CO2 being emitted. It might be the least important variable. Our view is the level of soot in the atmosphere, levels of methane and forestation are far more important variables - along with general climatic cycles that the earth passes through ("glacial" cold/arid low sea levels to "interglacial" warm and hot with high sea levels). If you have any comments on this, please contact us on enquiries@propertyinvesting.net

Oil and Power: If you want good safe stocks, looking back in history, the big oil companies have been around for 100 years so you cannot go far wrong with these stocksf or protection – and they pay ~5% dividend. Large electrical companies like GE might be worth considering – they are likely to increase manufacture of turbines as the developed nations build more pow er plants.

er plants.

Land and Food: As food prices sky-rocket, shares in fertilizer and seed companies will likely rise – companies like Potash and Monsanto might be worth a look. If you want to protect your wealth, another good place is land – good quality farmland close to markets (cities). As inflation takes off, land prices are likely to rise with inflation or at a greater pace – as smart investors flood into the commodities and agricultural markets that have been depressed for the last 30 years.

Predictable Super Cycle: It’s all part of a huge super cycle – the 17˝ commodities bull market that started in 2000 and will likely end around mid 2017. This of course coinciding with a 17˝ stock bear market that started at the same time and will end at the same time. It’s still reasonably trendy to own stocks, but as inflation kicks in further – people will switch to oil, gold, silver and agricultural commodities. They always do when governments print money – as a hedge against rampant inflation. This time is no different – apart from the fact it's even more accentuated with debt levels higher and oil production more constrained than the previous end commodities bull runs – e.g. in 1980 and 1945.

Civil Strife: Another consideration is that at the end of commodities bull runs – as very high inflation takes control of economies after governments print too much money, social unrest, civil disorder, crime and unemployment all rise. Normally the final outcome is gold and silver prices going ballistic and war. With 200 large countries in the world, it’s difficult to predict which countries would go to war, but the some ones as in 1980 are likely at the end of the cycle – namely:

· Iran

· Iraq

· Israel

· North Korea

· Lebanon/Levant

Eventually Leading To War: Wars raged in the 1970s and e arly 1980s in these area – and by 2017 its quite probable that we will have the same again as food prices sky-rocket and economic stability declines. As nations get desperate – politicians and populations start doing desperate things. But this time, the USA cannot afford to be the policeman of the world – with its democratic government it’s far less likely to get involved in regional disputes. Hence as oil prices rise, and the disparity between different countries increases, wars are likely to break out regrettably. This will also have an impact on gold and silver prices – they will rise even further because of their safe haven status amongst the world’s wealthiest citizens, investors and governments.

arly 1980s in these area – and by 2017 its quite probable that we will have the same again as food prices sky-rocket and economic stability declines. As nations get desperate – politicians and populations start doing desperate things. But this time, the USA cannot afford to be the policeman of the world – with its democratic government it’s far less likely to get involved in regional disputes. Hence as oil prices rise, and the disparity between different countries increases, wars are likely to break out regrettably. This will also have an impact on gold and silver prices – they will rise even further because of their safe haven status amongst the world’s wealthiest citizens, investors and governments.

Young Financiers Don’t Remember: The current cadre of hedge fund managers and most investors have no experience, recollection or knowledge of what happened in 1980 at the end of the last commodities bull run. This was the time which ended with the Iranian revolution, gold prices rising ten-fold and oil prices sky-rocketing along with debt and inflation. A huge recession happened. Unemployment is some parts of the UK rose to 25%. Britain went to war with Argentina. Riots followed in July 1981. Cities went into decline. People who rode the last gold bull market that started to rise up in 1975, if they were an experience 35 years old investor at this time, would now be aged 72 years – they are more or less retired. History has a habit of repeating itself – and this gold bull run is just part of a super cycle of printed money that is relatively straight forward to predict, despite the doubting Thomas’s views to the contrary. It doesn't take a rocket scientist to determine that the extent of the printed money and currency debasement will lead to very high inflation and a bond market crisis in the USA shortly. This is our view on what is required and what will happen:

be aged 72 years – they are more or less retired. History has a habit of repeating itself – and this gold bull run is just part of a super cycle of printed money that is relatively straight forward to predict, despite the doubting Thomas’s views to the contrary. It doesn't take a rocket scientist to determine that the extent of the printed money and currency debasement will lead to very high inflation and a bond market crisis in the USA shortly. This is our view on what is required and what will happen:

What is required: Austrian School of Economics: Prudent management of economy, strong currency, small government, less regulation, reduction in debt, encouraging savings, high interest rates to control any inflation, target low inflation, building gold reserves, stimulating private enterprise, privatization

What will happen: Keynesian School of Economics: Try to spend ones way out of recession, weak currency, large government, more regulation, increase in debts, discouraging savings, low interest rates to stimulate inflation - then reactive switching to very high rates when inflation gets out of control, selling gold reserves, regulating private enterprise, forms of nationalisation

How To Make Money in a Socialist-Liberal Keynesian World:

Expectations: More printed money, rampant runaway inflation, high unemployment, currency devaluation, debt default

Investment Outcome: High oil, gold, silver prices, inflation, commodities bubble – then economic crisis, crash and collapse

Mining and Oil Stocks Undervalued: In 1980 the oil and mining stocks made up 25% of the value of the US stock market. Today they make up a mere 5%. This means oil and commodities companies are worth relatively five times less. It also means of course that there are may high tech businesses that are valued very highly – that have out performed the oil and mining sectors since 1980. But we would make the case that oil and mining stocks are worth half of what they should be at this time. We see oil and metals prices rising far high, and with them oil company and mining profits will also rise sharply – as should their stock price. Other stocks will decline in comparison. It will be oil, gas, mining, commodities and agricultural stocks that will see the biggest gains in the next few years as inflation explodes and input costs sky-rocket, damaging manufacturing returns.

In 1980 the oil and mining stocks made up 25% of the value of the US stock market. Today they make up a mere 5%. This means oil and commodities companies are worth relatively five times less. It also means of course that there are may high tech businesses that are valued very highly – that have out performed the oil and mining sectors since 1980. But we would make the case that oil and mining stocks are worth half of what they should be at this time. We see oil and metals prices rising far high, and with them oil company and mining profits will also rise sharply – as should their stock price. Other stocks will decline in comparison. It will be oil, gas, mining, commodities and agricultural stocks that will see the biggest gains in the next few years as inflation explodes and input costs sky-rocket, damaging manufacturing returns.

We hope this Special Report has help you framing your investment portfolio decision. If you have any comments and questions, please contact us on enquiries@propertyinvesting.net