405: Bond Market Blow-Off Bubble - Gold/Silver Price To Skyrocket

12-17-2011

PropertyInvesting.net team

Purpose: In this Special Report, we will describe why you should expect a long decline and collapse in living standards is western developed oil importing nations in the next six years. And how ultimately there will be a gigantic transfer of wealth from people with cash and bonds to people with gold, silver and commodities.

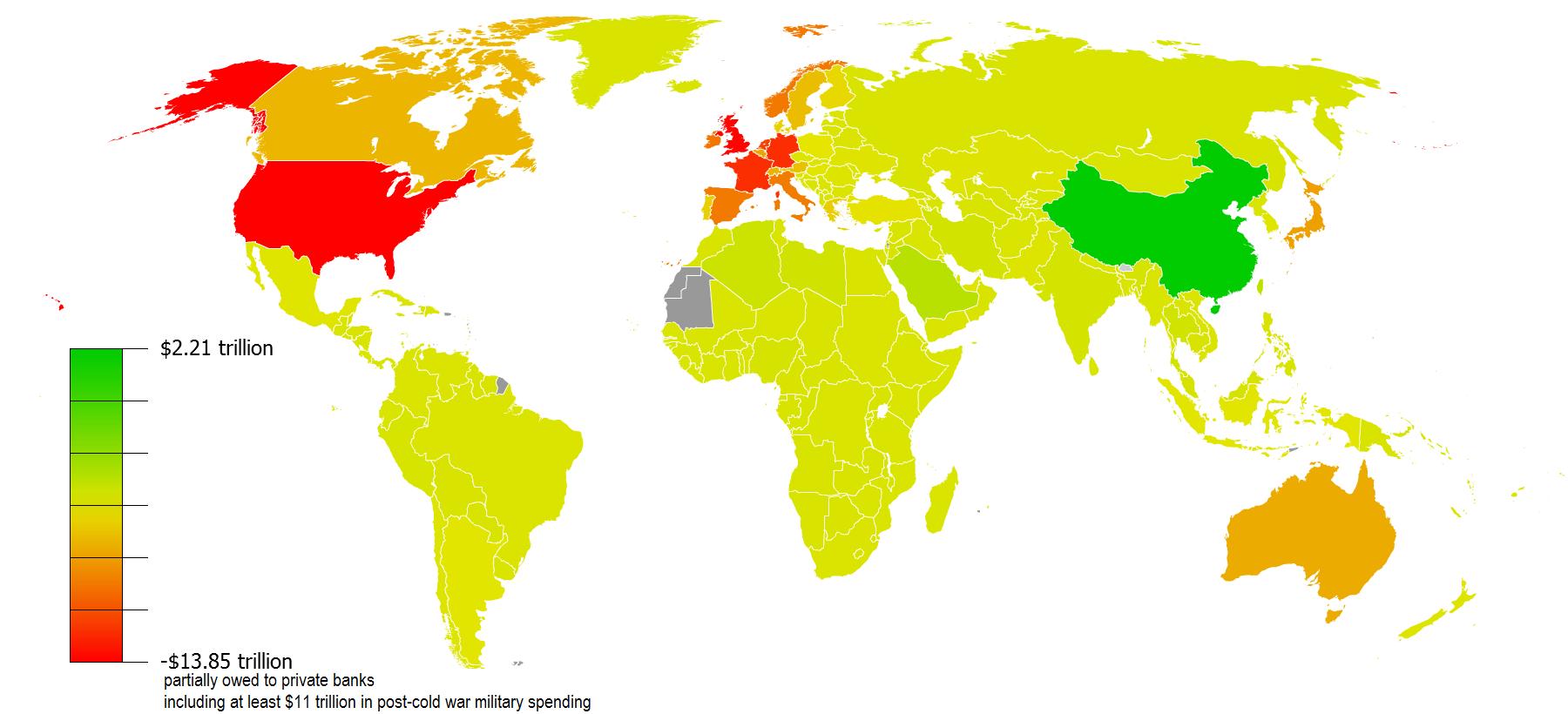

Huge Debt: The back-drop to the problem is massively increasing sovereign debt in western developed nations. When this reaches 90% of GDP, history tells us that it get beyond redemption. There are only a few ways out of the wall of debt:

· Printing money – leading to very high inflation, or

· Debt default and collapse

In summary:

· Mainland Europe is flirting with debt default and collapse with corresponding declines in real standards of living

· USA and UK are heading towards very high inflation and currency debasement with corresponding declines in real standards of living

Housing Bubble: Learned people knew about the US housing boom and its dangers back in 2004 – Alan Greenspan ignored the warnings and the result was huge toxic debt rolled up as sub-prime mortgages as cheap Fed money was used to try and make high returns from indebted private individuals that should not have been loaned money.

New Bond Market Bubble: Everyone in th e financial world now knows that the bond markets are the elephant in the room. Unless you were now aware, the real issue is that long term debt is being bought nations own government central banks by printing of money and debasing their currencies. However the privately held short term debt – that’s the debt that needs auctioning in a 0.5 to 2 year time-frame - continues to increase dramatically. Because government print money, this makes money readily available at rates of 0.5%. Banks then use this money to buy long dated bonds at 5% - thereby pocketing 4.5% - a nice return on a supposedly low risk asset. But the problem is, its not a low risk asset at all, because most banks know the government will one day not be able to afford interest payments on these loans. This charade has been going on for four years now and is getting to crisis proportions.

e financial world now knows that the bond markets are the elephant in the room. Unless you were now aware, the real issue is that long term debt is being bought nations own government central banks by printing of money and debasing their currencies. However the privately held short term debt – that’s the debt that needs auctioning in a 0.5 to 2 year time-frame - continues to increase dramatically. Because government print money, this makes money readily available at rates of 0.5%. Banks then use this money to buy long dated bonds at 5% - thereby pocketing 4.5% - a nice return on a supposedly low risk asset. But the problem is, its not a low risk asset at all, because most banks know the government will one day not be able to afford interest payments on these loans. This charade has been going on for four years now and is getting to crisis proportions.

Interest Rates Rise: As ratings agencies downgrade sovereign governments, this will increase the pressure on interest rates. Government will either have to increase printing of money or increase interest rates. Both will either lead to high inflation or default. Both scenarios are bleak and we are now past a point of no return for the USA, UK, Portugal, Italy, Ireland, Spain, Greece – and possibly France.

Gold Rocket: If you check back in history, you will find that in Weimer Germany in the 1920s, gold prices sky-rocketed 17 fold even through a period of deflation. Gold prices also skyrocket during periods of inflation, as people take flight to gold as a physical asset class that stores wealth – and mitigates against in the ravaged of inflation. The message we bring here is that gold goes up if there is either inflation or deflation of you look back in history. Any major instability causes gold prices to rise sharply.

Not Chaotic Yet: Now you might think things are chaotic at the moment, but they are not. There is no panic or shock or fast collapse. The US and UK government have been holding rates close to 0% for 3½ years whilst printing money. It doesn’t get much better (or worse) than this – this has kept propping things up. But a bond market collapse is just around the corner.

Bond Collapse: So what happens when the bond markets collapse? Well it means all confidence is lost in government bonds – their ability to pay back the debt and/or private investors ask for far higher interest rates because they have to factor this risk into their purchases. We make the c ase now that the bond markets are artificially propped up by government printed money – and this cannot go on for ever. We eventually get a collapse or hyper-inflation or both. This is when the panic and collapse set in. It could happen in the next 6 months or it could take 4 years – we really don’t know. But what were a almost certain about is that it will happen. The cosy relationship between nationalised banks and western central banks have created a facade whereby the toxic private debt has been transferred to the governments (nationalised) and the tax payers and savers are paying for the problems. For every £1 issued on bonds – easy money for the banks – only about 1p will ever get to the private enterprises that need this money to invest in their businesses and create jobs. Instead the money is taken by the banks and used to speculate (or invest) in commodities – they are after all trying to increase their returns. They know every time another batch of printed money arrives, their best hope is commodities as the printed money will lead to inflation of commodities. It always has and it always will. They also put some of this money temporarily into the stock markets because these markets rise and fall depending on the printing of money.

ase now that the bond markets are artificially propped up by government printed money – and this cannot go on for ever. We eventually get a collapse or hyper-inflation or both. This is when the panic and collapse set in. It could happen in the next 6 months or it could take 4 years – we really don’t know. But what were a almost certain about is that it will happen. The cosy relationship between nationalised banks and western central banks have created a facade whereby the toxic private debt has been transferred to the governments (nationalised) and the tax payers and savers are paying for the problems. For every £1 issued on bonds – easy money for the banks – only about 1p will ever get to the private enterprises that need this money to invest in their businesses and create jobs. Instead the money is taken by the banks and used to speculate (or invest) in commodities – they are after all trying to increase their returns. They know every time another batch of printed money arrives, their best hope is commodities as the printed money will lead to inflation of commodities. It always has and it always will. They also put some of this money temporarily into the stock markets because these markets rise and fall depending on the printing of money.

$85 Trillion Wall Of Money: When the bond markets collapse – this $85 Trillion wall of mo ney will hit the global economy and people will switch rapidly into commodities – any assets that can store wealth. This will be the final phase of the commodities blow-off bubble – when oil prices skyrocket and gold and silver prices follow suit. It will be a parabolic shift – rapidly to high levels as every man and his dog panic and try and get into something that will store their wealth as confidence disappears on currencies – just like it did on real estate in 2007, the dotcom bubble in 2000 and bank stocks in 2008.

ney will hit the global economy and people will switch rapidly into commodities – any assets that can store wealth. This will be the final phase of the commodities blow-off bubble – when oil prices skyrocket and gold and silver prices follow suit. It will be a parabolic shift – rapidly to high levels as every man and his dog panic and try and get into something that will store their wealth as confidence disappears on currencies – just like it did on real estate in 2007, the dotcom bubble in 2000 and bank stocks in 2008.

Gold Versus Bond Market: Now compare the size of the Bond market of $85 Trillion with the size of the total Gold market – which is $7 Trillion. It make it more transparent, we enclose a listing that shows only 18% of the gold market is privately held gold. Jewellery is the largest part of the market, but of course people do not generally melt down jewellery for investment and hence this is considered off the market. Government are generally increasing their gold reserves – or at least trying to. So you can hopefully see that if the people that buy bonds bail out of this “investment” and switch to gold – because the bond market is 85 times the private investment gold market – gold prices would need to skyrocket. So what’s the chance this would happen? We would say rather high – because just like sub-prime mortgages and the housing bubble, we think the bond market is the next bubble to pop. The chance it won’t pop is probably small. When it does, panic will set in and everyone will flee to gold and silver. The silver market is even smaller – some 100 times smaller than the gold market. So silver would likely s ky-rocket along with its more expensive sister precious metal.

ky-rocket along with its more expensive sister precious metal.

Gold Reserves Worldwide Market

%

Tonnes

Trillion $

Official Reserves Central Banks

18

30000

1.2

Private investment

18

30000

1.2

Other

12

20000

0.8

Jewellery

52

86000

3.8

100

166000

7

GFMS Source: $ based on $40 mln per tonne

Technology Will Not Save Us: Our view is that the only way that western oil importing (high deficit) nations can be saved now is if there is a technology innovation that improves productivity to ~4% per annum (from current levels of 1-2%). This would translate into real GDP growth and suppress inflation, to allow governments to pay back their debts in a controlled long term manner. But the chance of this miracle happening is in our view minute because:

· Any technology innovation is likely to be seized by the Chinese who will manufacture at low cost and under-cut the high cost west

· There is no technology that is on the radar screen we can see (unlike in 1982 we had the microchip, 1995 we had PCs and mobile phones then the internet).

· Government do not want to increase unemployment in the public or private sector and hence productivity improvements are declining.

· Technologies like shale gas (fraccing), nuclear power, wind and solar are being stifled by environmental and Nimby concerns – a classic example is decommissioning of low cost nuclear power in Germany because of a Japanese tidal wave.

1980s Comparison: If we think back to the early 1980s, after the last commodities bull market ended with gold rising from $50/ounce to $850/ounce and oil prices rising from $8/bbl to $35/bbl – Volker increased interest rates to 18% (4% over inflation) to stifle inflationary threats. However US government debt was $0.7 Trillion so the US could afford to do this. The economy readjusted and the micro-processor and energy efficient usages along with low oil prices by 1986 of $8/bbl led to rapid productivity improvements, strong growth and a fundamental improvement in the US economy. Its thought that Reagan and Volker did a deal with Saudi Arabia that they should pump as much oil as possible in March 1986 to flood the oil markets and drive oil prices down from $35/bbl to $8/bbl – this made Soviet Oil exports uneconomic because the cost to pipe the oil to Europe was $14.bbl. This then caused the Soviet Union to collapse within 3 years and meant less military spending. In return the USA would guarantee Saudi security against the twin threats of Iran and Iraq – of course they delivered on their promise because in 1990 after Iraq invaded Kuwait, they took back Kuwait and eradicated this risk for Saudi. They also defended Saudi from the Iranian threat over this long period since the Iranian Revolution in 1980. The 1980s were the ultimate high point in the USA’s military, strategic and economic super-power – when they won the cold war against the Soviets leading to the collapse of the Berlin Wall, and kept Iran and Iraq in check whilst maintaining low oil prices to fuel their booming technology lead economy. Anyone that thinks Ronal Reagan was not intelligent think again – at the bare minimum he must have surrounded himself with the best brains in the land.

afford to do this. The economy readjusted and the micro-processor and energy efficient usages along with low oil prices by 1986 of $8/bbl led to rapid productivity improvements, strong growth and a fundamental improvement in the US economy. Its thought that Reagan and Volker did a deal with Saudi Arabia that they should pump as much oil as possible in March 1986 to flood the oil markets and drive oil prices down from $35/bbl to $8/bbl – this made Soviet Oil exports uneconomic because the cost to pipe the oil to Europe was $14.bbl. This then caused the Soviet Union to collapse within 3 years and meant less military spending. In return the USA would guarantee Saudi security against the twin threats of Iran and Iraq – of course they delivered on their promise because in 1990 after Iraq invaded Kuwait, they took back Kuwait and eradicated this risk for Saudi. They also defended Saudi from the Iranian threat over this long period since the Iranian Revolution in 1980. The 1980s were the ultimate high point in the USA’s military, strategic and economic super-power – when they won the cold war against the Soviets leading to the collapse of the Berlin Wall, and kept Iran and Iraq in check whilst maintaining low oil prices to fuel their booming technology lead economy. Anyone that thinks Ronal Reagan was not intelligent think again – at the bare minimum he must have surrounded himself with the best brains in the land.

Today’s US Situation: Compare this with today’s situation – US government debt is $15 Trillion and projected to be at least $20 Trillion by 2017. There is no technology innovation to boost productivity. The US has a socialist government that has nationalised banks and has no intent on reducing the size of the bloated public sector. Interest payments at a conservative 6% of $15 Trillion would cost the entire tax revenue of the country to pay on an annual basis. Private enterprise is leaving the USA to lower cost areas – more offshoring of financing is taking place as taxes rise and regulations increase. The Chinese demand for resources is accelerati ng and driving up input costs for the USA. Healthcare costs are $6000/per/annum. Military costs are $1500/person/annum. Oil import costs are $1500/person/annum. We think the USA is to all intense and purposes already bankrupt – at least on an expectation projection. And see no way productivity improvements will lead to strong growth and high tax returns. Tax returns are likely to stagnate, borrowing costs will rise, then very high (possibly hyper) inflation will start as bond markets collapse and/or printing of money accelerates. Add to this the Fed is run by an academic – the most important business person in the world has no business background! Obama has no meaningful business skills, experience or knowledge – he’s always been a public sector politician. It’s like putting a civil servant and a professor in charge of the biggest company in the world – the shareholder would never agree. Remember all taxes come from the private sector – but these two do not seem to realise that as the public sector increases in size, their tax revenues will decline!

ng and driving up input costs for the USA. Healthcare costs are $6000/per/annum. Military costs are $1500/person/annum. Oil import costs are $1500/person/annum. We think the USA is to all intense and purposes already bankrupt – at least on an expectation projection. And see no way productivity improvements will lead to strong growth and high tax returns. Tax returns are likely to stagnate, borrowing costs will rise, then very high (possibly hyper) inflation will start as bond markets collapse and/or printing of money accelerates. Add to this the Fed is run by an academic – the most important business person in the world has no business background! Obama has no meaningful business skills, experience or knowledge – he’s always been a public sector politician. It’s like putting a civil servant and a professor in charge of the biggest company in the world – the shareholder would never agree. Remember all taxes come from the private sector – but these two do not seem to realise that as the public sector increases in size, their tax revenues will decline!

Bond Bubble Collapse: Ultimately the $85 Trillion bond market bubble collapse will see gold prices go ballistic when this wall of money is pulled and people dive into gold, silver and oil in the final phase of the blow-off bubble. Currency saving will be destroyed, bonds will be wiped out (yes, defaults, gigantic “hair-cuts” and the like) – and the only good store of wealth will be – gold, silver, oil and food.

$85 Trillion: Let’s just say this $85 Trillion of bonds (or loans or debt) is divided by the 500,000,000 wealthy western people – that’s the combined populations of USA and western Europe, this is $170,000 per person. For an average family of four – that’s $680,000. Because the average wage is about $48,000 – that’s about 13 times gross earnings or 26 times after tax earnings. That’s too much debt for too few people. It will either have to be defaulted on – or inflated away. Both scenarios lead to far h igher gold prices.

igher gold prices.

Temporary US Reprieve Because of Weak Euro: One of the only reasons why we are not seeing rampant US inflation at this time is that people have temporarily taken flight from the Euro into the "so-called" safe haven of US Treasuries, thereby increasing the value of the dollar and decreasing inflationary pressures. However, when people finally realise just what a basket case the US is in terms of debt and finances, they will sell their bonds - this will then drive up interest rates, drive down the dollar, drive up inflation and lead to a vicious circle and final bond collapse. At this time - when investors finally get wind of the ramifications of the US debt issue - gold will sky-rocket. It's also worth noting that the Eurozone is at least trying to prevent the printing of money and is trying to put pressure on peripheral European governments to reduce their deficits, public spending and shore up their finances. But quietly the US Fed and to a lesser extent the UK are doing the opposite. They have been printing money for many years to subsidize their bond auctions. The focus is on the Eurozone only because its more newsworthy at the moment - the politics, arguments and stories give the focus to the Eurozone - but the underlying problem is the rediculously low interest one gets on US bonds - and this will and will have to reverse - this will cause a crisis when international investors demand higher rates, the dollar collapses and inflation takes hold in the US. This is when the big movement into gold will begin. At this time gold prices could quiet easily rise four fold. At $1500/ounce - its extremely good value. Gold is money (despiate what Ben Benacke thinks!) and when confidence is lost in currencies as printing continues, gold will sharply rise.

Official Inflation: The other issue is that we should not believe the official US, UK or Euro inflation rate. The UK CPI is supposed to be about 4.8% - but does anyone really believe this number? Energy prices are rising at about 15% a year, food at 10%, tax is increasing, and imported goods from the Far East are rising sharply. Inflation is more like 8-10% in both the USA and the UK. Lets just look  at oil for instance. In 2003 the oil price was $25/bbl - now despite a recession and general stagflation, oil prices are four times higher at $100-$110/bbl. Everything is getting more expensive as Sterling and the US dollar are debased. The low cost Chinese miracle of the 1990-2005 period has ended - their costs have risen and the imported goods prices are rising along with raw commodities prices. Remember how prosperous Argentina was in 1975 - and look what happened by 1985. The same will happen to Greece in 2005 - versus Greece in 2015. The regrettably - the USA will be next.

at oil for instance. In 2003 the oil price was $25/bbl - now despite a recession and general stagflation, oil prices are four times higher at $100-$110/bbl. Everything is getting more expensive as Sterling and the US dollar are debased. The low cost Chinese miracle of the 1990-2005 period has ended - their costs have risen and the imported goods prices are rising along with raw commodities prices. Remember how prosperous Argentina was in 1975 - and look what happened by 1985. The same will happen to Greece in 2005 - versus Greece in 2015. The regrettably - the USA will be next.

Downside Scenario: One particular concern we have with the USA is a little talk about subject. Another inconvenient truth or elephant in the room. Almost all Americans own a gun and are prepared to use it. If an economic crisis breaks out - without wanting to sound like a doom-monger - any breakdown in civil disorder would be catastrophic for the economy and security. How can you control 150,000,000 more more guns within a population of 300,000 million. Compare this with the UK where almost no-one owns a gun. In this scenario, yes you would get riots, but they would not be gun battles. One reason why we prefer to be UK based rather than US based.

Gold Production Stagnation: In the period Gold production 1980 to the year 2000, gold production rose from 1250 Tonnes per annum to 2600 Tonnes per annum – gold production appears t o have peak in 2003 and has since decline to 2450 Tonnes despite gold prices rising from $350/ounce to $1500/ounce. This is because government are taxing gold miners at far higher levels and forcing them to comply with stringent social and environmental regulations and costs. This shows no sign or reversing and gold mining costs have sky-rocketed from about $50/ounce to in some cased $1000/ounce. Bottom line is, not much new supply is likely to feed through to the gold market.

o have peak in 2003 and has since decline to 2450 Tonnes despite gold prices rising from $350/ounce to $1500/ounce. This is because government are taxing gold miners at far higher levels and forcing them to comply with stringent social and environmental regulations and costs. This shows no sign or reversing and gold mining costs have sky-rocketed from about $50/ounce to in some cased $1000/ounce. Bottom line is, not much new supply is likely to feed through to the gold market.

No Great Technology Innovation: Higher level, as the eastern economies continue to boom taking more of the resources, this will be at the expense of higher cost western developed nations. The US strategy is to try and encourage people to buy the dollar and discourage people from buying silver and gold (their competitors). Interestingly, India and China have the strategy of distrusting the dollar and encouraging their private individual populations to own gold. Indians buy huge quantities of gold for jewellery. Meanwhile the canny Chinese by large quantities of physical gold – coins and bars. This is encouraged we believe because the Chinese see the demise of the dollar as almost certain and want the ir country (in its totality) to own as much gold as possible as the true store or wealth – before the panic sets in.

ir country (in its totality) to own as much gold as possible as the true store or wealth – before the panic sets in.

Gold Shake Out: Last Thursday 14 December – someone appears to dump large quantities of gold onto the market – there was even talk this was Gadiffi’s gold being sold by the Americans. No-one can be sure what happened – but we believe it was the US government trying to frighten the gold investors and flush them out – force them back into the dollar. But government intervention never works in the longer term – it will back-fire and one day, you will see a gigantic upward move in gold prices that the US government will never be able to stop. They probably wish they had far more gold – but of course they would never admit this because it would be a sign that they don’t believe in their own fiat currency.

UK Gold Sold At All Time Low: As far as the UK is concern, Gordon Brown sold most of the UK gold reserves at the all time inflation adjusted bottom of the market – around $250/ounce – in 2003. It has since risen six fold – or 600% - and hence in 9 years he singularly destroyed about $20 Billion of UK value when he sold this gold during the “good times”. That’s what happens when you put a politician in charge of the Treasury with absolutely no business experience.

Property: A final note on property. At the end of the day, when the currencies fail and gold prices sky-rocket – property is still a physical asset and is well protected against the ravages of inflation. It is also protected against deflation if all other items deflate around it. The big winners at  the end of the day are people that get out of bonds and cash, into gold, silver and oil – hold some high yielding rental property, then buy property with gold at the end of the gold bull run – in the final stage of the western economic collapse. Just like in Argentina in 1982, anyone holding gold would have been able to buy whole residential housing blocks in 1988 in dollars with small quantities of gold. It will probably be similar in the USA and UK by the end of this decade.

the end of the day are people that get out of bonds and cash, into gold, silver and oil – hold some high yielding rental property, then buy property with gold at the end of the gold bull run – in the final stage of the western economic collapse. Just like in Argentina in 1982, anyone holding gold would have been able to buy whole residential housing blocks in 1988 in dollars with small quantities of gold. It will probably be similar in the USA and UK by the end of this decade.

That Shake Out Will Not Work: So in the whole scheme of things, the shake out that happened on 14 December is insignificant – and should only be viewed as an improved buying opportunity for precious metals. Gold at $1600/ounce and silver at $30/ounce are both bargains. Ultimately it will be the market that decides the dollar, gold and silver’s fait – and we strongly believe its time to get out of fiat cash-currency and into gold and silver as negative interest rates are here to stay as governments continue print money, prop up failed banks and governments, debases currencies and destroy savings.

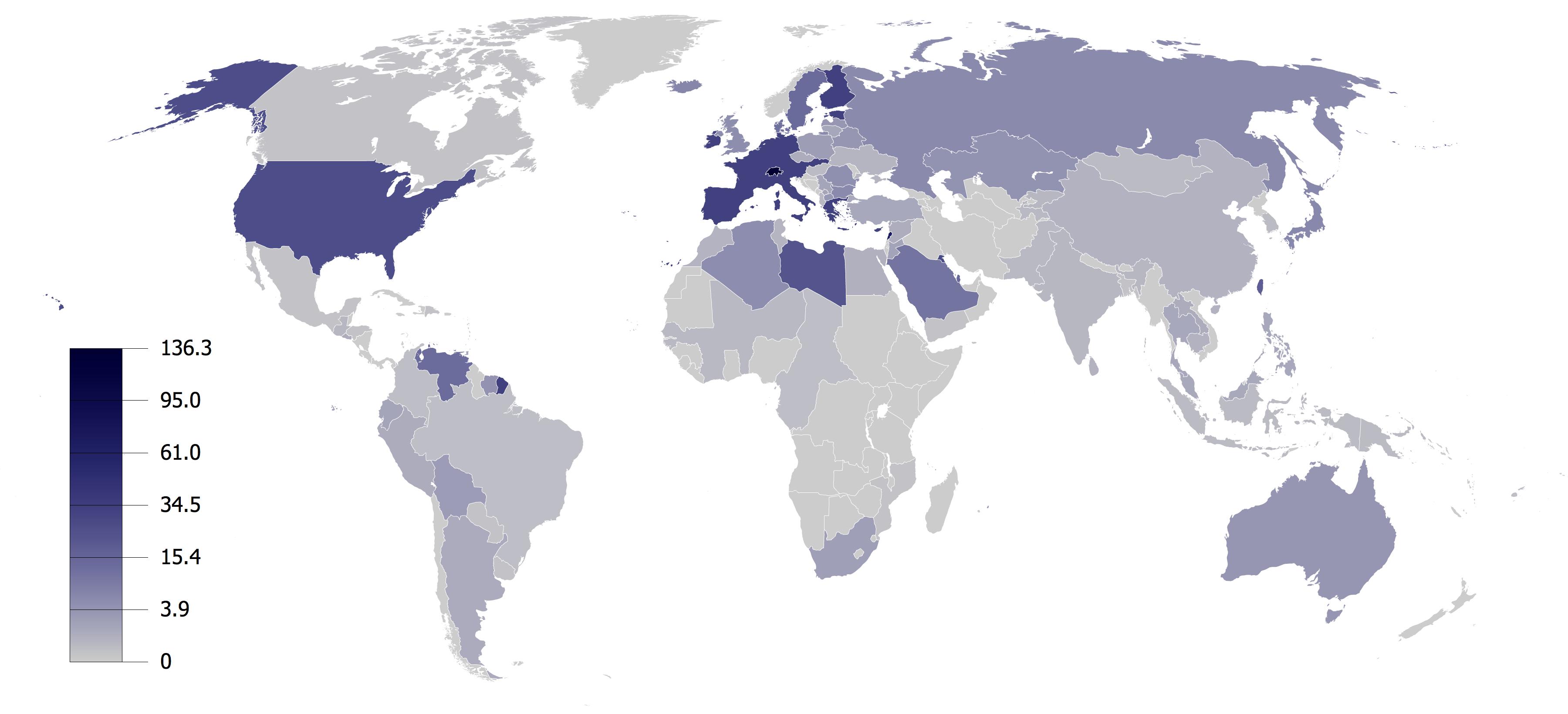

Table showing gold reserves per country - global (courtesy www.wikipendia.com )

| Rank | Country | Gold Tonnes | Gold Share of National Forex |

| 1 | USA | 8,133.5 | 74.7% |

| 2 | Germany | 3,401.0 | 71.7% |

| 3 | Italy | 2,451.8 | 71.4% |

| 4 | France | 2,435.4 | 66.1% |

| 5 | China | 1,054.1 | 1.7% |

| 6 | Switzerland | 1,040.1 | 16.4% |

| 7 | India | 946.7 | 9.0% |

| 9 | Russia | 851.5 | 8.6% |

| 8 | Qatar | 12.4 | 3.5% |

| 10 | Japan | 765.2 | 3.0% |

| 11 | Netherlands | 612.5 | 59.4% |

| 12 | ROC (Taiwan) | 423.6 | 4.6% |

| 13 | Portugal | 421.6 | 81.1% |

| 14 | Venezuela | 401.1 | 52.4% |

| 15 | Saudi Arabia | 322.9 | 3.0% |

| 16 | Islamic Republic of Iran | 320 | |

| 17 | United Kingdom | 310.3 | 16.8% |

| 18 | Lebanon | 300 | 27.6% |

| 19 | Spain | 281.6 | 38.6% |

| 20 | Austria | 280 | 56.2% |

| 21 | Belgium | 227.5 | 36.8% |

| 22 | Pakistan | 184.4 | 17.6% |

| 23 | Philippines | 175.9 | 14.0% |

| 24 | Algeria | 173.6 | 4.5% |

| 25 | Libya | 143.8 | 5.6% |

| 26 | Singapore | 127.4 | 2.5% |

| 27 | Sweden | 125.7 | 11.1% |

| 28 | South Africa | 124.9 | 12.2% |

| 29 | Turkey | 116.1 | 6.0% |

| 30 | Greece | 111.7 | 78.7% |

| 31 | Romania | 103.7 | 9.1% |

| 32 | Poland | 102.9 | 4.5% |

| 33 | Mexico | 101.1 | 3.8% |

| 34 | Thailand | 99.5 | 2.5% |

| 35 | Australia | 79.9 | 8.1% |

| 36 | Kuwait | 79 | 13.5% |

| 37 | Egypt | 75.6 | 8.7% |

| 38 | Indonesia | 73.1 | 3.6% |

| 39 | Kazakhstan | 67.3 | 10.0% |

| 40 | Denmark | 66.5 | 3.3% |

| 41 | Argentina | 54.7 | 4.5% |

| 42 | South Korea | 54.4 | ?% |

| 43 | Finland | 49.1 | 20.6% |

| 44 | Bulgaria | 39.9 | 9.9% |

| 45 | Malaysia | 36.4 | 1.5% |

| 46 | Peru | 34.7 | 3.6% |

| 47 | Belarus | 32 | 24.5% |

| 48 | Brazil | 33.6 | 0.5% |

| 49 | Slovakia | 31.8 | 65.4% |

| 50 | Bolivia | 28.3 | 13.4% |

| 51 | Ukraine | 27.2 | 3.5% |

| 52 | Ecuador | 26.3 | 31.0% |

| 53 | Syria | 25.8 | 0.0% |

| 54 | Morocco | 22 | 4.2% |

| 55 | Nigeria | 21.4 | 0.0% |

| 56 | Sri Lanka | 17.5 | 11.9% |

| 57 | Cyprus | 13.9 | 50.8% |

| 58 | Bangladesh | 13.5 | 5.2% |

| 59 | Serbia | 13.1 | 4.2% |

| 60 | Netherlands Antilles | 13.1 | 36.3% |

| 61 | Jordan | 12.8 | 4.3% |

| 62 | Czech Republic | 12.7 | 1.2% |

| 63 | Cambodia | 12.4 | 14.4% |

| 64 | Laos | 8.8 | 36.5% |

| 65 | Latvia | 7.7 | 4.0% |

| 66 | El Salvador | 7.3 | 10.6% |

| 67 | Guatemala | 6.9 | 5.3% |

| 68 | Colombia | 6.9 | 1.1% |

| 69 | Macedonia | 6.8 | 12.7% |

| 70 | Tunisia | 6.8 | 0.0% |

| 71 | Ireland | 6 | 11.8% |

| 72 | Lithuania | 5.8 | 3.8% |

| 73 | Bahrain | 4.7 | 0.0% |

| 74 | Mauritius | 3.9 | 6.8% |

| 75 | Canada | 3.4 | 0.2% |

| 76 | Tajikistan | 3.3 | 0.0% |

| 77 | Slovenia | 3.2 | 13.4% |

| 78 | Aruba | 3.1 | 17.7% |

| 79 | Hungary | 3.1 | 0.3% |

| 80 | Kyrgyzstan | 2.6 | 6.5% |

| 81 | Luxembourg | 2.2 | 11.7% |

| 82 | Hong Kong | 2.1 | 0.0% |

| 83 | Suriname | 2 | 11.4% |

| 84 | Iceland | 2 | 1.6% |

| 85 | Papua New Guinea | 2 | 2.9% |

| 86 | Trinidad and Tobago | 1.9 | 0.8% |

| 87 | Albania | 1.6 | 2.8% |

| 88 | Yemen | 1.6 | 1.1% |

| 89 | Cameroon | 0.9 | 1.2% |

| 90 | Mongolia | 0.9 | 2.4% |

| 91 | Honduras | 0.7 | 0.0% |

| 92 | Paraguay | 0.7 | 0.7% |

| 93 | Dominican Republic | 0.6 | 1.0% |

| 94 | Gabon | 0.4 | 0.8% |

| 95 | Malawi | 0.4 | 6.2% |

| 96 | Central African Rep | 0.3 | 8.4% |

| 97 | Chad | 0.3 | 2.4% |

| 98 | Republic of the Congo | 0.3 | 0.4% |

| 99 | Uruguay | 0.3 | 0.1% |

| 100 | Fiji | 0.2 | 0.0% |

| 101 | Estonia | 0.2 | 0.3% |

| 102 | Chile | 0.2 | 0.0% |

| 103 | Malta | 0.2 | 1.6% |

| 104 | Costa Rica | 0.1 | 0.1% |

| 105 | Haiti | 0 | 0.1% |

| 106 | Burundi | 0 | 0.5% |

| 107 | Oman | 0 | 0.0% |

| 108 | Comoros | 0 | 0.0% |

| 109 | Kenya | 0 | 0.0% |

Gold Reserves as a percentage of GDP

Country Foreign Exchange Reserves Minus External Debt