396: Silver the greatest investment for 100 years - inflation and the dollar demise

10-02-2011

PropertyInvesting.net team

Incredible Opportunity: Do you ever get that uplifting and excited feeling of smugness, emboldened self-confidence and calm sense of security after finding a great investment. And you are so sure that you willingly put huge amounts of your hard earned cash into it.

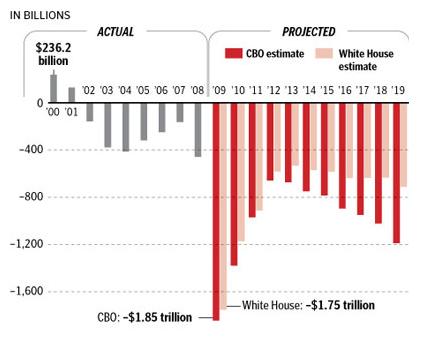

Inflation All The Way: Well, we’ve been doing a huge amount of research lately into inflation, deflation, previous bear markets, bull markets and depressions. And we think we have it clear in our minds what’s going to happen. As we have described before, beyond any doubt it’s “inflation all the way” from now on. Deflation will not happen – at least not in the next five years. The reasons are:

· The US and European debts are now so large, governments think they need to inflate their way out of the debt mountain

· Politicians are running the central banks – and need short term fixes of cash to keep a mirage of growth and economic momentum going before their next elections

· Tough decisions are not being made – instead of default and re-structuring, the politicians are trying to push out the evil day in a vein hope it might go away or into someone else’s governing period

· There are no easy short term options apart from printing money

Debt Bubble: As the printing presses continue – more b ubbles will be created. The price of almost everything will rise, but wages will probably lag inflation and disposable income will drop in the UK, USA and most western economies. As inflation accelerates into 2012, the following things will happen:

ubbles will be created. The price of almost everything will rise, but wages will probably lag inflation and disposable income will drop in the UK, USA and most western economies. As inflation accelerates into 2012, the following things will happen:

· Oil prices will rise, along with gas, coal, water and electricity

· Gold prices will soar to new levels – well above $1800/ounce

· Silver prices will take-off – to levels will above $50/ounce

· Property prices will stay in the doldrums, but might actually start rising slightly, though not as fast as overall inflation

· Food prices will soar as all agricultural commodities take off

· The stock market will gyrate wildly – there might be some form of crash, but the stock market may also rise though not as fast as inflation on an annual basis (hence the index may rise, but will drop in inflation adjusted terms)

· The US Bond market bubble will pop.

· Retail sales stay in the doldrums and lag far behind inflation

· Many high street retail companies will go bankrupt though internet retail will boom

· Airlines will go bankrupt and auto companies will struggle

· Farmland prices will rise

Bond Market Bubble: The US Bond market bubble popping will be the real t rigger for a sovereign US debt crisis. You see, when international investors demand 8% instead of 4% for bonds because of their risk, the US will not be able to pay the interest on its debts. Printing money won’t help anymore because the international investment community will have lost its interest in the dollar as the reserve currency. As the dollar value declines, US interest rates skyrocket and inflation takes off well above 10% per annum, the Fed will be scared to raise rates quickly and high because so many people would be bankrupted. But of course, this will be the wrong thing to do again, and inflation will then accelerate further. As more money is printed, wage inflation will need to kick-in, oil prices will rise further and a vicious period of stagflation in the USA and UK start in earnest. Then silver and gold prices will skyrocket as everyone starts to panic.

rigger for a sovereign US debt crisis. You see, when international investors demand 8% instead of 4% for bonds because of their risk, the US will not be able to pay the interest on its debts. Printing money won’t help anymore because the international investment community will have lost its interest in the dollar as the reserve currency. As the dollar value declines, US interest rates skyrocket and inflation takes off well above 10% per annum, the Fed will be scared to raise rates quickly and high because so many people would be bankrupted. But of course, this will be the wrong thing to do again, and inflation will then accelerate further. As more money is printed, wage inflation will need to kick-in, oil prices will rise further and a vicious period of stagflation in the USA and UK start in earnest. Then silver and gold prices will skyrocket as everyone starts to panic.

Implosion of Western Debt: This process will take some years – anything from one to five years. But it will happen. You don’t have to believe us of course. But let’s just say we are feeling self assured that our very early retirement and full financial freedom will be achieved in the next few years as the whole global economy implodes. We regret government are printing so much money, it’s totally the wrong thing to do. But they will do it. And we are not going to sit there and watch this happen, only for governments to destroy our pension pots, savings and tax us to death.

Take Action Now: No, we have acted over the last few years and are putting in place new investments now:

· Period 1999-2005 Property Investments - actual

· Period 2005-2011 Oil Investments - actual

· Period Oct 2011 Silver, Gold Investment (plus more oil) - plan

We have a very focussed strategy – and are now convinced everything is in place for a massive silver and gold bull run.

Rational for Gold and Silver Investment: Since 2003 when gold was $300 /ounce, the amount of dollars printed has grown exponentially by about ten fold. Gold should therefore now be $3000/ounce and is lagging well behind the amount of printed dollars. Silver has risen from $5/ounce in 2003 to $30/ounce Oct 2011 – this sounds like a huge rise, but there has been such a gigantic increase in money supply that it still looks very cheap. Furthermore:

/ounce, the amount of dollars printed has grown exponentially by about ten fold. Gold should therefore now be $3000/ounce and is lagging well behind the amount of printed dollars. Silver has risen from $5/ounce in 2003 to $30/ounce Oct 2011 – this sounds like a huge rise, but there has been such a gigantic increase in money supply that it still looks very cheap. Furthermore:

· Silver production is on a steep decline – its normally mined in conjunction with gold – an gold production is dropping (albeit hardly an gold is used for manufacturing, so gold reserves continue to climb)

· Silver reserves are declining to very slow levels because silver is used for industrial purposes like electronics, paints, speciality metals etc

Silver Shortages: Some very smart metals investors actually believe silver prices should be higher than gold – we don’t quite agree with this ourselves, but there is an logic to their arguments. The bottom line is, we see very little risk of silver dropping below say $20/ounce and a massive – a gigantic – upside to $50, $100, or even $1000/ounce in the next 1-5 years. We just would not be surprised if the price skyrocketed to $300/ounce – a tenfold increase. If this happens – even half was to $150/ounce, we will be early retired. It’s very exciting.

Possible Silver Market Manipulation: The have also been stories swirling around that governments (and possibly some large private investors) have tried to keep silver prices suppressed to reduce the metals attraction and/or so these entities can capture as much cheap silver as possible – before it becomes very obvious that there is far less silver supply available than originally thought. We have not researched this in any detail – but our intuition suggests some form of manipulation has taken place over time – and it’s more to the “keeping prices low” than the “driving prices higher”. Hence this increases the upside and reduces the downside.

More Printing = High Silver: So every time the governments are stupid and print more money – almost a 100% certainty – then we will be fully hedged and making serious returns as silver and gold prices sour. Lets face it, the dollar is a currency, not money. Its paper backed by nothing but a promise from a politician.

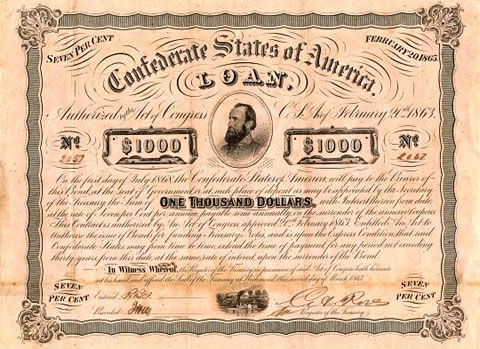

Stocks Better Than Bonds, Silver/Gold/Oil Better than Stock s: Another key insight is that stocks are actually safer than bonds and treasuries. Why? Because sovereign debt default will happen – almost for certain. Then you will be given a haircut of at least 50%, possible 90% or 100%. That’s a very poor return. If you hold a stock in a company, a good solid company like Shell, it may drop by 20%, but you’ll get a 4% dividend, they won’t default and Shell has been going for 110 years – without default. But take the German government. They defaulted and had hyperinflation in 1931, had a war in 1918, another war in 1945 – three haircuts. Meanwhile if you own part of a company, the government cannot confiscate this unless you live in a place like Venezuela.

s: Another key insight is that stocks are actually safer than bonds and treasuries. Why? Because sovereign debt default will happen – almost for certain. Then you will be given a haircut of at least 50%, possible 90% or 100%. That’s a very poor return. If you hold a stock in a company, a good solid company like Shell, it may drop by 20%, but you’ll get a 4% dividend, they won’t default and Shell has been going for 110 years – without default. But take the German government. They defaulted and had hyperinflation in 1931, had a war in 1918, another war in 1945 – three haircuts. Meanwhile if you own part of a company, the government cannot confiscate this unless you live in a place like Venezuela.

Gold and Silver Is Real Saving and Real Investment: Meanwhile although gold does not pay a dividend, has not return and costs money to store, it should increase in value at the same pace or possibly higher than the money supply. So your savings will not be destroyed by inflation. Remember gold is a saving – and it is real money – not a fiat printed piece of paper that can default. That’s why all sensible governments hold large gold reserves. It’s a real asset, not a fiat currency that can be abused by politicians and central bankers who are working in cohorts to try short-term fixes to long term debt problems.

Don’t Be The Last At The Party: Instead of being the last people to inv est in gold and silver, you need to be one of the first – or relatively early. We don’t think it’s too late. Gold and silver prices will gyrate dramatically – and will likely end one day in a parabolic final bull market blow-up, at which time you will need to get out before the top of course. But we have not seen any parabolic moves and think this is more likely to be at some point between end 2012 and 2019 – at the very least a year away. If gold and silver dips, you should buy on a dip. If it goes up rapidly, sell a bit on a high, then buy on the dips again. But get out when you see a parabolic rise and you find out your neighbour and every man and his dog is being gold and silver.

est in gold and silver, you need to be one of the first – or relatively early. We don’t think it’s too late. Gold and silver prices will gyrate dramatically – and will likely end one day in a parabolic final bull market blow-up, at which time you will need to get out before the top of course. But we have not seen any parabolic moves and think this is more likely to be at some point between end 2012 and 2019 – at the very least a year away. If gold and silver dips, you should buy on a dip. If it goes up rapidly, sell a bit on a high, then buy on the dips again. But get out when you see a parabolic rise and you find out your neighbour and every man and his dog is being gold and silver.

Safe Haven Long Term: When people are saying “this time it’s different” and “this bull market will keep rising because the whole lots melted down” then it’s time to get out. But we are far off this point at present. We haven’t even had our first sovereign debt default. And inflation is only 4-8%. God it’s early. And we don’t thing $30/ounce will ever be seen again for silver!

Gold To $3800 or More: According to our conservative research, gold should rise to range $3800/ounce at the end of this commodities bull run, most likely around 2018. This is when the ratio of Dow Jones to Gold drops about three fold from its current level of 7 to around 3. This would therefore imply the Dow would be at 11000 by 2018 – a further drop of say 50% in inflation adjusted terms by then. It’s quite possible gold could go a lot higher if there is very high inflation and bankruptcy in the USA, but conservatively it should double from hereon with a mid case of an almost tripling from its current $1600 ounce level over a 7 year period to the end of the secular commodities bull run in 2018. Let’s face it, if inflation starts in earnest like we expect it to in 2012, this will depress the Dow, inflation commodities prices and with it drive gold far higher as a safe haven against the declining dollar value. As the USA dollar loses it’s reserve currency status as gigantic quantities of fiat money is printed, gold will go higher. It’s quite simple. Only austerity, the stopping of printed money, severe US deficit reduction and return to normal capitalist growth trends all together could de-rail the gold bull run. We think this chance of this happening is almost zero percent.

conservative research, gold should rise to range $3800/ounce at the end of this commodities bull run, most likely around 2018. This is when the ratio of Dow Jones to Gold drops about three fold from its current level of 7 to around 3. This would therefore imply the Dow would be at 11000 by 2018 – a further drop of say 50% in inflation adjusted terms by then. It’s quite possible gold could go a lot higher if there is very high inflation and bankruptcy in the USA, but conservatively it should double from hereon with a mid case of an almost tripling from its current $1600 ounce level over a 7 year period to the end of the secular commodities bull run in 2018. Let’s face it, if inflation starts in earnest like we expect it to in 2012, this will depress the Dow, inflation commodities prices and with it drive gold far higher as a safe haven against the declining dollar value. As the USA dollar loses it’s reserve currency status as gigantic quantities of fiat money is printed, gold will go higher. It’s quite simple. Only austerity, the stopping of printed money, severe US deficit reduction and return to normal capitalist growth trends all together could de-rail the gold bull run. We think this chance of this happening is almost zero percent.

Crisis: When a crisis comes, gold and silver are always the places that weal thy people run to, to protect their wealth. This has been the same for centuries. It has not changed. The crisis has only just begun, the first stage was the financial crash in mid 2008. This collapse of the western economies has probably got another 7 years left according to our analysis. This will be the end of the stock market bear run, end of the commodities bull run and end of inflationary period some time around 2018, as described in our previous special reports.

thy people run to, to protect their wealth. This has been the same for centuries. It has not changed. The crisis has only just begun, the first stage was the financial crash in mid 2008. This collapse of the western economies has probably got another 7 years left according to our analysis. This will be the end of the stock market bear run, end of the commodities bull run and end of inflationary period some time around 2018, as described in our previous special reports.

A House For 500 ounces of Silver Costing $12000: In the USA, it took 1980 1000 ounces of silver to buy a house. Its likely at the end of this silver bull run, because silver is also in short supply, it might take even less silver to buy a US property in 2018. This would imply silver sky-rocketting from $30/ounce to $150/ounce, a five fold increase in 7 years. Yes, we are serious. Silver is so cheap today in inflation adjusted terms, it’s an absolute bargain. We see a downside to $15/ounce and an upside to well over $500/ounce if the US dollar crashes and inflation takes off to over 15% per annum.

Dollar Collapse: The inflation adjusted value of the dollar has decline 95% sinc e the year 1900. It is now worth a paltry 5 cents. Meanwhile, it’s no surprise that gold value in dollar terms rose 900% in that time. Cash looses value at a rate of 5-10% a year, and this is likely to worsen in the next 7 years. As inflation takes off, gold will rise sharply as will silver and oil.

e the year 1900. It is now worth a paltry 5 cents. Meanwhile, it’s no surprise that gold value in dollar terms rose 900% in that time. Cash looses value at a rate of 5-10% a year, and this is likely to worsen in the next 7 years. As inflation takes off, gold will rise sharply as will silver and oil.

60% Way Through Bull Silver-Gold Market: We are entering the last 40% period of a secular bear market in stocks and 40% period of a secular bull market in commodities. The next 7 years will see an ugly mix of inflation, high unemployment, bankruptcies,

Money Supply Explosion: The monetary base in the USA expanded from $0.85 Trillion to $3 Trillion from 2007 to mid 2011. That’s a fourfold increase in three years, compared with its base that took hundreds of years to build up as the economy expanded.

Fed Is Private Entity and Has No Reserves: The US Fed does not have reserves. It is not a bank. It’s a private organisation. It does not even need to print money. It just creates money out of thin air – by adding zeros. The Fed has stock holders – that are paid a dividend. They are a private organisation. They make promises. They claim to pay people back. But one day they will go bankrupt.  The only way they are not bankrupt at this time is because they have free reign to print money. But this cannot continue forever. The only money being loaned out now is not from savers. The US banks have $41 Billion of reserves. But they lend of Trillions. What the Fed does is print some money, stick it into their deposit, then they can lend out 90% of this, then this is then lend onwards, maybe ten times – so there might eventually by $10 circulation for every $1 printed. The Fed continues to dilute everyone else’s dollars.

The only way they are not bankrupt at this time is because they have free reign to print money. But this cannot continue forever. The only money being loaned out now is not from savers. The US banks have $41 Billion of reserves. But they lend of Trillions. What the Fed does is print some money, stick it into their deposit, then they can lend out 90% of this, then this is then lend onwards, maybe ten times – so there might eventually by $10 circulation for every $1 printed. The Fed continues to dilute everyone else’s dollars.

Every year the US deficit increases. The gigantic 2011 mortgage re-sets were bailed out this year by the Fed simple printing money. The borrowing is rising so sharply that the only way to continue is to hyper-inflate. And that is probably the key reason we are shifting rapidly into gold and silver. It’s like being in 1973 – and this commodities bull run will end in 1980 – or 2018 in today’s timescale. It’s inflation all the way.

Property Investing And Inflation: The good news for property investors in the USA at the moment is US government has started buy mortgage debt through the back door. They has QE1 and QE2. Then everyone seemed to be hoping f or another fix with QE3. They got disappointed after the Jackson Hole speech – nothing. Then came “Operation Twist” – a back door silence QE3 – buying bad mortgage debt to prop up the real estate market and reduce the mortgage rates. Sure enough, they have dropped from 5% to 4%, a historic low and we believe US real estate prices could start shifting higher in the next few months as more cheap mortgages are available. Of course the Fed is directly intervening to create another little real estate bubble just before the next end 2012 election to try and get Obama back into power – it’s the only way Helicopter Ben will keep his job of course. So if you jump onto this bandwagon, make sure you get off before the election, because after the election, when the Republicans get in, we are pretty sure real estate prices will go into depression again. By that time, there may be such high general inflation at 15%, real estate prices might actually be rising by 10%, but not enough to keep pace with inflation. We have almost zero confidence in the current US administrations ability to control the debt problem, deficit and inflation. The USA deficit is running at $1 Trillion a year – then Tim what’s his name had the cheek to visit Europe last month and express his deep concern about the European debt situation and the Europeans handling of it. Well, he probably has a point of course but coming from the US Fed is enough to make anyone either laugh or cry. Its just a question of a toss of as coin whether the US or Europe will be the first to default.

or another fix with QE3. They got disappointed after the Jackson Hole speech – nothing. Then came “Operation Twist” – a back door silence QE3 – buying bad mortgage debt to prop up the real estate market and reduce the mortgage rates. Sure enough, they have dropped from 5% to 4%, a historic low and we believe US real estate prices could start shifting higher in the next few months as more cheap mortgages are available. Of course the Fed is directly intervening to create another little real estate bubble just before the next end 2012 election to try and get Obama back into power – it’s the only way Helicopter Ben will keep his job of course. So if you jump onto this bandwagon, make sure you get off before the election, because after the election, when the Republicans get in, we are pretty sure real estate prices will go into depression again. By that time, there may be such high general inflation at 15%, real estate prices might actually be rising by 10%, but not enough to keep pace with inflation. We have almost zero confidence in the current US administrations ability to control the debt problem, deficit and inflation. The USA deficit is running at $1 Trillion a year – then Tim what’s his name had the cheek to visit Europe last month and express his deep concern about the European debt situation and the Europeans handling of it. Well, he probably has a point of course but coming from the US Fed is enough to make anyone either laugh or cry. Its just a question of a toss of as coin whether the US or Europe will be the first to default.

The dollar and all currencies that were converted into dollars – were up until 1971 pegged to the price of gold. In 1971, Nixon took the USA off the gold standard. Which meant the Fed could then print as much money as it deemed appropriate. The money supply has risen so sharply that inflation is certain now – and with it – gold prices should rise sharply.

Gold Standard: If the USA wanted to get back onto the gold standard, gold would need to be worth $15000/ounce. This is the implies price to cover all the printed money. It’s still conceivable that gold will rise to these levels – because every time hyper-inflation has started, gold normally catches up with the currency value as people need gold to make purchases and buy food. The silver and gold prices going up will be when people finally wake up to the fact that the dollar is a an almost worthless inflating currency which has fallen into disrepute.

Transfer of Wealth From Middle Class Dollar Owner To Silver-Gold Investors: There will be a huge transfer of wealth. At no other time in history have all currencies been fiat currencies, meanwhile gold is freely available to be purchased by a private individual. This is an amazing opportun ity to secure your future by buying as much silver as possible.

ity to secure your future by buying as much silver as possible.

Silver supply has dropped: How many months supply are available? In the 1960s and 1970s, there was about 10-20 years of supply above ground. In 2006 this went down to a meagre 3 month.

Silver is rarer than gold: There is more gold available to buy now than silver at this time. The total amount of gold in the world would fit into a 20m x 20m cube. But the entire amount of silver would fit into a 12m x 12m cube. Far less.

Silver is consumed: It is the most reflective, most electrically conductive and most thermally conductive element on earth. It is needed in electronic manufacturing. In most cases there is no replacement. It is a single element. It cannot be re-constituted. Years ago in 1975, there were probably 200 million people that were able to buy silver. Now about 5 billion people have access to silver investment.

Internet Accessibility: The internet, smart phones and banking connectivity means most people can now buy silver and gold using a smart phone in an instant. It also needs very little financial education to buy silver and gold. One day – we believe the Chinese, Indians and every man and his dog will be piling into silver and gold – in the final blow-off period some years away. Obviously one should get out when the hyperbolic blow-off commences – but we think this is years away. But when it happens, it could be very quickly and the last people in will get slaughtered of course.

Quiet Life: Gold and silver is also an excellent investment if you want a quiet life. No tenants. No currency issues. You don’t even need to keep accounts. You just need to make sure yo u know how many coins you have. Or ounces you own. It’s a real asset class. No mirage or fiat. You can even drop by your safe deposit box and check on it. And pull it out if you need to. Or store in a safe vault with a secure company. Don’t buy any ETFs though – they are run by governments and banks and you might find one day that gold was some form of legal mirage. It never existed – and was just another promise of gold.

u know how many coins you have. Or ounces you own. It’s a real asset class. No mirage or fiat. You can even drop by your safe deposit box and check on it. And pull it out if you need to. Or store in a safe vault with a secure company. Don’t buy any ETFs though – they are run by governments and banks and you might find one day that gold was some form of legal mirage. It never existed – and was just another promise of gold.

Yes – Another Bubble: Stocks has a bubble in 2000. Real Estate had a bubble in 2006. There was a few oil bubbles and might be more. The Bond bubble is now. And the final bubble will be gold and silver – it will skyrocket, then crash. It’s time to get into this bubble early.

Shift to Silver and Gold: Also, don’t listen to those clowns that say you should only put in 10% of your investments in gold and silver. No – that’s rubbish. One needs to seize this opportunity and shift into a focussed strategy if one can identify a good investment opportunity. Silver and gold in our view is even better than oil and property at this time – so we have starting a gigantic shift into silver and gold and plan to continue to aggressively accumulate for the next few years.

Silver Ratios Look Compelling: There are some smart investors that think, because of silvers rarity, it should be trading at a ratio of 1:10 against gold. So if gold is $1600/ounce then silver should be $160/ounce (not $30/ounce). But if and/or when gold caught up with the fiat dollar, as seems logical eventually, gold would be $15,000/ounce. And if silver was at a ratio of 1:10, then silver price should be $1,500 ounce. That would be a 50 times increase from current levels. That means if you put £100,000 into silver today, by 2018 it could be worth £5 million. Yes, this is the logical size of the upside in silver. That’s why we’re are piling into silver. Silver at $30/ounce is a screaming bargain. It was $50/ounce in 1980, 31 years ago. After 31 years of inflation, it is still only 60% of the value of its 1980’s peak despite the dollar money supply rising about 20 fold.

times increase from current levels. That means if you put £100,000 into silver today, by 2018 it could be worth £5 million. Yes, this is the logical size of the upside in silver. That’s why we’re are piling into silver. Silver at $30/ounce is a screaming bargain. It was $50/ounce in 1980, 31 years ago. After 31 years of inflation, it is still only 60% of the value of its 1980’s peak despite the dollar money supply rising about 20 fold.

Money Supply: Another example is in Australia. Since 1960, the amount of Australian dollars has risen 180 times. That’s gigantic. Meanwhile silver prices have hardly moved. Surely silver prices should be at least 10, possibly up to 100 times current levels.

Investor Numbers and Liquidity: Compared with the last gold peak in 1980, we now have ten times more people, with ten times more investors and ten times more currency. When this gigantic investing populating finally wake up to the fact that money is getting worthless, they will pile into silver and gold – then the price will sky-rocket into a final blow-off phase – most likely sometime between 2015 and 2020. It’s a very exciting prospect for all precious metal investors. The fundamentals are so compelling – its difficult to see any downside risk and the upside is just gigantic. We have already de-risked our early retirement!

Tax: One of the only downsides is having to pay VAT in the initial purchase in the UK  - of 20%. That said, we think the upside is so huge globally, that the 20% tax is worth this risk - even though we cannot understand how a government can put VAT on a coin (silver coins should be treated like gold coins).

- of 20%. That said, we think the upside is so huge globally, that the 20% tax is worth this risk - even though we cannot understand how a government can put VAT on a coin (silver coins should be treated like gold coins).

Reckless Money Printing = High Gold Price: The more reckless the governments get with printing money, the higher silver and gold prices will rise. The more stupid they get borrowing money and proceeding with social policies – the more gold and silver prices will catch up with the fiat printed money. Eventually there will be a gigantic rapid transfer of wealth as people dump the fiat money and pile into the only thing in history that has ever kept its value – silver and gold. They have never gone to nothing – unlike currencies (remember in Weimer Germany in 1931, people used the German Mark for fuel because it was so worthless).

Further Reasons Why Silver and Gold Prices Will Rise Sharply:

· The Chinese are using only 1/70th of the amount of silver the average American uses and this has quadrupled recently - Chinese silver demand is skyrocketting

· Silver is now a global market and can be purchased on the internet

· The amount of silver available is now 25% of the amount compared with when i n the 1980s when the Hunt Brothers "quote” cornered the silver market ”unquote” and drove prices to $50/ounce

n the 1980s when the Hunt Brothers "quote” cornered the silver market ”unquote” and drove prices to $50/ounce

· Silver is the unit of last resort because of its unit volume

· The amount of gold invested as a percentage of a US investors portfolio in the year 2000 was 2% 2000 is now 0.8% of portfolio

· Very few people making new investments in the area

· Only early movers are currently in the market - most hedge funds and pension funds do not own gold yet - they will one day enter the market driving up demand

· Silver and gold has not hit mainstream yet

· Institutional investment in silver is minimal

· Gold and silver will hit a tipping point and investors will realise silver and gold - and will start to gain interest

· Silver industrial utility and scarcity is a real opportunity

· 900 million ounces supply per year – hence only

· 2005 China was net exporter 100 million ounces now importer 100 million in 2011

· Demand is far outweighing supply

· 18-20% increase in demand for industrial usage

· Someone one day will say “they cannot buy silver anymore” then the silver price will sky-rocket

· There is no spare ilver lying around

· Comex only has 28 million ounces that is worth only $1.2 Billion - this is nothing - any large institution could buy the whole amount in one transaction

· There is evidence of take down and manipulation of silver market downwards

· The is a physical problem in the silver market - there is not enough silver available, being mined and at surface

Gold and Silver Investors Questionnaire: If you are wondering whether you should invest in gold and silver – you might like to answer the following questionnaire:

1 Do you think inflation will fall in the next few years?

2 Do you think governments will stop printing money in the next few years?

3 Are you confident that the Euro and US debt issues will go away?

4 Do you think savings rates will rise above inflation again?

5 Do you trust politicians with your savings?

6 Do you think taxes will fall shortly?

7 Do you see a nice bull run in the stock market?

8 Do you see oil prices falling a lot?

9 Do you think it is safe to put spare cash into a banks?

10 Do you think nervous markets will quieten down?

11 Do you think a financial collapse would be ring-fenced into a few small locations?

If you answer no to all these questions, then you clearly need to get into gold and silver investment  rapidly. The reason being you think inflation will rise, believe politicians will continue to print money and your savings will be eroded – the only safe investment is gold and silver. As money printing accelerates, so will the price of gold and silver.

rapidly. The reason being you think inflation will rise, believe politicians will continue to print money and your savings will be eroded – the only safe investment is gold and silver. As money printing accelerates, so will the price of gold and silver.

Silver, Gold and Inflation All The Way: Anyway, after six years of research, we have convinced ourselves that silver and gold investment is the way forward – along with oil, farmland and selective property investment. Its time to get heavily into silver and gold – for the next five years. And we look forward to an early retirement in 2018.

We hope you have found this Special Report insightful and it has helped you understand the opportunity in gold and silver at this time. If you have any comments, please contact us on enquiries@propertyinvesting.net