394: Politics, Printed Money and Peak Oil Investment Opportunities

09-01-2011

PropertyInvesting.net team

Upwards in Market for a While: We have turned more bullish on the stock market just for a while anyway - because a number of things have come together:

· Germany have voted in favour of the European bail-out measured to prop Greece, Italy, Spain and other up (after a legal challenge failed) delaying for some months the broader Euro currency demise

· Increasing talk of QE3 resumption of money printing possibly starting 21 Sept

· Continued very low interest rates with no immediate inflationary crisis in 2011 (even talk of Euro rates dropping)

· Hedge Fund Managers have returned from their August summer holidays and have taken away their automatic stop losses and started to enter the market again

· The printed money if it turns up will boost the stock market

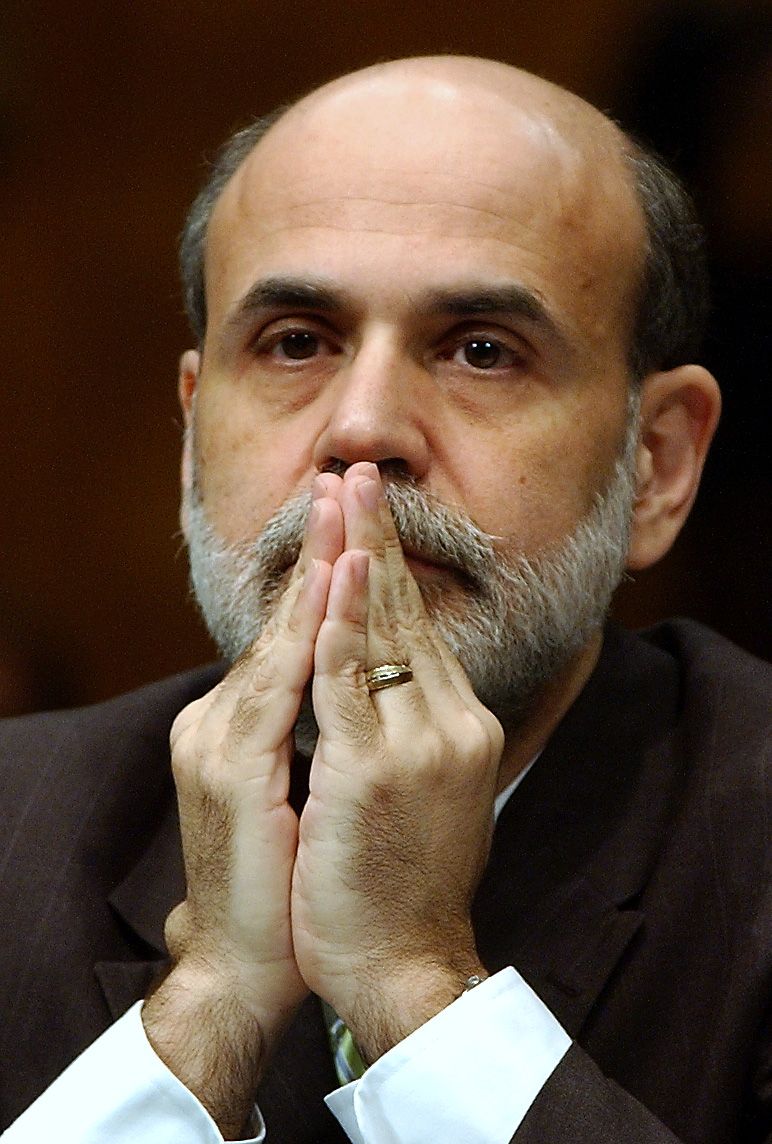

QE3: Ben Benacke will likely time the next bout of printed money to start some 10 months before the US elections, just in time for the positive effects of this money to boost the economy for his boss President Obama in the last likely vain hope of him retaining his job. Ben knows he will lose his position if the Republicans get into power, his only hope is to start the printing presses again to prop the markets and economy back up.

QE3: Ben Benacke will likely time the next bout of printed money to start some 10 months before the US elections, just in time for the positive effects of this money to boost the economy for his boss President Obama in the last likely vain hope of him retaining his job. Ben knows he will lose his position if the Republicans get into power, his only hope is to start the printing presses again to prop the markets and economy back up.

US Should Stop Printing: Let us make a one thing crystal clear though. We do not think printing of money is either the right thing or a wise thing to do it will eventually lead to disaster in the form of rampant inflation, higher interest rates and ultimately the US going bankrupt and defaulting. But we think QE3 will start some time before year end. And that is why the stock markets are starting to shift upwards. The US investors realise this. They will jump back in to follow the printed money - because there is an extremely good correlation between the printed money and stock markets rising. They then would plan to bail out just as the money printing presses stop again head for the hills - just like they did in July 2011.

Its that simple. Follow the printed money. Then get out before it stops.

Printing Again: As the printing presses start again, this ultra-cheap money will start flooding through the global markets again and will:

1 Boost US, European and Emerging stock markets generally

2 Give a massive boost to commodities prices and the stocks of oil and mining companies

3 Reduce the value of the dollar

4 Gold initially will likely stay stable, but will eventually sky-rocket when the smart investors switch from the stock markets before the crash into gold as a safe haven say end 2012 - most likely just after the US election

Bull or Bear: Remember we are:

A. 60% of the way through a very dangerous, depressing 17.5 year stock bear market likely to end in a whimper in 2017 - with high unemployment, more repossessions and deep depression

B. 60% of the way through a sustainable exciting 17.5 year commodities bull market likely to crash some time 2016-2018 - smart investor will make serious returns in this super-cycle

Peak Oil: The economic turbulence is constraining the amount of money oil and mining companies are able to safely invest, and hence there is not enough spare capacity in oil, coal and metals to fuel China and Indias massive new demands. So as the printing starts again, do not expect oil production to increase. Instead, it will remain remarkably stable at ~88.5 mln bbls/day and oil prices will skyrocket again thence slowing the global economy down once more. To re-iterate, the global economic growth is now constrained to a huge extent by oil prices (and oil production capacities). This will continue because no low cost oil supplies are available anymore. Remember our strong guidance is that Peak Oil (crude oil) was 2005, and Peak Oil (all liquids) was July 2008, though this peak was matched briefly in Jan 2011 before a further decline set in.

Peak Oil Exposure: We have mathematically modelled oil export/import deficit/surplus as a percentage of GDP at oil prices of $100/bbl - predicted/modelled for 2011 - using a proprietary model. This tabulation please click here to view - is a fairly good proxy for the exposure of different countries to high oil prices and the affects of Peak Oil. This is a unique tabulation - not supplied by any other analysts.

Oil Surplus Deficit @ $100/bbl as percentage of GDP

2008 $Bln

2011 Surplus/ Deficit $bln at $100/bbl

GDP $bln (2007)

% GDP

Remarks

Prediction

Qatar

51.8

56

92.1%

Also big gas producer

Massive wealth

Iraq

86.7

100

86.7%

Increasing wealth for future

Kuwait

76.5

116

66.2%

Massive wealth

UAE

77.6

132

58.8%

Also gas producer

Massive wealth

Azerbaijan

35.6

65

54.6%

Saudi Arabia

258.3

554

46.6%

Also gas producer

Decreasing exports

Kazakhstan

57.1

168

34.1%

Also gas producer

Brunei

6.3

19

33.0%

Also big gas producer

Nigeria

87.7

293

30.0%

Also gas producer

Algeria

54.1

188

28.7%

Also big gas producer

Norway

66.4

253

26.3%

Also big gas producer

Venezuela

60.1

334

18.0%

Russian Federation

257.8

2088

12.3%

Also big gas producer

Iran

88.6

777

11.4%

Turkmenistan

3.4

34

9.7%

Also big gas producer

Ecuador

9.4

99

9.5%

Libya

5.0

69

7.2%

Colombia

21.5

321

6.7%

Vietnam

13.5

221

6.1%

Canada

41.3

1178

3.5%

Also big gas producer

Mexico

33.4

1346

2.5%

Also gas producer

Malaysia

5.5

355

1.5%

Also big gas producer

Denmark

2.2

198

1.1%

Egypt

3.2

404

0.8%

Also gas producer

Argentina

2.6

523

0.5%

Also gas producer

Peru

-0.9

219

-0.4%

United Kingdom

-11.0

2082

-0.5%

Also gas producer

In severe debt

Brazil

-16.4

1834

-0.9%

Growing supply and demand

Only biofuels helps exports

Romania

-3.6

246

-1.5%

Indonesia

-13.9

841

-1.7%

Australia

-14.1

733

-1.9%

Also gas producer

Huge commodities exports - okay

China

-200.2

7348

-2.7%

Growing demand - boom

Italy

-51.0

1780

-2.9%

Most exposed

Close to bankrupt

France

-62.1

2054

-3.0%

Most exposed

In severe debt

India

-95.5

3092

-3.1%

Growing demand - boom

Germany

-85.5

2752

-3.1%

Most exposed

Manufacturing strength to mitigate

USA

-430.2

13811

-3.1%

Most exposed

Close to bankrupt

Japan

-159.2

4284

-3.7%

Most exposed

Will slow economy

Spain

-53.6

1373

-3.9%

Most exposed

Close to bankrupt

Thailand

-30.0

519

-5.8%

Most exposed

Heavy user of oil

Netherlands

-37.4

625

-6.0%

Big gas producer

Large gas producer - okay

South Korea

-87.4

1199

-7.3%

Hugely exposed - no oil/gas

Okay in view of strong manuf.

Uzbekistan

-3.7

45

-8.2%

Hugely exposed to Russia

Continued reliance on Russia

Production Declines: Some examples of struggling crude oil production:

1 Russian oil production is struggling to increase and looks likely to start a decline shortly after 20 years of increases, Rosnefts production is dropping, part reason why they are so keen to start Arctic exploration

2 UK oil production is dropped off a cliff ever since the government imposed punitive taxes in March 2011 (declines will accelerate from 5% to 10% per annum, a production crash has just started with drilling cut in half since March 2011)

3 Iraqi oil production increases are far slower than originally envisaged by most analysts

4 Iranian oil production is being held back by sanctions and they are not interested in increasing exports in any case

5 Libyan oil production dropped from 1.6 mln bbls to 0.1 mln bbls/day full ramp up will take 2-3 years at least production may never fully recover

6 US oil production in 2011 will be lower than in 2010 after President Obama banned offshore drilling and the regulatory environment was tightened

7 Norways oil production continues to decline by 8% per annum

8 Angolas oil production is no longer increasing

9 Brazil: Despite a lot of hype, Brazil is not producing enough oil to feed its own needs, never mind export to help the global supplies (Brazil is only able to export liquid oil because of its huge bio-fuels from sugar cane production, without this it would be importing oil)

10 Kuwaiti is not able to increase production, and the UAE is at its maximum

11 Venezuelan oil production has been on a steady decline since 1999 when oil company nationalisation took place

12 Syrian, Egyptian and Yemeni oil production has been affected by the civil strife

13 Saudi Arabia is now pumping at maximum rate, having increase production by 0.8 mln bbls/day but half of this new maximum (0.4 mln bbls) is used for power generation to keep the population cool and desalinate water

14 Canadas oil sands expansion plans have been affected by global market uncertainties, environmental constraints, rising costs and water and engineering skills shortages plus uncertain oil prices (oil production at the giant oil sands producer Canadian Natural Resources is in decline).

Maxxed Out: Bottom line is, the whole global oil production system is maxxed out no amount of investment can significantly boost rates in the next 2-3 years. Oil prices will therefore rise if money printing recommences. And with it oil company stocks and values.

Production Declines: Non-OPEC production is declining now 15 of the largest 20 Non-OPEC oil companies have recently reported a drop in oil production, averaging 5% for the year. Even though oil prices sky-rocketted to $125/bbl, oil production declined. Meanwhile OPEC oil production rose to ~30.5 mln bbls over the summer period - but regrettably much of this increase was to fuel power generation in hot desert countries electricity for air conditioners to cool a massively growing desert population living in a non sustainable environment (ref: few people can survive 48 deg heat with little fresh water for long periods without of course cheap oil and power).

China: Chinas oil demand continues to grow by 6% per annum, with its GDP growing at 10-11%. China now uses more calorific energy than the USA. But just imagine how much they could use if they consumed the same energy per head as Americans with a population four times bigger. An energy crisis is just around the corner. For this reason we are long on oil and gas companies. Coal is also a good investment. And of course gold and silver once inflation kicks in, in earnest.

China: Chinas oil demand continues to grow by 6% per annum, with its GDP growing at 10-11%. China now uses more calorific energy than the USA. But just imagine how much they could use if they consumed the same energy per head as Americans with a population four times bigger. An energy crisis is just around the corner. For this reason we are long on oil and gas companies. Coal is also a good investment. And of course gold and silver once inflation kicks in, in earnest.

Investing: So whats all this mean for the smart investor? It means that oil companies stock prices are likely to rise sharply as oil prices rise further as the printing presses start again and the dollar declines. These four always go together in the same cycle-trend. Many oil stocks lost 25% of their value in the month of August 2011 alone they are now a screaming bargain as long as QE3 starts sometime in the next few months, as is likely.

US 2012 Elections: Its a very sorry state of affairs but expect Ben Benacke to appease his boss the President and switch the printing presses back on now that it looks like the USA is slipping back into a recession. This is the last giant gamble before the Fall 2012 US Presidential Elections. It will keep the investment banker friends happy for a while as this latest fix of cheap money boosts returns, before the whole pack of cards comes crashing down some time just after the 2012 Elections. As far as objective banking and economics is concerned forget it. Too much politics and vested interests are operating. So dont ignore the reality. Instead, follow the printed money this last time. QE3. And get out before the printing presses stop again.

Academics and Politicians: Also consider that Professor Ben Benacke is a university academic he has never run a business, knows little about real practical economics and President Obama has always been a politician. We really think they do not realise how bad the situation will get when they inject another $800 Billion into the markets. Theirn investment advises and lobbyists have vested interests in more cheap money to jump into another binge of stock market increases before the next crash. The Fed has already injected $2.3 Trillion its the only thing they know to do. It will lead to catastrophic inflation. The course is already set even after QE2, and QE3 will only make it far worse. But rather than dwelling on this 2013 problem, lets seize this current opportunity and go with the flow follow the money like everyone else. It will surely boost the markets temporarily but just like every other great fix in life, the hangover will be more extreme.

Academics and Politicians: Also consider that Professor Ben Benacke is a university academic he has never run a business, knows little about real practical economics and President Obama has always been a politician. We really think they do not realise how bad the situation will get when they inject another $800 Billion into the markets. Theirn investment advises and lobbyists have vested interests in more cheap money to jump into another binge of stock market increases before the next crash. The Fed has already injected $2.3 Trillion its the only thing they know to do. It will lead to catastrophic inflation. The course is already set even after QE2, and QE3 will only make it far worse. But rather than dwelling on this 2013 problem, lets seize this current opportunity and go with the flow follow the money like everyone else. It will surely boost the markets temporarily but just like every other great fix in life, the hangover will be more extreme.

Spending: What the USA really needs to do is, cut public spending, cut taxes, cut the size of the government, stop printing money and reduce restrictive regulation on private enterprise (remember all public funds come from private profits and taxes). Instead public sector spending increases wasteful projects now public spending is $2.75 Trillion a year, whilst tax receipts are only $1.75 Trillion a $1 Trillion deficit or 8% of GDP. Its totally unsustainable, and one day the international markets will turn on the bankrupt dollar, and interest rates will skyrocket as people ask for a risk premium against default. Just like they demand 50% for new Greek debt. Its just a question of time in our view before this happens when, not if.

Strategy summary:

1. Expect a short term boost to the stock market following recommencement of QE3 printing

2. Oil prices and oil stocks to rise sharply

3. Inflation to increase

4. US dollar to decline further

5. Eventually, gold prices to sky-rocket in the latter stages of this process possible as stocks start to crash again

Real Estate: For the real estate investor, US property prices will drop further over time, especially in inflation adjusted terms. Price may track inflation say minus 2%. If the property is cheap enough, has high rental yield and you can find good tenants, then your returns could be very healthy. But be careful an area does not go downhill completely boarded up properties and bad neighbourhood can knock 60% or more off property prices. There will be many more bargain around in future years so no hurry but in areas with low prices real estate, repossessions and reasonable employment levels you could find buying post crash rental property very lucrative. North Carolina springs to mind as a more robust new higher technology manufacturing area that will probably do better than most. We would avoid Detroit, Pittsburgh and heavy industrial areas. Texas is a winner because of the booking oil/gas businesses and services. North Dakota is another booking area with its Oil Shale and Shale gas plays and expanding population. This area was one of the most depressed until about 4 years ago rental returns will be special in areas services oil rigs.

Real Estate: For the real estate investor, US property prices will drop further over time, especially in inflation adjusted terms. Price may track inflation say minus 2%. If the property is cheap enough, has high rental yield and you can find good tenants, then your returns could be very healthy. But be careful an area does not go downhill completely boarded up properties and bad neighbourhood can knock 60% or more off property prices. There will be many more bargain around in future years so no hurry but in areas with low prices real estate, repossessions and reasonable employment levels you could find buying post crash rental property very lucrative. North Carolina springs to mind as a more robust new higher technology manufacturing area that will probably do better than most. We would avoid Detroit, Pittsburgh and heavy industrial areas. Texas is a winner because of the booking oil/gas businesses and services. North Dakota is another booking area with its Oil Shale and Shale gas plays and expanding population. This area was one of the most depressed until about 4 years ago rental returns will be special in areas services oil rigs.

Help: We hope you can identify with this Special Report and understand where we are coming from. Lets not be in denial. Instead, lets look at things as frankly as possible and somewhere within this mess, investors will be able to eke out a good profit. We hope weve helped. If you have any comments, please contact us on enquiries@propertyinvesting.net