374: Less than 4 weeks left

04-12-2011

PropertyInvesting.net team

Timing Running Out: Three weeks left until the baby-boomers bail out and head for the hills for the very last time.

Baby-Boomers Bail Out: Let’s be brutally frank. In early 2008, many western baby-boomers were all prepared to bail-out and retire, but their pensions, investments and saving went up in smoke during the last financial meltdown.

Deferred Bail Out: Some had tried to get out way back in 2000 (dot com bust) then in late 2001 (9/11 crash) but needed to keep in the market and gainfully employed – but they blew it in early 2008 because the  market crashed – and by the time they realised it was too late to get out. Same only saying “oh, it’s too late to sell know, I might as well keep in the market” – meaning, I miserably failed and I’m a big time looser.

market crashed – and by the time they realised it was too late to get out. Same only saying “oh, it’s too late to sell know, I might as well keep in the market” – meaning, I miserably failed and I’m a big time looser.

Aging: These frustrated people aren’t 52 anymore, they are 62 – and they are now desperate to retire.

Printing Money: Meanwhile Uncle Ben and Obama have created a beautiful easy to recognize bubble – a quick run up from the early 2009 low. Now it’s their last chance to get out – they are getting a little greedy by staying in so long. But they are all watching the run up like a hawks. This is your smart investor, plus the investment banks and every other trader worth his or her salt.

May Drop: As in almost all years in record, by mid May the market drops. It doesn’t really get back going until mid Sept again. The reason is very straight-forward. The richest people sell down before their summer holidays – then relax on their big boats in the Med and Florida. Also, company results in the summer tend to be weak because production drops in the northern hemisphere – service levels and manufacturing dip as does employment.

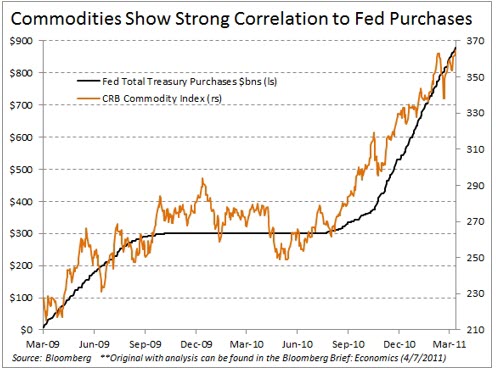

Printing Presses Stop: This year is of course very special because everyone knows Uncle Ben will stop printing money to the tune of $100 Billion a month in ten weeks time – on 30th June to be precise. Most knowledgeable people also know that this $2 Trillion is the reason why the stock market and commodities markets have been roaring ahead so frantically since they started the printing presses again last November.

So do you think everyone will wait until  30th June before bailing out? No way. It will happen between now and then. Sometime in the next ten weeks – we think there will be an almighty crash.

30th June before bailing out? No way. It will happen between now and then. Sometime in the next ten weeks – we think there will be an almighty crash.

Reasons for Crash: The other reasons why the crash will occur are because:

· Oil prices are at an all time high in UK Sterling terms at $126/bbl – anything over about $110/bbl should lead to a recession in the western developed (oil importing) world when oil imports in most nations reach about 4-5% of GDP

· Inflation is getting out of control

· Bad debts are still there – and any increase in interest rates will make it almost impossible for people and countries to make payments on their debt

· The economic recovery is very fragile

· Many parts of North Africa and the Middle East are in turmoil

· There is an increase in terrorism – from Northern Ireland to Belarus, Nigeria to Israel

· Food prices have sky-rocketed destabilizing many poorer countries

· The US debt is $14.5 Trillion – and the deficit is $1 Trillion on $2.75 Trillion annual spending (with deficit of >10% of GDP) – totally unsustainable (projected to reach $20.5 Trillion by 2016)

· After Ireland, Iceland, Greece and Portugal have needed bail-outs, the next country will be Spain if oil price remain over $120/bbl. Because Spain’s economy is four times larger than the largest of these first four, the bail-out will be too much for Germany and France to finance – even if they wanted to. At this stage, the Euro will break-up and the European stock markets will plummet. The safest place to be will be is in the Norwegian Kronor, German Mark or Swiss Franc.

· The nuclear meltdown and earthquake in Japan has not helped, reducing global GDP by 0.5% –  and will drive prices higher as more resources will be required to recover

and will drive prices higher as more resources will be required to recover

Get Your Money Off The Table: Bottom line is – if you are heavily risk-invested into the stock market and commodities at the moment – you have ten weeks to get your money off the table. And head for the hills. After you’ve got out, don’t expect to have any friends because everyone will have lost their shirts. So don’t go around bragging about it – not a good idea.

Get Out: We hope you have found this Special Report insightful – and you may also notice it is entirely consistent with the last ten Special Reports written since mid January of this year. Time is running out – best get all your money off the table by 6 May 2011 or earlier.

As Uncle Ben prints money, oil prices sky-rocket - what will happen when the printing presses stop?

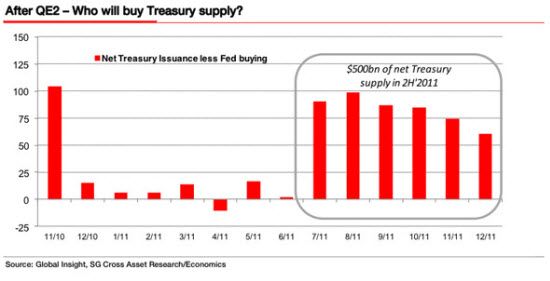

And who will buy the debt after 30th June 2011?