372: Tax, oil and a crash

04-05-2011

PropertyInvesting.net team  www.google.co.uk

www.google.co.uk

Tax on Oil Of course when governments start to feel the pinch, the effects of peak oil and high debt levels, they might sometimes be tempted to or actually target oil companies revenues to increase their tax income. But this normally would only make matters worse because it has a dire impact on oil investments, reduces future oil supply and thence oil prices rise even further. The reduced oil production and less investment would then almost certainly reduce overall tax take. The UK made this mistake in the end March 2011 budget. It’s probably Chancellor Osborne’s first and biggest mistake so far. An extra tax take of $2 Billion a year, but now $12 Billion worth of projects have been cancelled because of it – mainly from Statoil, along with thousands of UK job losses – and it’s now likely to lead to even hi gher oil imports, higher oil prices and less energy dependency. We cannot understand the logic in this? Hence increasing the UK's dependence on imported oil from the Middle East, Russia and North Africa. As the North Sea oil and gas decline – this will accelerate the decline and lead to ever increasing reliance on imported fuels – just when the risks to sustainable imports increase.

gher oil imports, higher oil prices and less energy dependency. We cannot understand the logic in this? Hence increasing the UK's dependence on imported oil from the Middle East, Russia and North Africa. As the North Sea oil and gas decline – this will accelerate the decline and lead to ever increasing reliance on imported fuels – just when the risks to sustainable imports increase.

96.8% Tax On Oil This 82% tax on oil supply comes on top of the 82% tax on consumption at the petrol pump – highlighting a mind-boggling combined oil tax in the UK of 96.8% (yes, we have to apply 82% tax on the 18% remaining oil). That’s the highest combined oil tax in the world. This from a country that was the 5th biggest oil producer in the world only ten years ago. This from a government that claims to be business friendly. This from a nation that until a few years ago was totally self sufficient in oil – with all oil investment coming from the private sector. Yes, they are the ones now living with two massive tax increases in the last four years. The UK now has the most unstable oil tax regime in the world – no other country has risen tax so fast and so many times in such a short period of time. And there is no guarantee whatsoever that it will not happen again. In fact, it seems every time th ere is a new government, that take another swipe.

ere is a new government, that take another swipe.

Brutal Truth The brutal truth is – the -5% oil production decline is now likely to accelerate to something in the order of -7%. It’s possible production will actually crash with lack of investment as oil rigs leave the UK waters for lower tax areas. For instance, whilst the UK tax on gas is now 82%, tax in The Netherlands is 50% and it's been like that for decades. The Scottish oil industry will feel the pinch now. We advise avoiding property investment in Aberdeen until the affects are clear.

We Are Being Fleeced So please be aware that when you go down and fill up with petrol, the oil will be from the North Sea (British oil) and for every £1 you pay at the petrol pump, then government will make a profit of £2 whilst the oil companies will make 4p after spending about 50p on investments. The government will have invested zero, and risk nothing, but taken 96.8% of the money for every barrel produced. Surely no other government in the world could get away with this fleecing of both the general public and the oil companies combined. Remember they also make more money when the oil prices rise! It’s a tax on the cost at the pump or the revenue from supply – so on both accounts at higher oil prices the government make even more money. They are laughing all the way to the banks – and their bankers bonuses. We just thought we should shed some likely into this murky tax structure.

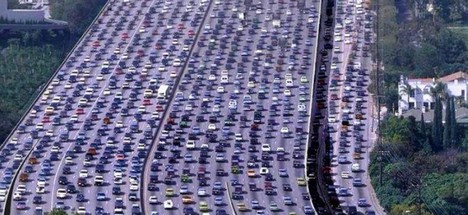

Where Does This All Lead As oil prices rise, the costs will be passed onto customers in all goods and services. Nothing is detached from the affects of high oil prices. It’s always the same – remember the history:

· 1973 recession – oil crisis

· 1982 recession – oil spike to $35/bbl

· 2008 recession – oil spike to $147/bbl

· 2011 recession? – oil price to $120/bbl so far

Inflation From our analysis, inflation is now out of control. The Bank of England are completely toothless, soft and wrong. It defied logic that they keep interest rates at 0.5% whilst inflation is 4% - when their sole purpose in life is to keep inflation at 2%. It’s almost as if they have done a pack with the private banks to keep interest rates a s low as possible for as long as possible so the banks can keep charging the general public 6% for mortgages and thereby making a gigantic annual 5.5% uplift (when normally they would make 0.5% on borrowed money). This is the only logic we can think of. But it will end in tears because inflation is now running out of control. By mid 2011 because of the high oil prices, inflation will be over 5% and the Bank of England will be forced to rake up interest rates so fast it will cause a shock, then the country will dive into recession again and more companies and private individuals will go broke.

s low as possible for as long as possible so the banks can keep charging the general public 6% for mortgages and thereby making a gigantic annual 5.5% uplift (when normally they would make 0.5% on borrowed money). This is the only logic we can think of. But it will end in tears because inflation is now running out of control. By mid 2011 because of the high oil prices, inflation will be over 5% and the Bank of England will be forced to rake up interest rates so fast it will cause a shock, then the country will dive into recession again and more companies and private individuals will go broke.

Guidance That’s why our guidance is the following:

· Get your stock market money off the table as soon as possible – before the end of April

· Don't buy any property this year – wait until after the 2011 bubble has burst

· Get your money into cash soonest

· Don’t be the last to bail out – don’t get too greedy – it will backfire

As our regular visitors will know, in the last six years we have been some of the most optimistic analysts – regrettable (and we hope we are wrong) – we think we are on the cusp of a recession and market meltdown.

How the markets can all but ignore what is happening in the Middle East is beyond belief.

The next crisis is likely to be Nigeria – with it’s elections already delayed until 16 April – this crisis could know another 2 million barrels of high quality oil off the market. With Libya, Yemen and Bahrain in turmoil and Iran calling for $150/bbl oil, it looks increasingly grim. Don’t expect the FTSE100 to stay at 6000 much longer.

Central Prediction: In the next few months:

· The dollar will decline

· Oil price will rise

· UK retail sales will slump

· UK unemployment will start to rise again

· UK property prices will dip from June onwards

· Gold and silver prices will rise

· Interest rates will rise – for a short period

· Then there will be a crash and a recession will have begun

This is our central objective prediction. Just look at the underlying issues with the Euro deficits (Portugal, Greece, Ireland), debt contagion, US $12 Trillion debt, Middle East and North Africa turmoil plus sky high oil prices and a Chinese property bubble. It is all looking very bleak – but the markets look stable and we think the hedge funds and smart investors are position to bail out big time.

Euro Contagion To Worsen It's very simple and deterministic to us that Ireland, Greece and Portugal will get into dire straits shortly over their budget deficits and debts. The reason is the oil price. As oil prices rise from $80 to $120/bbl, this adds 2% to their budget deficits and thence wipes out any hard won gains from budget-spending cuts. It must be a demoralizing position to be in - just when you think you've achieved something, it's wiped out by oil prices. And it's only likely to get worse in the short-medium term. There will come a point when France and Germany refuse to put up any more cash, then the Euro will crash - and with it the stock markets. Our prediction is - just as every one is looking forward to getting away for their month long French summer holidays, there will be some form of market meltdown. Don't under-estimate the panic about to happen. We could quite easily see a 35% drop in a few days in the stock market in Europe and the USA - sometime this summer. No wander the interest rates are so high for any new debt these countries try to raise - would you lend them money? More ratings downgrades, unsustainably high interest rates and plunging confidence. Bail outs will not work in the long run.

one is looking forward to getting away for their month long French summer holidays, there will be some form of market meltdown. Don't under-estimate the panic about to happen. We could quite easily see a 35% drop in a few days in the stock market in Europe and the USA - sometime this summer. No wander the interest rates are so high for any new debt these countries try to raise - would you lend them money? More ratings downgrades, unsustainably high interest rates and plunging confidence. Bail outs will not work in the long run.

In summary - there are too many politicians and business people being too optimistic – expecting a global economic recovery that cannot happen being of Peak Oil – not enough low cost energy to fuel expansion. The margin energy growth goes to China and India being low cost centres – and the rest of the western world is and will suffer from resources shortages (competition), high energy prices and inflation. We’ve hit the Peak Oil economic plateau – with the developed west expected to fall as the fuel goes to the east. Sustainable high economic growth in oil importing nations is not possible with high oil prices. Unless massive energy efficiency and conservation measures are introduced to boost productivity per energy unit. And frankly this is not happening and there is no sign of this happening.

2011 is shaping up exactly like 2008 – except this time its sovereign debt (rather than bank debt) that is the elephant in the room.

Watch out!