369: The final blow off

03-14-2011

PropertyInvesting.net www.google.co.uk

Earthquake: The Japan earthquake has caused a double negative whammy for energy supply. Firstly, nuclear power will be set back by the meltdown occurring. It highlights once more the dangers of nuclear power albeit many will argue the risks are still far less than CO2 emissions and global warming.

Nuclear: As the nuclear plants lay idle – more oil will be required in the medium term to fuel power stations and temporary units. The massive rebuilding will also need more power – and oil imports will likely rise in the medium to long term. Rebuilding is likely to cost $1 Trillion - some 20% of GDP.

Libya: In Libya – it is possible Gaddafi will regain control of the country except for Benghazi within the nex t week – so some form of oil exports will likely resume shortly after that. However, sanctions are likely to keep exports at a minimum - may be 0.4 million bbls/day instead of the normal 1.7 million bbls/day. There could be a longer protracted civil war in the Benghazi city (similar to Beirut) - the loyalist forces could well take the city fairly quickly. However, now that the UN, UK, France or Arab nations have achieved a no fly zone (18 March) it's even more uncertain the outcome of the strife.

t week – so some form of oil exports will likely resume shortly after that. However, sanctions are likely to keep exports at a minimum - may be 0.4 million bbls/day instead of the normal 1.7 million bbls/day. There could be a longer protracted civil war in the Benghazi city (similar to Beirut) - the loyalist forces could well take the city fairly quickly. However, now that the UN, UK, France or Arab nations have achieved a no fly zone (18 March) it's even more uncertain the outcome of the strife.

Bahrain: Of particular concern is the Saudi Arabian forces moving into Bahrain today. It seems both the Sunni Bahraini's and Saudi's are very scared of the situation deteriorating and the troubles spreading across the causeway into Shiite minority areas in Saudi Arabian Eastern Province where most of the Saudi oil is produced. Without going into detail, it seems that the initial uprising against the Tunisian and Egyptian autocracies has mutated into serious tensions and violence between the Sunni and Shiites and tribal tensions across the region from Libya to Iran. The fear is that global oil supplies will be severely disrupted as violence escalates sending oil prices skyrocketting.

Iran: Meanwhile just across the water, Iran is quietly giving out disapproving messages. In a way, simply put, at high level it’s a power struggle between the Sunni Saudi Arabians and the Shiite Iranians. It's escalating in the wrong direction. Anyone that tries t o put a positive spin on this escalation is probably deluding themselves. Ideally – a beautiful new democratic utopian world would come out of it – but lets get real – what’s the chance of this happening?

o put a positive spin on this escalation is probably deluding themselves. Ideally – a beautiful new democratic utopian world would come out of it – but lets get real – what’s the chance of this happening?

Oil Listing: We have itemised the different upward pressures on oil demand from recent crises and policy changes:

-

600,000 China adding to strategic oil reserves until 2020

-

150,000 India adding to strategic oil reserves until 2015

-

250,000 Additional oil for power generation in Japan after nuclear crisis for at least a year

-

In addition to these numbers, there are seasonal aspects and oil production disruptions in Q1 2011:

-

-1,000,000 US summer driving season additional demand (and end of US refinery maintenance)

-

-1,200,000 lost Libyan oil production for a term of at least 2-3 months and likely longer

-

-150,000 Bahrain, Egypt, Oman, Nigeria lost production from riots and distu

rbances

rbances

Potential Disruption: Add to this the potential disruptions to Saudi, Algerian, Yemeni and Iranian oil production if the troubles escalate or Nigerian oil production during the April election period, and you get a very unnerving feeling that oil prices are about to sky-rocket. There are just too many potential supply downsides and no extra oil production upside identified or planned. The world will struggle very hard to keep oil production at the current levels.

Peak Oil: The above tabulation makes a net increase of 1 mln bbls and a net loss of 2.35 mln bbls – that’s a massive 3.5 mln bbl/day. Production should be 87 mln/bbl all going well. End 2010, before we had these disruptions, we thought there was about 2-3 mln bbls of spare capacity – mainly in Saudi Arabia. Since then, as one can see if you believe these numbers, there should now in theory (in our view) be no additional extra capacity. Yes, that’s it! Within the next few weeks, we think oil shortages will become far more obvious and this will drive the oil price far higher. OPEC will blame speculators. The US government will demand OPEC produce more oil. Why do you think OPEC does not want to officially raise it’s production levels? We think it’s because if they did, there would be zero impact. Then the “cat would be out the bag”. The simple conclusion we come to is: OPEC along with non OPEC countries are now producing at their maximum rate.

will demand OPEC produce more oil. Why do you think OPEC does not want to officially raise it’s production levels? We think it’s because if they did, there would be zero impact. Then the “cat would be out the bag”. The simple conclusion we come to is: OPEC along with non OPEC countries are now producing at their maximum rate.

Current production rates are now no more than what the world was producing in mid 2008 – and they are also no different to total crude oil production in 2005. The world has been on a plateau of oil production fighting to prevent a decline for that past six years. It’s just that no-one seems to have highlighted this. The only thing that will bring oil prices lower would be demand destruction caused by a slowing of economic growth or a recession. Get the picture? The world economies are being controlled by oil production and just when they get going – and the oil price then rises above $100/bbl, inflation kicks in, debts increase and growth slows followed by destruction of demand. We are at Peak Oil – in fact it was six years ago. Why else has oil production stayed the same whilst oil prices have risen from $45/bbl to $147/bbl, then dropped to $35/bbl then risen to $115/bbl. All the time oil production has hardly budged.

Economic Struggle: Meanwhile in the west, economies struggle against $100 /bbl oil and we are probably already in recession in the UK and USA but it's just that no-one has told us. The final act of the hedge funds, sophisticated investors and speculators will be to use all Obama’s printed money to buy oil and commodities in a final bull run blow-off before the whole thing comes crashing down.

/bbl oil and we are probably already in recession in the UK and USA but it's just that no-one has told us. The final act of the hedge funds, sophisticated investors and speculators will be to use all Obama’s printed money to buy oil and commodities in a final bull run blow-off before the whole thing comes crashing down.

Blow Off: We actually think we are in the final stages of this process – sometime in the next 6 week to 6 months, the whole pack of cards will come crashing down. Peak Oil was 2005 (crude oil) and July 2008 (all oils) but no-one is interested in acknowlegding these facts - we've been bleating about this for years now - the world is in denial. Global economic hardship we believe is directly linked to Peak Oil - high oil prices. Wealth was created by energy-power from cheap oil. There is no more cheap oil left. Its likely to follow a familiar route:

· Oil prices rise to about $120/bbl

· Central Banks make their first moves to raise interest rates

· Middle Eastern situation deteriorates further

· News of sovereign debt fears

· Confirmation of recessions in some developed nations (a double dip or beginning of a depression)

· Stock market crash

· Asset bubble crash –property prices dip across the board

The exact sequence may be in a slightly different order, but the big trigger that will mak e everyone realise how bad it is, is when the stock market crashes in the US and western developed nations. This actually could happen first.

e everyone realise how bad it is, is when the stock market crashes in the US and western developed nations. This actually could happen first.

End of Printed Money: Just remember, the USA stops printing money on 30th June, so many investors will want to get out of stock just before this date, put their money into cash, then put this into banks for the interest earned – take their risk money off the table for the summer. So expect any time from now on the stock markets to wobble them tumble. The hedge funds and investment banks will be the first ones out as always. As transactions increase, their fees will go up and their bonuses will be high by year end, but the stock markets will be far lower.

Timing: Expect from 9 May 2011 the market to keep dipping down - all the way through to end October 2011. Our feeling is - be out of the stock market by 9 May and get back in early November after the big down-swing.

Hold on for the Ride: So – for all PropertyInvesting.net visitors, be very careful in the next 6 weeks to 6 months. It’s not a good time to buy property and if you have a chance to sell at a good price, take it! If you have any comments, please contact us on enquiries@propertyinvesting.net

Peak Oil Supply -demand imbalance and production crisis (unconstrained consumption assuming $75/bbl and global growth of 4% per annum)

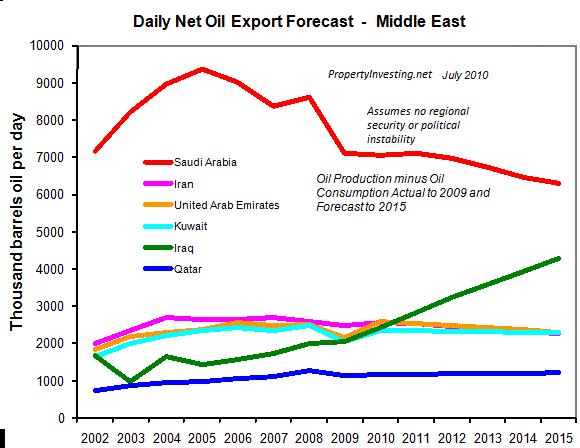

Middle East Export Oil production crisis production population explosion

PropertyInvesting.net team are of the view that mid March 2011 the actual total global spare capacity is ~1 million barrels/day (theoretical) with an actual practical zero spare capacity in view of the Japanese energy crisis that is starting to develop 13 March 2011