360: The cracks are appearing

01-29-2011

PropertyInvesting.net team

Rocky Ride: We are in for a very rocky ride in 2011. On the face of it, the global economy is motoring nicely out of recession 2½ years after the financial meltdown and recession that lasted about a year -all economies are now growing at a fair clip. But there are mounting and huge problems on the horizon politicians are pasting over the cracks.

US Deficit $1.5 Trillion: This week the USA announced that the 2011 deficit will be $1.5 Trillion or 10% of the GDP thats gigantic. The deficit is not dropping as planned if anything it's rising. The USA will soon have severe problems servicing its debt. Meanwhile the Obama administration has printed $2 Trillion of money and pumped it mainly into the public sector to try and reduce unemployment but of course it has not helped. If anything unemployment is  still rising scant value created from the $2 Trillion injection. Tax receipts are not rising even though company profits are healthy. The US government have too many "give-aways" to help appease both the democrats (social spending) and republicans (tax breaks for companies).

still rising scant value created from the $2 Trillion injection. Tax receipts are not rising even though company profits are healthy. The US government have too many "give-aways" to help appease both the democrats (social spending) and republicans (tax breaks for companies).

Oil Prices Skyrocket Again: The oil prices have of course sky-rocketted from $37/bbl end 2008 to $95/bbl today. Food prices have risen to 215 on the UN food index (100 was the average price from 2002-2004). Floods, drought and failed harvests with a massively expanding world population eating far more energy intensive meat is all putting huge pressures on resources food, water, oil, gas, coal, metals. All commodities prices have risen dramatically. Also consider that oil prices on a rolling annual basis are now higher than in 2008. It's worrying. Why do we think a country like Greece can afford these commodities import prices?

Food Inflation: So the next thing we should expect feeding rapidly through is inflation. But the really concerning thing is the affects riots and instability in North Africa, Middle East and South Asia would do to oil prices. If the autocratic regimes, many of which are propped up by the US military, came toppling down many people might think that the resulting so called democracy would benefit the world. But we think this new society would be very risky, potentially leading the civil wars, strife, more hardship and disruptions in oil supplies and oil exports. This could then lead to escalating food prices and further food scarcity and hardship for the poorest people in the world. Of course rich western nations would also suffer as their oil import bills sky-rocketted and unemployment rose.

Instability Pasting Over The Cracks: So we give warning about the following in t he next five months. Just when the stock markets look stable, growth looks like it is picking up nicely and everyone seems to be feeling far rosier than they did before, if the riots spread through North Africa and Middle East then inflation will take off, all economies will suffer and the world could tip rapidly into a big further recession by mid 2011. Another big threat is that as strife occurs in North Africa and Middle Eastern autocracies any new governments could be led by fundamentalists. Logically one would expect terrorism to increase and security to decrease. Assurance of stable oil exports and OPEC concert to keep oil prices stable would be severely undermined. Why is this so important? Because oil powers about 70% of transportation tractors, harvesters, trucks, railways, power stations etc. Without cheap oil, food prices skyrocket and the poor suffer as well as the wealthy. During low oil prices, employment increase as does growth. During high oil price times, stagflation takes hold, unemployment rises and most countries go into decline. Every calorie of food now takes 7 calories of oil to produce and distribute. A fully grown 550kg beef bull takes 1000 litres of oil to produce - that's 6.2 barrels costing $600.

he next five months. Just when the stock markets look stable, growth looks like it is picking up nicely and everyone seems to be feeling far rosier than they did before, if the riots spread through North Africa and Middle East then inflation will take off, all economies will suffer and the world could tip rapidly into a big further recession by mid 2011. Another big threat is that as strife occurs in North Africa and Middle Eastern autocracies any new governments could be led by fundamentalists. Logically one would expect terrorism to increase and security to decrease. Assurance of stable oil exports and OPEC concert to keep oil prices stable would be severely undermined. Why is this so important? Because oil powers about 70% of transportation tractors, harvesters, trucks, railways, power stations etc. Without cheap oil, food prices skyrocket and the poor suffer as well as the wealthy. During low oil prices, employment increase as does growth. During high oil price times, stagflation takes hold, unemployment rises and most countries go into decline. Every calorie of food now takes 7 calories of oil to produce and distribute. A fully grown 550kg beef bull takes 1000 litres of oil to produce - that's 6.2 barrels costing $600.

Mirage Money, The Bubble, The Crash: Watch the oil price rise, stock markets shift up, then people complain about high food prices, high oil prices, high gas prices, riots, instability then a crash.

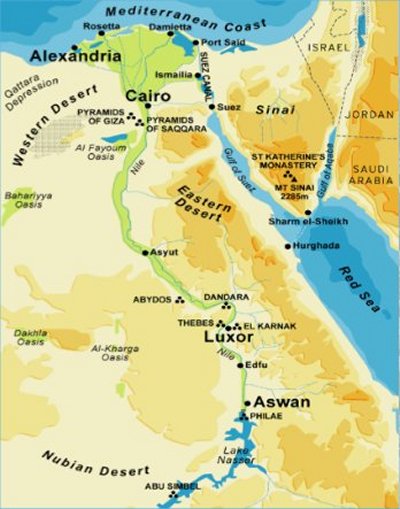

Desert Populations: If you consider that the population of North Africa and the Mi ddle East has grown tenfold in 50 years and all these people live in a desert one can understand there will come a point when it's difficult to feed all these people food subsidies cannot be paid for. Water is scarce. Food it expensive - especially in deserts. Its no exactly sustainable. Especially if oil production is going down in places like Yemen. And food import bills are sky-rocketting. If you consider water shortages and fertile farmland shortages juxtaposed against this population increase and masses of unemployed youths it's a recipe for instability. 30 years of autocratic family rule. Looks tenuous. But the alternative could be even worse. Time will tell and we dont know whats around the corner on this issue. It's just a major global risk.

ddle East has grown tenfold in 50 years and all these people live in a desert one can understand there will come a point when it's difficult to feed all these people food subsidies cannot be paid for. Water is scarce. Food it expensive - especially in deserts. Its no exactly sustainable. Especially if oil production is going down in places like Yemen. And food import bills are sky-rocketting. If you consider water shortages and fertile farmland shortages juxtaposed against this population increase and masses of unemployed youths it's a recipe for instability. 30 years of autocratic family rule. Looks tenuous. But the alternative could be even worse. Time will tell and we dont know whats around the corner on this issue. It's just a major global risk.

From Bedouin to Super City: If one considers UAE had a few fishing villages and bedouin cattlemen only 70 years ago - but that oil has powered the huge construction boom in Dubai. Now, an indoor sky-slope uses 1500 barrels of oil a day to power in the middle of a desert. The World Cup will come to Qatar in 2022 - how do you keep 100,000 fans cool in a desert? It's all based on cheap oil. And with oil in decline - surely its all totally unsustainable longer term. Cairo has 18 million people living in a dusty desert. Nubian Sandstone water reservoirs are being depleted - to water Egyptian potato fields in the middle of the desert that takes peat from Ireland, potato seeds from Scotland then ship the final product - potatoes back to the UK. Meanwhile flowers are airlifted from Kenya to Europe while food prices sky-rocket across the world because the oil prices rise. It's mad.

China Bubble: Then there are worries about when Chinas bubble will pop will this be in 3 months time or 3 years? Whole cities of new flats but no-one living in them. It looks like a classic bubble formed after the recession started mid 2008 when the Chinese pumped huge amounts of money into the economy to keep growth going after the Olympics but it now seems to have overheated the economy.

Mid 2011 Crash: For investors make sure you get your money off the table first rather than last. Best before mid May 2011 we thing the real negative action will be by June Aug 2011. Stock markets will drop, banks will default and some countries like Greece and Portugal will be unable to service their debts once oil import costs rise further . Then Germany will not want to bail them out. As for the USA, it seems to be on very rocky foundations. Just imagine if you earned £50,000 a year, but every year you had to borrow £5,000 at the end of the year and your debt was £100,000. Then you went back to the bank to ask for another £5,000 for the next year and so on surely they would say no?

. Then Germany will not want to bail them out. As for the USA, it seems to be on very rocky foundations. Just imagine if you earned £50,000 a year, but every year you had to borrow £5,000 at the end of the year and your debt was £100,000. Then you went back to the bank to ask for another £5,000 for the next year and so on surely they would say no?

Denial of Issue: If we think back to what people thought just before WWII most people were in denial they said it would not happen but in a way, it was highly likely to happen. Ditto the dot com boom and bust how can the market continue to grow at 20% a year indefinitely? In early 2008 most people felt like things were overheating and by July 2008 most people thought a recession was going to happen as a consequence of the financial meltdown. So we ask you now with rising oil prices, rising food prices, riots in North Africa, mammoth uncontrolled US deficit, Euro debt contagion and Chinese bubble why do you think that by Dec 2011 we will not be in another crash-recessionary situation? Why do we all expect continued growth with such resource pressures? Why do we not think those we althy western baby-booming hedge fund managers are not pushing the market up one last time before they bail out and head for the hills this time for good? Its time to get out of the market and not into it. Because this growth spurt may be the shortest on record a phantom spurt from mirage US printed money.

althy western baby-booming hedge fund managers are not pushing the market up one last time before they bail out and head for the hills this time for good? Its time to get out of the market and not into it. Because this growth spurt may be the shortest on record a phantom spurt from mirage US printed money.

Contingency Plan: None. Period. We dont believe governments have any contingency plans in the event of oil shortages and sky-rocketting prices. It seems their economic advisers think the market will sort itself out when the price of oil goes up, supply will increase but it does not work like that as depleting resources mean that 80% of the easy oil has been produced. To try and accelerate oil production further would need such massive financial, engineering, environmental, skills and physical resources to achieve that we think its unrealistic to expect any meaningful increase in overall global oil production moving forwards particularly with the social, political, regulatory and environmental constraints. Projects of production increasing from t he current levels of 88.6 million barrels a day to over 95 million barrels by 2025 are unrealistic. We will be lucky to keep on a flat plateau. New oil developments take 5-10 years the world is already in desperate trouble Obamas drilling ban has just made things worse.

he current levels of 88.6 million barrels a day to over 95 million barrels by 2025 are unrealistic. We will be lucky to keep on a flat plateau. New oil developments take 5-10 years the world is already in desperate trouble Obamas drilling ban has just made things worse.

Some Sense in the Madness: The closest we have to a contingency plan is probably the UK governments recent study of fuel rationing which seems to be a step in the right direction but can you image the up-roar in the State if someone said they wanted to ration gas for their 6 litre trucks used to pick up the shopping. The average American uses five times more oil than a Chinese person, double the amount compared to a European person but the USA imports 10 million barrels a day costing $350 Billion a year. Its crazy. But there is no sign of this behaviour stopping. No plans to mitigate the risk. Just a feeling in the States that all citizens have the right to drive a 6 litre truck and use gasoline at 15 mpg with no regard to its true value. Its bordering on archaic.

Investing: So what does this mean for property investors:

· Avoid owning property in North Africa and the Middle East exposure to riots and instability

· Avoid owning property in Portugal, Spain, Greece, Italy, Ireland, Iceland all big oil/gas /coal importing countries with poor manufacturing and high social costs

/coal importing countries with poor manufacturing and high social costs

· Concentrate property purchases and rentals in safe havens Canada, Norway, Australia, UK/London, Switzerland are about the only ones left (Sweden, Germany, Demark, Holland and France might just about join this exclusive club)

· Heavy exposure in oil, oil producing companies but be ready to exit at short notice before a crash (most likely mid May onwards)

· Short airlines, tourism to North Africa/Middle East

· Invest in coal mining in Australia and areas close to China

· Invest in food commodities as prices rise but again, be prepared to exit at short notice before the bubble bursts

· Purchase of farmland in areas with stable rainfall close to centres of population (as oil prices rise)

· Be careful with investments in BRIC countries remember these look excellent and attractive in the good times, but if there is a global financial meltdown these markets will also be severely hit as money is pulled from the investment arena

· Longer term ,as long as the country remains peaceful India could be a star because of its rapidly expanding population, large land area, education system and rapidly expanding middle classes (energy, oil, gas and chemicals companies spring to mind).

· Be very careful about gold we  think it might be over-valued and due for a correction wed rather be in oil

think it might be over-valued and due for a correction wed rather be in oil

· Invest in potash mining fertilizer for higher yielding crops

· Invest in high-tech agricultural firms that specialise in high crop yields through low water usage

· Invest in the Bakken Oil play in North Dakota the only oil booming area in the USA using high technology horizontal well fraccing this state is likely to be the strongest growing state in the USA in 2011 consider buying good quality rental property for oil/rig workers

· Invest in pure un-hedged uranium mining companies with good exploration and production track records (Nuclear Power is booming in the developing world and as oil prices sky-rocket, and more electricity is needed for cars and homes, nuclear will become the power source of choice)

Investment Insights: Thats about it. Simple. We hope it makes sen se. We have tried to be as frank as possible we are genuinely concerned about developments triggered by Tunisia as our Special Report of 16 January described and the Black Swan contagion seems to be taking hold now that riots have started in Yemen, after Algeria, Tunisia and Egypt. The global markets might look stable for a while longer, but just wait until inflation really takes off in a few months time, interest rates start sky-rocketting, then the next thing will be defaults and a financial meltdown logically. The only way this could reverse is if oil prices drop back to say $75/bbl but we think this is highly unlikely because we have reached Peak Oil whilst demand is still rising as we described in June 2007.

se. We have tried to be as frank as possible we are genuinely concerned about developments triggered by Tunisia as our Special Report of 16 January described and the Black Swan contagion seems to be taking hold now that riots have started in Yemen, after Algeria, Tunisia and Egypt. The global markets might look stable for a while longer, but just wait until inflation really takes off in a few months time, interest rates start sky-rocketting, then the next thing will be defaults and a financial meltdown logically. The only way this could reverse is if oil prices drop back to say $75/bbl but we think this is highly unlikely because we have reached Peak Oil whilst demand is still rising as we described in June 2007.

Get Out if $115/bbl reached: Good investing to you all. There are plenty of opportunities still out there., But you will need to be financially smart to benefit. There will be a lot of desperate governments. Watch out for the first government default then the contagion this will trigger likely as oil prices top $110/bbl by mid 2011.