358: Black Swan Peak Oil, Food Shortages, Turmoil and Democracy

01-17-2011

PropertyInvesting.net team

Black Swan: Most crises are triggered by events that are almost impossible to predict. Events happen asymmetrically. They are invariably always a surprise. Some people claim to have spotted the crisis on the horizon but human beings are in general rather optimistic, and look to the past and history to try and predict the future. But so often, the future is nothing like the past. We cannot use history to predict the future.

All Quiet: In early 2011 the world has less starvation, less war, less turmoil than at any time in its history. Many people think this trend could continue as technology, development and infra-structure improvements in roads, housing, education and other social project gain momentum in the developed world. It all looks relatively stable. But normally when things look the most stable, t hey are actually the most unstable. 9/11 was a good example - it came from nowhere. The financial crisis of 2008 was difficult to predict. The dot-com boom then bust and collapse of the Soviet Union are others. In 1938 even though Hitler was being very aggressive, almost everyone thought there would not be another World War. We tend the think on the bright side.

hey are actually the most unstable. 9/11 was a good example - it came from nowhere. The financial crisis of 2008 was difficult to predict. The dot-com boom then bust and collapse of the Soviet Union are others. In 1938 even though Hitler was being very aggressive, almost everyone thought there would not be another World War. We tend the think on the bright side.

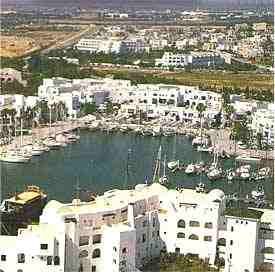

Tunisia: Is it the Black Swan? Events of Tunisia are an example of a seemingly stable country which has had a dictator for 20 years that has tumbled in the space of a few days. A few things came together to cause this overthrow and new coalition-democracy:

1) Food prices sky-rocketing, inflation and food riots-protests

2) Internet organisation of mass protests

3) Population pressures in a desert country - along with festering resentment

Now, many of the other autocratic countries in North Africa, The Levant countries and the Middle East are now worried about similar protests and organised democratic up-rising. Could Tunisia be the trigger for a huge upheaval. Like the upheaval that bought down the Berlin Wall?

Not significant until oil is involved: Tunisia has almost no oil and gas production, no significant exports or military strategic context and on a global scale, its economy is almost irrelevant. But just imagine if a similar occurrence spilled-over into Algeria, Libya, Egypt, Saudi and other OPEC producers - if such strife hit oil/gas exporting countries. This would undoubtedly send oil prices sky-rocketing and with it food prices further and this could then cause a global food crisis. Then there is the affect of a new radical government on Israel - with it's tensions with Iran. Could all become very unstable.

The bottom line is that there are no tensions or security issues that are currently holding back oil production in early 2011 its all relatively quiet even in hotspots like Nigeria. There is no spill, no war, Iraq and regional Kurdistan are exporting oil at higher levels than at any time in ten years. Russia is producing at maximum rate ever. No hurricane season. Everyone is at their maximum reasonable rate. Higher prices will not change this significantly.

Dislocation Risk: Could Tunisia of all places be the Black Swan? Could it be the trigger event that disrupts, dislocates and changes? Something barely recognized as significant?

Well have to wait and see. Probably it won't spread like a contagion, but the point is that any such event when you consider the wider implications can cause a trigger for strife.

Peak Resources: The underlying issue is global resources constraints with a massively expanding population. There are 7 billion people to feed now, with 9 billion forecast by 2050 and well need all the innovation, technology and efficiency improvements and drive to keep these people fed and happy. To stand still and expect things to be like they were is naive. To go back to organic farming methods would send crop yields crashing and foot prices sky-rocketing further. Inflation with it.

Global Resource Shortages: Our prediction - based on six years of analysis - is that we are now entering a period where this massive population explosion will put immense pressure on oil, gas, water, food, land, potash and metals resources. The developed world will drive prices up and the developed west will have to cut back on these resources. The incredible wastage of oil, gas, wat er and food that we have all become used to will have to end quickly. Resource conservation and energy efficiency improvements are paramount - to avoid wastage and unsustainable developments and consumerism.

er and food that we have all become used to will have to end quickly. Resource conservation and energy efficiency improvements are paramount - to avoid wastage and unsustainable developments and consumerism.

Printed Money: Inflation is of course getting out of control as the mirage money printed by the USA has been exported abroad. Much of this going into speculative higher risk commodities investments. To think differently is naive. One last short sharp bull run before the investors "in the know" bail out, leave the dumb investors at the table, and head for the hills - or to their big Mediterranean boats for the extended summer - to enjoy the returns. Just watch what happens in early May. They'll all sell up - they always do - many of these financial savvy baby-booming investors will be selling up - but this time for good. The last big chance to bail out on a high and head for the retirement hills. And leaving all those younger dumb investors behind to clear up the mess. It'll be the shortest recovery bull run you have ever seen. Propped up and pasted over by printed US money. Be careful in May and through the summer - as inflation takes hold, the most successful investors will be quietly heading for the hills (again). Highly likely there will be a crash just when everyone's feeling like its going well and the recovery has taken hold.

Currency Wars: In a vague effort to inflate their way out of a debt crisis, boost national jobs, try to improve competitiveness in an inefficient world, the USA has printed a further $1 Trillion - flooded the market with this easy money and is hoping it will kick-start th eir economy. But the same energy intensive habits have not changed. OPEC are holding back production to inflate oil prices to compensate for the declining dollar. The Chinese refuse to float their currency. The dollars fly abroad and are not creating US job. Instead, global inflation is taking hold - surely someone should have anticipated this. Food riots, fuel riots, declining disposable incomes will start taking their toll in the next six months. Expect the big bump mid year. But expect the same massive Mediterranean boats to take to the seas this summer as normal.

eir economy. But the same energy intensive habits have not changed. OPEC are holding back production to inflate oil prices to compensate for the declining dollar. The Chinese refuse to float their currency. The dollars fly abroad and are not creating US job. Instead, global inflation is taking hold - surely someone should have anticipated this. Food riots, fuel riots, declining disposable incomes will start taking their toll in the next six months. Expect the big bump mid year. But expect the same massive Mediterranean boats to take to the seas this summer as normal.

USA versus China: China has an annual export surplus of $300 Billion with the USA - a gigantic ongoing amount - getting bigger every year. Meanwhile China owns 25% of the US debt. So one can understand that China needs the USA to continue its economic prosperity not only so they keep buying Chinese exports, but also to be able to service the debt to China. China however has the power to sell the dollar and precipitate a dollar crash - so the USA needs to be very careful with this relationship. As long as the Chinese continue to buy dollars - the USA should be okay. But just imagine if the Chinese started selling their dollars after a big bust up with the USA over something like arms, territory or oil. Another potential Black Swan.

Oil: There is an almighty struggle to grab oil by China and USA. The Iraqi oil is now flowing at higher rates than years gone by, but not to the USA - many contracts were awarded to European, Russian and Chinese companies, only a few to private US companies. Meanwhile China is investing in Canadian oil sands - on the doorstep of the USA. They have been busy buying up small oil producers around the world - trying to keep out of the USA's hair after the USA blocked the Unocal oil deal years ago. The available exports of oil will start dropping or continue to drop in countries like Mexico, Iran, Venezuela, UK, Norway and Oman etc - Russia is probably at a peak, Saudi probably does not have that much spare capacity left. We are bumping along an undulating Peak Oil plateau - oil production has not increased overall for 6 years despite a massively booming world population. A major global risk.

Iran Wildcard: Remember that Iran is the rotating President of OPEC for 2011 - they always look to hike up the oil price to help their economy which is stressed to put it mildly. Last year the USA are alleged to have mounted an attack on computers running the Iranian uranium enrichment facility that probably put their enrichment project by 5 years - so the Iranian's will hardly be bending over backwards to bring the oil price down to help with Americans in 2011. Even though oil is $95/bbl, the OPEC President does not see any reason to have a meeting in March - the next meeting is planned for June. Ominous signs.

The Numbers Don't Ad d Up: According to our research, the world is now producing about 88.6 million b/d of oil (that's 74 million b/d of crude oil and the rest is natural gas liquids, oil from oil sands and ethanol from sugar cane and corn). But the world is consuming 1 million b/d more than it is producing - about 89.6 million b/d. Stocks are getting drawn down. Saudi is beginning quietly to ramp up production and everyone is maxed out - no disruptions of note. It's rather like late 2007 all over again before the massive oil spike from $75/bbl to $147/bbl by July 2008. If this spike kicks in, inflation will be out of control by end 2011 then there will be a crash - no question in our minds. The minute oil prices rise above $120/bbl - there will be a crash - at over $120/bbl the global economy is totally unstable. Watch out for the oil price!

d Up: According to our research, the world is now producing about 88.6 million b/d of oil (that's 74 million b/d of crude oil and the rest is natural gas liquids, oil from oil sands and ethanol from sugar cane and corn). But the world is consuming 1 million b/d more than it is producing - about 89.6 million b/d. Stocks are getting drawn down. Saudi is beginning quietly to ramp up production and everyone is maxed out - no disruptions of note. It's rather like late 2007 all over again before the massive oil spike from $75/bbl to $147/bbl by July 2008. If this spike kicks in, inflation will be out of control by end 2011 then there will be a crash - no question in our minds. The minute oil prices rise above $120/bbl - there will be a crash - at over $120/bbl the global economy is totally unstable. Watch out for the oil price!

OPEC increase but far from 2008 levels: OPEC increased production in December 2010 compared to November 2010 levels by 0.25 mln barrels of oil a day to 29.6 mln b/d when oil increased to $95/bbl. However, this oil production is still far from the 32 mln b/d produced in mid 2008. It begs the question "how much spare capacity OPEC actually has" - they claim to have 5 mln b/d but we are sceptical about this number. It could be more like 2.5 mln b/day which is enough for two more years of increasing global oil demand only. This might be the reason why oil prices are rising strongly now - because the market is sceptical about whether extra capacity can or would be bought onto the market if oil prices rise above $100/bbl. The market smells a rat.

Rationing: Yes, be prepared for energy rationing and conservation measures. It's very close now to this situation in the UK had energy is rationed (it's happening in China already) - the end of endless consumption increase with no regard to it's consequences. It's only logical that energy efficiency and conservation measures should be introduced to allow stronger economic growth with less energy inputs. Less wastage. Expect to hear a lot more about this in 2011.

Property: Not advisable to be making large investment is early 2011. We would wait until year end because things are just far too unstable at present. If you are rather worried, best sell down some of your portfolio - as we say, the risk of a general crash in May is quite high.

We hope this Special Report has given you some interesting insights and you think it makes sense - we always try and be as objective and frank as we can to help investors. If you have any comments, please contact us on enquiries@propertyinvesting.net