347: The oil problem - opportunities and threats

10-07-2010

PropertyInvesting.net team www.google.co.uk

Read This: We read an article recently:

" According to the Oil Market Report released in September 2010 by The International Energy Agency (IEA), Global oil demand is projected to average 86.6 mb/d in 2010 and 87.9 mb/d in 2011. 2010 readings were revised marginally higher based on stronger data from OECD (Organization for Economic Co-operation and Development) countries. The report also projects global oil demand to grow by more than 25% in the coming 20 years to 103 mb/d".

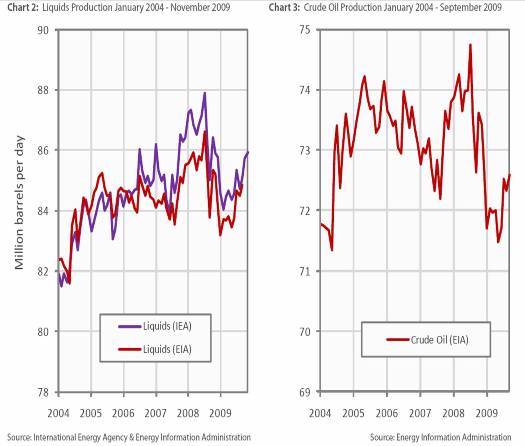

Far Too Optimistic: First and foremost, it will be very difficult for global oil production to rise from 86.6 mb/d to 87.9 mb/d part of the reason for this is that it would be an all time global oil production record.  This would be higher than the previous oil peaks in 2005 and July 2008. Whatever happens, the gap between potential supply and demand will narrow markedly - and the mirage 5 mb/d of extra OPEC capacity will not materialise - it will take a few years for everyone to "cotton on", but it should become evident by 2012.

This would be higher than the previous oil peaks in 2005 and July 2008. Whatever happens, the gap between potential supply and demand will narrow markedly - and the mirage 5 mb/d of extra OPEC capacity will not materialise - it will take a few years for everyone to "cotton on", but it should become evident by 2012.

No Oil Production Rise for 6 years: Secondly and far more seriously for the credibility of the IEA is their prediction that oil production will rise to 103 mb/d in 20 year they must be joking! All those high paid experts - they are so wrong. In 20 years time oil production will be lower than it is today, not higher - and certainly not 18 mb/d higher. Because of depletion at 5% a year, this is equivalent to the world finding another six Saudi Arabia and sustaining that production. We will be extremely fortunate if we can keep the plateau going at 86 mb/d - never mind increase it. Remember, the global oil industry has not succeeded in raising oil production in the last 6 year despite massive expansion in India, China and the Middle East why do so called experts seem to think the world oil industry can keep raising oil production in a nice straight line to 103 mb/d by 2030? Conveniently following population growth and projected GDP growth. Its pie in the sky. There is a considerable chance that oil production might start a terminal decline in the next five years - we can see with a bit of optimism a bumpy plateau up to 2015, but whatever happens after that depends on Iraq producing more than 5.5 mb/d by then. If this does not materialise, we are really in trouble.

nice straight line to 103 mb/d by 2030? Conveniently following population growth and projected GDP growth. Its pie in the sky. There is a considerable chance that oil production might start a terminal decline in the next five years - we can see with a bit of optimism a bumpy plateau up to 2015, but whatever happens after that depends on Iraq producing more than 5.5 mb/d by then. If this does not materialise, we are really in trouble.

Reserves Scepticism is Reality: Some people are pointing to positive news from Iraq on oil reserves they have been increased 27% to 167 billion bbls in the last few days. But its not paper reserves that matter its oil production to the surface - and into a tank. For example, the biggest reserves in the world are held by Venezuela, but their oil production has crashed since 1999 when Chavez was elected into power - from 3 mb/d to 1.9 mb/d. Iraqs oil production is no higher today than it was immediately after the Iraq war about 5 years ago it's stayed static at 2.2 mb/d what has changed though is the Iraqi national oil demand this is skyrocketting - as people buy cars and need more electricity for air-cons. Security has improved and consumption has risen.

Security Threats: Meanwhile we are getting increasing terror activity in Yemen, Pakistan and other countries that casts a cloud on the security of oil supplies. Iran is another notable concern. The last four years have been very peaceful but increasing population, less resources and money per person, food shortages and high unemployment globally - also in poor countries - will likely feed through to deteriorating security in many areas particularly as global security leadership is markedly less than it has been in the the period 1995 to 2005. The economic trouble don't help - and fuel tensions.

What to Expect: What we expect to happen is oil demand will rise, oil supply will stay flat, and oil prices will rise further. Simple. Then inflation will increase, growth will slow in the developed world, more money will be printed, the dollar will decline further, gold will rise, and with it, oil prices will rise further. As the dollar declines and/or inflation increases or a monetary stimulus gets put on the table then oil prices will rise further and the asset prices of oil companies and oil reserves will also increase. Then property prices in oil importing nations will drop. But property prices in countries that export large quantities of oil might actually rise (Norway, Canada, UAE, Kuwait, Russia).

What to Expect: What we expect to happen is oil demand will rise, oil supply will stay flat, and oil prices will rise further. Simple. Then inflation will increase, growth will slow in the developed world, more money will be printed, the dollar will decline further, gold will rise, and with it, oil prices will rise further. As the dollar declines and/or inflation increases or a monetary stimulus gets put on the table then oil prices will rise further and the asset prices of oil companies and oil reserves will also increase. Then property prices in oil importing nations will drop. But property prices in countries that export large quantities of oil might actually rise (Norway, Canada, UAE, Kuwait, Russia).

We think oil prices will head up now this winter to $90/bbl and possible as high as $100/bbl by the end of the winter, particularly if there is any significant security concerns in the Middle East.

Government Intervention: When oil starts to become scarce and high priced, governments are likely to intervene in various ways - depending on their level of desired control and politics:

-

Fue

l subsidies may be either increased (if riots break out due to high fuel prices) or decreased (if funding dries up for such subsidies) - the latter more likely

l subsidies may be either increased (if riots break out due to high fuel prices) or decreased (if funding dries up for such subsidies) - the latter more likely -

Taxes on fuel may be either decreased (if riots break out due to high fuel prices) or increased (if funding dries up in central government) - the latter more likely

-

Windfall taxes on energy companies profits

-

Government force private oil companies to give higher equity, fields or reserves into state hands - "reserves grab" - as happened in Russia and Venezuela about 3-4 years ago

-

Governments would start blaming oil companies for all the economic problems in a desparate bid to deflect away from lack of good energy policy and lack of preparedness for oil shortages

-

Government would hoard oil for military, health, police and public sector usage - to keep essential services going (to prevent civil disorder and breakdown). The last person in the line for fuel would be your average private sector car driver trying to get to work, do shopping or go on holiday

-

Governments may start fuel rationing if the situation became dire.

-

New government regulations would be enforced on energy efficiency of cars, trucks, homes, heating, insulation, metering - subsidies could be awarded if these could be afforded at the time for "green energy" such as wind turbines, solar cells, electric cars, smart grids

Government Intervention equals lower production rates: Such government intervention would likely make the situation worse in that, because investor confidence would be damaged, less money would be invested in oil extraction and production rates would decline further. This can be seen in Venezuela's oil production since President Chavez was voted as leader in 1999 - and private companies assets were either seized or heavily taxed - and all private employees of the state oil company were sacked after a strike (oil production crashed from 3 mb/d to 1.9 mb/d despite oil re serves increasing).

serves increasing).

Special Returns: Because there are so few areas to make special returns on investments in the developed world, hedge funds and investment banks are likely to turn more to oil as a physical asset class to invest in. Particularly as currency wars break out - the race of Central Banks to drop their currency values to try and boost growth - competing to be the lowest. The best way to hedge against this - it seems - is to buy oil, oil company shares, gold and/or mining stock. As China and India show no signs of slowing their appetite for oil and commodities or their GDP - expect these prices to continue to rise.

USA Angle: Ultimately, the developed world is heading for an unstable time where the GDP growth will be controlled by the oil price in all developed countries with high wage costs that do not produce their own oil (or gas). So avoid Spain, Greece, Portugal, Italy. Look to Canada, Norway. Consider the UK (London/ Aberdeen) as a reasonable hedge - neutral stance. The USA looks like a sorry story regrettably as taxes rise for the rich, driving out many of these wealthy investors - with a knock on impact across the economy. The not very business-friendly administration will struggle as deficits rise, tax receipts drop and unemployment rises further. The dollar will decline as investors accept higher risk growth options in developing countries. Another quantitative easing package is not likely to help much - the fundamental flaws in the economy are too deep. When one considers every American costs $1500 a year on oil import bills and $6500 a year in medical care bills its any wonder the country is in decline and the dollar with it. A family of four costs $32,000 a year in oil and medical costs thats a hell of a lot of money that private companies have to make to pay out of taxes and profits. We frankly can't see where all the money comes from. Some countries have huge surpluses like Japan, China and Germany (fuelled by exports). They use this surplus to purchase foreign currency but how long will they continue to acquire dollars when it looks like they might not get their money back one day? May be we are being too simplistic its just the oil, military and health care spending of the USA is far beyond its means and nothing is being done about it if anything, these costs just keep rising at a higher rate than inflation. So our advice is, with the current administration, stay away from investing in the USA.

many of these wealthy investors - with a knock on impact across the economy. The not very business-friendly administration will struggle as deficits rise, tax receipts drop and unemployment rises further. The dollar will decline as investors accept higher risk growth options in developing countries. Another quantitative easing package is not likely to help much - the fundamental flaws in the economy are too deep. When one considers every American costs $1500 a year on oil import bills and $6500 a year in medical care bills its any wonder the country is in decline and the dollar with it. A family of four costs $32,000 a year in oil and medical costs thats a hell of a lot of money that private companies have to make to pay out of taxes and profits. We frankly can't see where all the money comes from. Some countries have huge surpluses like Japan, China and Germany (fuelled by exports). They use this surplus to purchase foreign currency but how long will they continue to acquire dollars when it looks like they might not get their money back one day? May be we are being too simplistic its just the oil, military and health care spending of the USA is far beyond its means and nothing is being done about it if anything, these costs just keep rising at a higher rate than inflation. So our advice is, with the current administration, stay away from investing in the USA.

Winning: In this ne w global world of oil shortages, the winners will be:

w global world of oil shortages, the winners will be:

· strong exporting manufacturing countries

· countries that export oil, gas, coal, metals and other commodities

· countries with large natural resources not heavily reliant on imported oil

· open transparent culture honest with good laws stable fiscal regime

· secure and low crime

Losing: Conversely the losers will be countries that:

· Have huge oil, gas, coal and metals import bills compared to their GDP and population

· Declining and aging population

· High wages with unionised labour

· Inefficient and wasteful public sector

· Weak manufacturing and financial services sector

· Poorly educated and not very innovative workforce (no new technology implementation)

· Corrupt, opaque, dishonest with poor changing laws and taxes

· Insecure and high crime

Winners include: Canada, Norway, Australia, possibly Russia (also Iraq, Kuwait)

Losers include: Portugal, Italy, Greece, Spain

Neutral: UK, Denmark, Holland, Sweden, Germany, France, Poland

Neutral: UK, Denmark, Holland, Sweden, Germany, France, Poland

Tax havens that prosper when commodities boom will also probably do rather well examples include Channel Islands, Luxemburg, Switzerland, Monaco and Bermuda.

Other Investment Areas: Investments in energy conservation services, metering, smart grids, solar and wind could do well - but they are risky - because many of them will never take off or funding will not be available if there is a financial meltdown caused by high oil prices. Just because oil prices skyrocket does not mean renewable energy companies will automatically prosper - they could even have subsidies taken away "if the money runs out". Certainly - the very finest companies involved in electric motor and battery manufacture could do well - as more petrol/diesel engines are replaced with electric motors over time. One could imagine a large scale coordinated chan ge-out of diesel engines in military vehicles for large-robust electic motors as an example (or diesel-electric like in many locomotives - e.g. InterCity 125 trains in West England). Investment in electric infra-structure related to electric cars could also be lucrative. Lithium mining is worth a look. But if oil prices sky-rocket, the companies that are likely to increase in value the most are all those companies that have good oil reserves and oil production - especially those that might be attractive as acquisition targets for Chinese and Indian companies.

ge-out of diesel engines in military vehicles for large-robust electic motors as an example (or diesel-electric like in many locomotives - e.g. InterCity 125 trains in West England). Investment in electric infra-structure related to electric cars could also be lucrative. Lithium mining is worth a look. But if oil prices sky-rocket, the companies that are likely to increase in value the most are all those companies that have good oil reserves and oil production - especially those that might be attractive as acquisition targets for Chinese and Indian companies.

Another Ugly Recession: The only reason why oil may not rise much above about $120/bbl is because by then, there will be so many broke countries that demand will drop away again and oil prices will then drop as they did end 2008. For now, expect the rise to continue but also watch out for a potential fall back again if and when the global economy dips back into financial crisis and recession.

Were bumping along a Peak Oil plateau as we warned a few years ago.

We hope the Special Report has helped give some interesting insights for your investment decisions. We hope it makes sense to you and you can see where we are coming from. If you have any comments, please contact us on enquiries@propertyinvesting.net