342: Housing building crisis developments

09-04-2010

PropertyInvesting.net team www.google.co.uk

www.google.co.uk

History of Hidden Crisis: Thirteen years of Labour saw property prices rise three fold. Much of this rise was through increased employment through public sector expansion and spending, and fairly loose lending practices. The population rose dramatically with increased immigration – and with this larger sized families. Meanwhile – despite the market requirement, the level of home building consistently dropped to an incredibly low level of 149,000 in 2009 and less by the time Labour finally left office. Meanwhile, 25,000 homes were being demolished a year – leading to a final net of around 100,000 homes being built annually early 2010. The proceeds of North Sea oil and consistent growth of 2-4% for 11 years resulted in this meagre building programme - meanwhile the population was expanding by 300,000 a year. Almost all these properties were privately built, mostly out of reach of first time buyers. Almost all were flats, exactly what hard working families did not want. They wanted houses – three bedroomed with a small garden and somewhere safe to park the car. A simple working class aspiration. A middle class aspiration as well. The property price declines of 2008 to April 2009 partly masked this crisis.

· So will things improve?

· What policies will be put in place to boost home building?

· Will the crisis be mitigated or worsened?

Lib-Con Coalition: The LibDem-Conservative coalition, in our view, have no interest in boosting house building or developments in general. They both seem in favour of stopping projects and saving money, particularly if these are either funded by public money or have public guarantees underpinning them. Examples are – cancellation of Heathrow third runway and re-evaluation of Crossrail. Both parties value the countryside, Greenbelt, countryside and lack of change to this resource, lack of urban sprawl and both parties listen to green views. We think it most likely there will be a further drop in house building in 2010, particularly in non urban areas. This could be caused by plans to give more planning control at local level – thereby making it easier for local planning offices to stop projects, or neighbouring area's projects. We expect building levels to decline further below the 90,000 a year mark through 2010 and 2011. Remember the Barker Report – seems a distant memory now. But this report recommended building levels of at least 200,000 homes a year – but preferably 250,000 to 300,000 homes a year. 100,000 homes minus demolished properties is pretty close to zero. Meanwhile the population of the UK is forecast to rise from 60 million to 70 million by 2030. Where will the extra 10 million people live we wander? Southern towns such as Kingston and Colchester are expected to see their populations rise by 15% in the next ten years - primarily through immigration from eastern Europe. Where will people live?

change to this resource, lack of urban sprawl and both parties listen to green views. We think it most likely there will be a further drop in house building in 2010, particularly in non urban areas. This could be caused by plans to give more planning control at local level – thereby making it easier for local planning offices to stop projects, or neighbouring area's projects. We expect building levels to decline further below the 90,000 a year mark through 2010 and 2011. Remember the Barker Report – seems a distant memory now. But this report recommended building levels of at least 200,000 homes a year – but preferably 250,000 to 300,000 homes a year. 100,000 homes minus demolished properties is pretty close to zero. Meanwhile the population of the UK is forecast to rise from 60 million to 70 million by 2030. Where will the extra 10 million people live we wander? Southern towns such as Kingston and Colchester are expected to see their populations rise by 15% in the next ten years - primarily through immigration from eastern Europe. Where will people live?

Cramped in flats: Already, British people live in about the most cramped accommodation in the whole of Europe. The average floor space is 40% lower than a Dutch home (and the Dutch have less land than the UK). Building and land costs are high. Just when we desperately need incentives to stimulate home building, the new Lib-Con coalitio n increased capital gains tax from 18% to 28% on developments and private buy-to-let businesses – this certainly won’t help stimulate home building.

n increased capital gains tax from 18% to 28% on developments and private buy-to-let businesses – this certainly won’t help stimulate home building.

Slow Planning Not Helping: Because of the extremely slow planning procedures, timing, effort required and costs, many commercial properties lie empty because change of use is required from – for example – an office to a place for teaching, or paper shop to fast food shop. Every time there is even the slightest change of use, one needs to apply for planning permission – an 8 week process costing £600 if the forms are filled in perfectly (every box not correctly ticked leads to a 4 week delay). No wander commercial investors cannot re-lease properties because they are constantly battling planning and building regulations in a vein attempt to achieve permission - before the interested prospective leaseholder finds another property. This hardly benefits the country economically. It leads to many properties standing empty. It panders to the Nimbys and anyone that does not want to see employment or wealth creation or change of use of buildings.

Negative Impacts: The increase in capital gains tax rises, increasing planning and building regulations burden plus lack of home building, the supply of suitable homes for families will dry up even more. Wealthy elderly people will continue to live in large homes because the cost of moving and paying stamp duty on an alternative smaller property is prohibitive. Families with kids will continue to live in cramped accommodation. Young people will see their rents rise, and will be lucky to be able to afford renting a small studio. Three bedroomed detached houses in the south of England will be for the wealthy only – and they will be taxed to death trying to afford to live in them. Once a family moves in, they will stay and build loft conversions, extend into basements and every other way to increase the size of the property rather than  pay horrendous stamp duty, capital gains taxes, fees and VAT every time they move home. Gardens will be paved over. Houses will be build in gardens. Worker mobility will decrease. Old people will hog big houses. Families that need houses will stay in flats. One third of men and one fifth of women between the ages of 25 and 35 in the UK continue to live with their parents because homes are not available at reasonable prices. The average age of non-parent assisted first time buyers is now 37 years old. Not a pretty story for society as a whole.

pay horrendous stamp duty, capital gains taxes, fees and VAT every time they move home. Gardens will be paved over. Houses will be build in gardens. Worker mobility will decrease. Old people will hog big houses. Families that need houses will stay in flats. One third of men and one fifth of women between the ages of 25 and 35 in the UK continue to live with their parents because homes are not available at reasonable prices. The average age of non-parent assisted first time buyers is now 37 years old. Not a pretty story for society as a whole.

No-one moves anymore: A little know fact is that in the 1960 – during the so called “building boom” or babyboomer housing boom – the average person who owned a home moved every 6 years. They were moving up from small houses to larger houses as families grew - quite a natural process. Indigenous UK people now only move every 18 years – they stay put three times longer. Very little trading up takes place. Meanwhile people that rent – those millions that cannot afford to buy – will move every few years. These people have no assets, student debts, and marry when they are 40 (instead of 25 in the 1970s) – many women try and have kids when they are 38, some never succeed. It's a sorry tail that leads back to the lack of properties being built. Prices in the areas of increasing population in southern England continue increasing  leaving people under 40 out of the market - multiples of five times salary are required with a 20% deposit for a reasonable interest rate. Only the most wealthy younger people can afford to own a property. A sorry tail when compared with the 1970s and 1980s. It is estimated that 80% of first-time buyers now get help from the Bank f Mum and Dad. By inference this means that kids with wealthy parents will be able to own a property – but if your parents haven’t got any spare cash – you’ll be renting. Interesting social vicious circle.

leaving people under 40 out of the market - multiples of five times salary are required with a 20% deposit for a reasonable interest rate. Only the most wealthy younger people can afford to own a property. A sorry tail when compared with the 1970s and 1980s. It is estimated that 80% of first-time buyers now get help from the Bank f Mum and Dad. By inference this means that kids with wealthy parents will be able to own a property – but if your parents haven’t got any spare cash – you’ll be renting. Interesting social vicious circle.

Housing Shortage Tends to Underpin Long Term Market: For the property investor, what it means is that property prices and rental prices will be underpinned by the lack of supply. Property prices have started to dip after the capital gain tax increases and uncertainty of public sector jobs cuts.

Failed Policies and Low Building Rates: In summary, Labour failed in its housing policy - failed it's core voters – and this has lead to many social problems. The best way to get your own home is to be a single mother or pregnant soon to be single mother. Married families go to the bottom of the queue. And it looks most likely the rot will not be reversed by the LibDem-Conservative Coalition either. In the long term, as long as financing can be accessed, properties prices would likely drift higher as more and more of people's disposable income is spent on h ousing, along with tax, at the expense of holidays, clothes, meals out and leisure activities..

ousing, along with tax, at the expense of holidays, clothes, meals out and leisure activities..

Impact of Tax Changes Would Make Matters Worse: The new government desperately needs to encourage home building and increasing flows of property for private rental - but so far we have seen no evidence that this will be the case. In fact, all the evidence so far points to further housing shortages, shortages of mortgages, lack of confidence by buy-to-let investors after the capital gains tax rises. Unsurprisingly, rents have risen as so few first time buyers enter the market and many properties stand empty through poor planning procedures and lack of banking finance for renovations. What is also prohibitive is that with inflation at 3.5%, and capital gains tax at 28%, after ten years, most of the tax is on inflation – not a true asset value gain – and this when investors have been paying 5% over base rates for their financing – it’s a mugs game! The Coalition does not seem to understand that UK capital gains tax is about the highest in the world, and it taxes gains from inflation after years – absurd for anyone who understands basic economics. So if inflation is 3.5% and house prices rise 3.5% a year, after ten years, there is no real asset price increase (its only kept pace with inflation), yet you get a gigantic tax bill to  pay. And you have been paying well over the inflation rate for your interest rate. Difficult to make money in that environment.

pay. And you have been paying well over the inflation rate for your interest rate. Difficult to make money in that environment.

Instability and Shortage: Overall - whilst there is a massive shortage of good quality accommodation for rental and purchase, there has been another tax policy change that has destabilised the property market from June onwards – it’s close to causing another mini-crash – it certainly has started in the more depressed areas in the North of England.

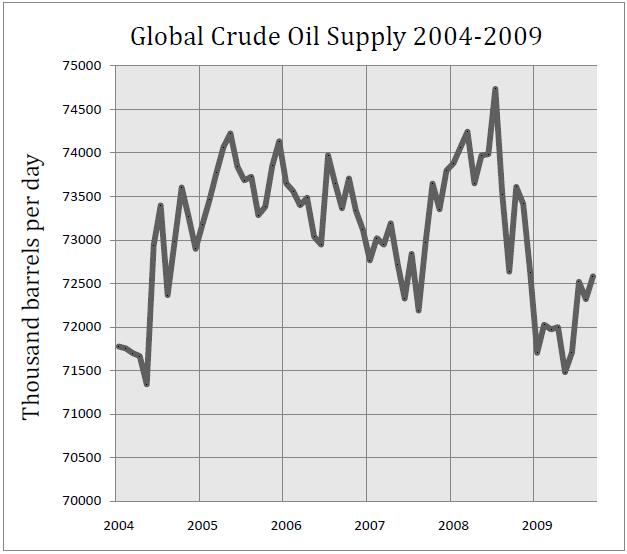

Strategy: Overall, with the public sector cuts and stimulation to private sector – we advise again investing in London and SE England for the next five years. The further away from London generally the higher proportion of public sector jobs and % jobs cuts in stall. Eventually, tax reductions for the better off in the UK will further benefit London in the run up to the London Olympics. Best avoid investment in the north unless you can find a low cost property with very good stable rental demand from good tenants in your area – and good yield. But don’t expect property prices to rise in places like Bury and Bradford for years. In London, property prices will probably be broadly level for a while before going up in 2012 as the economy starts to improve in earnest, unless oil prices rise above $100/bbl – in which case “all bets are off” – inflation will kick in and property prices will probably drop.