339: Resources competition - threat of a western decline

07-29-2010

PropertyInvesting.net

www.google.comThe World As A Business: One can treat the world like a giant company with lots of different business units or products. Some product lines will do very well – have turbo-charged economics like Apple, the iPod, the iPad or Google. Other countries will be laggards – declining because they are in the wrong market and the market is not in favour of them - their costs are too high.

Cheap Oil Created Boom: When commodities and oil were cheap, the countries with the best  technology, efficiency and knowledge grew the strongest – fuelled by cheap commodities especially oil and gas. As they grew, they used more money to keep the environment as clean as practical, they spent more on healthcare and social spending, and their costs rose and efficiency dropped. But it was okay because the growth was fuelled by cheap commodities imported from other countries – oil, gas, coal, wood, metals and the like. The promise of cheap oil led to high borrowing and debt levels. The world population was also far smaller and the rich got richer and the poor stayed relatively poor – partly because of corrupt governments, wars, lack of security, lack of organisation and infra-structure, education and available finance. The rich used better and more efficient technologies to steal a march on the poor – their educated masses create value. This was in the period up to about 1999.

technology, efficiency and knowledge grew the strongest – fuelled by cheap commodities especially oil and gas. As they grew, they used more money to keep the environment as clean as practical, they spent more on healthcare and social spending, and their costs rose and efficiency dropped. But it was okay because the growth was fuelled by cheap commodities imported from other countries – oil, gas, coal, wood, metals and the like. The promise of cheap oil led to high borrowing and debt levels. The world population was also far smaller and the rich got richer and the poor stayed relatively poor – partly because of corrupt governments, wars, lack of security, lack of organisation and infra-structure, education and available finance. The rich used better and more efficient technologies to steal a march on the poor – their educated masses create value. This was in the period up to about 1999.

Oil Production Plateau for the Western World:

But then oil production started to plateau around early 2005 and did not rise after this (raw crude oil). Meanwhile the population continued to expand at alarming rates. The world population grew 100% in forty years from 1960 to 2000. More cars were sold and oil consumption rose, but supply did not – and oil prices rose from $9.5/bbl in 1999 to $147/bbl by mid 2008 – a fifteen fold increase. Oil prices crashed, co-incident with a financial meltdown as the first affects of Peak Oil could be felt. The Peak Oil for all oil liquids (including bio-fuels and natural gas liquids) was measured in July 2008 just before the financial crash – as China pulled on oil supplies like crazy to supply the Olympics and reduce coal consumption and pollution during the games. Globalisation had become so interlinked within everyone’s economies that whatever happened in China could be felt in Chile – global markets, trade and pricing.India and China: But rather than the developing nations like India and China going into recession in 2009 as well, their GDP dropped from 12% to 9% and 8% to 6% respectively only – then started to recover. Their oil consumption continued to rise. Brazil and other developing countries also continued to grow. The population and oil consumption in the Middle East continued to sky-rocket – exporting oil became more difficult. Meanwhile USA and Europe had severe recessions in which about 10% of their GDP disappeared in 18 months. Developed countries that imported all their commodities like Spain, Iceland, Greece, Portugal and Ireland suffered the most as their lack of manufacturing prowess, high social spending, property bubbles and Euro linkages caused a massive shock and their deficits sky-rocketted. The UK suffered as manufacturing was hit again and consumer spending and lending declined – with London keeping the show on the road assisted by government bank bail-outs.

The Future: So what about the future? What lies in stall for Europe and USA? Well, it’s not really pretty because – these business units are poorly performing, particularly the less competitive fringe areas. The big problem is, most governments do not seem to understand that all funding comes from the private sector. So if you kill off business, you kill off the public sector – or your deficit goes shooting up – then you kill off the public sector a little later. The western developed nations that will do the best economically – which will positively impact property prices and rental demand – are the countries that reduce their deficits and are fiscally prudent. They will tend to be right of centre. This is far easier to achieve if you have oil or gas production and exports. A strong financial services sector helps a lot. A strong and highly competitive manufacturing sector also helps a lot. Efficient use of fossil fuels also helps – measured in barrels of oil per unit GDP. This will protect countries from the ravages of Peak Oil, that acts like a heavy tax on all goods and services and causes inflation and higher borrowing costs.

Resource Rich: Such countries that are well protected as resources start running short because these countries are reasonably efficient and export oil and or gas are:

Canada, Norway, Australia

PIGS: Developed countries that are particularly exposed to resources shortages are:

Spain, Italy, Portugal, Greece, Ireland and Iceland – along with USA and Japan

The PIGS countries have little option but to keep their fingers crossed whilst their populations decline, oil and gas prices rise and they try hard to tackle massive deficits with an aging population, a currency that is twice as strong as it should be for their competitiveness and mounting debts. As oil prices rise, airline travel reduces, low priced airline travel and tourism declines and the southern Mediterranean countries economies go into decline. No amount of beautiful beaches will make up for the lack of cheap oil to jet weekenders and short breakers to these destinations. Times will be hard.

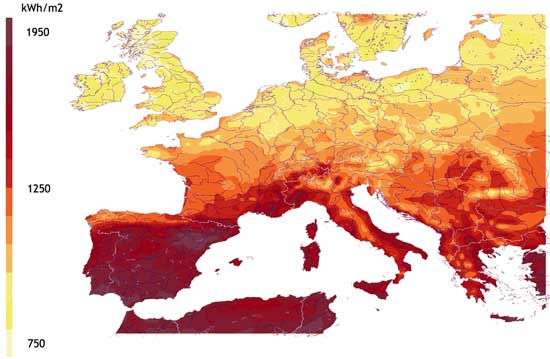

Germany: Back at the German mother-ship, increased exports of engineering goods and luxury cars to China and the Far East will see the German economy continue to expand as long as it’s not dragged down by the PIGS. The problem has not gone away – it’s just been delayed until the next oil price spike. If oil prices rise from $75/bbl to $150/bbl, the Greek deficit will rise by 4% - from 12% to 16%. It’s a serious issue. Who in their right minds would invest in property in Greece with this looming issue? Greece will decline – because it’s currency is too strong for its competitiveness, it imports all commodities, exports little, has high social costs, an aging population, low retirement age, declining population, it does not have a competitive banking sector, it has no manufacturing prowess, and it uses massive quantities of oil per unit GDP (three times more than the UK). Can you think of any reason why the Greek economy should start to grow strongly again, unless oil prices crash?

France: The French economy will also likely perform reasonably well because it has masses of low cost nuclear power, its pretty good at manufacturing, is fairly efficient, has a good financial services sector, an increasing population and a younger population than Spain, Greece and Portugal. Yes, it imports a lot of oil and gas, but the unit GDP per barrel of oil used is far higher than it is in Greece.

UK:

The UK still produces 60% of it’s oil and 50% of its gas requirements – that’s pretty good for a western country. It is globally renowned for its financial services, it has massive international inflows and tourism to London, a moderate manufacturing sector and a Coalition that wants to tackle the deficit. In summary, things are beginning to head in the right direction. The Bank of England is realistic and working in concert with the government to keep growth on track, bring down the deficit and try and keep inflation under control. It won’t be easy, but we would expect GDP growth moving forwards at about 2%, with inflation at 3.5%, interest rates at 0.5% for the remainder of 2010, mortgage rates at 5% (high) with big public sector cuts and the private sector mounting a mild recovery this autumn. London should fair the best regionally with areas far from London the worst affected as public sector funding dries up and taxes rise. Northern cities will also be hit hard.Resources Competition: Be prepared for high inflation in the UK – officially it will be about 3.5%, but will feel like 7%. All prices will rise. But the wildcard is the oil price. If oil prices skyrocket again, there will be another recession – period. There has to be. You see, it’s because China and India need the resources – and they are pricing us out. Their massively lower labour costs mean they can subsidize oil and gas prices – which means demand keeps rising, energy conservation is almost non-existent and raw materials will head for the new mother-ships – China and India. This is not going to stop. It will not slow down. It will continue. As it continues, the western economies will stagnate – they have to in a way – because there are only enough resources for the most competitive. If we dropped our wages to 10% of current levels, w e would win hands-down, but who wants a wage cut? We only get wage cuts by stealth through higher taxes and higher prices. This will become endemic and the economy will be anaemic. Anyone that thinks we can continue to get far more wealthy had better realise that there are 1.2 billion Chinese and 1.5 billion Indians all wanting to own cars, live in a nice house with central heating and air conditioning. Where will all the energy come from? Where will the raw materials come from? They have to be re-distributed from western developed nations. So you will notice a slowdown in building, projects cancelled, making the most of what has already been built. We’ll have to start becoming far more efficient in our energy usage – driving less, going on less far flung holidays, spending less on imported goods, and cutting back on spending generally. Our living standards are set to decline – whether it will be hardly noticeable or a shock, we’re not quite sure, but economically we see no way this will not happen. There has to be a shift from western nations to China and India. It’s like having a business where two units are doing very well because they have a low cost advantage – even when input prices go up. The capital is shifted to these low cost centres – to achieve higher returns. The bloated high cost centre start to shrivel.

e would win hands-down, but who wants a wage cut? We only get wage cuts by stealth through higher taxes and higher prices. This will become endemic and the economy will be anaemic. Anyone that thinks we can continue to get far more wealthy had better realise that there are 1.2 billion Chinese and 1.5 billion Indians all wanting to own cars, live in a nice house with central heating and air conditioning. Where will all the energy come from? Where will the raw materials come from? They have to be re-distributed from western developed nations. So you will notice a slowdown in building, projects cancelled, making the most of what has already been built. We’ll have to start becoming far more efficient in our energy usage – driving less, going on less far flung holidays, spending less on imported goods, and cutting back on spending generally. Our living standards are set to decline – whether it will be hardly noticeable or a shock, we’re not quite sure, but economically we see no way this will not happen. There has to be a shift from western nations to China and India. It’s like having a business where two units are doing very well because they have a low cost advantage – even when input prices go up. The capital is shifted to these low cost centres – to achieve higher returns. The bloated high cost centre start to shrivel.

UK Business Decline: Let’s take a simple example. The UK stock market top 100 companies are worth less today than 13 years ago. If one adjusts for inflation, they are worth only half the amount. Yes – publically floated industry has been in decline for years in the UK from the affects of high taxes, low demand and rising oil prices – and general lack of international competitiveness. 1999 was about the best year – when oil prices reached an all time low of $9.5/bbl. End of 2008 was the worst, just after oil prices had reached $147/bbl. Does this tell us something? Yes – it means cheap oil has driven the massive wealth and debt expansion. But there is no cheap oil left. So expect the wealth and finance to dry up followed by the threat of increasing debt. The smarter governments already realise what a predicament they are in – but they won’t tell you – otherwise you won’t vote for them. The UK government seems clued-in to Peak Oil – and are doing something about it – trying to encourage energy efficiency and cycling all helps. The other correlation on business decline is of course with the Labour government who got into power in 1997 – 13 years of stealth taxes and public sector expansion has got to have taken a severe toll on the private sector – surely it has to because you need to milk the private sector to feed the public sector – because overall the UK is a business. Little wander it led to the 12% budget deficit end 2008 as oil production was allowed to declined after big taxes increase and public taxes and public spending sky-rocketted – it will take years to clear up the mess – but at least it has started.

UK Business Decline: Let’s take a simple example. The UK stock market top 100 companies are worth less today than 13 years ago. If one adjusts for inflation, they are worth only half the amount. Yes – publically floated industry has been in decline for years in the UK from the affects of high taxes, low demand and rising oil prices – and general lack of international competitiveness. 1999 was about the best year – when oil prices reached an all time low of $9.5/bbl. End of 2008 was the worst, just after oil prices had reached $147/bbl. Does this tell us something? Yes – it means cheap oil has driven the massive wealth and debt expansion. But there is no cheap oil left. So expect the wealth and finance to dry up followed by the threat of increasing debt. The smarter governments already realise what a predicament they are in – but they won’t tell you – otherwise you won’t vote for them. The UK government seems clued-in to Peak Oil – and are doing something about it – trying to encourage energy efficiency and cycling all helps. The other correlation on business decline is of course with the Labour government who got into power in 1997 – 13 years of stealth taxes and public sector expansion has got to have taken a severe toll on the private sector – surely it has to because you need to milk the private sector to feed the public sector – because overall the UK is a business. Little wander it led to the 12% budget deficit end 2008 as oil production was allowed to declined after big taxes increase and public taxes and public spending sky-rocketted – it will take years to clear up the mess – but at least it has started.

USA problems: Our biggest concern is the USA and the US government. The USA imports 12 million barrels of oil a day – an oil import bill of $350 billion a year. Meanwhile for each man, woman and child in the USA, they shell out $6500 a year on healthcare alone. And Obama has just increased spending on healthcare with his new landmark bill. There seems to be no effort at all to reign in the deficit. In our view, the dollar will continue to decline, interest rates will need to rise, the deficit will rise, growth will slow and the $2 Trillion of stimulus – wasted money in our view – will have been squandered. Why the USA does not invest in national gas – and conversion of their truck and auto fleets to national gas or gas to electric power is beyond us. The USA has enough gas to last 100s of years but instead imports 12 million barrels of oil a day from mainly unfriendly neighbours like Venezuela. Defies logic. May be it’s the powerful agricultural, auto industry and energy industry lobby – they don’t want to change because it cost money and takes effort. But it’s the wrong decision at this time to continue down the same old road – because oil prices will skyrocket shortly and because the USA imports so much oil, it will create the next recession

USA problems: Our biggest concern is the USA and the US government. The USA imports 12 million barrels of oil a day – an oil import bill of $350 billion a year. Meanwhile for each man, woman and child in the USA, they shell out $6500 a year on healthcare alone. And Obama has just increased spending on healthcare with his new landmark bill. There seems to be no effort at all to reign in the deficit. In our view, the dollar will continue to decline, interest rates will need to rise, the deficit will rise, growth will slow and the $2 Trillion of stimulus – wasted money in our view – will have been squandered. Why the USA does not invest in national gas – and conversion of their truck and auto fleets to national gas or gas to electric power is beyond us. The USA has enough gas to last 100s of years but instead imports 12 million barrels of oil a day from mainly unfriendly neighbours like Venezuela. Defies logic. May be it’s the powerful agricultural, auto industry and energy industry lobby – they don’t want to change because it cost money and takes effort. But it’s the wrong decision at this time to continue down the same old road – because oil prices will skyrocket shortly and because the USA imports so much oil, it will create the next recession

then Obama’s stimulus plans, spending binges and inefficiencies will start to look frankly stupid. It’s a polarised government of left and right not working in concert – we warn - the USA is spending far too much – a very dangerous strategy and we think it is flawed. Hence our guidance is not to invest in the USA real estate market at this time. Far too exposed to high oil prices just around the corner. If you must invest in North America, then Canada is a top location. Calgary has low taxes and will boom as the oil prices rise. Masses of land, forestry, oil, gas, water, agricultural land and a small population – with a secure export markets to the USA – yes, the USA needs all the oil and gas it can get. The Canadian dollar will continue to strengthen. The US dollar will continue to decline. Buying stocks in Canadian oil companies on the Toronto stock market must be one of the safest pension pots available for anyone on the planet – because as oil prices rise, oil production will rise, profits will rise, the Canadian dollar will ris e and your pension pot will rise – particularly if you spend US dollars! It’s not rocket science.

e and your pension pot will rise – particularly if you spend US dollars! It’s not rocket science.

Norway boom: A similar but even better story is Norway. Can you name a country that has 5 million highly educated honest hard working indigenous peaceful people – a moderately expanding population, that exports 1.5 million barrels of oil a day and the same amount in gas equivalent terms – and will continue to do this for the next 20 years? It also has lots of forests, land, water, hydro-electric power and it’s very safe, secure and scenic – yes, that’s Norway. Then add to this one of the biggest and most successful sovereign wealth funds on the plant – yes, shrewd investors, and you have Norway. Why wouldn’t the property prices rise sustainably, particularly with environmental constraints and why wouldn’t the currency rise with such a massive budget surplus +15%? And what happens when oil and gas prices skyrockets – you guessed it – they make even more money. Laughing all the way to the bank – well, the Norwegians don’t laugh much, particularly when it come to money. But you get the drift – there’s not much that holds the Vikings back apart from the miserable weather in winter.

Mining Giants: If you believe metals commodity prices will sky-rocket, then there are a few excellent countries to invest in:

Australia (safe/secure), Chile, Mongolia (Bolivia is another possibility though high social taxes are a concern)

As China and India need more metals to industrialise – just like the USA and Europe did in the 1950s to 1970s – metals prices will likely rise. If the country exports metals and oil and gas – that’s even better. Canada and Australia are about as close to this as you can get – others are Russia and Kazakstan.

Insights on Resources: We hope we have given you a prospective on how the economies of different countries are likely to perform as resources shortages start to bite. There are plenty of safe havens – but we hope you can see there are plenty of potential basket cases. Would you seriously want to expose yourself to high commodities prices – caused by China and India industrialising in the next ten years? Ask yourself, do you think they will stop industrialising or slow down in their use of raw materials? Realistically they won’t and prices will rise – so if you are a western developed nation that competes for the same raw materials imported into China, surely you will end up losing – and having economic hardship. And that this will then affect property prices and rental demand – particularly if your population is in decline.

Spain, Portugal, Italy and Greece peaked along with Peak Oil in 2005. They will decline with oil’s decline – simplistic but realistic. They were countries built from cheap oil – but unsustainable with high oil prices. As we saw be end 2008 – as oil production started to decline – so did these economies.

We hope this Special Report has helped give you some insights into property investing in different countries – and the link between oil, metal, China, India, spending and property prices. If you have any comments, please contact us on enquiries@propertyinvesting.net