315: The party's over

04-23-2010

PropertyInvesting.net team

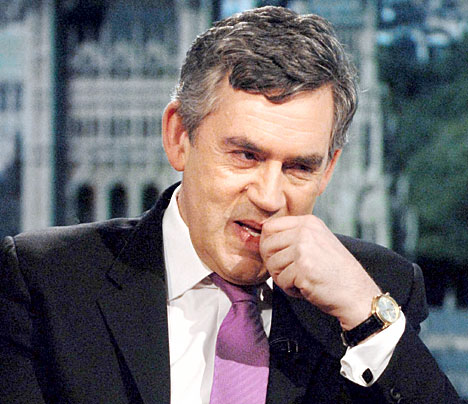

It’s not been a good week. An election by beauty contest – the Political X-factor – has thrust an almost unknown figure Nick Clegg from backwater to being ahead of Gordon Brown and close to David Cameron in the polls. We’re not quite sure why - articles about how attractive he looks and "sounded nice" spring to mind. It really does now look like a hung parliament – a disaster waiting to happen. Style over substance? Surely the electorate can see through the smoke and mirrors – we hope so - the fear is that it will not be the case.

The government currently borrows £1 for every £4 it spends. Our decifit is a massive 12% of GDP - as much as Greece. Totally unsustainable and a serious mismanagement of the UK finances. Meanwhile the Bank of England has been propping up guilt yields by printing mirage money to the tune of £200 billion – a rigged market. This is coming to an end. The Liberals like taxing even more than Labour – so it will be worse if the Liberals gain any sort of foothold. Their poli cies are far left. Left of New Labour.

cies are far left. Left of New Labour.

No wander Grordon Brown is cosying up to Nick Clegg. The debates remind us of school bullies. No pleasant to watch. We feel sorry for the person who will be left out - or right out - no pun intended.

A hung parliament spells indecision, infighting, political posturing, back-stage side deals and fudged policy - smoke and mirrors multiplied. The Liberal Democrats want 50% capital gains tax – this would be a disaster. The possibility of another election means any parties in power will want to continue the spending spree rather than make tough decisions - to improve efficiency and reduce the deficit. The financial community are well aware of this - and think back to the early 1970s crisis when we had to go cap in hand to the IMF for a bail out - and top rate earning income tax was a staggering 83%.

On top of the 50% earned income tax - there would likely be further tax rises - watch out. Don't believe any pledge that 50% will be kept - its likely go up rather than down particularly with a hung parliament. Vince Cable does not seem to like bankers either - another key concern on the 50% rate. There will be more banker bashing. An assault on business. More blaming the private sector for the economic wows bought on by public sector spending, higher taxes and declining oil and gas revenues. Eventually, the private sector will vote with their feet and leave – to set up in other countries. Our prediction of what is more than likely to happen is:

-

Hung parliament

-

Lib-Lab pack (Tories marginalised, possibility still of Gordon Brown retaining power)

-

The deficit not being tackled

-

Inflation increases to 5%

-

Interest rates rise dramatically

-

The UK loses its AAA rating

-

Unemployment rises - both public sector and private sector

-

Property prices drop

-

Tax receipts come down as tax rates rise and capital outflow start

-

Sterling crisis

-

Housing crisis as building drops to an all time low

-

FT stock market drops for UK companies

-

Wealthiest bankers and individuals move out of UK (like they did in the 1970s)

-

Further political malaise

-

Low growth world with recessions and stagflation

If the Labour and Liberals do a Lib Lab pack – the most likely outcome - then force in "proportional representation" – a definite possibility - then it will be the end of any future chance of a Tory working majority and the UK will see years of high tax socialism – that means a weak pound, high inflation, high tax, high public spending and low economic growth rates with creeping unemployment and more energy imports. Just think - the way the Liberals could change politics for ever in the UK would be to get into a hung parliament where Gordon Brown needs them to get a working majority. Then a behind closed doors deal that Gordon get the PM job if he drives through proportional representation. Then a hung parliament and indecision for ever - just like in Italy -with an economic performance comparable henceforth.

We wish we could be more optimistic but regrettably last week’s first election debate was the tipping point. We now think the chances of a hung parliament chances are about 80% and it’s not good news after this.

We therefore think now is a good time to sell. Particularly if the property not in southern England. And we would not recommend buying property anywhere at present – because we think prices will drop by year end. This is the first time we have ever had a sell recommendation. 80% of people think prices will rise by year end - that's another reason to sell! That makes no sense when interest rates and mortgage rates are just about to rise, taxes are rising and a hung parliament is on the cards.

The other reason is – oil prices are rising – inflation is rising – it hit 3.4% CPI last week and barely a mention in the papers – this is a disaster – why do so many people think inflation will fall? – we think it will keep rising.... The CPI target is 2% - why do we think we can get away with 3.4% and rising whilst holding rates at 0.5%? But it’s hardly surprizing inflation is rising when oil prices rose from $37/bbl to $86/bbl in the last 12 months – analysts don't seem to realize that high oil prices lead to high inflation that eventually leads to recessions. So the next recession is not far away – it just needs oil prices to rise over $100/bbl and a hung parliament to trigger this. So watch out. And you can’t say we haven’t been right in our predictions before!

The other reason is – oil prices are rising – inflation is rising – it hit 3.4% CPI last week and barely a mention in the papers – this is a disaster – why do so many people think inflation will fall? – we think it will keep rising.... The CPI target is 2% - why do we think we can get away with 3.4% and rising whilst holding rates at 0.5%? But it’s hardly surprizing inflation is rising when oil prices rose from $37/bbl to $86/bbl in the last 12 months – analysts don't seem to realize that high oil prices lead to high inflation that eventually leads to recessions. So the next recession is not far away – it just needs oil prices to rise over $100/bbl and a hung parliament to trigger this. So watch out. And you can’t say we haven’t been right in our predictions before!

And when you are at the petrol pump, when you pay £100 for a tank full of petrol, £80 will be going to the Treasury - more if the Liberal and Labour do a deal together. Meanwhile, if you get on a plane and your ticket cost £100, nothing will go to the Treasury. In fact, after the Icelandic ash cloud – the airlines are even asking the governments and EU for money to help. Even though airlines burn ten times more fuel were passenger mile than a driver of a car - its insane use of a depleting resource. Encouraging people to make useless trips abroad to spend their money - meanwhile penalising them for travelling at home and spending their money at home doesn't make sense. May be its something to do with being a "captive audience" - all those cars have got to fill up sometime and the private motorist can't go on "car driving strike".

And when you are at the petrol pump, when you pay £100 for a tank full of petrol, £80 will be going to the Treasury - more if the Liberal and Labour do a deal together. Meanwhile, if you get on a plane and your ticket cost £100, nothing will go to the Treasury. In fact, after the Icelandic ash cloud – the airlines are even asking the governments and EU for money to help. Even though airlines burn ten times more fuel were passenger mile than a driver of a car - its insane use of a depleting resource. Encouraging people to make useless trips abroad to spend their money - meanwhile penalising them for travelling at home and spending their money at home doesn't make sense. May be its something to do with being a "captive audience" - all those cars have got to fill up sometime and the private motorist can't go on "car driving strike".

Because we have now reached Peak Oil (July 2008 for all liquids, 2004 for conventional crude oil) – we are on an undulating total oil production plateau of about 85 million barrels, and Chinese oil demand is increasing at 25% per annum – oil prices will rise further, inflation will rise, growth will slow and deficits will rise in the western developed world. Regrettably we are rather pessimistic with three weeks left before the election. The saving grace is that in the UK, we only import about 30% of our oil needs so are more protected from Peak il than most developed nations.

To think the bankers have not got contingency plans that they are now brushing off to head of a tax threat. If taxes rise further they will simple move - then total tax receipts will drop - then the deficit will rise. If the government gets too greedy (already way past that point) - they will get less not more. Bankers can move anywhere the money is. So they will not tolerate higher taxes. They will just move. Like they did in the mid 1970s - the "brain drain" they called it then.

A hung parliament would be a disaster. It will be a disaster. The only route out of the mess is a Tory majority. And we don’t think it will happen. The party is well and truly over.