300: Global Crisis and Tax-Deficit Update

12-15-2009

PropertyInvesting.net team

Financial Crisis: The financial crisis of 2008 started with the sub-prime bad debit, high oil prices (leading to annual $350 Billion oil import bill for USA) and then the spread to Lehman Brothers and around the world it has hit the UK and Ireland hard.

Economic Crisis: The financial crisis then became an economic crisis that required governments to print money, issue debt and increase their deficits.

Sovereign Crisis: The next step in this process of even rising levels crisis in the hierarchy is for governments of countries to either threaten or pass into default. This started with Iceland, but such a small economy was like a business going into default. Dubai is another example. Then follows talk of Greece going into default. For 2010, the big worry is a big economy like Greece, Spain, Italy or even the UK going into default. The percentage annual budget deficits of Spain, Ireland, Greece, UK and USA are huge. If a Eurozone country goes into default, it will be interesting to see whether France and Germany select to bail them out or not.

Euro Crisis? One can see there is a continual knock-on impact to a higher levelbigger player. If Germany and France was to take on too much bad debit from its Eurozone neighbours, they could then get into trouble themselves. For the European economy, it has long been views that very low interest rates to help sure up the large low growth economies of France and Germany are not necessarily a good thing for the smaller peripheral economies such as Ireland, Greece and Portugal. The reason is that they will lead to asset bubbles and over-borrowing during the good times, then lack of stimulus and recession in the bad times. Not having the interest rate lever to control the economy is a huge disadvantage which many would argue out-weighs the advantages of being in the Euro.

Property impact: The reason for discussing these crises is that as a property investor one needs to be conscious that the world economic climate is not a safe one at this time or ever. In Europe and the USA a return to the good old days is difficult to see in our opinion. There is no use taking huge debt risk if asset prices could crash further. That said, if inflation starts kicking in as we expect in about 6 months time savings will be a bad place to have money and real assets such as physical commodities (oil, gold, metals, gems) and property will be investment classes that will be protected more than most against the ravages of inflation. Remember, if you borrow 50% against a property, then inflation including that of property takes off the real cost of the 50% will drop dramatically over a ten year time frame, and the equity (and proportion and real value of the equity) will increase. This is one reason why property is such an important and popular asset class and wealthy individuals invest so much in property even if it is only one (large) home.

Property impact: The reason for discussing these crises is that as a property investor one needs to be conscious that the world economic climate is not a safe one at this time or ever. In Europe and the USA a return to the good old days is difficult to see in our opinion. There is no use taking huge debt risk if asset prices could crash further. That said, if inflation starts kicking in as we expect in about 6 months time savings will be a bad place to have money and real assets such as physical commodities (oil, gold, metals, gems) and property will be investment classes that will be protected more than most against the ravages of inflation. Remember, if you borrow 50% against a property, then inflation including that of property takes off the real cost of the 50% will drop dramatically over a ten year time frame, and the equity (and proportion and real value of the equity) will increase. This is one reason why property is such an important and popular asset class and wealthy individuals invest so much in property even if it is only one (large) home.

Historical Debit Crises: After such a country crisis, it normally takes many years for the  country to recover as public sector spending is slashed, unemployment rises and the public finances improve. Take a look at Russia and Argentina around 1999 and Malaysia around the same time. These countries were booming, their finances were over-stretched then there were massive financial crash. It took about five years to start a concerted recovery. But anyone that bought assets at the deflated post crash prices would have made huge returns. A similar thing happened in Turkey around 2001. The message is, if you are thinking of buying assets in countries that have poor public finances then think again. Wait until after the crash. Dont get in before a crash! Examples of countries we think could crash further are Ireland, Portugal, Spain, Greece, Italy and UAE wait for the bottom before entering these countries.

country to recover as public sector spending is slashed, unemployment rises and the public finances improve. Take a look at Russia and Argentina around 1999 and Malaysia around the same time. These countries were booming, their finances were over-stretched then there were massive financial crash. It took about five years to start a concerted recovery. But anyone that bought assets at the deflated post crash prices would have made huge returns. A similar thing happened in Turkey around 2001. The message is, if you are thinking of buying assets in countries that have poor public finances then think again. Wait until after the crash. Dont get in before a crash! Examples of countries we think could crash further are Ireland, Portugal, Spain, Greece, Italy and UAE wait for the bottom before entering these countries.

More Special Reports on Peak Oil and Energy:

277: Country Ranking in a Peak Oil World with Resources Scarcity

275: Cars - The Absurdity and Necessity

274: How susceptible are countries to high energy prices? Impact for property investors..

270: Turbulance in Property Markets Caused By Oil Price Spikes and Peak Oil

265: How to Profit from Peak Oil - USA, UK and Europe

264: Another oil price spike is just about to hit us...watch out

263: Investing in Property with Energy in Mind "post Peak Oil"

262: Electric Revolution, the Environment and the Next Energy Crisis

257: Property investing, the UK economic situation and oil & gas

251: Peak Everything!

249: What's next?

244: It's the oil price again - it caused the recession

243: Oil price crash sows seed for next massive oil spike

242: Oil, Cars & Property - what we'd do if we were UK Prime Minister

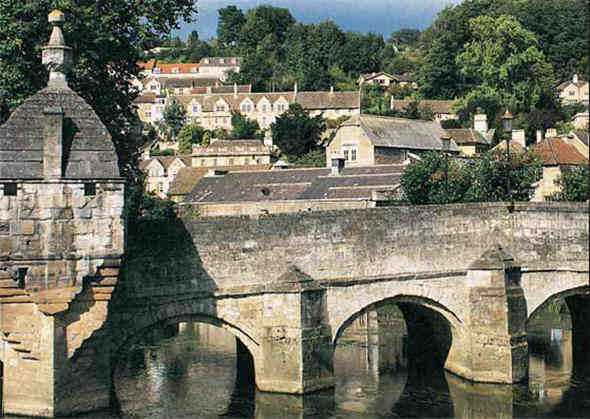

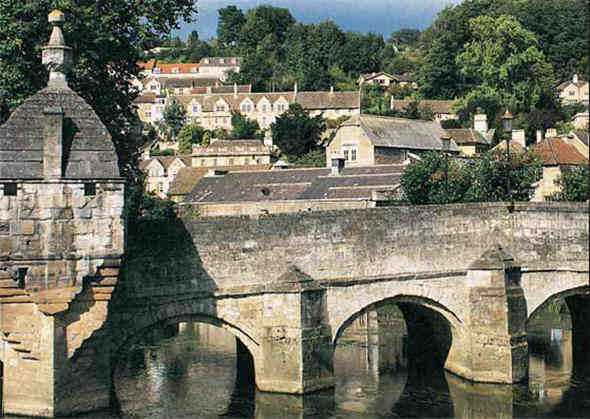

Greece and outlying Mediterranean Euro Countries: We have given warns about Greece before it has always come out low in our ranking and analysis because it has no oil, gas, coal, metals production, a declining and aging population and is not famous for financial servi ces or manufacturing. It has no particular competitive edge we can think of part from tourism. Its a beautiful place for a holiday, but relying on airline travel for tourism in a period of post Peak Oil is high risk. This is why we would far rather invest in SE England close to high paid jobs. Spain is another high risk play same analysis applies, albeit Spain has some good financial services and moderate manufacturing though we would not describe these as impressive. Both Spain and Greece are exposed to climate change in warming temperatures and potential water shortages. Well always try and go on holiday to such beautiful and historic destinations with lovely people, but the foundations for their economies are not robust. Portugal is another problem area its possible they will also get into trouble in 2010. And Italy is another potential problem area.

ces or manufacturing. It has no particular competitive edge we can think of part from tourism. Its a beautiful place for a holiday, but relying on airline travel for tourism in a period of post Peak Oil is high risk. This is why we would far rather invest in SE England close to high paid jobs. Spain is another high risk play same analysis applies, albeit Spain has some good financial services and moderate manufacturing though we would not describe these as impressive. Both Spain and Greece are exposed to climate change in warming temperatures and potential water shortages. Well always try and go on holiday to such beautiful and historic destinations with lovely people, but the foundations for their economies are not robust. Portugal is another problem area its possible they will also get into trouble in 2010. And Italy is another potential problem area.

UK Deficit: The UK also needs to be very careful the deficit is gigantic, taxes will rise, productivity is likely to drop and lower growth will be evident until someone repairs the public finances that have been decimated by increases in public sector, productivity drop, public sector pensions and administrator etc). Oil production has crashed from 2.1 million bbls/day to 1  million since 1999. Bank of England borrowing has risen from 4% in 1997 to 20% of GDP in 2009 a massive increase. The 79% taxation on the wealthy (earned income tax at 50%, VAT 17.5%, national insurance, fuel costs, duties, property tax, inheritance and pension tax etc) will drive many wealthy people away from the UK to tax havens so the overall tax take will probably drop as taxes rise and bankers leave as the smart money goes overseas. This normally happens when punitive taxes are implemented the rich will always find ways of avoiding the tax even if it means leaving the country. The only cancellation is that France and Germany may also tax bonuses and high earners leaving the bankers with fewer options they will likely select pure tax havens.

million since 1999. Bank of England borrowing has risen from 4% in 1997 to 20% of GDP in 2009 a massive increase. The 79% taxation on the wealthy (earned income tax at 50%, VAT 17.5%, national insurance, fuel costs, duties, property tax, inheritance and pension tax etc) will drive many wealthy people away from the UK to tax havens so the overall tax take will probably drop as taxes rise and bankers leave as the smart money goes overseas. This normally happens when punitive taxes are implemented the rich will always find ways of avoiding the tax even if it means leaving the country. The only cancellation is that France and Germany may also tax bonuses and high earners leaving the bankers with fewer options they will likely select pure tax havens.

London Special Reports:

280: London Villages - Hotspots for the Future

266: London Olympics Regeneration and Infra-structure Boom

267: UK Property Update

256: London regeneration update for property investors

254: London 2012 Olympic Regeneration - Property Investor's Update

248: Cornwall - demographics and direction

247: London property investing - hotspots 2010-2012

234: London Olympic Games - impact on London property

231: UK inflation, house prices and growth for the next 2 years

227: Importance of Tube and Metros to European City Property Investment

226: London Property Hotspots - Tube, Olympics, Regeneration

219: Property investors - socio-economic trend update - hotspots

217: UK massive housing shortage 2010 onwards

213: East London regeneration and infra-structure update for property investors

212: UK property hotspots 2008 for a 2-3 year timeframe

Tax Havens: The biggest beneficiaries may well be the European tax havens. Do not be surprised if property prices rise strongly in Monaco, Luxemburg, Geneva, Isle of Man and  Jersey. With Switzerland being the highlight with a flat tax of about £23,000 per annum regardless of income, its pretty hard to beat! Slovakia with flat tax of 22% is another good place worth considering property investment as the massive tax increases start to drive wealthy people away from countries with huge deficits. We are now in a high tax low growth world with escalating energy costs because of competition from China and India and other developing countries ignoring this trend will damage your returns. But acknowledging it might identify some excellent opportunities ad lead to escalating returns.

Jersey. With Switzerland being the highlight with a flat tax of about £23,000 per annum regardless of income, its pretty hard to beat! Slovakia with flat tax of 22% is another good place worth considering property investment as the massive tax increases start to drive wealthy people away from countries with huge deficits. We are now in a high tax low growth world with escalating energy costs because of competition from China and India and other developing countries ignoring this trend will damage your returns. But acknowledging it might identify some excellent opportunities ad lead to escalating returns.

We hope this Newsletter has been helpful in giving you investment guidance. If you have any comments, please contact us on

enquiries@propertyinvesting.net

back to top

Property impact: The reason for discussing these crises is that as a property investor one needs to be conscious that the world economic climate is not a safe one at this time or ever. In Europe and the

Property impact: The reason for discussing these crises is that as a property investor one needs to be conscious that the world economic climate is not a safe one at this time or ever. In Europe and the  country to recover as public sector spending is slashed, unemployment rises and the public finances improve. Take a look at

country to recover as public sector spending is slashed, unemployment rises and the public finances improve. Take a look at  ces or manufacturing. It has no particular competitive edge we can think of part from tourism. Its a beautiful place for a holiday, but relying on airline travel for tourism in a period of post Peak Oil is high risk. This is why we would far rather invest in

ces or manufacturing. It has no particular competitive edge we can think of part from tourism. Its a beautiful place for a holiday, but relying on airline travel for tourism in a period of post Peak Oil is high risk. This is why we would far rather invest in  million since 1999. Bank of England borrowing has risen from 4% in 1997 to 20% of GDP in 2009 a massive increase. The 79% taxation on the wealthy (earned income tax at 50%, VAT 17.5%, national insurance, fuel costs, duties, property tax, inheritance and pension tax etc) will drive many wealthy people away from the UK to tax havens so the overall tax take will probably drop as taxes rise and bankers leave as the smart money goes overseas. This normally happens when punitive taxes are implemented the rich will always find ways of avoiding the tax even if it means leaving the country. The only cancellation is that

million since 1999. Bank of England borrowing has risen from 4% in 1997 to 20% of GDP in 2009 a massive increase. The 79% taxation on the wealthy (earned income tax at 50%, VAT 17.5%, national insurance, fuel costs, duties, property tax, inheritance and pension tax etc) will drive many wealthy people away from the UK to tax havens so the overall tax take will probably drop as taxes rise and bankers leave as the smart money goes overseas. This normally happens when punitive taxes are implemented the rich will always find ways of avoiding the tax even if it means leaving the country. The only cancellation is that  Jersey

Jersey