251: Peak Everything!

02-08-2009

PropertyInvesting.net team

PropertyInvesting.net team

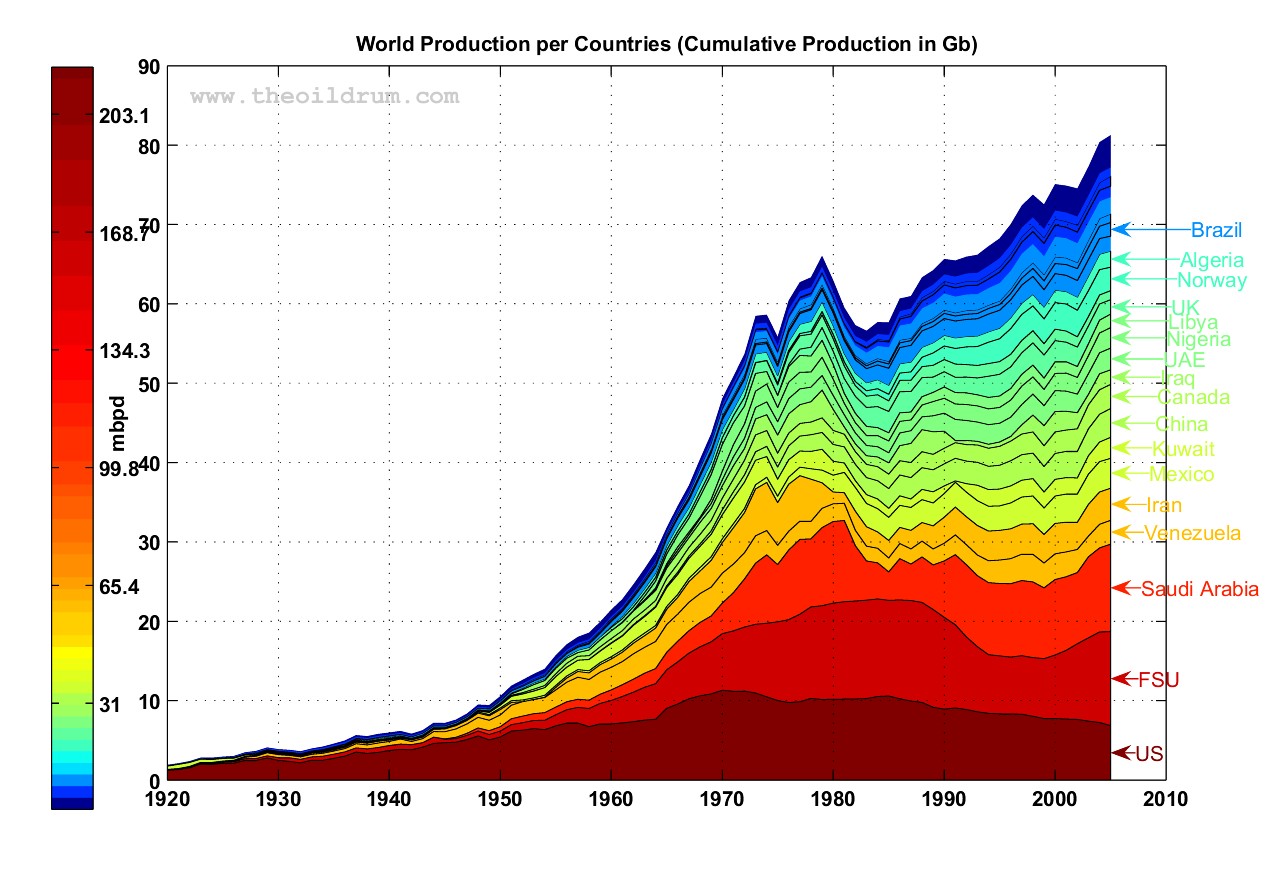

Peak resources: One concern we have at PropertyInvesting.net as the global economy moves forward is that commodities - not only oil, will peak and start to decline in production. Environmental, planning, financial and political barriers exist to mining and oil/gas/coal extraction - costs will rise, delays will be commonplace and engineering skills shortages are likely to remain. Oil, gas, coal and metals are finite resources - they are not renewable. Once used, there can be an element of recycling in metals, but oil, gas and coal are burnt and cannot be recycled. As the global population grows by 2% a year, the global GDP would normally at least match this at 2-4% a year. But as resources production peaks, the GDP would normally decline as productivity declined. Oil, gas and coal - along with uranium, "fuel the engine of global economic growth". No fuel - no growth. And if fuel becomes scarce, there will be less fuel to power the engine. Productivity would normally be severely affected. Home building - a very energy intensive operation - would become more difficult and expensive. Wood, cement, water, fired bricks and copper are required in large volumes to build property. As inflation takes hold, people have less money in their pockets. Recession can then kick-in as consumer spending drops. We'll provide more Special Reports on this subject in 2009, but in summary - we're in trouble. PropertyInvesting.net believe Peak Oil was July 2008 - and we are now in a terminal decline in oil production - it will not be able to match demand in years to come. Decline rates could be low - say 0.5%, but could be far higher - say 2-3% per annum. Meanwhile demand is projected to rise 2% per annum - the supply-demand don't balance! Oil prices will again start rising shortly - the next spike could already hit us by end 2009.

Peak resources: One concern we have at PropertyInvesting.net as the global economy moves forward is that commodities - not only oil, will peak and start to decline in production. Environmental, planning, financial and political barriers exist to mining and oil/gas/coal extraction - costs will rise, delays will be commonplace and engineering skills shortages are likely to remain. Oil, gas, coal and metals are finite resources - they are not renewable. Once used, there can be an element of recycling in metals, but oil, gas and coal are burnt and cannot be recycled. As the global population grows by 2% a year, the global GDP would normally at least match this at 2-4% a year. But as resources production peaks, the GDP would normally decline as productivity declined. Oil, gas and coal - along with uranium, "fuel the engine of global economic growth". No fuel - no growth. And if fuel becomes scarce, there will be less fuel to power the engine. Productivity would normally be severely affected. Home building - a very energy intensive operation - would become more difficult and expensive. Wood, cement, water, fired bricks and copper are required in large volumes to build property. As inflation takes hold, people have less money in their pockets. Recession can then kick-in as consumer spending drops. We'll provide more Special Reports on this subject in 2009, but in summary - we're in trouble. PropertyInvesting.net believe Peak Oil was July 2008 - and we are now in a terminal decline in oil production - it will not be able to match demand in years to come. Decline rates could be low - say 0.5%, but could be far higher - say 2-3% per annum. Meanwhile demand is projected to rise 2% per annum - the supply-demand don't balance! Oil prices will again start rising shortly - the next spike could already hit us by end 2009.

Peak Phosphorous: is another problem - phosphorous deposits are getting more difficult to locate and mines are stretched. Phosphorous is used in massive quantities for fertilizer for efficient food production. If shortages occur, fertilizer will be more difficult to come by - food prices will rise. Agricultural productivity could drop - with all the negative consequences of such a trend.

Peak Phosphorous: is another problem - phosphorous deposits are getting more difficult to locate and mines are stretched. Phosphorous is used in massive quantities for fertilizer for efficient food production. If shortages occur, fertilizer will be more difficult to come by - food prices will rise. Agricultural productivity could drop - with all the negative consequences of such a trend.

Peak Water: is another concern - the world uses far too much water - much of it is wasted in leakage - some estimate that over 50% of potable water in western economies is lost in old pipe-work. Climate change will probably exacerbate the problem in certain countries over the next 50 years. The unfortunate consequence in semi-arid areas requiring irrigation and fertilizer is food shortages for these populations. It so happens many of these countries have massively expanding populations - so starvation is a real concern - may be not now but in 10 to 20 years time.

Peak Water: is another concern - the world uses far too much water - much of it is wasted in leakage - some estimate that over 50% of potable water in western economies is lost in old pipe-work. Climate change will probably exacerbate the problem in certain countries over the next 50 years. The unfortunate consequence in semi-arid areas requiring irrigation and fertilizer is food shortages for these populations. It so happens many of these countries have massively expanding populations - so starvation is a real concern - may be not now but in 10 to 20 years time.

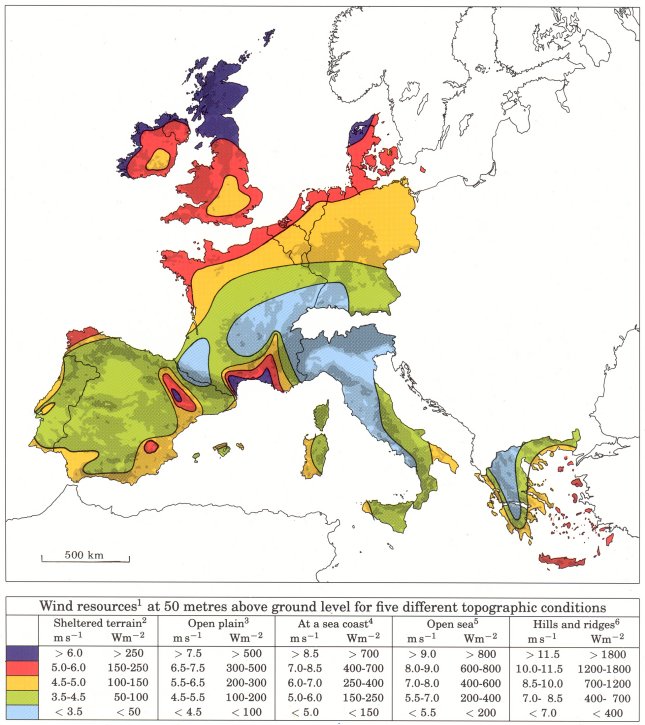

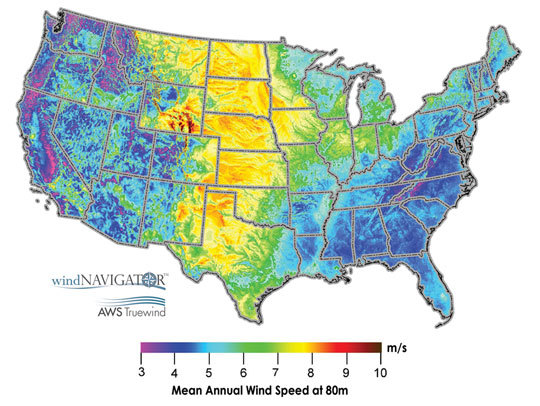

Property Investing Opportunities: The point to make here for the property investor is that shortages lead to inflation, and inflation is bad news for interest rates and GDP growth - and eventually will feed through to lower property prices in countries affected. To fully hedge yourself from these problems, it is best to invest in resource rich countries - with much water, wood, oil, gas, coal and preferably metals mining - examples are Norway, Russia and Canada. Australia is short of water, but makes up for this in metals mining. It has oil (declining) and gas/LNG (steady to expanding). The UK will find it more difficult as oil and gas production declines at ca. 5% per annum and more imports will be required and its coal mines remain uneconomic. But water is not a problem - it also has massive tidal energy reserves that can be used, and wind in western areas and offshore. As resources production peaks in oil/gas/metals/wood/water/commodities - the biggest winners will be large countries with many natural resources of oil-gas-coal-water-sun-wood-land-metals, particularly those with relatively small populations - hence more to go around. Countries with good governance, organisation, technology and banking services will also prosper - this is why long term Norway and Canada are in good positions. Russia has huge coal, oil and gas resources - also some mining and plenty of land and water. USA also benefits from large land area, massive coal deposits, mining, enough gas to for indigenous use for the next ten years, and half it's oil needs. Plenty of water in most central, north, SE and eastern areas. Countries with weak manufacturing, high wage costs, no mineral resources, small land areas, large aging populations and no real technology advantage will likely decline. Good examples are Italy and Greece, possibly Spain and Portugal - though they have much sun and heat, so if energy shortages start, at least they wont get too cold.

Property Investing Opportunities: The point to make here for the property investor is that shortages lead to inflation, and inflation is bad news for interest rates and GDP growth - and eventually will feed through to lower property prices in countries affected. To fully hedge yourself from these problems, it is best to invest in resource rich countries - with much water, wood, oil, gas, coal and preferably metals mining - examples are Norway, Russia and Canada. Australia is short of water, but makes up for this in metals mining. It has oil (declining) and gas/LNG (steady to expanding). The UK will find it more difficult as oil and gas production declines at ca. 5% per annum and more imports will be required and its coal mines remain uneconomic. But water is not a problem - it also has massive tidal energy reserves that can be used, and wind in western areas and offshore. As resources production peaks in oil/gas/metals/wood/water/commodities - the biggest winners will be large countries with many natural resources of oil-gas-coal-water-sun-wood-land-metals, particularly those with relatively small populations - hence more to go around. Countries with good governance, organisation, technology and banking services will also prosper - this is why long term Norway and Canada are in good positions. Russia has huge coal, oil and gas resources - also some mining and plenty of land and water. USA also benefits from large land area, massive coal deposits, mining, enough gas to for indigenous use for the next ten years, and half it's oil needs. Plenty of water in most central, north, SE and eastern areas. Countries with weak manufacturing, high wage costs, no mineral resources, small land areas, large aging populations and no real technology advantage will likely decline. Good examples are Italy and Greece, possibly Spain and Portugal - though they have much sun and heat, so if energy shortages start, at least they wont get too cold.

Green Infra-structure: One strategic direction for all government would be to install "green infra-structure" - renewable power systems then can then be used for electric car and vehicle propulsion. Many of these are not currently economic, but they will surely be in the future. To be proactive is key - before a crisis hits. The $147/bbl oil price in July 2008 was probably just a warning sign - how much would you pay for petrol if you really needed it to get to work and there was no other form of transport. 25 cents for a cup for oil is cheap. And it's likely never to be so cheap again. The UK is blessed with the biggest tidal energy source compared to country area than any other country in the world - the energy sources has not so far be tapped. Surely major efforts should be made to harness this energy.

Resource shortages: are bound to inflict problems with our economies in the next ten years - the global denudation of forests, rising CO2 levels, rising populations and peaking of resources will present many challenges and opportunities for business people. It's best you consider these now - rather than be blind-sided by them when they arrive. Energy prices will rise. Travel will become more expensive. Airline travel could be hit hard - consider this for far off holiday property - this market could be severely hit. Living in a city will become more efficient energy-wise. Properties in remote locations could lose value. Properties on good electric train lines will likely increase in value disproportionately. In the USA, large outlying suburban areas with large draughty energy intensive homes in cold locations will lose value. Efficient properties close to nice urban areas - in warmer climates will likely increase in value disproportionately.

Resource shortages: are bound to inflict problems with our economies in the next ten years - the global denudation of forests, rising CO2 levels, rising populations and peaking of resources will present many challenges and opportunities for business people. It's best you consider these now - rather than be blind-sided by them when they arrive. Energy prices will rise. Travel will become more expensive. Airline travel could be hit hard - consider this for far off holiday property - this market could be severely hit. Living in a city will become more efficient energy-wise. Properties in remote locations could lose value. Properties on good electric train lines will likely increase in value disproportionately. In the USA, large outlying suburban areas with large draughty energy intensive homes in cold locations will lose value. Efficient properties close to nice urban areas - in warmer climates will likely increase in value disproportionately.

Home Renewable Energy Systems: We also believe many homes in 20 years time will have their own small roof mounted windmill and PV solar cells. Garages will have electric cars. The car will be charged  overnight. There will be a move away from big integrated power systems to small local (single home) renewable electric units. We'll be using oil for chemicals, plastics, drugs - there wont be enough for cars and trucks - these will convert to electric (from wood, hydro, coal, renewables power plants). Corn to ethanol will be dead - we'll need the corn for food. And algae to bio-diesel will help fuel the old fleet of oil burning vehicles.

overnight. There will be a move away from big integrated power systems to small local (single home) renewable electric units. We'll be using oil for chemicals, plastics, drugs - there wont be enough for cars and trucks - these will convert to electric (from wood, hydro, coal, renewables power plants). Corn to ethanol will be dead - we'll need the corn for food. And algae to bio-diesel will help fuel the old fleet of oil burning vehicles.

Practical Ideas: A very simple way to create energy in your home is to paint your roof black - to absorb heat - in cold climates. In hot climates, paint it white or metallic - therefore reflecting heat (and thence reduce air conditioning bills). A simple way to gain solar power is to put a few jet back painted central heating radiators on your roof facing south set at the roof angle (normally ca. 35 degree) - hook them up to your central heating system and immersion hot water system for showers etc - and away you go. At night you can close the system to prevent heat losses. No expensive PV cells - just heat absorbed onto a black metal surface. Total cost could be as low as £1000 for such a system. You should get 70 deg C heat on a sunny day. And loft insulation is another quick win - if you haven't got at least 3 inches thickness in your roof, you'll be losing valuable heat and wasting money.

There are many property investing opportunities around these new businesses - and we encourage you to consider how you might purchase property in areas least affected by peak resources. We'll expand on these themes for you in future Special Reports on the website.

There are many property investing opportunities around these new businesses - and we encourage you to consider how you might purchase property in areas least affected by peak resources. We'll expand on these themes for you in future Special Reports on the website.

If you wish to refer to our prior Special Reports on Peak Oil, commodities and metals - and the impact these have on property investing, please click on the reports below. We hope you find these interesting:

- 246: Peak Oil - called July 2008 - massive switch needed despite $35/bbl oil

- 244: It's the oil price again - it caused the recession

- 243: Oil price crash sows seed for next massive oil spike

- 242: Oil, Cars & Property - what we'd do if we were UK Prime Minister

- 238: Oil, Cars & Real Estate - what we'd do if we were Pres. Obama

- 191: Oil Price Update and Real Estate

- 187: Real Estate and the commodities super-cycle

- 186: Oil price starts to skyrocket as predicted - how to profit

- 180: Oil prices continue to skyrocket

- 172: Make serious money - best investment sectors

- 169: Oil supply crunch begins… protect yourself

- 168: Alarm bells ringing - oil price shock now on the horizon

- 163: Making Serious Money as asset prices plateau - resources and property

- 161: Resources winners and losers - ranked list for property investors

- 160: Find out the winners and losers in the biggest oil boom in history - about to happen...

- 159: Massive oil boom - the winners and losers - be prepared

- 158: Supply and demand scenarios - oil boom and the property investors insights

- 157: Impact of "Peak Oil" for Property Investment

- 151: Oil price $125 / bbl and rising…how to take advantage in property

- 150: Peak Oil shortly due to be reach - unique insights for a property investor

- 148: Take advantage of the oil/gas/coal boom - key insights

Drax Power Station Coal Burning Power in UK (CO2 emmissions) - UK's largest power plant

Wind Map England, Europe and UK - a source of renewable energy

Wind Map USA - Renewable Energy Source

World Oil Production - courtesy from www.theoildrum.com

PropertyInvesting.net called Peak Oil July 2008 (in Oct 2008)