231: UK inflation, house prices and growth for the next 2 years

10-18-2008

PropertyInvesting.net team

Okay, the last few weeks have been very turbulent. Fear and panic have gripped global financial markets. Emerging markets have no been hit hard. No-one claims to have seen anything like it before. Stories and talk of a Great Depression or years of recession abound.

Yes - it's bad. What's going to happen next? People feel like the whole world has lost financial and economic control - things are caving in around them. So it's time to "snap out of it". Not a popular thing to say at present. People fear being shot down, or being branded the last of the optimists. Undoubtly it's gloomy and its difficult to predict when things will improve. But remember all those other panics:

Yes - it's bad. What's going to happen next? People feel like the whole world has lost financial and economic control - things are caving in around them. So it's time to "snap out of it". Not a popular thing to say at present. People fear being shot down, or being branded the last of the optimists. Undoubtly it's gloomy and its difficult to predict when things will improve. But remember all those other panics:

- Back Monday 1986

- Invasion of Kuwait

- AIDS global epidemic

- Asian currency crisis

- Dot-com bust March 2000

- 9/11 Sept 2001

- SARS global epidemic 2002

- Iraq invasion

- Global warming 2007

- Peak Oil Q1 2008

They all seem like distant memories. Is this any worse? Warren Buffett does not seem to think so - he's started buy US stocks like there is no tomorrow. He central ethos - when other people panic, he gets greedy. He buys on lows (panic) and sells on highs (euphoria) - or holds for the long term good quality companies. So if you copy Warren Buffett, you'd be buying US assets today. If you're in the UK, it's about eight months behind the US cycle, so it would be buy time end Q2 2009.

We've tried to take an objective look at the UK inflation, interest rates, GDP and House Price Inflation (of deflation), to map out a scenarios which is our base case. It's probably a bit more optimistic than most people believe at present, but we base this on previous reactions to financial crises, shocks and oil price changes.

Central to our argument is that oil prices have crashed to $70/bbl. We believe OPEC will cut production in the next few weeks by 1 million barrels a day, and this will be enough to set oil prices in the $75 to $100 per barrel range for the next year. A far cry from the $147 per barrel earlier this year - hence oil prices will have halved.

Food prices will drop, oil-energy prices will drop and as the US and European economies slow and unemployment rises, inflation in the UK will drop like a stone. It will drop from 4.7% today to about 1.5% by second half of 2009. This will allow the Bank of England to jack down interest rate s aggressively in stages to 3% by mid 2009. At this point we believe financial markets will free up, stock prices will rise in anticipation of a new economic growth cycle and dare we mention it - house prices will rapidly recover. By end 2009, we believe pent up demand from two years of very low market activity and almost no building will lead to house prices not only stablizing but actaully rising once more. From mid 2007 peak to trough, if our expectations are correct will be about -20% (or -27% if annual CPI inflation is added to this). We expect strongest growth starting end 2009 in London and southern England (>6% per annum house price increase 2011-2012), with a more moderate and later recovery in the Midlands and North of England (3-5% per annum 2011-2012). With Scotland not not seeing such a severe slowdown and mor stability than England, particularly the Aberdeen and Edinburgh areas.

s aggressively in stages to 3% by mid 2009. At this point we believe financial markets will free up, stock prices will rise in anticipation of a new economic growth cycle and dare we mention it - house prices will rapidly recover. By end 2009, we believe pent up demand from two years of very low market activity and almost no building will lead to house prices not only stablizing but actaully rising once more. From mid 2007 peak to trough, if our expectations are correct will be about -20% (or -27% if annual CPI inflation is added to this). We expect strongest growth starting end 2009 in London and southern England (>6% per annum house price increase 2011-2012), with a more moderate and later recovery in the Midlands and North of England (3-5% per annum 2011-2012). With Scotland not not seeing such a severe slowdown and mor stability than England, particularly the Aberdeen and Edinburgh areas.

What is most likely to happen is a waiting game. People reluctant to move at lower prices and holding off from selling. Buyers holding of from buying in expectation of further price drops. Then interest rates will shoot down and then, the hurd will get wind prices are starting to rise - both normal buyers, buy-to-let investors and first time buyers - then they'll start coming back with a fairly firm response when rates get to 3% and movement starts.

So be aware, the downturn might be quite sharp and severe, but the upturn could also come very quickly as well - with key double stimulations of far lower oil prices, inflation and interest rates jacked down to 3% - cheap money. Once the banks start lending and confidence returns, expect a quick upturn - and don't hang around when it arrives - if you want to get a bargain and buy on the low.

Only other thing to consider is, the last time there was a stock market crash in 2000 the late 2001, house prices boomed for the period 2002-2007. The reason - interest rates shot down and borrowing costs declined.

Only other thing to consider is, the last time there was a stock market crash in 2000 the late 2001, house prices boomed for the period 2002-2007. The reason - interest rates shot down and borrowing costs declined.

We expect on last good house price growth cycle - possibly from late 2009 to 2012 in the UK. The, we're afraid with all those wealthy retiring baby-boomers - it might be a good time to get out of stocks all together and sell down a good portion of your property portfolios.

Objective advice as always, we try and help our visitors. And yes, we might be wrong, no-one has a crystal ball. After the stock market crash in early October, another hurricane came through 22 years after the last one! - but this is our honest bse scenarios - an we are not buying at present. Instead, we will hold off until first half of 2009 for some bargains, then jump backin before the movement up starts again.

Hope the chart below helps. We know we'll be wrong in our prediction, but we think we'll be less wrong than most!

UK House Prices

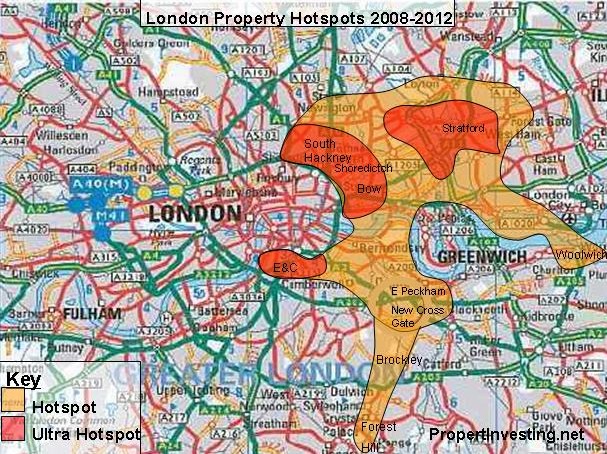

London Property Hotspots 2008-2012

Hotspots