230: Fear and panic grip the global financial markets

10-11-2008

PropertyInvesting.net team

Meltdown

This weeks financial meltdown has probably spooked you - it certainly has us. The contagion effects of US sub-prime mortgages that began August 2007 seems a long time gone by. The contagion has spread fro the USA to the UK, EU and now global banking sectors and started affecting all stock markets around the world this week. Most stock markets are now down between -28% and -33% this year. Bank shares have dropped in some cases tenfold - some other banks have gone under. Fear and panic have swept the markets. Governments and central bank involvement has become common place. The threat of a global recession is now very real, many say it's likely in 2009. No-one really fully understands what is going on - the route causes or the remedies. Hence there is a fear of lack of control in the financal markets, doubts about income growth, losses and whether the world economie are heading for a prolong period of recession or not. Russian, Ukrainian and Indonesian stock markets were closed in an unprecidented  move because of the rout. The Dow Jones dropped 8% on the open of trading on Friday 10th October - then rose 8% again in late trading. The G7 Finance Minister meet President Bush this weekend and European leaders are meeting to try and find a coordinated approach to stablising the global markets.

move because of the rout. The Dow Jones dropped 8% on the open of trading on Friday 10th October - then rose 8% again in late trading. The G7 Finance Minister meet President Bush this weekend and European leaders are meeting to try and find a coordinated approach to stablising the global markets.

It's Oil Again

As we have forewarned previously, every time oil prices have risen dramatically in the last 40 years, a recession in Europe and USA has been a consequence. 1971, 1981 and 1991 are examples. This times seems no different. The pain of oil prices rising from $10/bbl in 1999 to $147/bbl by mid 2008 has been too much for western economies to bear - USA $1 Trillion annual oil import bill (at $125/bbl) was too much. You can refer to our expert analysis on this subject in the special reports below. Now a period or retrenchment and asset price deflation has started - the bubble has burst. And no-one seems to know when it will end.

191: Oil Price Update and Real Estate

187: Real Estate and the commodities super-cycle

186: Oil price starts to skyrocket as predicted - how to profit

180: Oil prices continue to skyrocket

172: Make serious money - best investment sectors

169: Oil supply crunch begins… protect yourself

168: Alarm bells ringing – oil price shock now on the horizon

163: Making Serious Money as asset prices plateau – resources and property

161: Resources winners and losers - ranked list for property investors

160: Find out the winners and losers in the biggest oil boom in history - about to happen...

159: Massive oil boom - the winners and losers - be prepared

158: Supply and demand scenarios - oil boom and the property investors insights

157: Impact of "Peak Oil" for Property Investment

151: Oil price $125 / bbl and rising…how to take advantage in property

150: Peak Oil shortly due to be reach – unique insights for a property investor

148: Take advantage of the oil/gas/coal boom – key insights

Now oil prices have dropped to $80/bbl, even the Middle Eastern and Russian economies have been affected. It's likely on November 17th that OPEC will meet and cut production, to stablise oil prices in the range $80-$100/bbl. Longer term, investment will be hit and when the global economies come out of this period of weakness, it's likely supply problems will persistent. Oil demand will drop back in the short term because of the weakness in the global economy, but the outlook medium to longer term still looks tight.

Stocks Crater

Some point to the bottom of the stock market and real estate market, others are more pessimistic and say its the start of a prolonged bear market and possible deflationary period "a al Japan in the 1990s". $7 Trillion has disappears from stock markets this year - noone knows whether people have this money stashed away, whether it has moved, been lost or whether it was ever real money in the first place!

real money in the first place!

People that sold up early 2008, before the stock slide are quietly feeling pleased with themselves. Meanwhile all those people who were just about to retire are feeling like they've got to work another five years. May be their opportunity has been lost. Yes - its so far been depressing, distressing and nerve-racking.

And we wander whether we should pile into the market at it's current low (is it a low?) - and see prices rising sharply in the next year, but most people have been burnt - and are thinking "I don't want to get burnt further".

Now, we're property investors - and we can't claim to be experts at financial and stock markets. We generally avoid investing in stocks and shares. Stock markets crashing 33% has highlighted just how volatile stocks are - and how quickly the smart people are able to sell up and head  for the hills. This is one reason why we chose property investment rather than stocks. This sounds so familar - remember 5 years ago when pension cratored - the same has happened again. We're quietly hoping a similar thing will happen to the last stock market bubble that burst in March 2000 then went further south after 9/11 end 2001. That people have pulled their cash out and will re-invest in property. But frankly this is looking at things through rose tinted glasses. Because it's so difficult to borrow money - credit controls are so stringent - many property investors are reluctant to chance multiple refusals and these results being inserted into their personal credit ratings. Lack of finance and lack of motivation to get new finance - particularly as property prices are still dropping in almost all areas - will not help stimulate the property market. The governments financing of failed banks is also likely to lead to increases in taxes - just when people can least afford them.

for the hills. This is one reason why we chose property investment rather than stocks. This sounds so familar - remember 5 years ago when pension cratored - the same has happened again. We're quietly hoping a similar thing will happen to the last stock market bubble that burst in March 2000 then went further south after 9/11 end 2001. That people have pulled their cash out and will re-invest in property. But frankly this is looking at things through rose tinted glasses. Because it's so difficult to borrow money - credit controls are so stringent - many property investors are reluctant to chance multiple refusals and these results being inserted into their personal credit ratings. Lack of finance and lack of motivation to get new finance - particularly as property prices are still dropping in almost all areas - will not help stimulate the property market. The governments financing of failed banks is also likely to lead to increases in taxes - just when people can least afford them.

What's Next

Now the fear of unemployment as companies and governments lay of workers - and the effect this might have on property prices, payments and the banks - is the next key concern. The IMF now think UK unemployment will rise rapdily to 6% in 2009. It is possible stock markets and confidence could improve quickly, but it's more likely the gloom will be prolonged for a year or so, and companies will lay off workers - other companies may go under. In summary, a big shake out has started. Cash is king and asset prices have started a drop - with the end of the asset price drop is uncertain.

We wish we could be a bit more specific about where things are heading - but as you can understand, we're in the dark like most governments, city analysts and stock markets. If you would like to look at the three scenaros we mapped out last month, please refer to our Special Report 225.

Inflation, Interest Rates and Property Prices

We believe the UK's GDP growth will now slow very rapildy to zero or negative territory based on contraction in services industries, manufacturing, tourism, and a tightening of public spending. We also believe inflation will crash from 4.7% last month to about 1% by early 2009. The Bank of England will follow these trends down with interest rate drops - from 5% early last week, as we know now 4.5% on 8 October to about 3% by end Q1 2009. This will be the only way they will be able to try and avert a full recession. Inflation will almost certainly shoot down now oil prices have crashed from $147/bbl to $80/bbl (this should shave off 2% on its own). The key question will be, whether this will be enough to stimulate the propery market and prevent a fully fledged house price crash. If mortgage borrowing starts to become freely available again, we say - yes - by mid 2009, the worst will be over. But if borrowing and the credit crunch continues and deflation looks a possibility, then we could be in for a protracted period of house price crash then stagnation of property prices - and property prices could continue to deflate over a 5-10 year period. The most likely outcome is that the government will be able to inflate the economy back using all the global learnings of the last 20 years, whilst inflation will ease from its current level of 4.7% and conditions will get back to more normal - though lower GDP growth levels by end 2009. The downside is - a severe recession and even a prolonged depression.

Silver Lining

The good news is - inflation will drop dramatically in the next year. Petrol prices and energy prices will drop. Food prices will drop. Interest rates will drop and eventually mortgage rates and payments will drop. Okay, GDP growth will also drop and unemployment will likely rise with this. One would hope this will lead to stablisation of the property market but unemployment and higher taxes remain a concern - property prices rising will depend on banks starting to lend again and consumer and business confidence returning. As advised on 2nd October - don't buy now. Wait until the bottom of the UK property market is reached and it seems no time soon - it will probably be about 8 months earlier in the USA if our analysis is correct - the bottom could be reached by year end in the USA.

The good news is - inflation will drop dramatically in the next year. Petrol prices and energy prices will drop. Food prices will drop. Interest rates will drop and eventually mortgage rates and payments will drop. Okay, GDP growth will also drop and unemployment will likely rise with this. One would hope this will lead to stablisation of the property market but unemployment and higher taxes remain a concern - property prices rising will depend on banks starting to lend again and consumer and business confidence returning. As advised on 2nd October - don't buy now. Wait until the bottom of the UK property market is reached and it seems no time soon - it will probably be about 8 months earlier in the USA if our analysis is correct - the bottom could be reached by year end in the USA.

On a Lighter Note

We're ending on a philosphical note - courtesy of Hulettes White Sugar wrappers from Africa:

Just be what you are and speak from your guts and heart – it’s all a person has. HUBERT H. HUMPHREY

Now is no time to think of what you do not have. Think of what you can do with what there is.

ERNEST HEMINGWAY

Treat people as if they were what they ought to be and you will help them become what they are capable of becoming.

JOHANN WOLFGANG VON GEOTHE

You should always keep your word. All the setbacks in life come only because you don’t keep your word.

SIVANANDA

If you’ve only one breath left, use it to say thank you.

PAM BROWN

It is better to suffer wrong than to do it, and happier to be sometimes cheated than not to trust.

SAMUEL JOHNSON

If you propose to speak, always ask yourself – is it true, is it necessary, is it kind?...

GAUTAMA BUDDHA

When we can’t dream any longer, we die.

EMMA GOLDMAN

Health is Wealth

And remember, it's only money - we know how important this is, but never forget health and your family/friendships are most important. You can lose money and get it back with time, but health and wealth go together - often you can't get them back - and your family will always be number one.

Very Light Relief

And now for those who have read to the end of this article, go no further unless you want to laugh. For some very light relief, if you ever feel stupid for any reason (not selling your shares in early 2008 could be an example) - just put this into context with the opportunities we have located below. Enjoy..

Romanian Tractor Driver gets some help stabilizing with ballast from his wife

This overloaded car in USA has having problems moving forwards

This load in Pakistan back-fired - ever felt like a jackass?

This farmer even looks like a jackass

This London Council went completely overboard with the double yellow lines - they were serious

Believe it or not, this is Gemma Atkinson, daughter of Mr Bean

What about this for a stupid sign

This guy must feel stupid taking a power walk with his cat

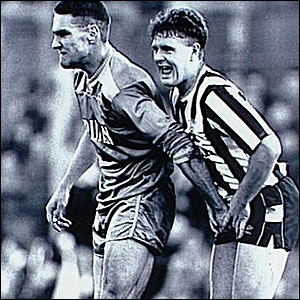

And finally - Vinnie Jones's famous below-the-belt grab at Gazza circa 1984

If you have any comments, please contact us on enquiries@propertyinvesting.net