227: Importance of Tube and Metros to European City Property Investment

09-29-2008

PropertyInvesting.net Team

This special report provides a listing of Metro Maps to assist international property investors in maing their decisions on which property to purchase.

Why have we done this?

In general, the better the infra-structure communications, the higher the property prices and the higher the expected property price increase in future years will be. This is because Metros are used to transport workers to their jobs. These jobs wealth (wages, bonuses, income, company profits) are what pays for property purchases and rental of property. The closer a city centre, in general, the higher the prices. Again, proximity to jobs, services, leisure, shops, theatre - all play a large part in increasing property prices the closer to a city centre one gets.

If ytou havce rental property, and this is further than 5-10 minutes walk to a Metro station, in Europe you can find it very difficult to rent out. The closer to the station the better. Convenience is king when it comes to rentals.

Can you show me a few examples?

If you purchase property in an area without a Metro station, that then gets one (one is built) this is even better - asset prices will rise significantly in most European cities. Some examples are:

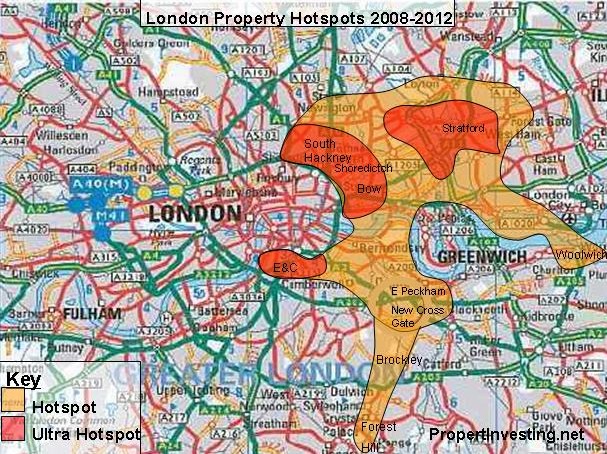

1. London 2010 East London Line (new tube)

- Haggerston

- Brockley

- Forest Hill

2. London Docklands Light Railway Connection - 2010 (new rail link to City-Docklands)

- Woolwich

3. Ebbsfleet - Gravesend (20 miles east of London)

- Commuter trains from 2010, new station openned 2007

What should I avoid - what should I do?

If you want to make serious money investing in low risk areas, if you purchase residential property in regenerating urban areas where a new Metro station is shortly due to open, you will very likely see exceptional investment returns.

The maps below are meant to guide you - do not purchase property in these cities without first studying and refering in them. Do not buy property miles from any Metro. Try and pruchase property a short distance from a fast Metro connection to the biggest employment areas (financial districts).

The very final map we show you is the PropertyInvesting.net London Hotspot map for the period 2009-2012 - these are will benefit from new tube connections, Olympic infra-structure upgrades and proximity to City and Docklands jobs, plus the West End. They are some of the lowest priced areas in London at present, and will likely see large increases in the run up to the Olympics in 2012. As Sydney, Athens, Beijing and Barcelona all did.

New York Map

Barcelona Metro Map

Spain

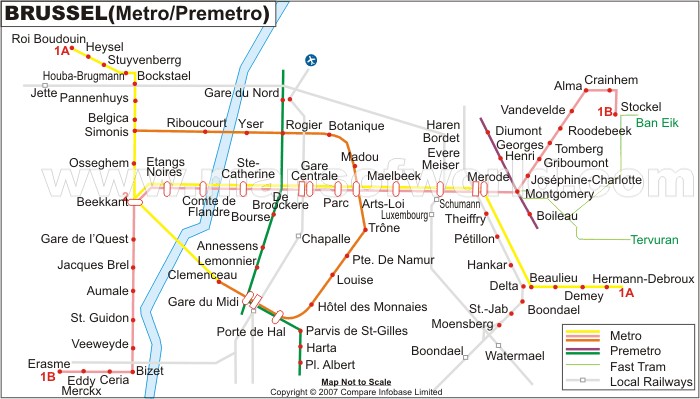

Brussels Metro Map

Belgium

Athens Metro Map

Greece

Paris Metro Map

France

Washington Metro Map

USA

Moscow Metro Map

Russia

Shanghai Metro Map

China

London Property Hotspot Map - where tube and rail infra-structure developments are planned

London

New York Metro Subway Map

USA

Metro Subway Map New York

USA

New York Metro

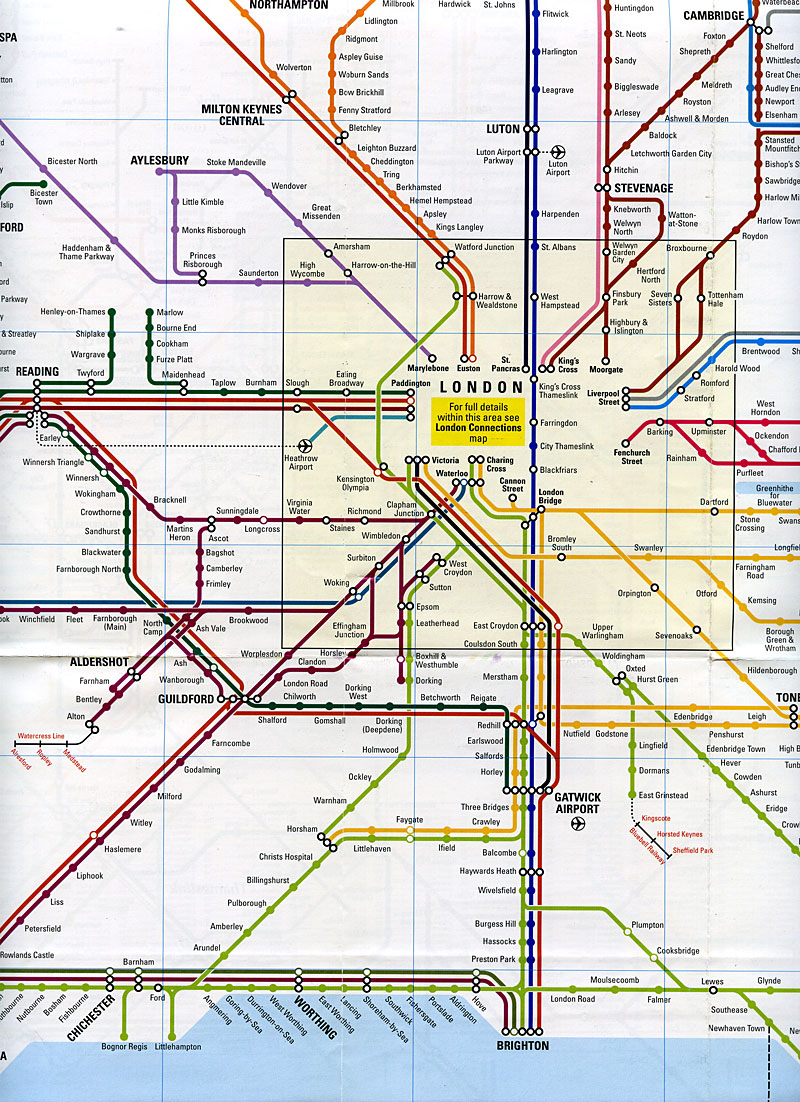

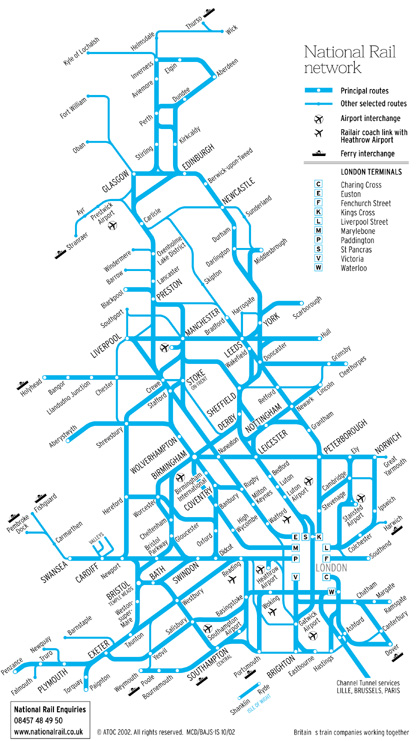

London Rail Map

London Metro Rail Map

Southern England and London Rail Map

Rail Map England

L.A-Subway Map Los Angeles USA Metro

www.google.co.uk

Moscow Metro Map Russia Tube Underground