168: Alarm bells ringing - oil price shock now on the horizon...

10-15-2007

PropertyInvesting.net team

Warning - Warning - Alarm Bells Ringing

Today, oil prices hit $86 per barrel. Our prediction in August was that oil prices would rise from $70 per barrel to $125 per barrel by end 2008 - this is starting to become a reality - but you aint seen nothing yet. We now predict that speculators will pile into the market before the winter period and drive price up quickly. As previously advised, any oil price above $80 per barrel should start the property investor's alarm bells ringing. It leads to higher inflation, higher interest rates and lower property prices in oil importing nations.

We can now put our readers on an amber warning status - it's now become precarious and we now  advise to go very carefully in property investing in any oil importing nation. To find out which countries are paricularly exposed to oil prices, read our Special Report 161.

advise to go very carefully in property investing in any oil importing nation. To find out which countries are paricularly exposed to oil prices, read our Special Report 161.

To take advantage of higher oil prices read our Special Report 160 and 159.

If you think there is plenty of news on "Climate Change" at the moment, this time next year - you'll find all the talk about "Peak Oil" - that is, the end of low priced oil. We want all our website visitors to fully understand the threat that "Peak Oil" will have on property investment, and ways you can mitigate your risks by investing in cities and countries that are positively exposed to high oil prices.

Food prices will also shoot up. It takes 5 barrels of oil to produce 1 barrel of food in calarie-energy equivalent terms. Food is very oil intensive. So food, transport, air travel, and goods and service prices will all rise because of oil prices rising. This will damage economies such as Spain, Italy, Germany, France, USA, South Korea and Japan. The UK will fair moderately because it produces half it's energy needs. Russia, Norway, Kuwait, Saudi, UAE, Qatar, Canada and Brunei will be some of the winners.

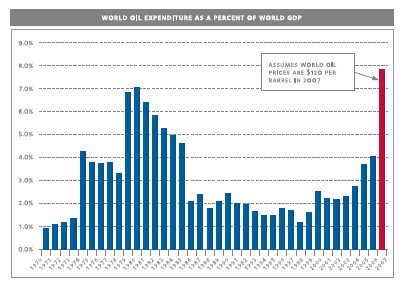

When oil prices reach $125 per barrel, 8.5% of the global GDP will be spent on oil - and there will be an almight transfer of wealth from the oil importing nations to the oil exporting nations. So read our special reports on the supply demand situation, and please do not get caught out. High oil prices will have a profound impact on our economies moving into the next few years. Some countries will go into recession because of it. Other will become immensely rich. The economic power and wealth will shift - like it did in the early 1970s to 1983, until the oil price crash of 1986. We have spent years modelling oil - our team expert economist has mathematically modelled Peak Oil - the supply and demand situation - and our unique model is now available for your use. We now believe the world is on plateau oil production - 86 million barrels a day - it will not rise any further - it will likely not drop like a stone either. But demand will rise by an extra 1.3 million barrels a day in each year. Meanwhile, we are burning 30 billion barrels of oil a year - the same as USA's total remaining oil reserves each and every year! But we're only finding about 5 billion barrels of new oil fields.

When the demand exceeds supply by 5% in about 18 months time, this will be enough to double oil prices - hence our $125 per barrel prediction. It's been too cheap for too long. We'll now get the mother of all shocks. No more 10 cents of cup of oil - cheaper than bottled water. More like 25 cents a cup - the same as bottled water! No longer will be treat oil like water. We'll treat it like a finite resource that is running out and cannot be replenished.

Protect your investment. And don't say we did not warn you!