Monetary Policy, Fiat Currency Printing, Gold-Silver and a Coronavirus update - for property investors

12-07-2020

PropertyInvesting.net team

Monetary Policy: For property investors, it is very good to understand the fundamentals of monetary policy and inflation in relation to whether you believe long term that property investment is the way forwards. The reason for this is because inflation, interest rates, the debit erosion over time with inflation is a very important part of assessing value creation, and ultimately return on investment.

Inflation Game: When you buy property investors are often playing the long game on inflation. As debit either stays the same in nominal terms or decreases in real terms and/or if you have repayment plans for mortgages the value creation increase as inflation drives up proper ty prices. Some people believe property prices will drop or stay permanently depressed but as decades have passes these forecasts have been proven to be wrong for the last century.

ty prices. Some people believe property prices will drop or stay permanently depressed but as decades have passes these forecasts have been proven to be wrong for the last century.

Leverage: If you buy property, you are normally borrowing money to then leverage up so any house prices increase have a multiplier effect. For instance, if you put a deposit down of 20% on a £200,000 house, then the property price rise just 10%, you have a 100% return on investment before tax and costs/fees. Its difficult to make such return in stocks and shares in large part because bank do not allow you to borrow money to invest in stocks and shares.

How Do Most People Make A Million? Ask yourself do I know anyone that has made a paper profit of say £500,000 on stocks and shares? Then ask yourself do I know anyone that has made a paper profit of £500,000 on property. Almost everyone will say, no and yes. This is probably why you are reading this article because property has to be the lowest risk and easiest way to make a million compared with risking investing in paper assets like stocks and shares, or bonds.

House Price Inflation Long Term Trend: Lets look at the average property prices in different periods of UK history and you will then realise how much inflation rages away every decade without fail. And there is nothing suggesting this will change in the next few decades. Even a gigantic economic crisis like COVID-19 has failed to reduce house prices so far despite rising unemployment.

Average UK Property Price

1950 £1,500

1960 £5,000

1970 £12,000

1980 £25,000

1990 £60,000

2000 £120,000

2010 £210,000

2020 £340,000

As you can see, since 1950 property prices have rise around 200 fold thats 20,000%. No a bad return on investment. We will now list a few things that will make property prices rise or fall (or stay depressed) in the next 10 years:

Prices Rising

Lack of building

Expanding population particularly in southern England

Lack of building land

Increase costs of building, raw materials, skilled labour and land

Tory government policies to try and encourage home ownership

Sterling currency printing to prop up the economic on a grand scale

Current devaluation causing international investors assess UK house prices as good value (low priced compared with US dollar, Euro or Chinese/Indian currencies) particular impact in London and major cities like Manchester (Chinese/US/Euro investment).

Low interest rates as economy struggles to gain momentum

General inflation staying subdued leading to low interest rates, wage growth and higher disposable incomes

Employment recovers sharply by mid-2021 after COVID-19 economic crisis

Prices Stagnating or Falling

Big building programmes get underway that lead to oversupply

The population expands at a far lower rate partly due to Brexit (lower immigration levels)

Building land is plentiful if government policies force the release of land or changes in planning procedures that encourage building on greenfield sites

Building, raw materials, skilled labour and land costs stay subdued

Labour get into power in 2024 leading to higher taxes, lower growth and less home ownership or demand of properties

The curtailment of Sterling currency printing leads to a major recessionary period or Sterling collapses if trust is lost in the UK government

International investment dries up particularly affecting London

Increasing interest rates as general inflation gets out of control, increasing mortgage payments and reducing prices

General inflation gets out of control driving up interest rates. Leading to relative wage growth stagnation and lower disposable incomes

Employment do not recover and actually get far worse 2021 after COVID-19 economic crisis

Gold Is Real Money

The US dollar used to be under-pinned by physical gold reserves. It was not possible to keep printing US currency unless there was gold to back it. This all changed in 1971, when President Nixon took the US off the Gold Standard to help pay for the failing Vietnam war. Ever since 1971, the US dollar has been a fiat currency that is being printed to some sort of oblivion eventually. Between 1971 and 1973 the old Bretton Wood monetary system was replaced by a de facto freely floating fiat currency system in the USA. This is also true of UK pound Sterling and the Euro. Central banks over the years keep electronically printing their currencies to prop up faltering economies and to create bail-out for banks and private sector enterprises. The inflation creates an illusion of wealth - but in a away the super rich who have access to the almost free currency get more wealthy and hide this away from the tax man by playing international games, meanwhile the poor without assets get poorer. The government need to keep the private sector going because the employment and corporations pay the taxes that are used to fund the public sector services. You don't get the public sector funded without the private sector funds - albeit governments can print their currencies to help the funding. So Central Banks keep inflating economies if deflationary periods start like COVID-19. The balance is between keep the trust of the global international investment communities versus taking the easy route out giving easy bail outs. This is why we are serious when we say that the UK pound is not real money, its a fiat currency that is constantly being de-valuing (like the dollar) and the only real money is gold.

Huge Debt Levels: Most western economies have debt levels of over 100% of annual GDP which means the debts can never be realistically re-paid. Any debt over 80% of GDP is general considered impossible to pay off. Its just possible one day Central Banks will get together and re-set debt and go back to the gold standard, but this seems unlikely and would need a massive economic collapse for this to happen in a coordinated way with central banks. Debts would be written off as a re-set occurred. This would be excellent news for property investors, but its just a ray of light at this time.

Overall Inflation Trend: But for now we should really consider general inflation to be on average running at about 2.2% a year in the UK with property prices rising slightly faster at say 3% a year over the long term 10 year trend. This means if you can load yourself up with lots of properties that just about pay for themselves on an annual basis, your returns will be high through asset value increase. Better still is to make a handsome positive cashflow and play the waiting game as property prices escalate and the true value or real term debt reduces over time. This is how property investors with large portfolios make many millions over decade terms.

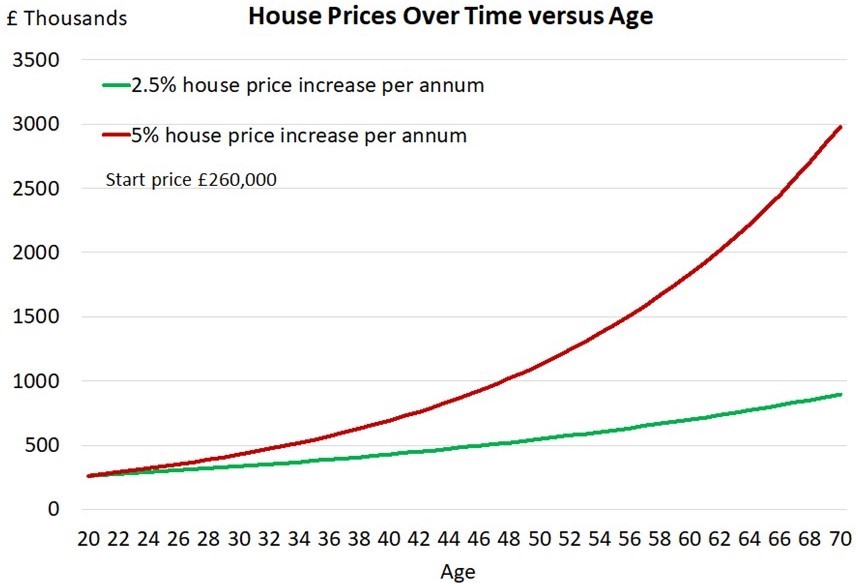

Start Young: For property investors, one of the key learnings we have is how important it is to start young. The graph below demonstrates this. If you start aged 20 with a single house or flat valued at £260,000, by the time of retirement age at 60, it should be worth ~750,000 (a ~280% increase) assuming 2.5% house price increase each year, or £1,800,000 assuming a 5% annual house price increase. But if you start at 45 years old, the property price would only rise from £500,000 to 750,000 (a 50% increase) assuming 2.5% house price increase each year. Those wasted investment years between ages 20 and 45 will have cost you £250,000 value increase for a single house/flat assuming a very conservative 2.5% house price increase. This graph below therefore shows the value of inflation and currency printing for property investors.

Its also worth pointing out that if you bought a house-flat for £280,000 with an 80% mortgage of £224,000 even if you have interest only payments, your gearing drops from 80% age 20 to ~30% by aged 60 assuming a very long extended mortgage.

Back to Gold -and Panics. Whenever there is panic either a big deflationary period or big inflationary period gold prices rise sharply. They respond to investor betting against central banks being about to control the economy. Buying physical gold is a hedge against an economic crisis or massive currency devaluation. For big investors, its though prudent to have something like 10-20% of your investment portfolio in physical gold (and silver) the real bullion. Its like an insurance policy against collapse.

Normally, when an economic shock starts, gold sometimes dips a bit in response to people simply selling get some cash to cover losses, but then central banks start programmes of printing electronic currency to devalue their currencies and helicopter drop currency into banks and private sector enterprises. This is when gold and silver prices really start to get going. There is often quite a good correlation between printed currency and gold prices rising as fit currency is created out of think air.

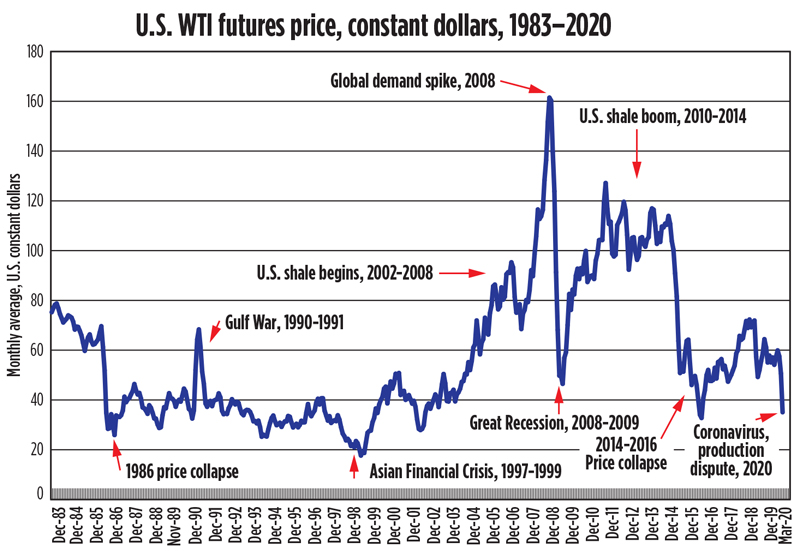

In these cycles the latest one starting mid Mach 2020 as the panic set in for COVID-19 a realisation it was deadly serious and businesses would need to shut-down as lockdowns started in UK/Europe and USA then as the currency is created this feeds through strongly to oil prices which despite demand not being strong, recover dramatically as this printed currency finds a home in commodities like oil and metals as a hedge against inflation. Smart investors start being physical assets before the economic recovery starts in earnest. This happed in 2010 and also 2020.

Based on previous experiences and historical analysis we expect oil prices to keep rising from $20/bbl in April 2020 (after they crashed from $60/bbl end 2019) back to around $65/bbl by mid 2021 as economic start to motor again and Far East/Chinese and Indian demand strengthens further.

Is Gold Expensive? If you think gold at $1840/ounce is expensive at this time, consider the following:

- Gold was $850/ounce in 1980 at the end of the last major inflationary period since then, inflation has increased ten-fold hence gold should be at least $8500/ounce at the end of the next inflationary period (just one example - remember one could buy a detached house in the UK in 1980 for £25,000 - this is now valued at £320,000).

- If one adds up all the money up in the world and divides it by the amount of gold e.g. if the world was to revert back to the gold standard, then you would need $85,000 for one ounce of gold

In 2003 gold was $350/ounce many people warn gold has risen to massive new high - a bubble, but in reality, since 2003, the amount of dollar debt and equity has risen ten-fold, so gold should actually be at least $5000/ounce today compared to $350/ounce in 2003. It's actually lagging far behind where it should be. - However, the advent of Bitcoin around 2015 probably subdued golds rise, as this became for a period the trendy alternative to holding currency as cash or betting against governments and central banks.

Oil Price And The Dollar: Another interesting consideration is the price of oil. Back in the 1960s, the oil price was about $3/bbl. Almost all of the oil price rise all the way through to $50/bbl has been because of the printing of the dollars the debasement of the dollar as a currency and the detachment of the dollar away from the price of gold - this was started in earnest in 1971 by Nixon. Governments want investors to buy their currency dollars in the US to prop up their economies and pay for public sector expansions. But in reality every year the value of these fiat currencies drop. The only things that retain true value are oil, silver and gold. The dollar today is only worth 3 cents in 1915 money just as an example. Yes, the dollar value has declined 97% in 97 years since the Federal Reserve was created.

Weimer Germany: Also consider when Germany was forced to print money to pay it's debts from 1920-1923, it's currency dropped by 97% versus gold. It was really just a gigantic transfer of wealth from the poor and middle class to the wealthy owners of gold - many headed to Switzerland. Sound familiar?

Blame It On Oil and Climate Change: Of course the politicians love to blame the oil companies for high energy prices but essentially if the dollar had not been devalued, the oil price would be $3.50/bbl. If we were still on the gold standard, oil would be at around $3.50/bbl. You can buy 30 barrels of oil for 1 ounce of gold. That ratio is about the same as in 1970 before Nixon took the USA off the gold standard. Hence the only reason why oil prices increased is because the US and other governments and central banks around the world have printed money - creating a credit line of $50 Trillion and a stimulus package of $10 Trillion in the last few years. No wander oil has risen from 20/bbl mid March to $48/bbl today.

Commodities Bull Market: As we play out this last devastating period of deflation starting around March 2020 the commodities and gold-silver will start their next bull market just like they did in 2000, then 2010 - we will see oil, gold and silver shortages and these prices will rise far higher as they are viewed as a hedge against inflation. You need to be long oil, gold and silver short almost everything else. Property with its debt is a great inflationary hedge one reason why so many rich people buy property. At least it cannot be seized, is a physical asset, one can use it and the debt will deflate away as more money is printed if property prices rise with inflation, of course equity increases over time as well.

UK Silver Investment: Also, if you are in the UK and buy silver Britannia and gold Britannia coins, you dont have to pay capital gains tax. Not bad at all. They are legal tender money. Hence no CGT. On silver, you will have to pay 20% VAT, but frankly with silver prices likely to go up between 2 and 5 fold, 20% initial tax is not a massive give on a stellar investment. Also, gold and silver coins are the least likely to be seized by government simply because they are legally money. Bullion bars are probably slightly more risky but very unlikely to be seized either no gold has every been seized before in Europe. Its certainly far lower risk than losing cash in a failed bank, or having your savings destroyed over time by inflation. Both the latter two scenarios are between "quite likely" and "almost certain to happen".

Silver is a screaming bargain Silver is currently $24/Troy ounce. It's a screaming bargain for the following reasons:

- 65% of silver is consumed in industrial processes

- The volume of silver stock is only 65% of gold stock on the earths surface (compared to 1000% 30 years ago)

- Silver will run out in 5-10 years unless there is an explosion in new mining activity

Most silver is mined close to the surface and these have all been depleted because they have been easy access - Silver is pretty close to essential in the manufacture of electronics, mobile phone, medical equipment (clean-sterile properties)

- Silver is normally a by-product of mining gold and most mined gold cost ~$1000/ounce to extract

Gold is so expensive that silver might be required to make coins if the world reverts back to the gold standard (e.g. a silver coin could be minted at $200, whilst a gold coin could be minted at $2000) - The ratio of silver to gold price is 40:1 historically silver has been 16:1 hence with gold at $1840/ounce, silver should be $115/ounce 4½ times higher than its current $24/ounce

- Some smart investor think the end of the gold bull commodities market in a few years time the Dow should equal the gold price. If the Fed keeps printing money as is certain, then inflation will take off. The Dow may stay close to 12000, but decline in inflation adjusted terms by 50% over 5 years. At such a time in the future, gold would be at $12,000/ounce. If silver was then priced at a 16:1 ratio, then silver would be $750/ounce.

Upside: As you can see there is a gigantic upside to both gold and silver. We cannot see any reason why they will not explode in price in the next few years.

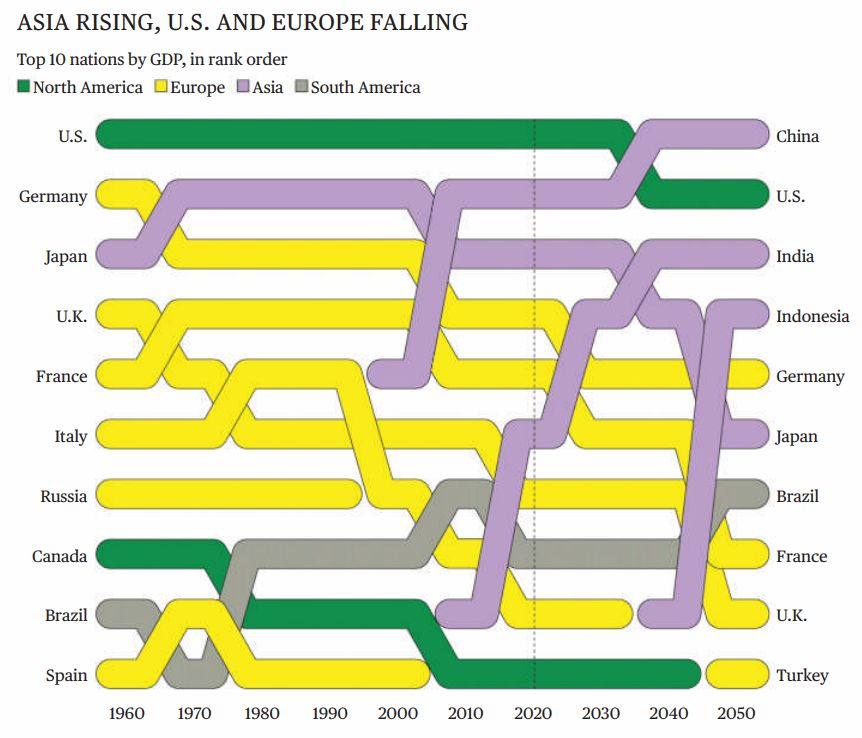

Western Decline: Developed nations in Western Europe and the USA are in decline. It will be very hard for these countries to grow. Part of the reason is higher taxes, climate change and environmental policies and regulations that lead to more expensive energy costs and business costs that should, feed through to higher commodities costs in the next 5 years things like metals, food, rare earths, fertilizers, wood, water, coal, gas and oil mean import costs rise like a tax. Even with a Tory government, with have waves of new regulations and burdens on business there seems to be no let up. Also this Tory government are have free spending populist monetary policies that are not conservative and more akin to a left leaning socialist spending government. They continue to added regulation, get more involved with often draconian rules and borrow more money. Their only way to survive is to print money. As taxes rise to pay for this, business and capital leave these countries and start-up in lower cost deregulated environments. Governments blamed the bankers in 2008-2010 and now blame COVID-19. You can look at how western ranked GDP will continue to decline in future years with this graphic below - as you can see China, India and Indonesia growth rapidly - all in the eastern hemisphere.

One thing is almost for certain, there will be continued fiat currency printing of UK pound Sterling to prop up the economy and this will lead to general inflation and also likely to inflation in house prices in a 1-5 year time frame.

We hope this Newsletter is insightful your all fellow property investors at this interesting time of UK currency printing and currency devaluation. If you have any questions or enquiries, please contact us on

www.google.co.uk (recommended search engine)