House prices to drop by up to 10% and transactions by 36% this year

05-07-2020

But Savills predicts economy and property market will recover quickly and return to pre-Coronavirus levels next year.

Nigel Lewis

Savills has revealed that house prices are to drop by up to 10% this year in the prime market as the economic downturn and the continuing difficulties of buying and selling homes impact the market.

The prediction was made during a webinar presentation yesterday by the company’s Head of UK Residential Research, Lucian Cook.

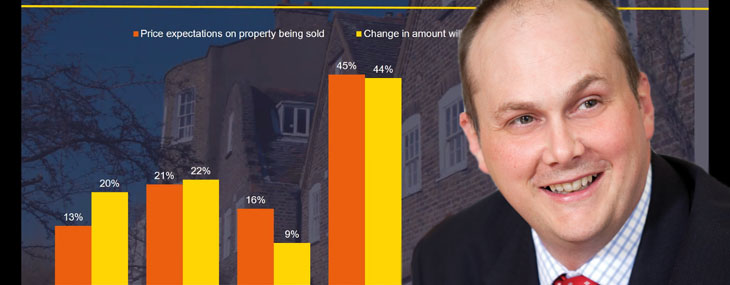

Looking at the prime market which Savills relies on so heavily, he said that 40 percent of the clients canvassed believed prices would drop, while 45% believed they would remain the same.

A further five percent, who appear to have spent too much time in their underground swimming pools during the crisis, believe prices will rise after the lockdown ends.

Savills says transaction levels will be hammered by the pandemic, dropping by 36% from 1.17 million in total last year to 745,000 this year.

In 2021 they will bounce back to 1.22 million sales and in 2022 rise even higher to 1.33 million.

V-SHAPED RECESSION

Cook said he is expecting a ‘V’ shaped recession after lockdown, which is a steep slowdown in economic growth followed by a quick rebound in house prices and activity.

Also, he predicts that the post-lockdown housing recession will be less severe than the one prompted by the financial crash for several key reasons.

These include sluggish house price growth prior to the crisis, low interest rates and swift action by the government to protect jobs and businesses.