Oil prices and property investing

12-05-2018

PropertyInvesting.net team

Oil Prices: Oil prices have crashed from $85/bbl to $50/bbl in the last few weeks which is super news for property investors, because it will help ease general inflationary pressure, keep mortgage rates lower and hence stimulate the housing prices in the UK, Europe and USA. As we have mentioned many times before, oil prices are critically important for the property market high oil prices create a drain on finances in all countries that have high oil import bills which is the bulk of European countries, South Asia and the Far East. They act like a tax. Low oil prices is like a tax cut.

Reasons for a big correction: The reasons why oil prices are crashing again is because:

- The USA have given waivers to many countries to purchase of Iranian crude that is supported to be sanctioned

- President Trump has repeatedly put pressure on Saudi Arabia and OPEC to increase production to drive oil prices down often via Twitter

- Saudi Arabia has had its wings clipped particularly Crown Prince Mohammad Bin Salmon (MBS) who is accused by Turkey and much of the western media of being behind the murder of Khoggi the Saudi journalist this has thrown a spotlight on Saudi human rights and they are not wanting to fall out further with Trump and also risk arms deals instead directionally pumping more crude than they normally would do although they d

ont want to

ont want to

Iran: The big beneficiary in the last few weeks seems to have been Iran which has been able to pump more crude than they thought and the focus has been on Saudi alleged atrocities rather than any done by Iran.

Oversupply: There is now a significant oversupply of crude in the tune of 1.5 million bbls/day which is undoing all the work OPEC did not reduce the glut over the last two year. Compounding the problem has been a slight slowing of the global economies less demand and now the market has switch rapidly from bull to bear just in the last few weeks and oil prices look like they are in free fall.

Its super for more consumers, property investors and not good for oil companies and OPEC, plus the US oil shale drillers in Texas. Oklahoma. Louisiana and North Dakota who will find it very hard to make a profit at $50/bbl oil.

We expect UK general inflation to drop sharply from around 2.4% to 1.7% in the next few months as the effects of the lower oil prices start to feed through this normally takes up to six months to fully work through. It comes at a time when house prices were starting to look very shaky with all the Brexit uncertainties and threat of a Labour government and/or another General Election.

Labour Threat: Lets be totally clear if Labour come to power house prices will crash because eventually taxes will rise, borrowing costs will rise, Sterling would crash, inflation would rise and thence unemployment would rise and the economy would sink it recession as businesses stopped investing in this challenging environment. The days of prolific spending and often useless projects (spend not invest) would start up again and the deficit would rise sharply and with it Sterling would drop. There is a real threat of Labour getting into power off the back of the Brexit turmoil the key rise period being in the next few months. The key question is whether Teressa May and her seemingly very unpopular deal will survive. Will she manage to get it through Parliament. As a property investor we hope she does because going back to the drawing board have having labour take control would cause a real crisis.

Economy Still Growing: Despite all the doom and gloom the economy is still growin g at a reasonable rate of 1.7% a year and unemployment is at a 40 year low. House prices are hanging in there. Can she muddle through and out the otherwise is the question. Can she avoid another Referendum, a leadership challenge and/or another General Election. Lets be frank, she was given a poison chalice, everyone knew it. Shes trying the fudge and steer a middle ground and the threat to all the centralists is that if she does not get this deal through the alternative would be a whole lot worse she needs to be able to convenience enough Tory and Labour centralists and Brexiteers that the alternative is just to unbearable and that they should back her fudge so the country can move on. Its not a popular proposition but maybe May will get it through. So we can all get back to focussing on the business and not Europe growth-investment and new trade deals and leave the unelected Eurocrats behind.

g at a reasonable rate of 1.7% a year and unemployment is at a 40 year low. House prices are hanging in there. Can she muddle through and out the otherwise is the question. Can she avoid another Referendum, a leadership challenge and/or another General Election. Lets be frank, she was given a poison chalice, everyone knew it. Shes trying the fudge and steer a middle ground and the threat to all the centralists is that if she does not get this deal through the alternative would be a whole lot worse she needs to be able to convenience enough Tory and Labour centralists and Brexiteers that the alternative is just to unbearable and that they should back her fudge so the country can move on. Its not a popular proposition but maybe May will get it through. So we can all get back to focussing on the business and not Europe growth-investment and new trade deals and leave the unelected Eurocrats behind.

Longer term anyone thinking about investing in property needs to bear in mind the key aspects of what sends house prices up or down. Its supply and demand. To achieve higher capital gains, you need to invest in area that:

- Are changing for the positive with new growing business moving in

- Have high population increases

- Where building supply is constrained

- Where major new infra-structure investments are being made that can-will transform an are

London Long Term Winner: Longer term London seems to be the best proposition although as we all know prices are already very high and rental yields fairly low because of this.

Larger Cities With Expanding Businesses: Further afield major cities with big commercial centres like Manchester, Leeds, Derby, Bristol, Reading, Southampton and Birmingham are probably attractive. They have expanding populations of well educated young professionals.

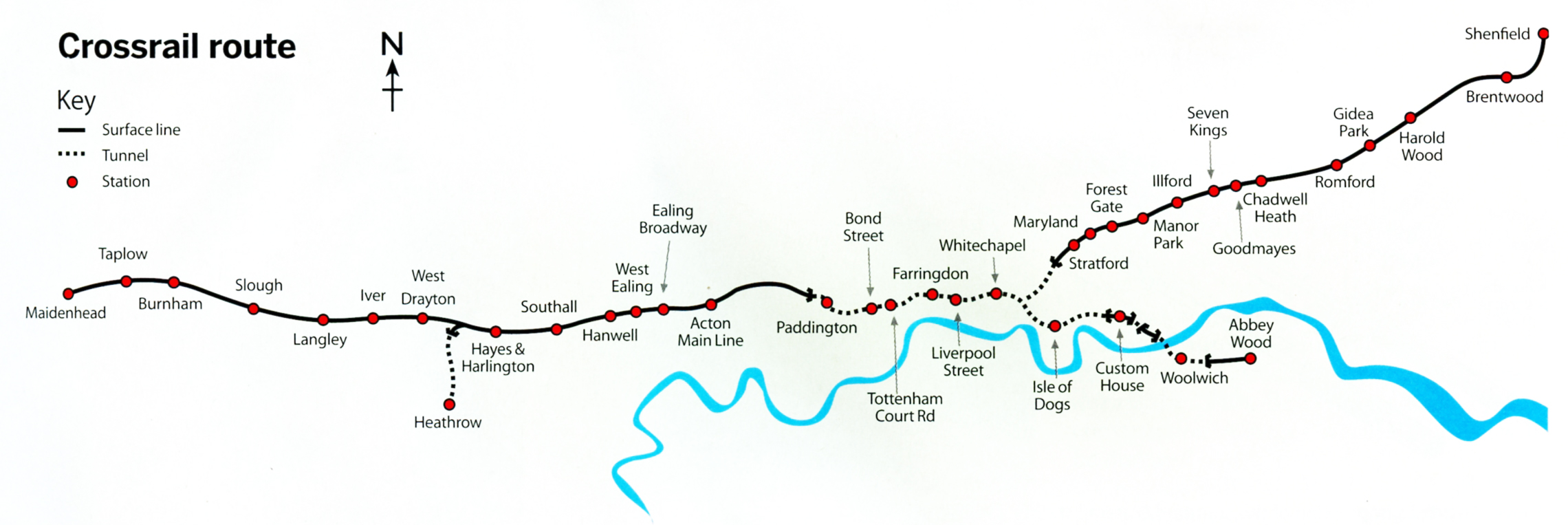

Crossrail a Key: Zeroing in on London, the big new development is of course Crossrail and around 3 months ago it was announced there would be a years delay in the finalisation of this major project which gives property investors another year to get in. This is handy because it could coincide with the worse being over on Brexit - say April 2019 if things settle down then there is still 6 months before the stations open to get a deal done.

Boom Stations: Now we are gong to be very specific. A property in a quiet street close to one of the new Crossrail stations in places like Acton Main, Paddington, Tottenham Court Rd, Forest Gate, Ealing  and Maidenhead are likely to see prices rise sharply after stations open as demand soars. This is also true of rental demand as soon as people realise how fast one can commute into the City or West End from places like Acton Main and Forest Gate, then rental prices will rise sharply.

and Maidenhead are likely to see prices rise sharply after stations open as demand soars. This is also true of rental demand as soon as people realise how fast one can commute into the City or West End from places like Acton Main and Forest Gate, then rental prices will rise sharply.

Commuting Times to Central London: If you are going to be very analytical you can take the current time and the new Crossrail time see the difference and go for the largest time difference. Places like Acton Main currently take around 55 minutes to get to the City but when Crossrail opens will drastically drop to just 20 mins this should send house prices and rental prices up sharply. Longer term its likely to just get better as these places go up market.

Previous Backwaters: Other places that have been depressed for decades and are likely to see gentrification are Hanwell, Southall, Hayes & Harlington and West Drayton in western London. In the east, Abby Wood will be transformed, as will Maryland, Forest Gate, Manor Park, and stations further afield like Chadwell Heath on the outer reaches of London please will be able to zoom into Farringdon and Liverpool Street. Its very exciting indeed.

Abbey Wood Bargains: For first time buyers who are finding it difficult to afford a place move to the sticks to Abbey Wood and rough it for a year then the station will open and transform this sleepy and rather bleak suburban transport backwater. What we are highlighting is extreme positive change from very lowest then heading towards the middle market in fairly short order. Prices in Abbey Wood should rise at least 20% in the next few years - so any first time buyer will find this drastically lowers their risks. The change of the station never opening must be less than 5%.

We hope this Special Report has been helpful in framing your property investment decisions. If you have any queries, please contact us on enquiries@propertyinvesting.nt