Eight legal ways to sidestep inheritance tax

09-11-2018

This promotion by southbankresearch.com– while not financial advice – should be read carefully. It contains the important information, facts and figures you need to make an informed decision – including the risks to your capital involved – about our research. If you are unsure whether this type of investing is right for you, seek independent personal financial advice.

Former Wall Street insider reveals…

Eight legal

ways to sidestep

Inheritance Tax

(And ensure your kids NEVER need to pay a penny to HMRC!)

HURRY: less than 100 copies remain today…

£325k.

That’s when they start bleeding you dry…

Helping themselves to all the money that you’ve left for your kids.

It’s infuriating isn’t it?

You’ve worked hard all your life.

You’ve saved diligently for your loved ones after you’ve gone.

You’ve planned and set things aside.

You’ve done everything you should. Everything you’ve been told to do.

Then the moment you’re gone, HMRC come knocking…

Saddling your children with a huge tax bill at the worst time of their lives.

And that £325k…

That includes EVERYTHING you own.

Your house, your savings, your cars, your holiday home, your stocks and shares, your assets, your art collection…

Literally everything.

It’s all fair game to HMRC. There’s nothing they won’t pilfer.

They’ll claim their slice of the pie – 40% of your entire estate – whether you like it or not.

My guess is your personal estate is way over the £325k threshold.

If you own a reasonably sized family home it almost certainly will be…

Meaning, unless you keep reading this letter…

Your kids will get stung after you’ve gone

Death tax is a veritable cash cow for HMRC.

Between 2017 and 2018, British citizens coughed up over £5.2 billion to the government.

You read that right… £5.2 BILLION.

That’s £5.2 BILLION they’re taking from people in mourning!

To my mind, it’s not right.

As part of Britain’s largest underground investment research network, I want to show you EIGHT ways you can protect what’s rightfully yours.

And ensure that when you go, your assets will benefit your loved ones as you intended them to…

And NOT the taxman’s coffers.

You won’t read about these tax secrets in the mainstream arena. You’ll likely have never heard of them, or even thought about them before.

That’s because our government doesn’t want you to know about them.

Some might see them as "fringe" or "controversial". But these ideas are often the most lucrative too.

When you claim your exclusive guide today, you’ll discover EIGHT under-the-radar wealth "shields" that you can action today, including:

- How to ensure your children won’t ever need to pay a penny to HMRC…

- The "off-market" shares you can raid to supercharge your tax relief…

- The "gift" you can make to shield a portion of your wealth from the taxman…

- The niche property sector that’s 100% exempt from "death tax"…

In a moment, I’ll show you how to keep HMRC at bay, and secure your loved ones’ future.

First, let me quickly introduce myself…

My name is Nick Hubble…

I’ve been on the inside at Goldman Sachs, and I’ll tell you now…

The system is rigged against YOU.

The government… bankers… fund managers – they’re not in it for you.

They’re in it for them – that’s just a fact.

They’ll use you as a means to an end…

Squeezing you for as much as they can to cover their backs on whatever scheme they’re running…

And to collect their fat bonuses, year after year.

It’s one of the reasons why I left Wall Street to become a senior strategist at the British division of an underground, global investment network.

I want to help regular investors like you make money.

As well as here in Britain, we have offices across five other continents, and an unrivalled stable of investment experts.

These include a former US government adviser, former Wall Street fund managers, a Pulitzer-nominated scientific journalist….

Cryptocurrency experts… master traders, award-winning investors… bestselling authors…

One of our guys is the former chairman of the International Federation of Technical Analysts…

Another managed £3 billion in client capital for HSBC…

But you’ll probably have never heard of us…

We don’t pay to advertise on TV or in the press. And we don’t receive marketing revenues from any outside agencies either.

We exist solely to help YOU make money.

It’s an unusual business model.

And it demands that our investment research is better and more original than anything else out there.

In our 36-year existence we’ve grown from a tiny startup into a vast multinational organisation…

Our London division has rapidly become the go-to place in Britain for alternative investment ideas…

Including on income protection… value investing… breakout tech-stocks… big picture portfolios… retirement and more…

All told, we’ve helped over 100,000 British investors make the most of their money.

Including people like AB who said:

“Your services have helped improve my overall savings and retirement funding, and I hope that applies to many others…”

Another reader wrote in to say:

“One of the best things I did this year (2017) was to subscribe to the amazing information and opportunities you guys provide…”

Plus Kevin, who said simply:

“My experience has been excellent. I plan to remain a subscriber for a long time to come…”

Now we want to help you.

You might be surprised at the options available to you – chances are you won’t realise they’re even on the table.

And I’ll say now…

There are two things I’d like to share with you that you need to act on immediately.

But keep in mind, when you claim your report:

“Eight legal ways to sidestep Inheritance Tax (And ensure your kids never need to pay a penny to HMRC!)…

Everything you’ll read inside is above board and 100% legal. It’s all based on current laws (that could change in future)…

It all flies well beneath the radar of the mainstream financial press...

And our government doesn’t want you to know about ANY of it.

That’s because they want to take as much from you as they possibly can.

In fact…

Your family could be forced to

“get a loan” just to survive…

Do you know what your current net worth is?

Or more importantly, how much your family will have to fork out to HMRC in the event of your death?

Well you should…

Karen, 64 years old from London*, was shocked when her partner died suddenly.

Unfortunately, she’d done nothing to prepare for the possibility of an inheritance tax (IHT) bill in the event of his death – and neither had he.

As she flicked through the 50-page IHT guideline document for the first time, she realised that her deceased partner’s bank accounts had already been frozen.

She had no means of paying any of his bills (aside from the funeral – an HMRC "exemption").

She wasn’t allowed to sell his properties, or settle ANY of the final utility bills until the IHT penalty was paid in full.

The total amount?

On their £1.1 million estate, an eye-watering £440,000.

When she asked how she was expected to cover the £440,000, she was simply told to “get a loan.”

Eventually, months later and with mounting legal bills, Karen finally settled the £440,000.

It’s £440,000 that she’ll never see again…

£440,000 that will benefit the state and NOT her children…

And during a time when she was grieving, that £440,000 was like a noose around her neck.

Think about that for a moment…

What if you go, and leave your kids in the same boat? Would they cope?

It’s something you shouldn’t be leaving to chance.

Especially when you consider that…

HMRC wants its share of your money BEFORE your children can even touch it!

That’s right…

To be 100% clear, Karen’s example isn’t a fictional account. It’s a true story and it’s not a one-off. It’s standard practice.

The taxman wants his money fast.

He issues his demand for settlement immediately.

BEFORE any assets have been passed on to your children.

So whatever your IHT liability is, it needs to be paid to HMRC before your family receives a penny from your estate.

Often, as with Karen’s case, the only means for them to pay will be from the assets within the estate itself.

So if it’s tied up in property, or stocks – whatever – your kids will need to find a way to pay the taxman, without touching anything within the "death estate."

That could mean having to endure the pain of selling off their own family home, their vehicles, or even their own business.

And HMRC demand its share is paid in full, within just six months of you passing.

After that, the interest starts.

As I said, the system isn’t set up for your benefit. It’s set up to benefit THEM.

And they’ll stop at nothing to collect their dues…

They’ll even tax you on money

you’ve already paid tax on…

In a lifetime, the average household in Britain pays over £825,000 to the taxman.

Look at how much tax you’ve ALREADY been forced to hand over to HMRC.

Your wages are taxed by up to 45%...

Any profits you make from investing – they’re taxed 25%…

When you buy a house the stamp duty is as much as 13%…

Whenever you drive your car you pay road tax…

Then there’s council tax… National Insurance… the list goes on and on.

And then when you die, the things you’ve already paid tax on are taxed again.

Worse still, it’s your family who has to foot the bill in the event of your death.

No one likes the thought of their relatives being chased for money after they’ve gone.

But the only way to ensure the taxman can’t get his mitts on your assets after you’ve passed…

Is to get your affairs in order NOW.

For many, the realisation that they’ll face a problem with IHT is something that creeps up on them.

Often, it’s too late in life for them to do anything about it, which can lead to a nasty surprise.

And the shocking truth is…

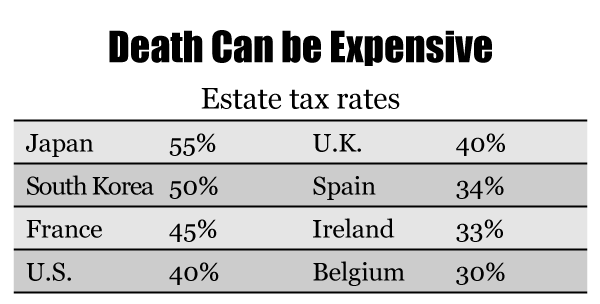

Here in Britain, we’re among the worst off on the entire planet when it comes to IHT.

In fact…

Britain is the fourth most expensive

place to die on Earth…

You might have thought that a hefty IHT bill was par for the course whatever country you live in.

It’s not.

In China, India, Russia, Sweden and even Australia…

Your estate isn’t taxed at all. And your kids don’t have to pay a penny after you’ve gone.

Even in places like Italy and Austria the amount they’re liable for is an absolute pittance – compared to what we have to cough up here in Britain.

And I should know…

My parents have moved to Austria and Australia largely to sidestep IHT.

source:taxfoundation.org

As you can see from this table, only three countries on Earth pay more IHT than Britain…

Japan, South korea and France.

I don’t know about you, but it makes me feel like we’re being robbed blind!

Is it fair?

No.

Can you do something about it?

Yes.

But you need to put a long-term plan in place, beginning right away.

Some of the things you’ll read about in your exclusive report require immediate action.

The longer you wait, the less chance you’ll have to use them to your advantage.

This isn’t something that you can sit back, forget about and just hope it’ll work itself out. That won’t fly.

Your family WILL pay the price, if you fail to act.

It’s that simple.

But follow the ideas in your report closely, and your children may never worry about having to paying a single penny to HMRC after you’ve gone.

In a moment I’ll show you how to claim your copy, but first, let me ask you a question…

Do you want to be clobbered by HMRC… or leave your wealth to your loved ones?

It should be an easy one for you – or anyone in Britain – to answer.

But the figures tell a different story…

More people than ever before are leaving their estate to the taxman, and not their loved ones.

Between 2010 and 2017, the number of families paying IHT in Britain is up 160%. By 2020 it's forecast to nearly DOUBLE again.

As I said, in the last year we paid £5.2 billion in IHT to the taxman – a record.

And as you can see from this chart, the rising value of property in the UK is one of the main reasons why more and more people are now above the IHT threshold.

.png)

Their assets are at the mercy of the taxman.

Maybe yours are too?

Well they needn’t be.

So…

Let me show you how to turn this situation to your advantage…

Your family can prosper from your estate after you’ve gone.

There’s one simple move you can make TODAY that will ensure your kids will never have to worry about covering an IHT bill in the event of your death.

It’s the first thing you’ll discover in your report, titled:

“Eight legal ways to sidestep Inheritance Tax (And ensure your kids never need to pay a penny to HMRC!)…

It’s something you probably won’t have thought about before. You probably won’t read about it in the mainstream financial press either…

- It DOESN’T involve investing in stocks…

- It DOESN’T involve setting up a trust…

- It has NOTHING to do with property…

- You DON’T need to "gift" anything to anyone…

- And you DON’T need to change your marital status or anything significant like that…

In fact, this is something that you can do easily today – in no more than a couple of hours.

It’s not overly complicated. It’s 100% legal, and it’s ethical. It’s not even a loophole. It’s just something many people don’t know about.

And I want to get you up to speed right away – because, without giving too much away here – the sooner you can act, the better.

In your exclusive report, I’ll reveal all.

Along with seven other steps you can take to ensure this whole situation plays out favourably for you and your family.

In a second I’ll show you how to get hold of a copy quickly and easily.

But right now I’d like you to understand what we’re all about here at Southbank Investment Research.

And explain why we’ve produced this exclusive guide that you can claim today.

Introducing our first-of-its kind investment advisory…

There are ALWAYS ways to protect your money from the clutches of the government and our fragile financial system…

While making potentially enormous returns at the same time.

You have to be bold… think differently… and be willing to consider ideas that you simply will not read about in the Financial Times or Bloomberg.

Some regular investors may see these ideas as too “out there”…

The fact is, there has NEVER been a better time to start thinking like this… and to start preparing for things that could help your family prosper, after you’ve gone.

Safeguarding what’s rightfully yours NOW is just the start.

In your exclusive guide, we’ll show you how your family can avoid paying inheritance tax altogether.

But there’s a lot more I’d like to show you today…

Including the secret, profitable actions you can take to secure long-term wealth. And to protect what you have in the wake of potential financial disaster.

Or in other words…

To get a portion of your money "off-grid" and OUT of the broken financial system by any means necessary…

To share the ideas that could turn potential financial disaster into jackpot events for you and your family…

To show you the secrets to making money no matter how bad things get in the financial system…

In Zero Hour Alert we share these ideas with you on a regular basis.

And if you’re worried about your family being stung with a devastating IHT bill later in life…

Or the fragility of the global financial system…

It’s absolutely vital reading.

It’s headed up by me, Nick Hubble, and my colleague Boaz Shoshan – a man who has personally helped manage millions of pounds of wealthy clients’ capital.

Put simply, our aim is to show you what you won’t find elsewhere: the unvarnished truth about our “establishment” and our fragile financial system… and the steps you need to take to survive and profit from it.

Each month as a Zero Hour Alert reader you'll get a REAL insight into what's happening in the global financial system...

Paired with actionable ways of turning those problems on their head and getting a portion of your money OUT of the broken system for good.

Chances are these "alternative" financial moves will help you sleep a lot better at night… and could end up making you a hell of a lot better off.

The bottom line is:

I don’t want the government to take your money.

I don’t want you to be hurt by the fallout from the next potential financial crisis.

So I want to show you the simple measures you can take to ensure your money isn’t at the mercy of the taxman, or our fragile financial system…

Starting with your exclusive report: "Eight legal ways to sidestep Inheritance Tax (And ensure your kids never need to pay a penny to HMRC!)".

Remember what you’ll discover the moment you read your report:

- How to ensure your children won’t ever need to pay a penny to HMRC…

- The "off-market" shares you can raid to supercharge your tax relief…

- The "gift" you can make to shield a portion of your wealth from the taxman…

- The niche property sector that’s 100% exempt from "death tax"…

Before you claim your copy however, I should remind you that this is a strictly limited offer…

Less than 100 copies are available today and I expect them to be snapped up quickly.

My advice to you is:

Take action immediately.

If you’re serious about protecting your "death estate" then you need this report in your hands right away.

And the moment you say the word, you’ll get an extra bonus…

An automatic…

30-day no-obligation FREE trial of our first-of-its-kind investment advisory, Zero Hour Alert…

You won’t need to do a thing after you’ve claimed your copy of your inheritance tax report.

You’ll instantly begin receiving our latest research in Zero Hour Alert for FREE…

And you’ll get all the benefits of a fully paid-up member without having to make a long-term financial commitment.

Here’s what’ll happen, the moment you claim your exclusive inheritance tax guide:

- I’ll rush you over your report: "Eight legal ways to sidestep inheritance tax (And ensure your kids never need to pay a penny to HMRC!)"...

- You’ll begin your FREE trial of Zero Hour Alert and receive your first issue direct to your inbox…

- You’ll get access to the members’ area where you can read all the past issues and get all the latest updates…

- Plus you’ll be able to get in touch with me and my team directly with any questions you may have about inheritance tax or anything else you read in Zero Hour Alert…

As I said, that’s all yours under no obligation for the next 30 days.

And it’s all yours to keep regardless – even if you decide Zero Hour Alert isn’t for you.

So read your exclusive report and all the past issues…

Check out our latest updates and decide whether Zero Hour Alert is right for you.

As you know…

Here at Southbank Investment Research, our insiders are the best in the business.

Some of our guys have walked away from managing hundreds of millions in client capital for some of the world’s biggest institutions to come and work for us.

Our founder Bill Bonner has written bestselling books and made award-winning documentaries.

He doesn’t publicise this of course: advertising isn’t what we’re about.

We’re a private intelligence network for investors who are serious about making money.

Our goal is bring you original, independent investment research that could help you achieve your investment goals… and more.

I’m talking about the kinds of ideas that you certainly won’t find elsewhere.

Ideas that the “establishment” don’t want you to know about.

Sidestepping "death tax" legally is just the start. It’s one of the first things you need to do to safeguard your next generation of family wealth.

But I also want to go a step further…

And in addition to your inheritance tax report and FREE no-obligation trial of Zero Hour Alert…

I want to send you a FREE bonus report…

It’s titled:

“Stealth Wealth: Four Ways to Get Off the Financial Grid.”

And it’ll introduce you to ways to move your wealth away from the fragile system, out of the hands of the taxman, sheltered from politicians and immune to whatever happens in the markets.

The moment you read it, you’ll discover…

- The exact amount of cash you should put aside as an “emergency fund” (and the exact denomination you should use too)…

- The particular types of gold bullion you should buy – and types you should avoid. (Case in fact: you do NOT want to buy 99.999% pure gold. I show you why)…

- The secret hidden system for buying gold anonymously…

- How to transfer wealth anonymously without detection – including the four-step process you need to follow to get started…

- One of the only investments that: (1) can be consumed, (2) can be sold, (3) performs well, (4) can be held for long enough to survive a financial crash, (4) diversifies your wealth, (5) has a big demand, plus much, much more...

Everything’s revealed inside your bonus report.

It’s yours for FREE the moment you claim a copy of our IHT guide and begin your FREE trial subscription to Zero Hour Alert.

This is an unmissable opportunity for you to ensure your family is set up for life after you’ve gone.

But only the first 100 people who contact me today will receive their guides and a no-obligation trial of Zero Hour Alert.

This is a strictly limited run, so if you are interested then don’t wait around.

Everything you’ll read about in your reports will give you an enormous edge over 99% of other investors out there.

But I should point out: all of the moves outlined in these two reports come with their own risks attached.

That’s why you should always think carefully when you invest your capital. Any investment involves risks that could result in you losing money. The value of any investment can go down as well as up.

The question you have to ask yourself is:

What’s the REAL risk to your capital?

My answer is – having it at the mercy of the taxman, or tied up in a broken, corrupt and fragile financial system.

Making a few simple moves to ensure your wealth benefits your family and not the taxman…

Plus taking 1-2% of it OUT of that system, is just good common sense to me.

I’m sure you agree.

But the fact remains, doing this isn’t risk free.

You will need to plan carefully, and some of the ideas in your exclusive inheritance tax guide may require professional assistance from your IFA.

Plus alternative investments can be hard to sell. In financial jargon this is known as being "illiquid". It means if you need to sell something in a hurry, it can be hard to find a buyer quickly. That's part and parcel of having some of your capital outside the system. It's not the same as a share portfolio you can cash in with a few clicks of a mouse.

To state the obvious: that's the whole point. The financial system itself is built on instant liquidity and vast numbers of buyers and sellers. That's the benefit... though it comes with its own risks, as we've been discussing.

Getting out involves different risks. Another is many "alternative" investments aren't regulated or covered by the Financial Services Compensation Scheme or Financial Ombudsman. That means you don’t have the same level of "protection" as you would with traditional investments.

I think the risks are worth it. And once you’ve read your exclusive reports, I think you will too.

So let’s get our work into your hands right away. Because the fact is…

This is information you won’t

find ANYWHERE ELSE

That’s a shameful indictment of our leaders, our media and our economists.

But it’s the sad truth.

Look at the Wall Street Journal. Look at the Financial Times. Are they providing real, practical steps to help people sidestep in legally, and to get your wealth off the grid?

No!

Most media outlets don’t even cover stories like this. That’s because the “establishment” has a vested interest in the status quo.

Most analysts would rather toe the line and pretend the academics, politicians and economists in charge of the system have everything under control, and that the system’s working just fine – for everyone.

But the truth is…

It’s set up to benefit them – and not YOU.

People don’t want to hear what’s really going on.

Government doesn’t want to hear it. They’re the biggest debtor on the planet. They don’t want to hear the end of the credit bubble is coming because they won’t be able to borrow anymore!

There are almost no serious financial actors who want to see the truth and want to talk about the truth.

It’s only we… the independent financial publishers… that can honestly report on what’s going on. And show people how to prepare.

We don’t take advertising. We’re not part of the financial industry. We’re not economists who are paid to look the other way. And we’re not big government.

We’re the only ones who are willing to tell the truth.

That’s why more 100,000 people pay to read our work here in the UK.

And it’s why we have such a loyal following of investors and savers.

In fact, since we started publishing our alternative ideas and insights, we’ve opened a lot of people’s eyes to what’s really happening in the financial world.

As one reader put it, our work is:

“A must read to REALLY understand what a calamitous situation we are living in – growing worse by the day and intensifying exponentially. IT’S A WAKE UP CALL – and NOT TO BE IGNORED! Failing to prepare is PREPARING TO FAIL!”

Another summed up my attitude to crisis preparation exactly, saying:

“Don’t trust or rely on the government but take action yourself to prepare for financial Armageddon.”

For some readers, our work is nothing short of life changing. This note alone made every word we publish worthwhile:

“Throughout some of my darkest moments of despair I have turned to reading your emails, not only as a search for 'a way out of the rat race , new forms of income, and a way of working from home' but also a source of positivity on which to focus.

Instead of being a crumbled wreck drowning in tears, torment & worry I read your emails and I am filled with a sense of encouragement, hope and determination that I can do this, albeit alone... I can & will turn things around for my little man & myself!

With hindsight one of the best things I did this year (2017) was to subscribe to the amazing information and opportunities you guys provide!

A HUGE thank you & hug for all the information & 'inspiration' you have given me in my search for a new beginning.”

One reader even wrote to tell us that thanks to our “joining the dots” he’d made his first million from our recommendations!

Believe me: nothing makes me feel better than receiving notes like these.

But I have to tell you, right now, I am really worried that a lot of our subscribers and many, many ordinary investors are going to get caught totally by surprise by inheritance tax, and when the next inevitable crisis hits.

That's why we created Zero Hour Alert.

And that's why I'd like to send you the full details on exactly how you can turn this situation to your advantage.

That all starts with my invitation to you today.

Just say the word and…

I’ll send you your inheritance tax guide and get you started with your FREE no-obligation trial of Zero Hour Alert immediately…

In fact, here’s everything you’ll get, right away:

1. EXCLUSIVE GUIDE: “Eight ways to sidestep inheritance tax (And ensure your kids never need to pay a penny to HMRC!)”. Worth £50.

Plus, you’ll automatically begin receiving…

2. MONTHLY RESEARCH: on the first Friday of each month we'll send you your monthly newsletter, Zero Hour Alert. We'll keep you up to date on exactly what's going on regarding this financial crisis, and show you some unusual and incredible ways to make money now and as it begins to unfold. You’ll get complete, unrestricted access to the Zero Hour Alert members’ website for the whole of your 30-day trial (worth £99).

Plus as an extra special bonus, you’ll also get this FREE report (worth £45):

“Stealth Wealth: Four Ways to Get Off the Financial Grid.”

I'll also keep you up to date on what I am doing to protect myself. I'll make sure you stay abreast of changes to the inheritance tax laws and government interventions.

But that’s not all…

Every day the markets are open, you’ll receive our "paid subscribers only" e-mail called Southbank Investment Daily.

In short, we report on all the work we are doing... the most interesting investment ideas... what we're researching now... and what we expect to happen in the months to come.

Our publisher, Nick O’Connor, sits down and writes this email every morning himself. It's free for paying subscribers of our work... but it gives you an insight into the network and thinking behind our research.

Now I’m sure you’re wondering…

How much does this “Zero Hour Alert package” cost... and how can you get started?

Well, a one-year subscription to Zero Hour Alert normally costs £99 per year…

Factor in the value of your inheritance tax guide and bonus report (£95 value), and that’s research worth £194…

But right now you can get everything (worth £194), for just £4.50.

Why so cheap?

Well, to be honest, our business really only works if our subscribers stick with us for the long-term. But we realise you've got to try our work first, to see if it's right for you.

And that's why, through this letter, we're making it so cheap, and so you can try it with no obligation.

Let me be 100% clear…

You'll receive your exclusive guide:

“Eight ways to legally sidestep Inheritance Tax (and ensure your kids don’t pay a penny to HMRC)”…

Immediately.

That’s yours to keep regardless.

Then you’ll have the next 30 days to see if Zero Hour Alert is for you or not.

You’ll get access to EVERYTHING. All the back issues, the special reports, the members’ area….

And within your 30-day no obligation trial you’ll also receive the next issue of Zero Hour Alert...

Try it for 30 days, if you like it, you don’t need to do anything and we’ll automatically renew your subscription for a year at the knock-down price of £49, saving you £50.

In other words, by taking me up on this offer, you are agreeing only to TRY my work to see if you like it.

Plus don’t forget… your BONUS report:

“Stealth Wealth: Four Ways to Get Off the Financial Grid”.

Both reports are yours to keep regardless – even if you decide not to continue beyond your trial.

I can’t say fairer than that.

I know it will be one of the best financial moves you ever make.

And the very fact you're still reading this letter tells me how seriously you're taking this.

That means you’re exactly the kind of investor I want to be working with, and for.

Now there's only one thing left to do…

You’ll still get to review everything on our secure order form.

But once you’re happy, enter your details at the bottom of the form and your order will be processed immediately.

You'll have access to all of our work in a matter of minutes.

But please remember, only the first 100 investors who contact me today will be successful.

So please don’t wait around.

Click here now to get started.

Best,

Nick Hubble,

Chief Strategist, Zero Hour Alert