Property Investing Update

07-23-2018

PropertyInvesting.net team

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gain, for our five thousand website visitors a day and the thousands of people signed up to your Newsletter.

Brexit Update: Wed firstly like to give a quick update on Brexit. As we all know, there is considerable uncertainty and that Brexit was expected to create quite a bit of business and political uncertainty with open borders (immigration) being a key issue, along with customs union (yes/no) and trade deals - and sure enough this is exactly what is happening. Lets firstly though acknowledge that things can move rapidly in negotiations as was seen with the agreement on divorce bill in principle late 2017. People are starting to panic a bit and we cant blame them. Lots of finger pointing. Teresa May has an impossible task keeping all the vested interests happy whilst remaining in power. Most of the hard right Brexiteers think its bes t to have a clean break from the EU e.g. walk out with a hard Brexit and no deal. But most people feel that if we are to exit, it should be with a so called soft Brexit whatever that means. The problem is the EU has most of the cards and wants to be awkward to avoid others wanting to exit the EU block. And a soft Brexit might be the worst of all worlds non of the benefits of a clean break, no benefits from the alliance and low freedom to do what we want to. Its all miserable watching it unfold years of pain and the economy appears to have slowed to around half its original growth rate with inflation rising sharply which seems to be caused by all the Brexit uncertainties and some people and businesses starting to choose Paris, Frankfurt and other destinations for the investments. We cant see it improving any time soon in fact, we think it will get a whole lot worse before it starts to get better. There is the first talk of an Article 50 extension, big businesses making lots of threats and further discord within the Tory Cabinet. All music to the ears of Corbyn waiting in the wings to assume power if the whole lot goes pear-shaped which is quite possible of course.

t to have a clean break from the EU e.g. walk out with a hard Brexit and no deal. But most people feel that if we are to exit, it should be with a so called soft Brexit whatever that means. The problem is the EU has most of the cards and wants to be awkward to avoid others wanting to exit the EU block. And a soft Brexit might be the worst of all worlds non of the benefits of a clean break, no benefits from the alliance and low freedom to do what we want to. Its all miserable watching it unfold years of pain and the economy appears to have slowed to around half its original growth rate with inflation rising sharply which seems to be caused by all the Brexit uncertainties and some people and businesses starting to choose Paris, Frankfurt and other destinations for the investments. We cant see it improving any time soon in fact, we think it will get a whole lot worse before it starts to get better. There is the first talk of an Article 50 extension, big businesses making lots of threats and further discord within the Tory Cabinet. All music to the ears of Corbyn waiting in the wings to assume power if the whole lot goes pear-shaped which is quite possible of course.

London Retrenchment: For the London property investor its further bad news and a big retrenchment started June 2016 after the Referendum result was announced. Its wait and see time with prices dropping. In the rest of the country, the ripple effect from high London prices and massive property shortages in the more populated areas continues to fan out. Prices are firmly rising in some of the lower priced area like Derby-Leicester, Leeds and Manchester and many places in central Scotland. Bristol and Bath prices have soared partly because people often move west after London prices have risen strongly. If Labour get into power, it will be very bad for southern house prices and initially northern prices might get another boost albeit in the longer term it would also be bad for northern prices. It has to be one of the riskiest times to buy property at this time because of all the uncertainty, both Brexit and a potential Labour government. Our advice would be to hold off until it looks like the Tories survive in power and the Brexit challenges start to subside the big risk period is in the next year. Its best to catch the end of the uncertainty dip not go head long too early into the start of the dip. The only exception is Aberdeen which we will describe later in this report.

Global Politics with Trump: Trump being elected is as predicted having a big impact on global politics and economies of different countries. One major concern is trade wars which are normally very bad for business and GDP growth and house prices. It could be even worse for the UK if we exit the EU without a trade deal then find ourselves in the middle of a trade war and cant get alternative deals done quickly or people think we are too small to deal with. During a trade war its probably best to be part of a big pact that has more power and weight.

Well describe a few trends we see developing to put some context into your investment decisions.

Hawks Towards Socialism: Firstly, Trump and the Republicans run by hawks like Pence, Bolton and Pompeo are showing their hand in acting aggressively towards the country they despise. Probably highest on their hit list seems to be Iran and second Venezuela - both interestingly far left socialist countries that are anti-western business. They have both been a thorn in the side of the US right wing political establishment for decades. When you think about this its hardly a surp rize. Trump seems to admire dictators there seems to be some sort of mutual admiration and respect with Kim Jong-Un and elected people like President Putin. He also seems to get on okay with Crown Prince Salman and the Saudi Kingdom and seems to have sided with the Sunnis against the Shias in Iran.

rize. Trump seems to admire dictators there seems to be some sort of mutual admiration and respect with Kim Jong-Un and elected people like President Putin. He also seems to get on okay with Crown Prince Salman and the Saudi Kingdom and seems to have sided with the Sunnis against the Shias in Iran.

Blaming Obama: Behind everything there is probably his views on business and his business friends that he will always lean to represent. He blames the socialists or democrats especially Obama for everything ill that happened and seems to be intent on rapidly reversing the 8 years of Democrat power since Bush was voted out. He has a highly interventionist and a rather manipulative style akin to a big controlling global business player. We need to try and understand this to predict what will happen in the future for business and property investment in the UK and globally.

North Korea: Firstly North Korea seems to have settled down which we think is surprizing but we doubt Kim Jong-Un is dismantling any of his nuclear capability and its not being checked or verified what he is doing which makes the deal that was done very shallow and not really particularly meaningful - in a way it was a directional communication rather than a formal agreement. It sounded good but it lacks any substance. Kim Yong-Un seems to have been let off lightly lots of political gesturing and he came out looking like an important global statesman rather than the tyrant dictator that he is lets remember how many people he has executed to keep himself and his friends in power including some of his own family and military generals. He probably thinks he has found a match with Trump and has adored all the adulation and attention all the pomp and ceremony. The long-term picture on the Korean peninsular is still very uncertain. We doubt there is much chance he will liberalise North Korean because in doing so he would immediately seed power.

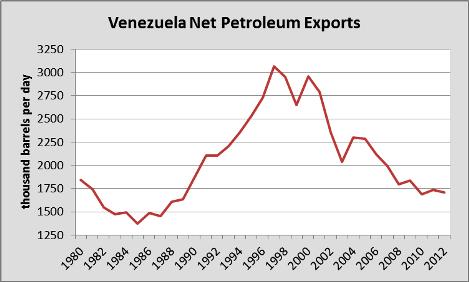

Iran and Venezuela: Trump criticises Obama for being very weak with Iran. It looks like hes done the same with North Korea though time will tell if he got it right or not. Meanwhile Trump is using oil to bring down the Venezuelan and Iranian governments. He knows this is where they get all their revenues from just like it was with the Soviet Union in 1986 when Ronald Reagan did a deal with Saudi to flood the oil market and drive the price down to $8/bbl which then collapsed the Soviet economy within 18 months because it cost them $10/bbl to transport the crude it cut off their life blood. Trump is trying the same with Iran and Venezuela now.

Oil Collapse in Venezuela: In Venezuela, US oil companies have seized offshore oil storage facilities through the law courts from PDVSA the Venezuelan state oil company which means they are severely restricted on where they can store their oil and this is hindering oil exports. They have also run out of money to finance the exports and refining. Its heavy oil requiring US imports of lig hter crude to dilute the heavy crude and allow it to be produced, shipped and exported. Their whole oil export supply chain has been severely impaired with tankers waiting in queues to take shipments the oil production is crashing like a stone and will take years to recover. Oil production was 3 million bbls/day when Chavez took charge in 1999 then dropped steadily to 2 million bbls/day by end 2017 after wholesale nationalisation and is now less than 1.5 mln bbl/day the Venezuelan government and PDVSA are bankrupt they cant pay their bills after 20 years of extreme socialism where the population has endured huge economic suffering. Hyper-inflation is occurring some 12,874% on an annualised basis at this time. The country is in collapse and we believe this is exactly what Trump and the Republicans want after years of Venezuela political sniping against the US political establishment it is their comeuppance. It is their strategy and its currently being executed. So expect the Venezuelan oil exports to crash and economy to go completely pear shaped then some sort of further revolution or civil strife. Of course the US government will want a pro-western business leaning right wing government to take over and invite US businesses in remember Venezuela has the worlds largest oil reserves some 220 billion bbls and if this oil was in the US production rates would be more like 10 million bbs/day (or 10% of the worlds oil production) rather than the meagre 1.5 million bbls/day (and 1.5% of global production). The crash in Venezuelan oil production is putting pressure on the global oil supply-demand picture and helping support oil prices around $75/bbl - which feeds through into general global inflation.

hter crude to dilute the heavy crude and allow it to be produced, shipped and exported. Their whole oil export supply chain has been severely impaired with tankers waiting in queues to take shipments the oil production is crashing like a stone and will take years to recover. Oil production was 3 million bbls/day when Chavez took charge in 1999 then dropped steadily to 2 million bbls/day by end 2017 after wholesale nationalisation and is now less than 1.5 mln bbl/day the Venezuelan government and PDVSA are bankrupt they cant pay their bills after 20 years of extreme socialism where the population has endured huge economic suffering. Hyper-inflation is occurring some 12,874% on an annualised basis at this time. The country is in collapse and we believe this is exactly what Trump and the Republicans want after years of Venezuela political sniping against the US political establishment it is their comeuppance. It is their strategy and its currently being executed. So expect the Venezuelan oil exports to crash and economy to go completely pear shaped then some sort of further revolution or civil strife. Of course the US government will want a pro-western business leaning right wing government to take over and invite US businesses in remember Venezuela has the worlds largest oil reserves some 220 billion bbls and if this oil was in the US production rates would be more like 10 million bbs/day (or 10% of the worlds oil production) rather than the meagre 1.5 million bbls/day (and 1.5% of global production). The crash in Venezuelan oil production is putting pressure on the global oil supply-demand picture and helping support oil prices around $75/bbl - which feeds through into general global inflation.

Iran Under Extreme Pressure: Next Iran they produce 3 million bbl/day (3% of the worlds oil production). But sanctions until end June week were thought likely to take 0.5 million bbld /day off the market. But Trump came out and threatened sanctions against any country buying Iranian crude which sent oil prices up 3% on 27 June. The market is now thinking oil production from Iran will crash from 3 to 2 million bbls/day or less. This will create a big squeeze on the Iranian economy that the USA hope will lead to the country collapsing. Trump and his inner circle are certain Iran is behind many of the terrorist groups active in the Middle East trying to increase its Shia and pro-Iranian sphere of influence to the detriment of the Sunni Saudi Arab alliance. So they are helping Saudi try to economically topple Iran. The US seems to have got the help from Saudi Arabia and even to a certain extent Russia. Its almost like an alliance of countries ganging up against Iran. These are USA, Saudi, Israel and Russia (remember the Israelis and Russians have quite a close relationship partly because there are so many Jewish people in Russia and Russian Jewish people in Israel). Which brings us back to oil because Russia, Saudi and USA all produce around 11 million bbls/day they are massive oil producers all of them each with 11% of global production. What seems to be happening is that the USA wants to crash oil production in Iran and Venezuela to rid the world of these regimes whilst using extra Russian, U

/day off the market. But Trump came out and threatened sanctions against any country buying Iranian crude which sent oil prices up 3% on 27 June. The market is now thinking oil production from Iran will crash from 3 to 2 million bbls/day or less. This will create a big squeeze on the Iranian economy that the USA hope will lead to the country collapsing. Trump and his inner circle are certain Iran is behind many of the terrorist groups active in the Middle East trying to increase its Shia and pro-Iranian sphere of influence to the detriment of the Sunni Saudi Arab alliance. So they are helping Saudi try to economically topple Iran. The US seems to have got the help from Saudi Arabia and even to a certain extent Russia. Its almost like an alliance of countries ganging up against Iran. These are USA, Saudi, Israel and Russia (remember the Israelis and Russians have quite a close relationship partly because there are so many Jewish people in Russia and Russian Jewish people in Israel). Which brings us back to oil because Russia, Saudi and USA all produce around 11 million bbls/day they are massive oil producers all of them each with 11% of global production. What seems to be happening is that the USA wants to crash oil production in Iran and Venezuela to rid the world of these regimes whilst using extra Russian, U S and Saudi oil supplies to stop the oil price going up too high and keeping around the $75/bbl mark where these countries make sizable oil profits whilst keeping demand strong and global economy clipping along at a good pace. Since Trump came to power, we have been observing and assessing and we think this direction will continue. Its rather a hidden alliance of super powers the Trump-Putin-Salman axis or alliance against Venezuela and Iran. With regard to China, Trump seems set on making their life difficult and we think a next step could be to threaten more trade tariffs if China continues to import Iranian crude. On 5 July China agreed to give Venezuela a financial life line which the US will certainly not take kindly too. The US are very unhappy about China assuming full control over the gigantic South China Sea maritime area. The USA also sees China as a threat to their global economic and military might and the might US dollar. They will want to cajole China into helping exert maximum economic pressure to Iran and Venezuela rather than China lending them more money and helping them with

S and Saudi oil supplies to stop the oil price going up too high and keeping around the $75/bbl mark where these countries make sizable oil profits whilst keeping demand strong and global economy clipping along at a good pace. Since Trump came to power, we have been observing and assessing and we think this direction will continue. Its rather a hidden alliance of super powers the Trump-Putin-Salman axis or alliance against Venezuela and Iran. With regard to China, Trump seems set on making their life difficult and we think a next step could be to threaten more trade tariffs if China continues to import Iranian crude. On 5 July China agreed to give Venezuela a financial life line which the US will certainly not take kindly too. The US are very unhappy about China assuming full control over the gigantic South China Sea maritime area. The USA also sees China as a threat to their global economic and military might and the might US dollar. They will want to cajole China into helping exert maximum economic pressure to Iran and Venezuela rather than China lending them more money and helping them with  their oil industries. This we believe is a key touch point behind the scenes. Meanwhile Taiwan remains an issue the US will get closer to Taiwan and the Chinese wont like it one bit. Its also worth noting Iran has started to make threats to close the Straits of Homez where 25% of the worlds oil is shipped and exporter between Iran and Oman. If this happened even for a short period there would be a very significant naval war and oil prices would skyrocket with such an Iranian blockade.

their oil industries. This we believe is a key touch point behind the scenes. Meanwhile Taiwan remains an issue the US will get closer to Taiwan and the Chinese wont like it one bit. Its also worth noting Iran has started to make threats to close the Straits of Homez where 25% of the worlds oil is shipped and exporter between Iran and Oman. If this happened even for a short period there would be a very significant naval war and oil prices would skyrocket with such an Iranian blockade.

The Mighty Dollar: Another consideration is that any country that challenges the mighty US dollar normally gets economically crushed and both Venezuela and Iran have done this in the last few years by trying to trade in other currencies very unpopular with the USA. Saudi seems to tow the line with using the US dollar to trade oil in which helps them keep out of trouble. This is probably also wrapped up in arms dollar deals. With regard to Japan this country imports 3 million bbls oil/day and a lot from Iran so Trump will try and curtail these imports by putting pressure on Japan. The Japanese are not likely to challenge the mighty dollar they will try and stay out of trouble.

US Economy: Now back to the state of the global economy. The USA is on trend to become a more nationalistic closed economy that will could well benefit the US manufacturing power base. Investors who are frightened might well think the best place to invest in, during this hostile global business climate, is actually the USA. Certainly the US financial and high-tech businesses could continue to prosper since they have global reach and avoid trade barriers with their customers in that space. The massive increase in US oil production since 2008 from 6 million to 11 million bbls/day is another huge benefit to the US economy. They also have huge amounts of cheap gas costing just $3.5/mmcf (rather than $8 in the UK and $12 in Japan). Expect states like California and Texas to do particularly  well off the back of higher oil prices, higher oil/gas production and booming technology companies and trade. New York remains exposed to a financial crash but baring this should also do well. Florida/Miami is the play-ground for the USA rich and middle classes so should also do well a lot of the business revenues will be spent in Miami on holidays and leisure it also has a booming population and businesses.

well off the back of higher oil prices, higher oil/gas production and booming technology companies and trade. New York remains exposed to a financial crash but baring this should also do well. Florida/Miami is the play-ground for the USA rich and middle classes so should also do well a lot of the business revenues will be spent in Miami on holidays and leisure it also has a booming population and businesses.

EU Block: Mainland European economies will start to struggle now that oil prices have risen to $75/bbl from $28/bbl in late 2016. Still not as high as $110/bbl in 2014 but remember that at those prices Greece, Spain, Portugal, Ireland and Italy started to go pear shaped and their economies only started to recover when oil prices crashed by end 2016 for the simple reason their oil import bills and oil intensity is so high per GDP and output. Nothing much has changed. As Italy struggles with the immigration issue along with a declining population and higher oil prices we expect their economy to hit a recession very soon. Their populist government will certainly not help business confidence it will be looked on like a mild version of the Venezuela populist government with right wing nationalist elements viewed with scepticism by the big global businesses. So since oil prices have risen and the immigration issue kicks off again in mainland Europe property investors should avoid Spain, Italy, Portugal and Greece the PIGS countries. Interestingly some of this investment money may start to arrive in London if things settle down on Brexit and the Tories look like retaining power longer term. What the EU needs urgently is a longer term solution to the migration crisis from North Africa and the Middle East they seem to have stemmed migration flows from the Middle East by doing a deal with  Turkey although they still owe the 3 billion Euro they pledged to secure this deal. But Italy is a whole other issue since their government is in power off the back of the migration issue and are unlikely to cooperate with any unity with Brussels on this issue. Merkel staying in power with her weak coalition depends on her securing a deal on how to tackle this issue watch this space in the next few months because if she fails, her party could collapse out of government and this would shake the European project severely to the core. Often the summer months get turbulent with economies slowing as people go on holidays and political turmoil starts to break out this years expectation seems no different.

Turkey although they still owe the 3 billion Euro they pledged to secure this deal. But Italy is a whole other issue since their government is in power off the back of the migration issue and are unlikely to cooperate with any unity with Brussels on this issue. Merkel staying in power with her weak coalition depends on her securing a deal on how to tackle this issue watch this space in the next few months because if she fails, her party could collapse out of government and this would shake the European project severely to the core. Often the summer months get turbulent with economies slowing as people go on holidays and political turmoil starts to break out this years expectation seems no different.

UK Property: This brings us onto the UK again. The UK only imports about 0.4 million bbls of oil a day so its fairly well protected against higher oil prices. It does not make much difference high oil prices lead to higher activity levels in the North Sea and comparative to mainland European countries the UK normally does quite well out of high oil prices - with London being a financial centre for the oil business both in the UK and globally. Many of the oil income from the Middle East and Africa will indirectly end up in London in real estate and tourism and retail spending. We are talking about the mobile wealthy super rich oil families that spend much of their time in the summer in London as they have done for decades no change. But we would not expect London prime property prices to go up just yet with the higher stamp duty and Brexit uncertainties. If oil prices rise to $100/bbl expect more Middle Eastern investments.

Aberdeen: The brightest ray of hope in the UK is Aberdeen. Property pri ces crashed in this important oil town starting late 2015 and have only just started to recover a little from their lows. They probably dropped about 25% as Aberdeen lost so many jobs. But many of these workers have now found new jobs in other industries and new oil jobs are starting to appear again. Its not just decommissioning in the North Sea, its some new oil development projects and oil services from Aberdeen as a base for some significant global oil operations. Houston is the biggest, London, Stavanger important but Aberdeen is still a big important oil town and with oil prices having risen from $28/bbl end 2016 to $75/bbl now we predict Aberdeen house prices to rise 10% a year for the next two years as the industry recovers. Rents are still fairly strong in Aberdeen with prices far lower now so yields are quite attractive. Its probably our top pick at the moment for buy-to-let investment. It could be the only UK pick of note. The fact that Sturgeon has gone quiet on Scotland leaving the UK is another positive for now since there was a time she really looking like doing some serious harm and was driving investment away. But despite her socialism and higher taxes and the uncertainty she brings Aberdeen property investment is certainly worth considering for the seasoned property investor. Our advice is if its for rental - it would have to be very central close to the city centre shops because this is where short term rental demand is strongest amongst professional oil workers that need somewhere to stay during the week they might fly out during the weekends. They will want to be close to shops, restaurants, bars and leisure/evening activities.

ces crashed in this important oil town starting late 2015 and have only just started to recover a little from their lows. They probably dropped about 25% as Aberdeen lost so many jobs. But many of these workers have now found new jobs in other industries and new oil jobs are starting to appear again. Its not just decommissioning in the North Sea, its some new oil development projects and oil services from Aberdeen as a base for some significant global oil operations. Houston is the biggest, London, Stavanger important but Aberdeen is still a big important oil town and with oil prices having risen from $28/bbl end 2016 to $75/bbl now we predict Aberdeen house prices to rise 10% a year for the next two years as the industry recovers. Rents are still fairly strong in Aberdeen with prices far lower now so yields are quite attractive. Its probably our top pick at the moment for buy-to-let investment. It could be the only UK pick of note. The fact that Sturgeon has gone quiet on Scotland leaving the UK is another positive for now since there was a time she really looking like doing some serious harm and was driving investment away. But despite her socialism and higher taxes and the uncertainty she brings Aberdeen property investment is certainly worth considering for the seasoned property investor. Our advice is if its for rental - it would have to be very central close to the city centre shops because this is where short term rental demand is strongest amongst professional oil workers that need somewhere to stay during the week they might fly out during the weekends. They will want to be close to shops, restaurants, bars and leisure/evening activities.

Losers: In summary, with regard to these Trump trends the countries that will be on the decline with his policies will be:

- Venezuela

- Iran

- Cuba

- Possibly China

- Italy

- Spain

- Greece

- Portugal

- Qatar that will become more economically isolated because of its alignment towards Iran unless is starts to side with Saudi Arabia/UAE, which is unlikely

- Many of the oil importing African and South American nations will struggle because of the higher dollar value, higher borrowing costs and higher oil prices some might collapse. Particularly exposed larger counties are South Africa and Democratic Republic of Congo.

- Other countries that could struggle with higher oil prices and higher dollar values against their own weak currencies are India, Pakistan and Bangladesh.

- Libya looks like being in a protracted war with factions fighting over oil export facilities we dont expect any improvement soon

- Nigeria despite is oil production is a loser because of its massive young population, corruption and regional civil strife we dont expect much change hear either

Winners: The countries on the ascent with his policies that also benefit from higher oil prices are:

- USA

- Russia

- Saudi Arabia

- UAE - Dubai

- Israel

- Norway

- Canada

- Possibly Brazil, Angola, Ghana, Oman

- Iraq and Syria settling down after years of war

General Summary: In very general terms, Sunni and centre-right countries will do better than Shia and socialist countries. Kingdoms and dictatorships will do relatively better than republican socialist democracies. The worst place to invest would be a religious socialist Shia democratic republic like Iran. Interestingly the two key socialist countries Iran and Venezuela have had their populist socialist policies and global influence funded by oil exports and this is where the US hawks see they can strategically cut off their funding by sanctioning their oil businesses. It is quite predictable what will happen regrettably for these countrys leaders. What the final outcome will be is most uncertain. Its important for global property investors to understand this of course, otherwise you could lose your shirt.

We hope this Newsletter has given you some interesting insights to shape your property investment decisions both within the UK and globally. Uncertain times, and we hope we have given you some insightful trends and pointers to what is really happening out there in that big wide world.

If you have any queries please contact us on