Can investors still make money from Buy to Let

08-10-2017

Can investors still make money from Buy to Let

Can investors still make money from investing in buy to let property with all the restrictions that have been placed on the industry?

In the recent budget announcement (2016) landlords could quite easily be left with a feeling that they have been targeted because of the previous Mortgage tax relief changes and investor Stamp Duty. Investors can no longer claim tax relief on all their mortgage interest payments, which means that if previously they were making a net profit of £10,000 per annum but was paying £5,000 in mortgage interest costs, they could wipe that off and only pay tax on the remaining £5,000. The changes mean that higher-rate taxpayers whose mortgage interest costs make up 75% or more of their rental income will see their profits completely wiped out.

It is understandable that both new and seasoned investors alike might be put off from investing in property. There are various solutions available that can help you maximise profits and ensure that you are getting the best value for money. Below are some suggestions that can help you make money in the buy to let property market.

Reduce the cost of purchasing a property

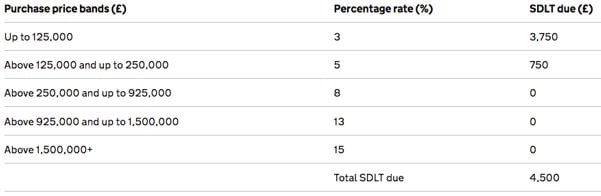

In April 2016 additional stamp duty charges were announced, which means that landlords must pay an extra 3% in stamp duty charges. With average house prices in the north west at £186k and west midlands at £213k according to Rightmove’s House Price Index, on a buy-to-let investment of £140,000 that means a whopping £4,500 in Stamp Duty.

https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/detail

Understandably, this has deterred investors from considering buy-to-let property, however there are alternative options that allow investors to mitigate their loss. Commercial property investments such as Care home investments and student property investments with values under £150,000, have NO stamp duty. Several investors are realising the benefits of these opportunities because the savings on Stamp Duty increases their yield on cost and ultimately the return on investment. Individuals have the potential to save thousands of pounds, simply by reconsidering the asset type they choose to own.

Research the most suitable areas for the asset class

The best areas for investment can be dependent upon the type of property you are wanting to purchase. For example, a sleepy town in the south west of England might be perfect for a care home investment, but not so suitable for a student accommodation investment.

For buy to let investments specifically, you should weigh up each area’s credentials in terms of its demographics, regeneration projects, vicinity to large cities (or whether the development is in a large city itself), transport links, employment options and comparable developments in the area. This research can be time consuming and for busy working professionals they find they cannot always afford the time to conduct such extensive research. Many employ the help of an investment company who have taken the leg work out of the research and who can provide guidance to investors.

Know the realistic rental yield that can be achieved

Achieving a good rental yield is a fine balancing act. For example, in London house prices are high so the average rental yield is around 4.4%. Compare that with the North West where property is typically cheaper and you are looking at returns of 6.4% on average, and according to Rightmove’s Rental Trends Tracker, Liverpool can achieve some of the highest yields in the country at 6.7%. This is all a balancing act though, as if you choose to buy a property at a rock-bottom price you may find that there is very little demand for the property, or that the rent generated from the property’s occupancy is disappointing. According to LendInvest, other areas that investors can expect a high yield include Peterborough, Stevenage and Rochester.

This leads us perfectly to our next point, which can have a knock-on effect with regards to how much rent per calendar month you can charge tenants.

Choose buy-to-let investments in areas experiencing regeneration

Investing in property in an area experiencing regeneration has many benefits, and one if which is that property prices are still reasonable but are predicted to increase in value once the regeneration is complete. This allows investors to either increase rent after a set period which has a knock-on effect on the annual rental yield, but it also means that they can sell on the property at a higher price, resulting in good capital uplift. The benefit of investing in an up-and-coming area is the increase in demand from young professionals, looking to move to the area in pursuit of fresh opportunities and jobs. Over the past twenty years, two London boroughs that have been particularly appealing to young professionals – Hackney and Haringey – have experienced the highest growth in terms of house prices at 749% and 544% respectively. They have all experienced regeneration and gentrification too, due to young professionals being priced out of the more expensive Shoreditch area.

Consider the condition of the property

Beautiful Georgian and Victorian buildings capture the hearts of most people. However, they are more likely to need significant repair work and care to make them attractive to the rental market. The cost that goes into renovating the development could seriously deplete profit margins, and may mean that the landlord will have to check up on the property and make improvements more often than with a new build. A building requiring a lot of maintenance will not only affect the rental yields, but also will mean that the investor would have to invest a significant amount of time to the property’s upkeep.

One Touch Property can help you take a decision on what would work best for your financial expectations. Whether it be a buy to let property investment or a different asset class, One Touch Property offers different types of investments to suit every individual’s needs.