UK house prices fall for third month in a row for first time since financial crisis

06-02-2017

UK house prices fall for third month in a row for first time since financial crisis

Nationwide says average cost of home fell 0.2% last month with price growth slowing further in 2017 as inflation squeezes household income

House prices in Britain have fallen for the third month in a row, for the first time since the height of the financial crisis in 2009.

The fall further dragged down the annual growth rate in May, to 2.1%, the lowest in nearly four years, providing further evidence that the housing market is losing steam, according to Nationwide, the UK’s biggest building society.

Its closely watched monthly house price index showed that the average price of a home fell by 0.2% between April and May, to £208,711. This compares with monthly declines of 0.4% in April and 0.3% in March. The annual growth rate of 2.1% is the lowest since June 2013, and compares with 2.6% in April.

Robert Gardner, Nationwide’s chief economist, said: “It is still early days, but this provides further evidence that the housing market is losing momentum. Moreover, this may be indicative of a wider slowdown in the household sector, though data continues to send mixed signals in this regard.”

He noted real incomes were under pressure as inflation had overtaken wage growth, although the number in work continued to rise at a healthy pace and the unemployment rate hit a 42-year low in the three months to March.

The UK’s other main house price index, from mortgage lender Halifax, is also on a downward trend. It showed a 0.1% fall in April, taking the average property price to £219,649 – nearly £3,000 below the peak in December 2016.

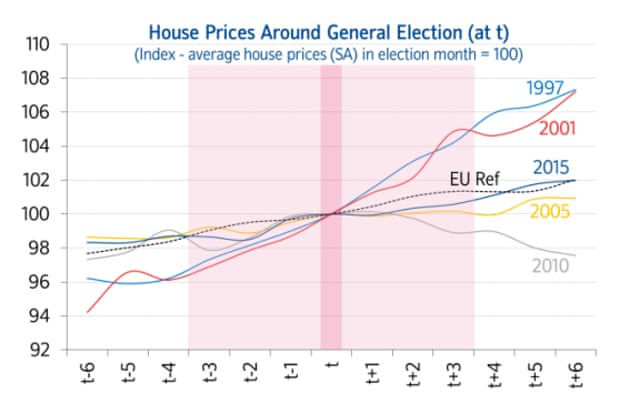

Gardner dismissed suggestions the slowdown was linked to the general election on 8 June. “If history is any guide, the slowdown is unlikely to be linked to election-related uncertainty. Housing market trends have not traditionally been impacted around the time of general elections. Rightly or wrongly, for most homebuyers, elections are not foremost in their minds while buying or selling their home.”

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, agreed. “Prices have been unaffected by previous elections and, unlike in 2015, none of the major parties plans to increase property taxation.”

Gardner said it was too early to say whether the slowdown was a blip, a reflection of the squeeze on household budgets or due to mounting affordability pressures in key areas of the country.

However, Nationwide believes house prices will slow further and household spending is likely to weaken along with the wider economy, as rising inflation further squeezes household budgets. The building society is predicting a small increase in house prices of around 2% this year, as the housing shortage will provide some support for prices.

Jonathan Hopper, managing director of Garrington Property Finders, said: “The slowdown is anything but uniform. Properties in some regions are seeing double-digit price reductions, yet at certain price points in the most in-demand areas, gazumping and intense competition between buyers are the order of the day.

“If there is one universal it is the chronic shortage of supply. Where there are more buyers than homes for sale, prices will inevitably edge upwards.”