Britain will never build enough houses to make property affordable for young people, according to research.

A study presented to the Royal Economic Society’s annual conference said those hoping to get on the ladder may have to rely on windows of opportunity created by periodic slumps in the market.

However, the overall trend will remain for residential property price rises to outpace salary growth, according to economists at the University of Reading.

“The increases in housing supply required to improve affordability have to be very large and long-lasting; the step change would need to be much larger than has ever been experienced before on a permanent basis,” said Geoffrey Meen, Alexander Mihailov and Yehui Wang.

The government has discussed moves to increase the supply of homes but the changes are on far too small a scale to act as a brake on price rises.

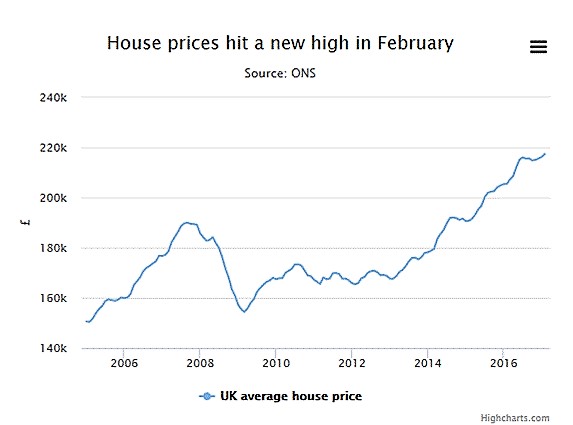

House prices in the UK stood at an average of £217,500 according to the Office for National Statistics.

That is 7.7-times the average full-time salary in the UK of £28,200.

By contrast in 2005 the average home cost £150,500, approximately 6.5-times the then-average full time salary of £22,888.

Former Bank of England policymaker Kate Barker believes the country needs an additional 60,000 homes per year on top of those already being built.

But the new paper argues there is little chance of this happening.

“Although higher levels of house building are certainly desirable, the paper shows that there is a limit to what can be achieved by this route,” the report found.

“The required increase in supply to stabilise the price to income ratio ... is not feasible - permanent increases in construction would be required that have never been achieved in history.”

Instead, “affordability will be improved by another factor: housing risk”, the paper argues.

"Price to income ratios are likely to stabilise even without major increases in supply, although adjustment could take the form of an undesirable market collapse.”

That would be a painful event for homeowners, but also could enable buyers to step into the market.

Historically there has been a view that house prices ultimately can only rise, but the economists describe this as a “myth”.

“A commonly held view is that house prices, at least in nominal terms, rarely fall and, therefore, housing is a safe investment. Historical experience appears to bear this out; between the mid-1950s and 1990, the annual growth rate in house prices was negative in only one quarter,” said the report.

“But the myth of permanent price increases was first dispelled in the recession of the early 1990s and, then, during the global financial crisis.”

This situation indicates that housing policies overall need a rethink, the economists said.

“Market crashes are hardly an optimal policy response to improving affordability, given the wider effects on the economy,” they concluded.

“If reliance on supply expansion is inadequate, then this implies the need for more integrated housing policies, where housing issues play a wider role in macroeconomic policies.”