Today will see two of buy-to-let landlord Jamie Brewis’s tenants – a couple in their 60s – having to move out of the bungalow that has been their home for the past four or so years. They didn’t want to go, and were good tenants. But Brewis says he had no choice but to give them notice, thereby forcing them to find somewhere else to live, because of major tax changes being phased in from this Thursday.

Brewis says he has decided to sell the property because the cut in tax relief on mortgage interest payments for buy-to-let landlords means that in this particular case the maths no longer stack up, and he would end up making a net loss. With what he is paying on the mortgage, against the rent he receives, he says the result will be that “I am not earning anything out of it – in fact, it’s costing me money.”

Brewis says the couple are upset, and he is, too. “I don’t want to chuck them out – they are in their 60s, they have lived their life in rental, and they are now not in a position to buy somewhere. I provide housing for a lot of people and I don’t charge them over and above market rent – I charge them market rent. If market rents don’t work because of these government changes, I’ve got no choice but to sell up and move on.”

The 38-year-old runs his own property development company, Haverbridge Homes, and outside his business he has personally invested in 21 buy-to-lets in and around Upminster, east London. He is also selling another of his higher-end properties, though the tenants living in it aren’t moving out for a couple of months because they recently had a baby. They and the older couple won’t be the only people affected by the changes – industry surveys suggest a fair number of landlords have already started offloading properties, or are thinking of doing so.

So what exactly has the government done? This shake-up was announced by the then chancellor George Osborne in the summer 2015 budget and is designed, says the government, “to make the tax system fairer”.

At the moment, landlords can deduct mortgage interest and other finance-related costs from their rental income before calculating their tax liability. But this interest relief is being slashed from the current 100% to zero, the change being phased in gradually between April 2017 and April 2020. What will happen instead is that the income tax on someone’s property profits and any other income sources will be totted up, and they will then be granted a “tax credit” worth 20% of the mortgage interest cost to offset against income tax.

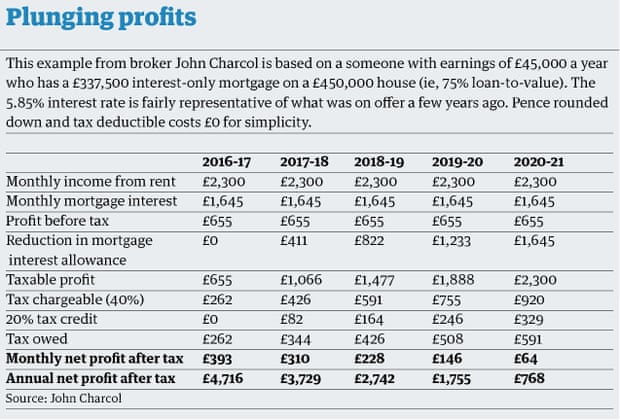

This might sound like quite a technical change, but the result will be that the amount of tax owed by some landlords will double or even triple. New figures produced by mortgage broker John Charcol suggest some could see their annual net profit tumble by 84%.

It’s not just landlord bodies that have expressed concern. In December Kate Barker, an influential economist, housing market expert and former member of the Bank of England’s monetary policy committee, told the Commons Treasury select committee that while she was generally supportive of the decision to increase stamp duty for people who were buying to let, she had more difficulty with the change to mortgage tax relief. “I would be uneasy if it has the unintended consequence of meaning that these families … who have been living in a house for some time and paying their rent and everything, are then forced to move because the buy-to-let landlord no longer finds the yield acceptable, or cannot afford it,” she said. “That effect on stock does worry me more, not so much because of the landlords, but because of the impact on the tenants down the line.”

However, campaign groups such as Generation Rent, say the changes could dampen property speculation and create a fairer market.

The t

However, if you were to change the interest rate on the mortgage to 2.57% – roughly what a new five-year fixed-rate buy-to-let mortgage on offer now would charge – the reduction in the annual net profit doesn’t look nearly so bad: from £11,354 in 2016-17 to £9,619 by 2020. Simon Collins at John Charcol says: “If you pick the right deal, the right rate, the right structure, [the changes] will have less of an impact.”

An increasing number of landlords are opting to hold their properties in limited companies, which are not subject to the same taxes. Some will opt to only use a company for any new properties they buy. However, if you have already got a property and are intending to hold it for quite a few years, selling it to your new limited company may well make sense, Collins says.