Brexit Update and the Chance of a Financial Shock

08-31-2016

PropertyInvesting.net team

More objective guidance and insights for property investors. Our aim is to help you improve your investment returns, flag key risk areas and stimulate strategic thought so you can position your portfolio to maximize gain, for our five thousand website visitors a day to our website. This Special Report cover one key topic:

Brexit Update and the Chance of a Financial Shock

Impact of Brexit: The economic impact of Brexit so far looks to be more benign than most people thought. Its early days, but a few directional pointers so far are:

• There is no indication of a property price crash

• The economy looks to have slowed down, but it still seems to be growing

• Sterling’s 20% drop in value has created a minor retail boom in London and other areas, probably because: 1) foreign tourists are coming over looking for bargains; 2) locals are buying expensive items before prices start rising; 3) confidence is not being impaired as much as envisaged

The house price ripple effect out from London continues with the strongest property price rises in places like Glasgow, Liverpool and Nottingham – how long this continues is another story.

Prime London Property - prices have dropped back a bit – as wealthy people pause to see the ramifications of the Brexit and consider whether large job losses of the higher paid financial services sector will dent demand or not. However, Nationwide Building Society reported on 31 August that July-August house prices rose by 0.5% to an all-time record - this certainly does not suggest prices are crashing. It looks like Prime London prices have dropped around 5%, whilst lower priced London areas are still rising albeit slowly. Cities like Liverpool, Manchester, Glasgow and Nottingham are displaying fairly healthy annualised house price increases of 5-10%. After the initial Brexit shock, the 0.25% drop in interest rates seems to have boosted confidence somewhat and mortgage rates have dropped slightly. The Sterling decline has also made it about 20% cheaper for rich overseas investors to pick up London property. The amount of transactions has dropped markedly, the amount of homes being built has dropped, the amount of new properties coming to the market has also dropped to new low – hence the market is fairly quiet for now and stable as demand meets very low supply. It’s early days, but the housing crisis is likely to worsen as builders hold back from starting new projects – further reducing supply. This should support prices as long as unemployment does not rise. Immigration continued to run at record levels further putting pressure on housing. The draconian and market distorting new taxes on buy-to-let landlords will reduce rental supply and lead to higher rents we believe.

Speed: The pace of the Brexit process seems to be very slow – and we can see the whole process dragging out for years. The initial shock has given way to a sense of almost boredom and even a reality that it might be the best thing in the long run – time will tell. A lot depends on what the eventual deal looks like, how badly the UK is treated during the exit process and how quickly the UK develops other trading partnerships with countries outside Europe.

Banking and Commerce: A lot will depend on the banking sector – and how business interfaces with Europe in the new relationship. It certainly does not seem to have negatively impacted Norway and Switzerland - so the hope is that the UK can Brexit without being beaten up too badly by Brussels and keep its global financial services sector intact.

Tourist Boom: What the decline in Sterling has initially caused is a boom in tourism – particularly in SW England and London. This should be good news for second home prices in these areas – and holiday rental demand. Hotels will also do very well and short term holiday rentals.

Inflation: In the medium term we expect inflation to start rearing its ugly head again – it could easily rise to 3-5% by early 2017 as higher oil prices and higher import costs start taking effect. This might even cause the Bank of England to raise rates – and make mortgages more expensive – and this could then lead to property prices dropping sharply. Certainly something to watch out.

it could easily rise to 3-5% by early 2017 as higher oil prices and higher import costs start taking effect. This might even cause the Bank of England to raise rates – and make mortgages more expensive – and this could then lead to property prices dropping sharply. Certainly something to watch out.

Debt Bomb: Now the shock of Brexit is over – we should really be focussing on the bigger picture global and UK economy. It’s all about debt. Where is it heading?

Unstable: In summary, things look very unstable. The world has gigantic global debt – the Central Banks are having to reduce interest rates to negative territory to stimulate their economies. They cannot “afford” to raise rates because there is so much bad debt that if rates were significantly raised, then both private businesses, private individuals, governments and councils would all get into serious financial trouble – there would be a financial melt-down.

Cycle – Time for Recession: The economic cycles of rising and lower of interest rates – with the occasional purge of poorly performing over-indebted businesses has been replaced regrettably by a system controlled by Central Bankers – the “too big to fail” strategy – one that kicks the can down the road – prints money at the first sign of financial turbulence and kills savers by keeping interest rates are record lows.

Rip-off Banking Rates: Recall around the mid-1990s when interest rates were about 6% and mortgage rates were 7%. Now we have interest rates at 0.5% and mortgage rates at 4.5% - a whopping 4% or eight times differential where banks are “fleecing” customers to prop themselves up after huge quantities or poor quality or bad loans have been given out.

Student Loans: These loans are another classic example of banks fleecing customer – namely the poor students. They pay cumulative 4.5% on their loans whilst interest rates are set at 0.25%. No wonder most cannot afford to buy a property until they are 40 years old – first they have to pay off their staggering loan whilst paying rent – then have to save a gigantic deposit. In the 1990s, student had not loans, deposits were 5% (£12,000), London flats were £60,000 and it took a few months to clear the student overdraft that was proportional to the amount of beer a student drank in their 3 years. How times have changed when a flat now cost £500,000 and deposit of 20% is around £100,000

Savers Destroyed: Savers used to get 7% - and now sometimes have to pay to have their cash stored in the bank. These savers are being destroyed by inefficient and poor banking practices.

Poor Efficiency: The whole system breads inefficiency – poor standards – and ultimately at some time – probably quite shortly – will lead to a financial meltdown.

Kick The Can Down The Road: It seems the inefficiencies of bad debt built up over decades are being kicked down the road with more and ever increasing sizes of money printing and ultra-low interest rates. Investors have been buying government bonds which promise a 4% return simply because there is nothing else worthy to invest in it seems. Companies have been borrowing money at record low rates to buy back their own stock – a weird economic manipulation that is not sustainable if rates rise.

Asset Price Bubbles from Printed Money: Meanwhile we know how much property prices have risen off the back of record low interest rates – how much long this can continue is of course subject to a lot of debate – on-one knows the answer. The waves of printed fiat currency have massively distorted markets and created bubbles in property, artwork, and high-tech stocks. For instance, in China who cities have been built where no-one lives – from easy debt – this certainly looks like a bubble. Every time government print more money it just leads to more inefficiency and sloppy lending practices – the weak hands stay alive and the strong hands with saving area destroyed. It leads to massive misallocation of capital. Instead of businesses investing in plant and machinery to improve returns and efficiency, the currency is squandered and shifted into speculative investment – like property and bonds, poor quality debt.

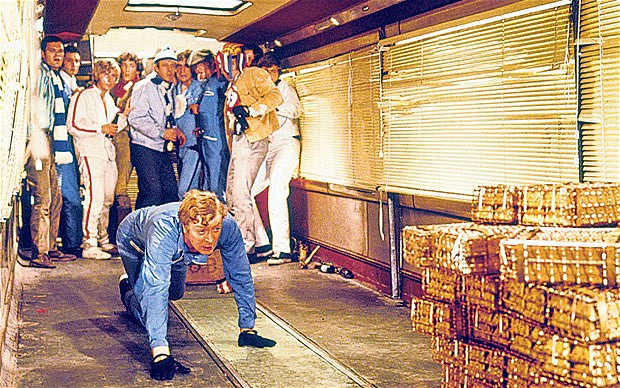

Gold and Silver: Ultimately we believe silver and gold prices wi ll skyrocket when panic sets in – as stock markets crash and debts turn bad. The 40 year bond market bubble will surely go pop one day – and when it does, this money will rapidly shift to gold and silver we believe. Everyone will be desperate to own “real money” which is of course gold (and silver). The US dollar has only been saved by the shale oil fraccing boom that reduced US oil imports – but this has recently reversed somewhat as oil imports have risen by 800,000 bbl/day in the last year as US oil production has declined and demand risen at the same time. Okay, the US economy certainly looks more fundamentally sound than the UK’s – but the point is – almost all western nations have huge debts, that they can never pay back – and something has to give one day. Can Central Banks continue to print their way out of the mess – we think not.

ll skyrocket when panic sets in – as stock markets crash and debts turn bad. The 40 year bond market bubble will surely go pop one day – and when it does, this money will rapidly shift to gold and silver we believe. Everyone will be desperate to own “real money” which is of course gold (and silver). The US dollar has only been saved by the shale oil fraccing boom that reduced US oil imports – but this has recently reversed somewhat as oil imports have risen by 800,000 bbl/day in the last year as US oil production has declined and demand risen at the same time. Okay, the US economy certainly looks more fundamentally sound than the UK’s – but the point is – almost all western nations have huge debts, that they can never pay back – and something has to give one day. Can Central Banks continue to print their way out of the mess – we think not.

Real Value of Gold: If you take the quantity of fiat dollar currency – even without the derivatives - and divide it by the amount of gold, an ounce of gold should be worth about $75,000. It currently trades at about £1350/ounce – some 50 times less. We see gold prices rising north of $2000/ounce if there is any even minor panic in the financial markets in the next six months – the upside is huge.

Silver is the Bargain of the Century: With regard to silver, the price of silver is ridiculously cheap in our view. It’s the only commodity or thing in the world that is cheaper in 2016 than it was in 1980 some 36 years ago! In fact, in 1980 silver was $55/ounce and it is now $19/ounce – about a third of the price. It’s the bargain of the century in our view. When panic sets in some time in the next year or so – silver will skyrocket – we would not be surprized to see $50/ounce. It’s definitely worth owning a considerable amount of silver bullion – the real physical stuff. Just consider this – on the surface of the earth there is one ounce of silver for every 14 people in the world – costing only $20/ounce. For all those asset hungry people that like “resources” – you need to get as many “people’s worth of silver” as possible as quickly as possible. Having 1000 people’s worth of silver will only cost you $1428 – that’s 71 ounces. That equates to about £1 per person in the cost of silver. It’s really not much! Just imagine all those mobile phone, hospital equipment, electronics and other manufactured items needing silver – suddenly finding there was none left. Surely each person’s silver should be worth more than £1?

Silver, Dollar – USA and China: Some sceptic may say that JP Morgan has been manipulating the silver prices down for decades, and they may have a point – but even if they actually are - how long can they short and keep the physical silver prices down. Surely one day, people will demand their physical sliver – a shortage will occur – and prices will skyrocket. It might be when people have lost confidence in the dollar. The US always keep the dollar as king – the new shale oil reserves, technology from companies like Google, Apple and Facebook help, along with the USA’s huge military and country resources – but can they keep printing whenever they feel like. Will oil always be traded in the mighty dollar. Will China or even India challenge the US dominance any time soon? Will tensions in the South China Sea be a trigger point for China and the US fall out – and with it put pressure on the dollar? Certainly it will be interesting observing the dollar, the US and Chinese debt and gold/silver prices in the next few months and years – something looks likely to pop.

We hope you have found this Special Report insightful and it helps as a backdrop to your investment decisions moving through 2016. If you have any queries or comment, please contact us on enquiries@propertyinvesting.net