The UK housing market paused for breath after the Brexit vote, but could take off again over the next 12 months, a poll of surveyors suggests.

The Royal Institution of Chartered Surveyors (Rics) survey showed house price rises slowed significantly in the three months to the end of July.

The surveyors said new buyer inquiries, home sales and new instructions all fell over the period.

But a separate survey indicated renewed confidence in commercial property.

Confidence 'resilient'

In the residential market, the number of surveyors reporting price increases dropped to its lowest in three years.

They outnumbered those seeing price falls by 5%, compared with a 15% margin in June.

The survey found prices had fallen outright in London, East Anglia, the North of England and the West Midlands.

Image copyright Thinkstock

Image copyright Thinkstock However, the Rics survey suggests that house price inflation could accelerate within a year.

A month ago - in the wake of the EU vote - surveyors were evenly divided about whether prices would rise or fall over the next 12 months.

Now, by a majority of 23%, most of them expect prices to go up.

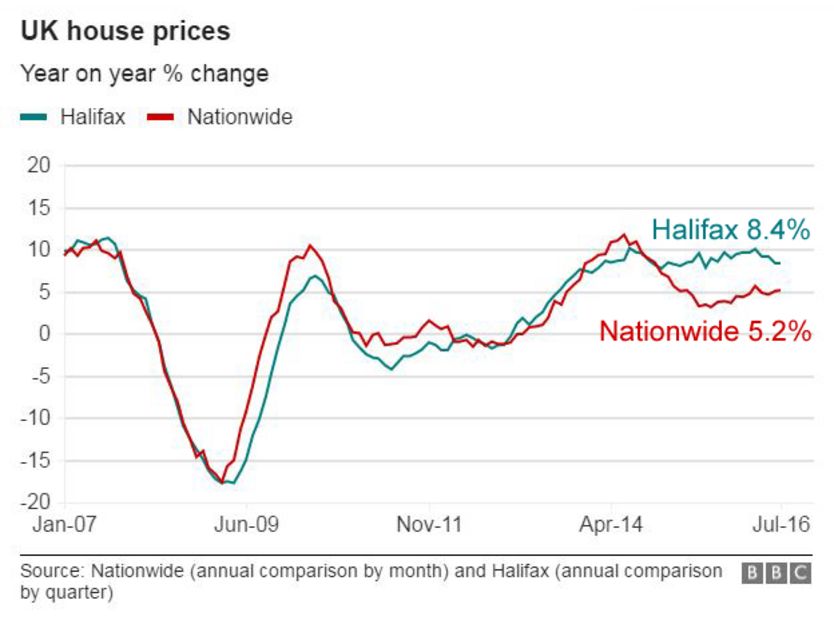

However, any such growth is likely to be modest compared with 2015, or the start of 2016, when prices were rising by up to 10% a year.

"It is not altogether surprising that near-term activity measures remain relatively flat," said Rics chief economist Simon Rubinsohn.

"However, the rebound in the key 12-month indicators in the July survey suggests that confidence remains more resilient than might have been anticipated."

A separate survey suggests that demand for office space in London has bounced back since the referendum vote.

The amount of space being taken by businesses rose to just under a million square feet in July, a 24% rise on the figure for June.

The figures were produced by commercial property company CBRE.

One of the biggest deals was with US bank Wells Fargo, which will move into an office in the City.

Inflation

Most surveyors responded to the questionnaire before the news came through last week that the Bank of England was cutting base rates by 0.25%.

Cheaper mortgages - if they happen on a significant scale - are likely to boost house prices.

The Halifax said last week that it was still too early to say how the Brexit vote would affect values.

However, its figures show that prices fell during the month of July by 1%.

Conversely, the Nationwide Building Society said prices rose by 0.5% during the month.

Annual house price inflation is running at 8.4% according to the Halifax, and 5.2% according to the Nationwide.