You might recall Deutsche Bank’s bearish note on the London buy-to-let market last month. It argued, in short, that regulatory changes had set property in the British capital on the road to a nasty crash in the not-so-distant future.

And that was before minor things like Brexit and the closure of a raft of open-ended property funds. (It still boggles the mind. Open-ended fund. Property funds. Open-ended… property…)

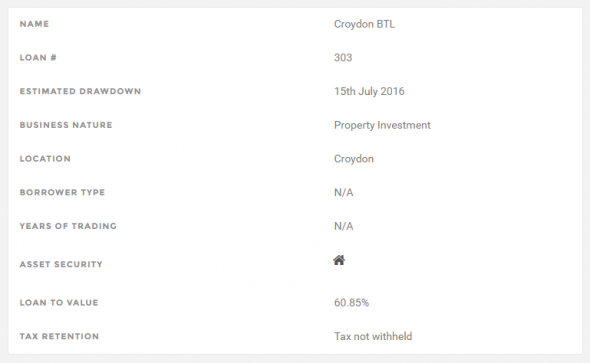

Well, online lenders are putting on a brave face and continuing boldly on. Here’s a prospective 12-month, £143,000 loan just listed on Assetz Capital, one of the many UK lending startups. It yields 7 per cent:

But that’s not really the interesting bit. This is:

As an overseas national and landlord with no previous letting experience, [the borrower] is restricted as to the number of buy-to-let lenders available to assist in the purchase, which is why he has requested a bridging facility through Assetz Capital. The Borrower’s intention is to use our loan to complete the purchase of the investment property for subsequent letting on an Assured Shorthold Tenancy Basis and to refinance the loan after 12 months when he is considered to be ‘experienced’ by a more mainstream lender. We understand that the introducer of the deal is already working on the potential exit.

The borrower lives in Sao Paolo, Brazil, and Assetz has first legal charge over the currently incomplete property. The more important question is what will London’s buy-to-let market look like in 12 months time? Who knows. It isn’t really discussed in the risks, although they do note that “the rental market in London is strong at present”.

Which is something that intelligent people could probably disagree about.