London’s super-rich are increasingly turning to renting in order to avoid paying stamp duty on expernsive purchases, a new report shows.

The number of letting deals on properties worth more than £10m increased by a third in the year to March 2016, according to figures by estate agent Knight Frank.

Sales of homes worth over £10m fell 33 per cent in the same period of time, to 138 in the year to March, down from 206 in the year to December 2015

Stamp duty went up 3 per cent on April 1, meaning the levy on a £15m home now costs buyers around £1.7m – the equivalennt of about three years' worth of rent for a similarly-priced house, according to the figures.

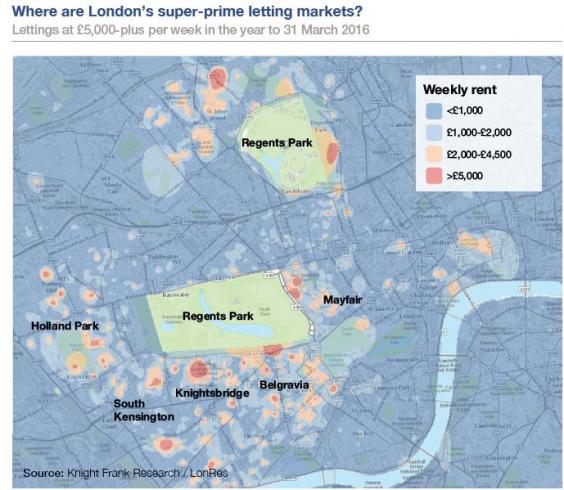

The areas with leases costing £5,000 per week or above include prime areas such as South Kensington, Knightsbridge, Mayfair, Regent’s Park and Holland Park.

But concerns over the outcome of the upcoming referendum and the Panama Papers tax scandal, which revealed how the owners of offshore companies used them to buy London properties, might also be prompting the super-wealthy to rent rather than to buy.

Henry Pryor, a buying agent, told the Financial Times that the Panama Papers has highlighted that ‘no one can buy quietly’ anymore.

“There are some people who will be put off by that, and they should be,” Pryor said.

The Panama Papers, leaked two weeks ago, found that 2,800 Mossack Fonseca companies are linked to the deeds of 6,000 properties in the UK, worth £7 billion.

It is estimated that 90,000 homes in England and Wales are registered to overseas owners, the majority of which (75,000 in total) are thought to be owned by companies registered within tax havens