-

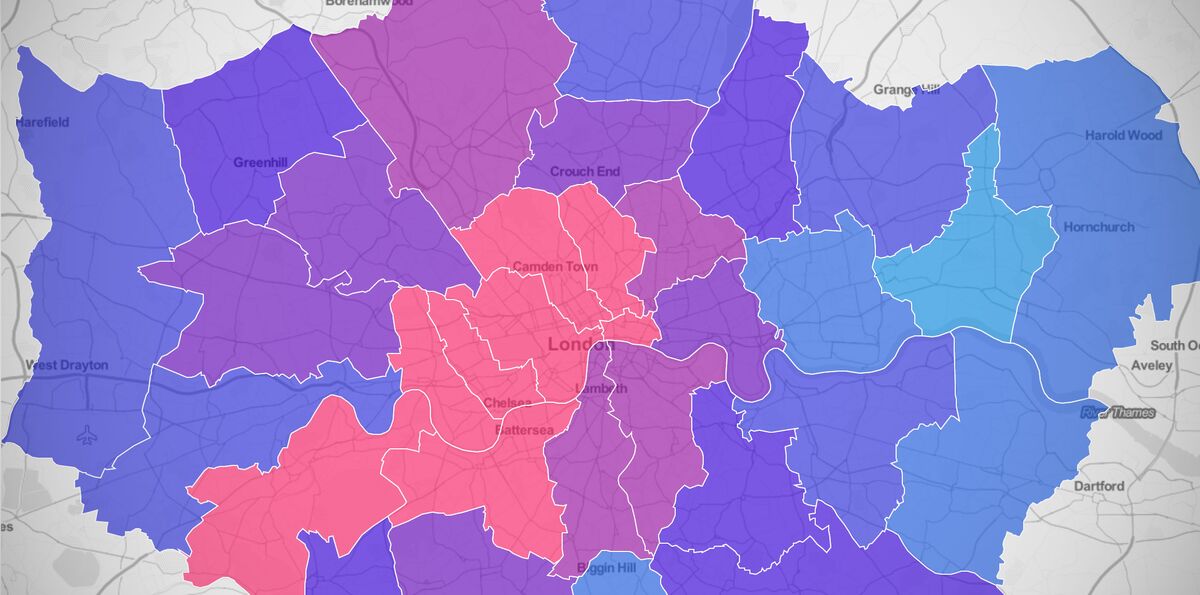

Central boroughs show lowest growth as buyers move further out

-

Fastest price growth seen in Waltham Forest and Newham

Hayley Johnson, a 37-year-old retailer from Upminster, had planned to sell her rental property in Plaistow in East London. Soaring values have made her think twice.

“The area is starting to have that up-and-coming hipster feel,” she said in a telephone interview from her home in the London district. “Given the jump in value since buying and prospective price growth, I’m now in two minds.”

Home values in the borough of Newham, where Johnson’s rental property is located, jumped 22.1 percent last year, the most in London. The central borough of Westminster had zero price growth and Kensington & Chelsea registered a 4.3 percent gain. The median house price in London climbed about 13 percent in December from a year earlier to 431,053 pounds ($615,931), according to an analysis of Land Registry data by Bloomberg.

Government measures to aid first-time buyers and a planned increase in the transaction tax on second homes and rental properties has fueled buying by both homeowners and professional landlords, particularly before the higher tax goes into effect in April. High prices in the center have pushed both types of buyers to seek better deals further afield.

Prices in Waltham Forest surged 21.9 percent in December from a year earlier and values in Hackney, near the heart of the city’s budding technology industry, jumped 19 percent, according to the data. Westminster, which includes the neighborhoods of Marylebone and Mayfair, was the only borough that had no price growth. The only decline was a 3.3 percent drop in the City of London financial district.

Plans to increase the stamp duty charges announced in November led to a surge in inquiries from investors looking to buy in the U.K., according to a survey published by Royal Institution of Chartered Surveyors on Jan. 21. The increase will cost landlords who purchase after April an average of 11 months rental income, according to an estimate by Countrywide Plc, the U.K.’s largest real estate agency.

Average rents in the capital climbed 11 percent over the last 12 months to 1,596 pounds a month, double the rest of the U.K., according to a report by Homelet, the U.K.’s largest reference-checking and rentals insurance company. It found that 64 percent of landlords in Greater London expect to increase rents in the near future.

“There’s likely to be a few lumps and bumps along the way as landlords get to grips with and adapt to the changing environment,” Johnny Morris, head of research at Countrywide, said in a telephone interview. Most landlords view property as a long-term investment and capital growth the up-and-coming areas will be enough to absorb the increase over time, he said.

“The new tax has definitely urged buyers to rush in before April,” said Johnson, who currently has an offer that is 50 percent more than she paid for the two-bedroom apartment in 2007. “That in turn will be good for price growth which will be good for me.”

Explore Housing Prices in London