High house prices relative to incomes mean a deposit is increasingly the barrier to first-time buyers making a purchase

|

High house prices relative to incomes mean a deposit is increasingly the barrier to first-time buyers making a purchase

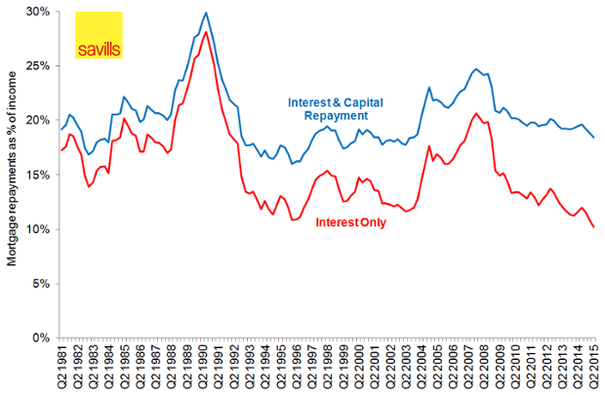

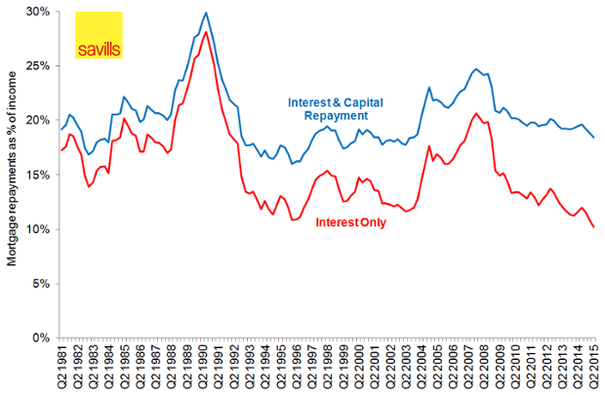

Owning a home is as cheap as it’s ever been, so why aren’t more people buying? Thanks to low rates, the annual cost of repaying a mortgage is well within historic affordable levels, with average repayments for first-time buyers equivalent to 18% of their gross annual income. That means owning with a mortgage is substantially cheaper than renting from a landlord, where rents take up 34% of the average household’s income.

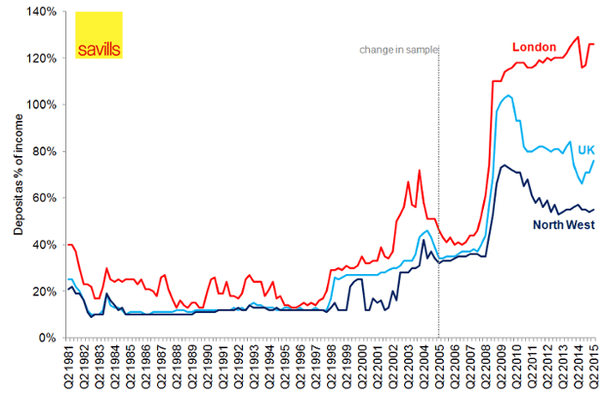

So why aren’t more people becoming homeowners? Being able to get a mortgage and afford the repayments may be easier than a few years ago, but it’s just one part of the funds a prospective first-time buyer needs to buy a home. The other part is the deposit. The wider availability of high loan-to-value (LTV) mortgages may have eased some of the pressure on deposits in more affordable markets. But, with house prices at many multiples of average incomes, whether a buyer can raise a sufficient deposit is one of the defining features of the current housing market.

According to the Council of Mortgage Lenders (CML), the average first-time buyer has an income of £39,000 and a deposit of £29,000. At 76% of their gross income, that may be lower than during the depths of the credit crunch, but it is well above historic levels – even allowing for the change in sample during 2005 to more accurate data.

In London, the typical first-time buyer has an income of £59,000 and needs a deposit equal to 126% of their income – £74,000. That’s even higher than during 2009 when the credit crunch was at its most severe.

With London house prices at many multiples of income and rising, the repayments on high LTV mortgages are unaffordable for all but the most income-rich buyers. Many first-time buyers are therefore dependent on help from the “bank of mum and dad”. Homeownership for younger generations is increasingly determined by how lucky their parents were in previous housing market booms.

So, thanks to high house prices relative to incomes, it is the cost of buying rather than the cost of owning that is the biggest barrier to people buying their first home. However, it is also important to recognise the longer-term costs of homeownership. Today’s low inflation and high debt environment means many first-time buyers could still be spending relatively large proportions of their income on mortgage repayments for almost the entirety of their mortgage term. That will lead to fundamental changes in how the market works, with the housing ladder broken in all but the highest demand markets.

• Neal Hudson is a housing market analyst for Savills. He can be found on Twitter @resi_analyst, and publishes a fortnightly housing market note.