The annual rate of increase is the lowest since November 2009, says estate agent Knight Frank, with some areas recording falls over the past 12 months

|

The annual rate of increase is the lowest since November 2009, says estate agent Knight Frank, with some areas recording falls over the past 12 months

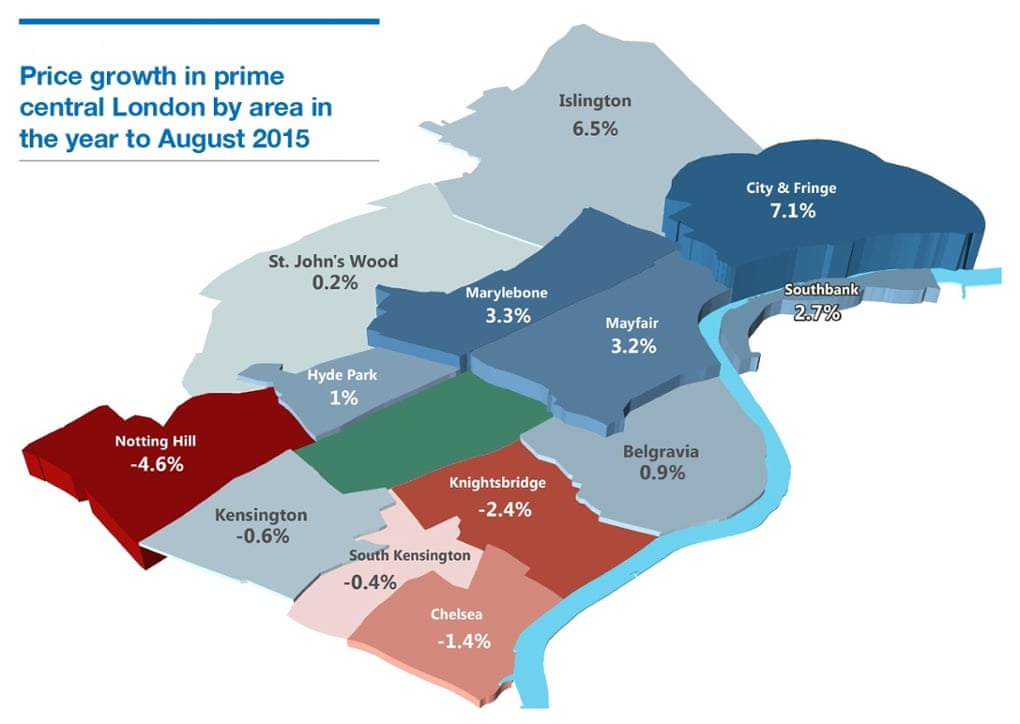

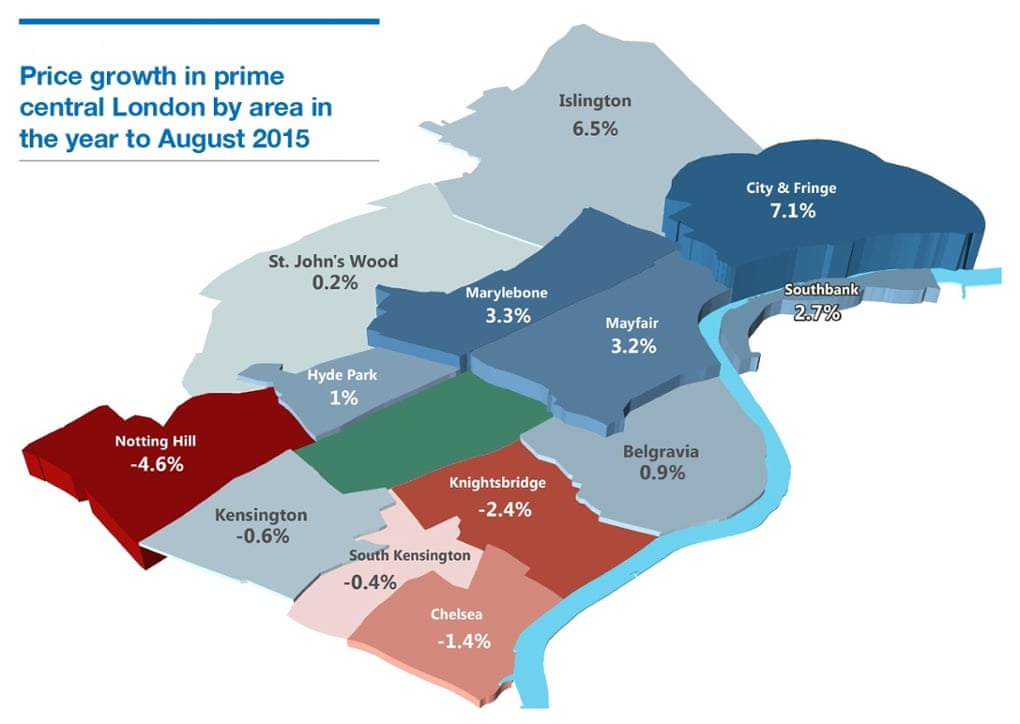

Property prices in London’s most expensive neighbourhoods have increased by 1.7% since August 2014, the lowest pace of change in more than five years, according to figures from Knight Frank.

The firm’s latest prime central London sales index suggests changes to stamp duty rules in December and uncertainty caused by China’s currency devaluation caused the summer slowdown to be sharper than usual.

The annual rate of increase was the lowest since November 2009, when the market was recovering from the 2008 financial crash, and the slowdown was felt most in the parts of London that have traditionally been favoured by wealthy buyers.

In the west London neighbourhood of Notting Hill, once home to prime minister David Cameron, prices have fallen by 4.6% over the past 12 months, while in Knightsbridge they are down by 2.4%.

Across west London’s prime areas prices were down, while in the City of London they have increased by 7.1% and in Islington in north London they are up by 6.5%.

Knight Frank said August was typically one of the quieter months of the year, but this year “this seasonal trend was compounded by the fact buyers have been coming to terms with higher stamp duty and uncertainty in global financial markets”.

The agent said China’s decision to devalue its currency had caused some buyers to postpone decision-making on property until there was a greater sense of certainty, but had also persuaded Chinese buyers to step up their interest in “safe haven” property markets.

Transaction levels fell after the introduction of higher rates of stamp duty on homes costing upwards of £1m, and Knight Frank said that between January and April, sales excluding new-build properties were down by an average of 48% in prime London.

Between May and July, after the general election, transactions picked up, but remained down 20% year-on-year.

Tom Bill, head of London residential research at Knight Frank, said: “The seasonal nature of the market dictates that buyers will become more active in the autumn and a greater sense of normality will return to the market, which will also be driven by the fact vendors are lining up new properties for sale.”